Montana Crummey Trust Agreement for Benefit of Child with Parents as Trustors

Description

How to fill out Crummey Trust Agreement For Benefit Of Child With Parents As Trustors?

You can spend numerous hours online searching for the official document format that meets federal and state requirements you need.

US Legal Forms provides an extensive array of legal documents that are reviewed by experts.

It is easy to obtain or print the Montana Crummey Trust Agreement for the Benefit of a Child with Parents as Trustors from the service.

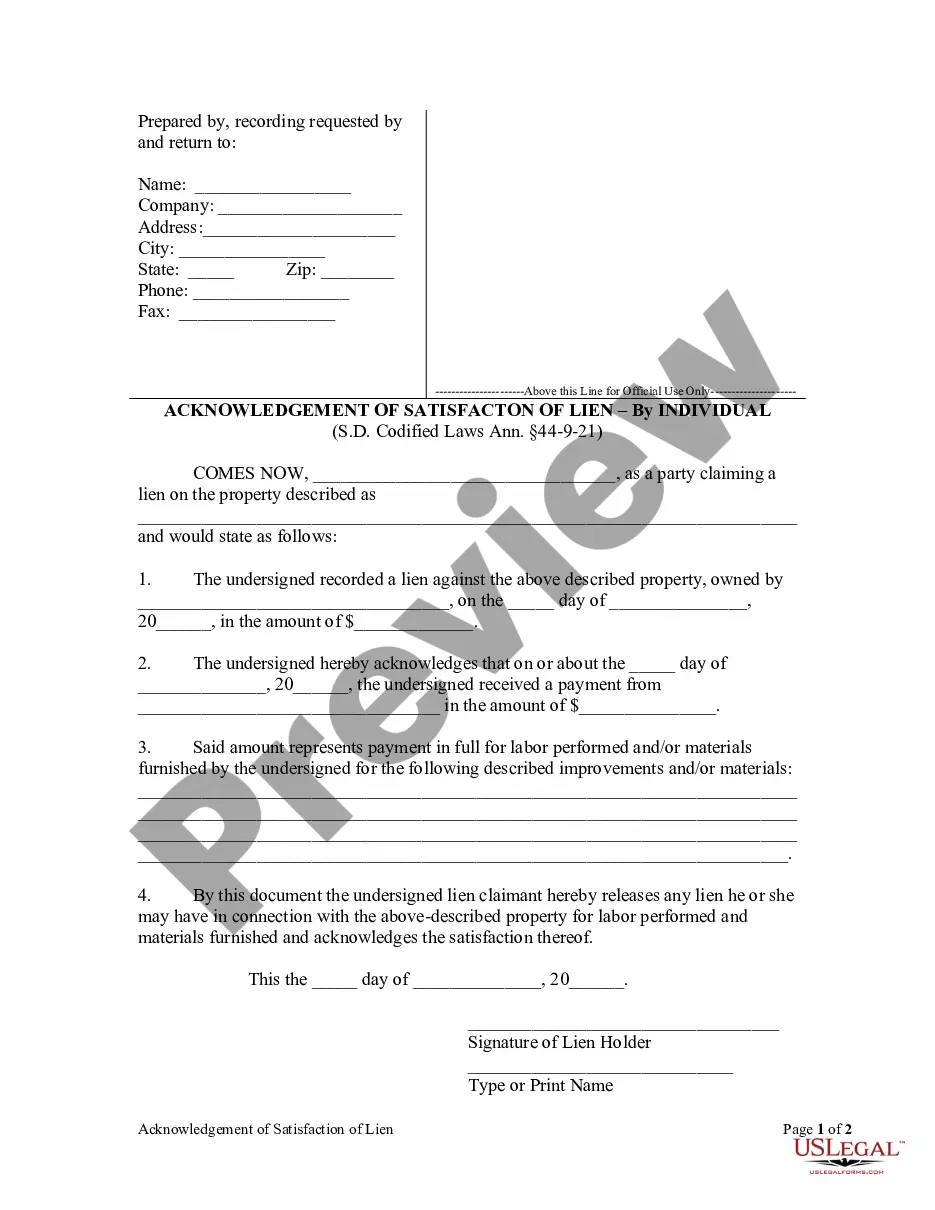

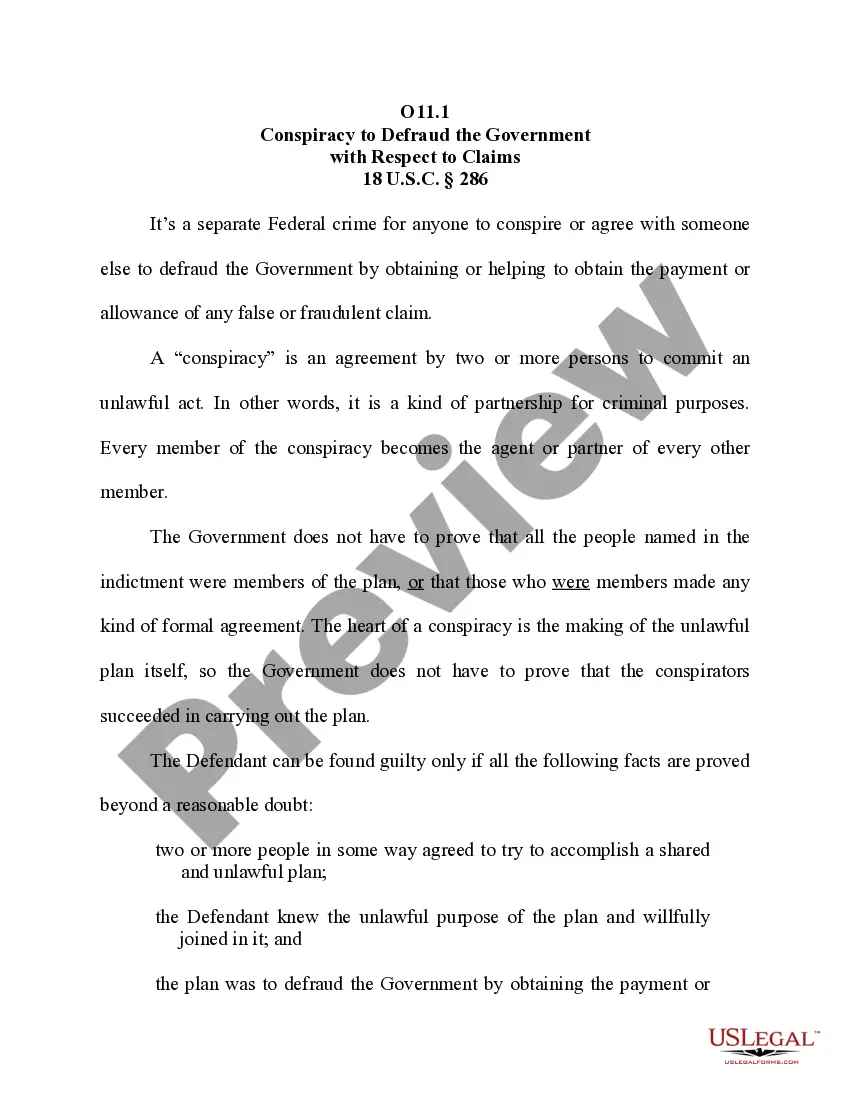

If available, utilize the Preview button to examine the document format as well.

- If you possess a US Legal Forms account, you may Log In and then click the Download button.

- Afterward, you may complete, modify, print, or sign the Montana Crummey Trust Agreement for Benefit of Child with Parents as Trustors.

- Every legal document format you purchase belongs to you permanently.

- To obtain an additional copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the state/city of your choice.

- Review the form summary to confirm you have chosen the correct form.

Form popularity

FAQ

A Montana Crummey Trust Agreement for Benefit of Child with Parents as Trustors operates by allowing the parents to fund the trust with gifts. Each year, the child has the right to withdraw a portion of these gifts for a limited time, which qualifies for annual gift tax exclusions. After this period, any undistributed amounts remain in the trust for the child's benefit. This mechanism effectively balances gift tax savings while ensuring the child's financial support.

A Crummey trust can have multiple beneficiaries. Unlike some college savings plans, there are no penalties if the funds are not used for higher education.

