Oregon Procedures Re Mortgage Modification are procedures that help homeowners in Oregon modify their mortgage and avoid foreclosure. The Oregon Homeownership Stabilization Initiative (OSI) was created to assist homeowners in Oregon who are in danger of losing their home due to mortgage delinquency or default. OSI offers a variety of foreclosure prevention and mortgage modification options to eligible homeowners. Types of Oregon Procedures Re Mortgage Modification include: loan modification, repayment plan, forbearance agreement, loan reinstatement, short sale, and deed-in-lieu of foreclosure. Loan modification involves a lender agreeing to alter the terms of a mortgage loan, such as an interest rate reduction or extended loan term, in order to help a homeowner keep their home. Repayment plan is an agreement between the lender and the homeowner that enables the homeowner to catch up on their delinquent payments over a period of time. Forbearance agreements allow the lender to temporarily suspend or reduce the homeowner’s mortgage payments for a specified period of time. Loan reinstatement involves the homeowner paying all past due amounts in one lump sum in order to bring the mortgage current and avoid foreclosure. Short sale is an agreement between the lender and the homeowner to allow the homeowner to sell their home for less than the amount owed on the mortgage. Deed-in-lieu of foreclosure is an agreement between the lender and the homeowner to transfer the deed to the home back to the lender in exchange for forgiveness of the remaining mortgage balance.

Oregon Procedures Re Mortgage Modification

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Oregon Procedures Re Mortgage Modification?

Coping with official documentation requires attention, accuracy, and using properly-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Oregon Procedures Re Mortgage Modification template from our library, you can be certain it meets federal and state laws.

Working with our service is simple and fast. To get the required paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to obtain your Oregon Procedures Re Mortgage Modification within minutes:

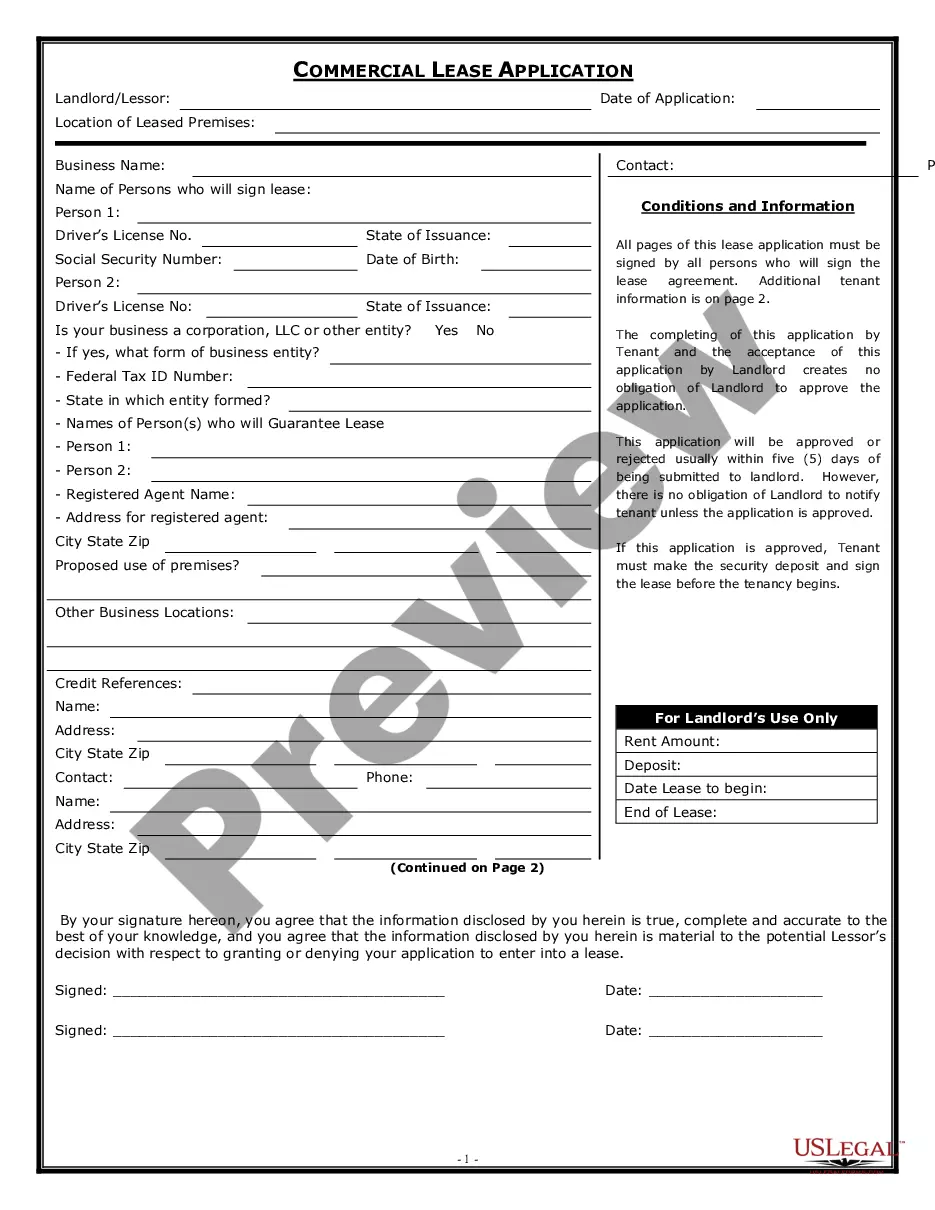

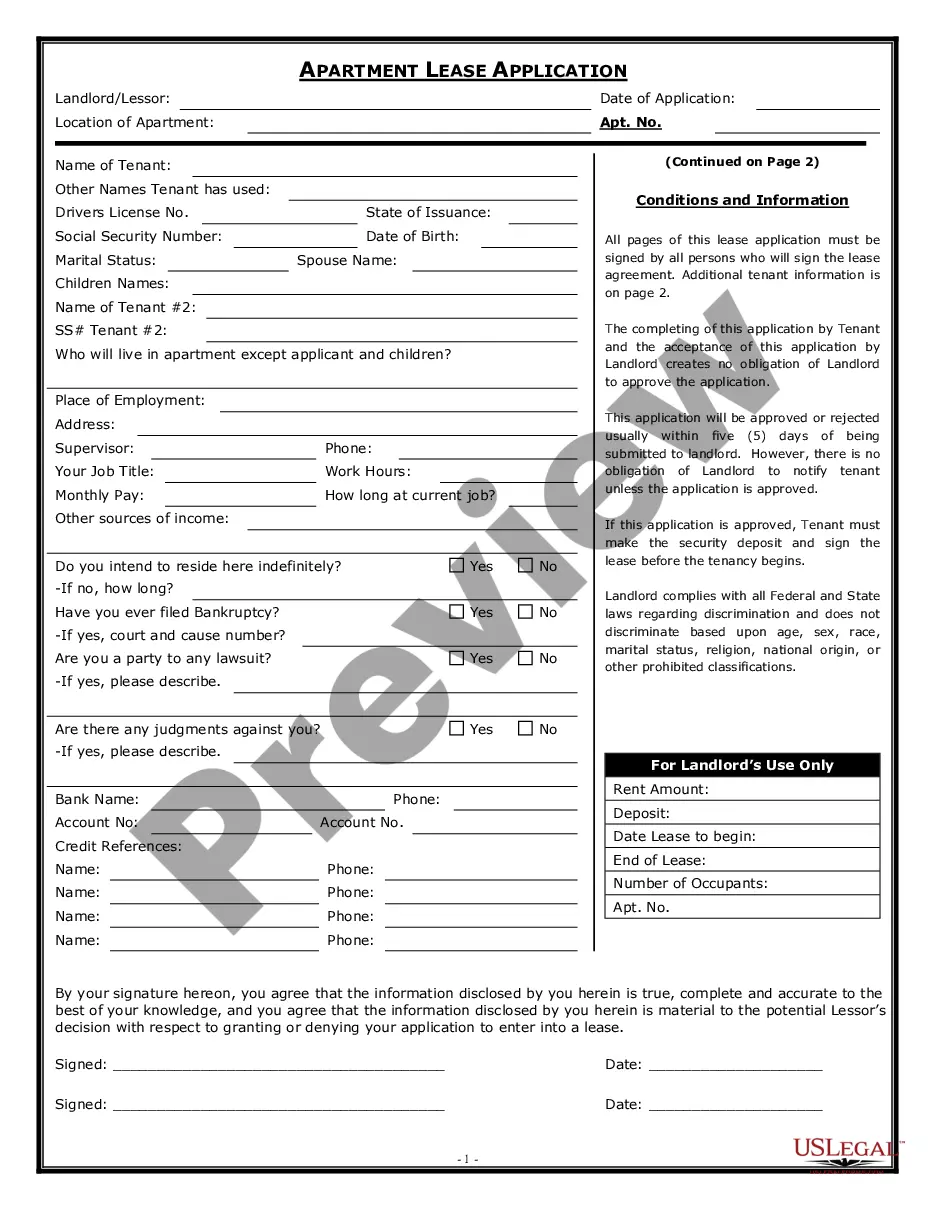

- Make sure to attentively examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for another official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Oregon Procedures Re Mortgage Modification in the format you need. If it’s your first time with our website, click Buy now to proceed.

- Create an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to prepare it paper-free.

All documents are created for multi-usage, like the Oregon Procedures Re Mortgage Modification you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

Lenders differ in their mortgage modification requirements, but typically they require you to show that: You're at least one regular mortgage payment behind, or a missed payment is imminent. You've incurred significant financial hardship, for reasons including: Long-term illness or disability.

It is better than foreclosure: many lenders prefer loan modification over foreclosure. While the lender may have to wait a while before they can foreclose a property, loan modification can take as little as 30-90 days for the entire process.

The modification is a type of loss mitigation. The modification can reduce your monthly payment to an amount you can afford. Modifications may involve extending the number of years you have to repay the loan, reducing your interest rate, and/or forbearing or reducing your principal balance.

The loan modification process typically takes 6 to 9 months, depending on your lender.

A mortgage modification changes the terms of your original mortgage agreement. Your lender will work with you to try and find a way to lower your monthly payment by adjusting the terms of your current mortgage. The goal is to help you get back on track.

What happens after a loan modification is approved? Once the loan modification is approved, you'll go through a trial modification where you must not miss a payment for three consecutive months. If you do miss a payment, then the modification is denied and you'll have to request another trial.

The modification is a type of loss mitigation. The modification can reduce your monthly payment to an amount you can afford. Modifications may involve extending the number of years you have to repay the loan, reducing your interest rate, and/or forbearing or reducing your principal balance.

Only your mortgage lender or servicer has the discretion to stop foreclosure and grant a loan modification. No third party can guarantee or pre-approve your mortgage modification application.