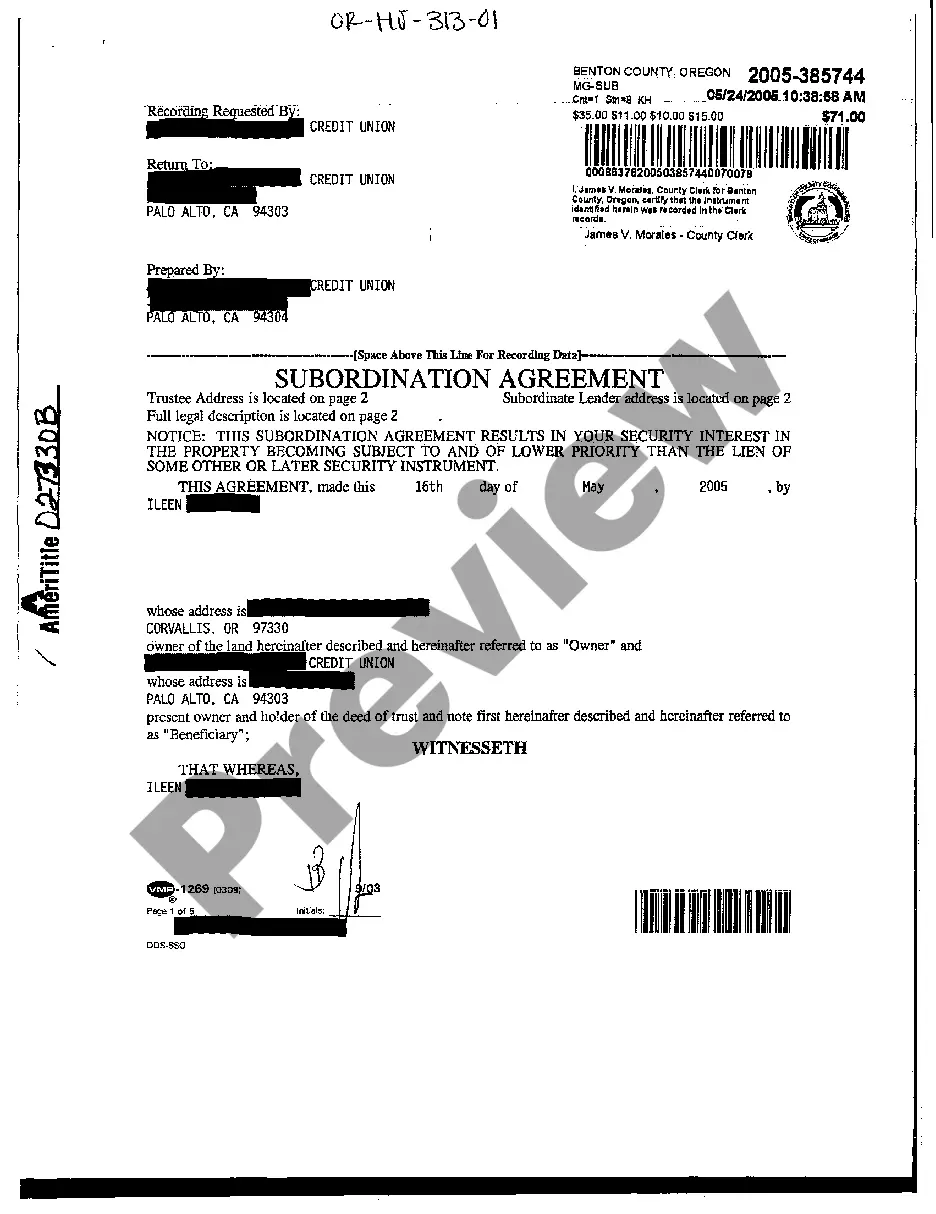

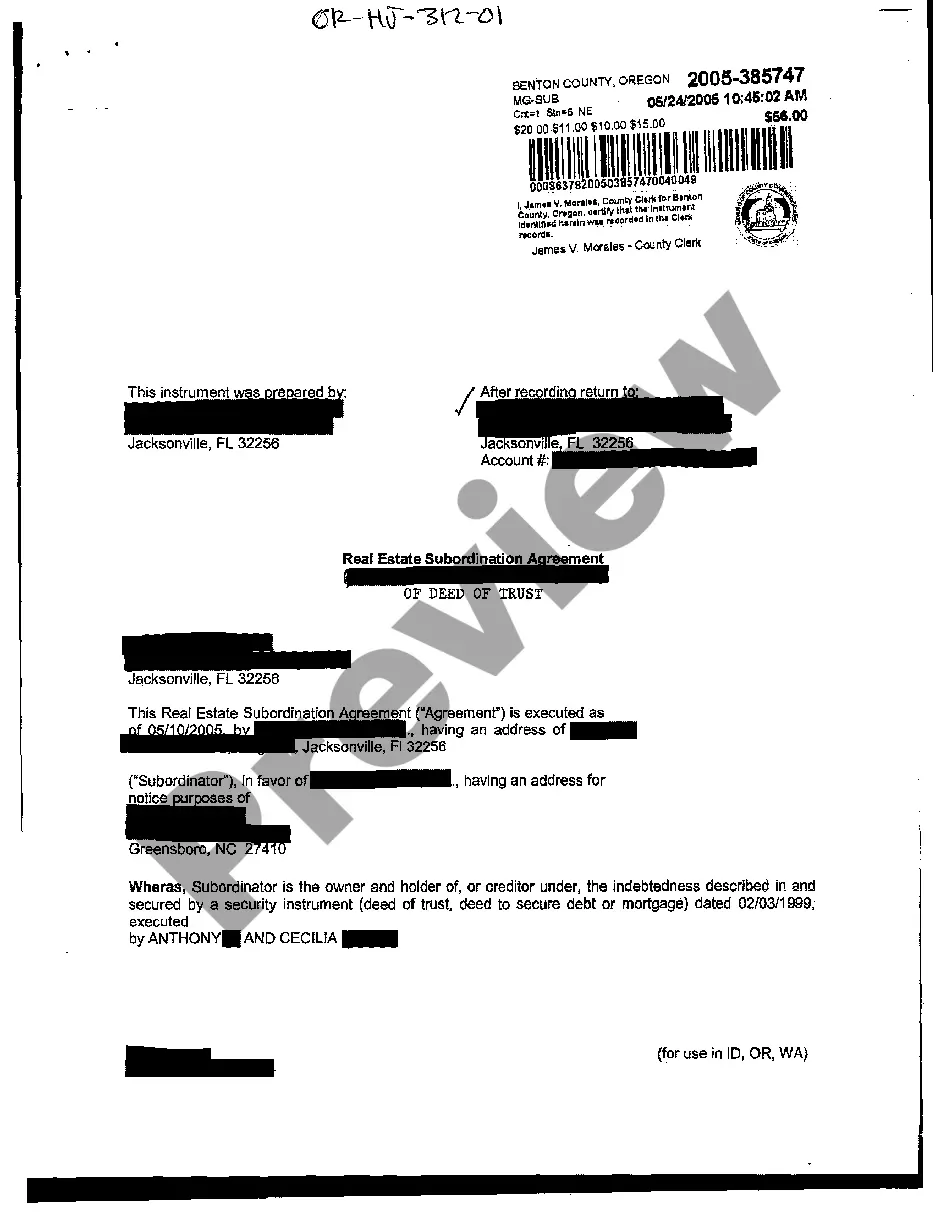

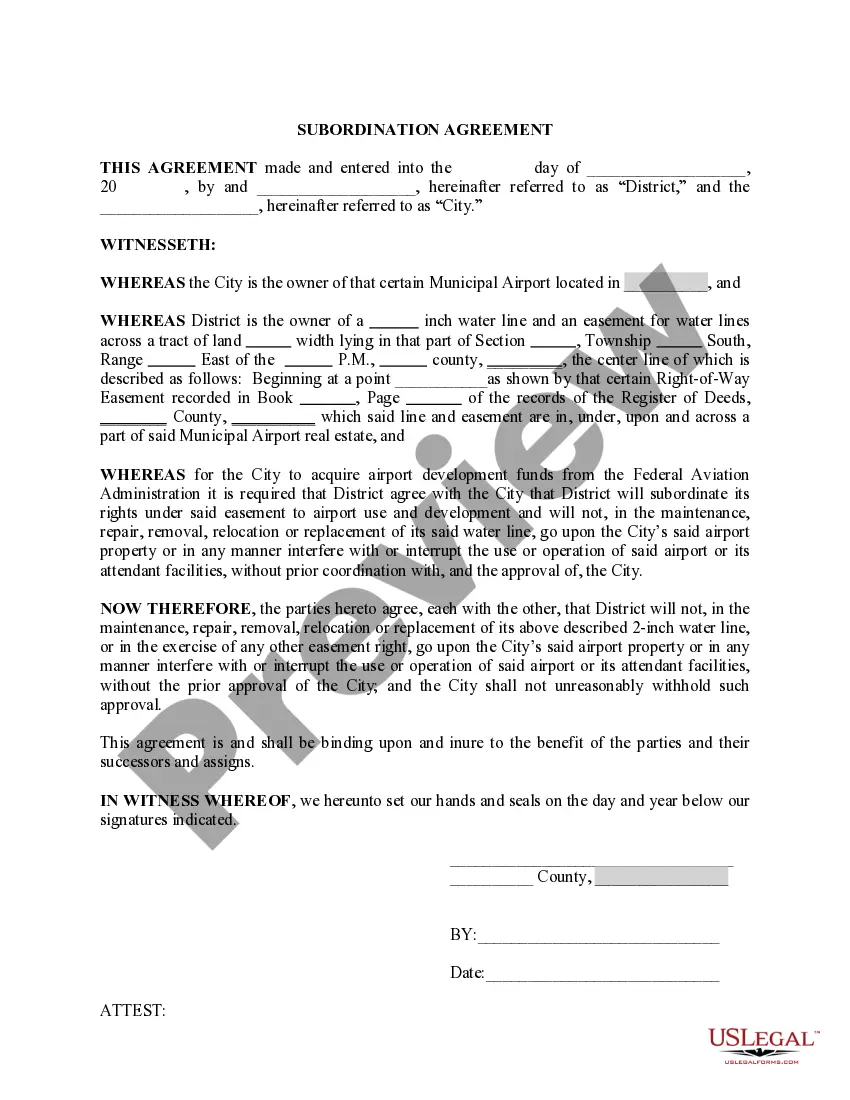

Oregon Subordination Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

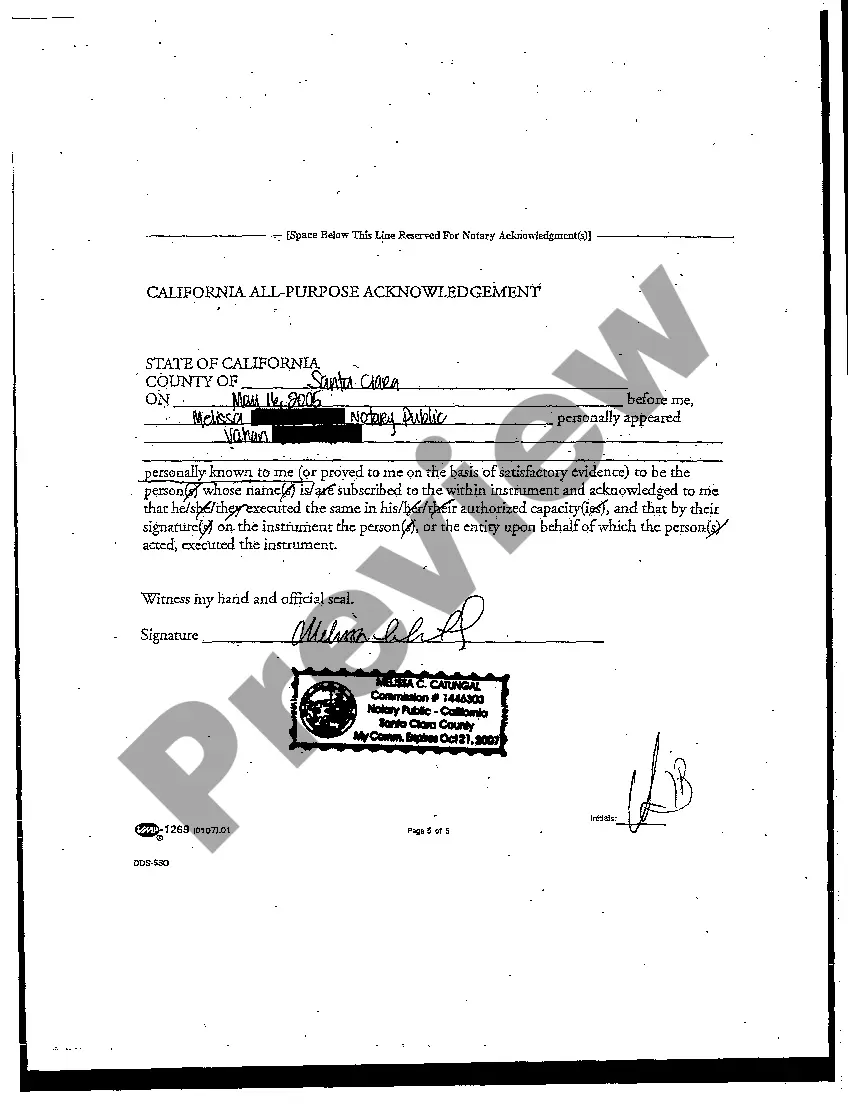

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Oregon Subordination Agreement?

The work with papers isn't the most straightforward job, especially for people who almost never deal with legal paperwork. That's why we advise using correct Oregon Subordination Agreement templates created by skilled lawyers. It allows you to stay away from difficulties when in court or dealing with official organizations. Find the samples you want on our site for high-quality forms and exact descriptions.

If you’re a user with a US Legal Forms subscription, simply log in your account. When you’re in, the Download button will automatically appear on the file webpage. Right after accessing the sample, it’ll be saved in the My Forms menu.

Customers without a subscription can easily create an account. Look at this simple step-by-step guide to get the Oregon Subordination Agreement:

- Make certain that the form you found is eligible for use in the state it’s needed in.

- Verify the file. Use the Preview feature or read its description (if offered).

- Buy Now if this template is what you need or utilize the Search field to get another one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

After finishing these easy steps, it is possible to complete the sample in a preferred editor. Recheck filled in data and consider requesting a legal representative to review your Oregon Subordination Agreement for correctness. With US Legal Forms, everything gets much easier. Try it now!