6 Potential Tax Consequences of a Crummey TrustYour irrevocable trust may be responsible for paying income taxes. This is true if the trust earns more than a certain amount each year. Depending on how the trust is drafted, the trust may need to obtain its own tax ID number.

The trustee manages assets of Crummey trusts, and you set terms that determine when distributions should be made. A Crummey Trust is generally more flexible and advantageous than a 529 college savings account. Multiple beneficiaries can be included in the trust, including beneficiaries over 21.

Crummey Trust, Definition This type of trust is typically used by parents who want to make financial gifts to minor or adult children, though anyone can establish one on behalf of a beneficiary.

Can a Trustee Also Be a Beneficiary of a Trust? Yes, a trustee can be one of the beneficiaries of a trust. For example, an individual could set up a trust, appoint themselves as trustee and distribute income to their family. However, a trustee cannot be the sole beneficiary of a trust.

QPRT Basics A qualified personal residence trust (QPRT) is a trust to which a person (called the settlor, donor, or grantor) transfers his personal residence. The grantor reserves the right to live in the house for a period of years; this retained interest reduces the current value of the gift for gift tax purposes.

A hanging power, whereby the "taxable" part of a beneficiary's power to invade corpus is carried over until it becomes nontaxable, can avoid gift tax consequences, but is likely to meet IRS opposition. This article examines the future use of hanging powers and alternatives to such powers.

A trust beneficiary can be a person, a company or the trustee of another trust. The trustee may also be a beneficiary, but not the sole beneficiary unless there is more than one trustee.

Key Takeaways. A 5 by 5 Power in Trust is a clause that lets the beneficiary make withdrawals from the trust on a yearly basis. The beneficiary can cash out $5,000 or 5% of the trust's fair market value each year, whichever is a higher amount.