Form popularity

FAQ

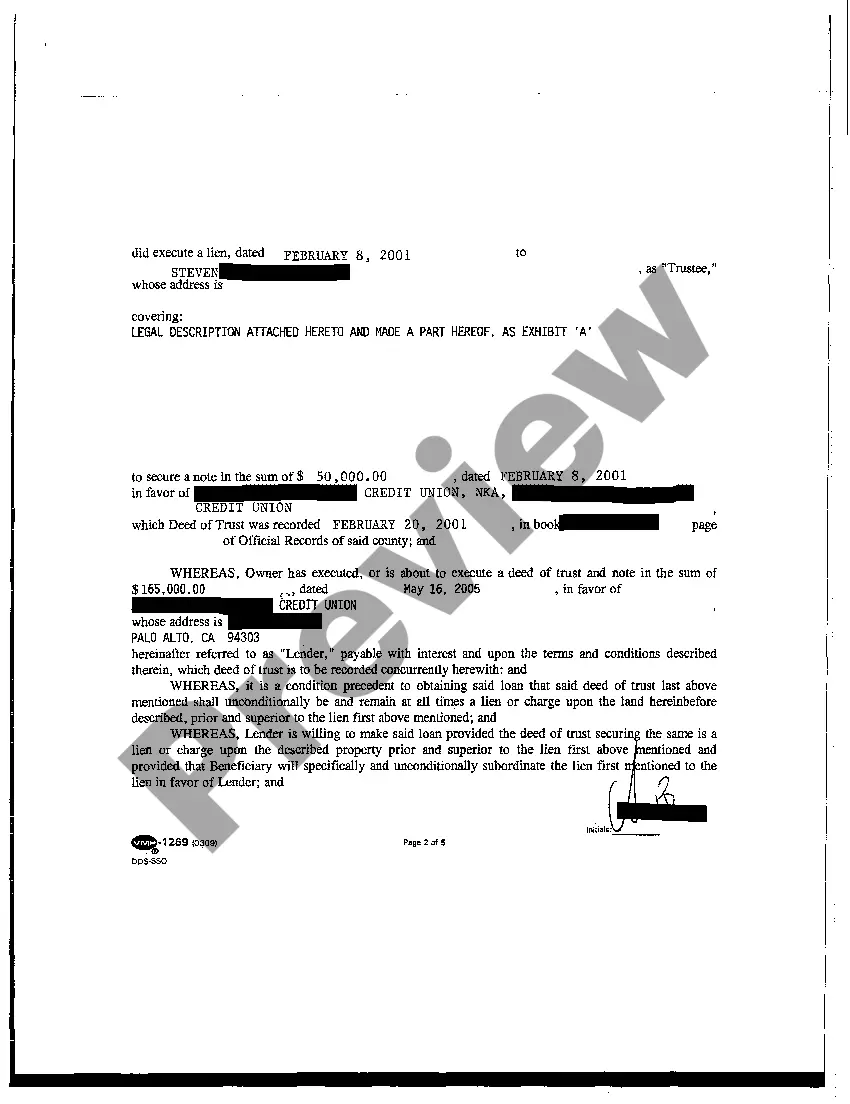

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit.

Subordination is the tenant's agreement that its interest under the lease will be subordinate to that of the lender. Of course, in many situations, the mortgage will already be superior, depending on when the mortgage was recorded and when the lease was recorded or the tenant took possession of the property.

A subordination agreement is an instrument that allows a first lien or interest to be paid off and allows another first mortgage company to come in and be the first priority lien holder. It is very common for the borrower to pay subordination fees.

Subordination clauses in mortgages refer to the portion of your agreement with the mortgage company that says their lien takes precedence over any other liens you may have on your property.The primary lien on a house is usually a mortgage. However, it's also possible to have other liens.

A subordination agreement often comes up when a home has a first and a second mortgage, and the borrower wants to refinance the first mortgage. If you have two mortgages on your home and refinance the first loan, the refinancing lender might require a subordination agreement.

But as property values are going up and the demand for refinance isn't as much, it seems that the subordination process has gotten a little easier. Typically, it takes two to three weeks to get the resubordination paperwork through, and it is likely to set you back $200 to $300.

The process by which a creditor holding a priority debt agrees to accept a lower priority for the collection of its debt in a deference to a new debt. ( See also: subordination agreement)

A written contract in which a lender who has secured a loan by a mortgage or deed of trust agrees with the property owner to subordinate its loan (accept a lower priority for the collection of its debt), thus giving the new loan priority in any foreclosure or payoff.