Oklahoma FLSA Exempt / Nonexempt Compliance Form

Description

How to fill out FLSA Exempt / Nonexempt Compliance Form?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for both commercial and personal purposes, categorized by type, state, or keywords. You can find the most recent versions of documents such as the Oklahoma FLSA Exempt / Nonexempt Compliance Form in just moments.

If you already hold a membership, Log In to download the Oklahoma FLSA Exempt / Nonexempt Compliance Form from your US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Make modifications. Fill out, edit, print, and sign the downloaded Oklahoma FLSA Exempt / Nonexempt Compliance Form.

Each template you add to your account does not have an expiration date and remains yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the Oklahoma FLSA Exempt / Nonexempt Compliance Form with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are straightforward instructions to get started.

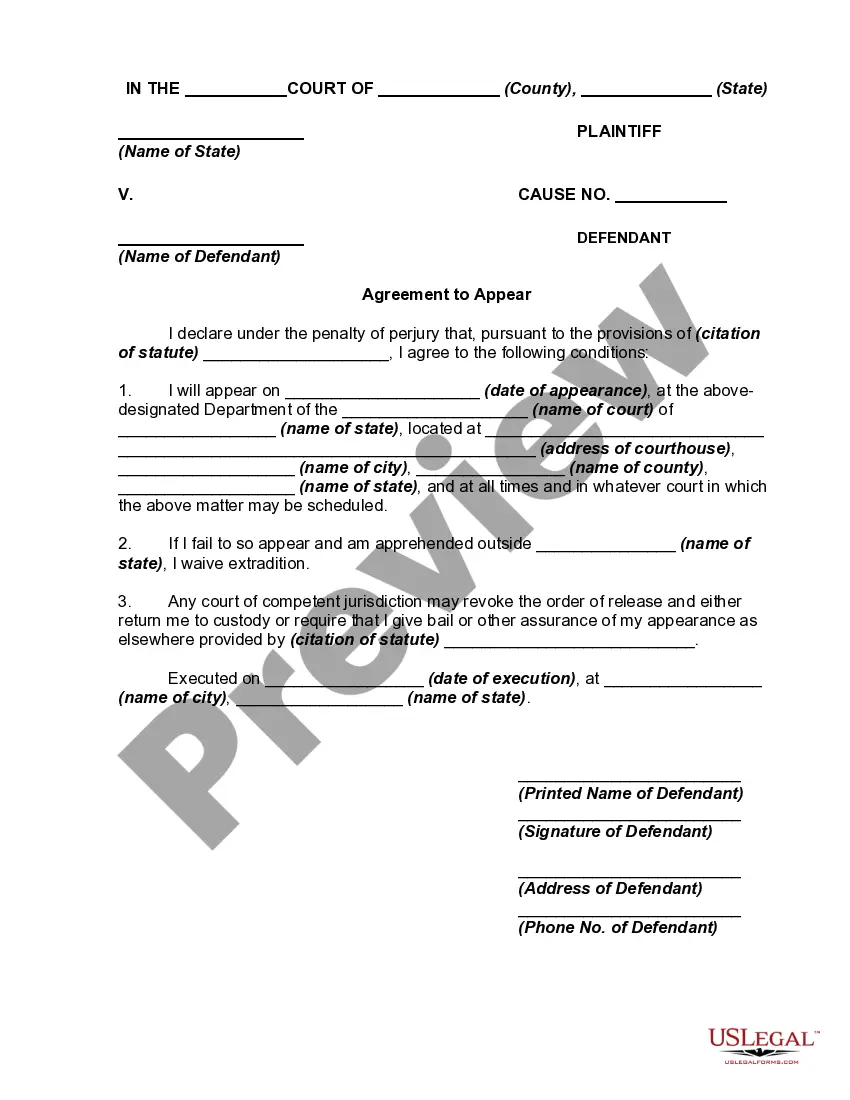

- Ensure you have selected the correct form for your locality. Click the Preview button to review the form's content. Check the form's description to confirm that it is the right one.

- If the form does not meet your needs, utilize the Search field at the top of the screen to locate one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose the payment plan you prefer and provide your credentials to sign up for the account.

- Complete the transaction. Use your credit card or PayPal account to finish the purchase.

- Select the format and download the form to your device.

Form popularity

FAQ

To change an employee's status from exempt to nonexempt, review their job responsibilities and salary structure. Next, fill out the Oklahoma FLSA Exempt / Nonexempt Compliance Form, which provides the framework for making the change compliant with labor laws. Be transparent with the employee about how this change will affect their compensation, particularly regarding overtime eligibility. This proactive approach can help maintain trust and clarity with your team.

Exempt: Employees primarily performing work that is not subject to overtime provisions of the Fair Labor Standards Act. Overtime pay is not required by FLSA for exempt employees; however, the University chooses to pay overtime to exempt Non-V Class employees.

Nonexempt: An individual who is not exempt from the overtime provisions of the FLSA and is therefore entitled to overtime pay for all hours worked beyond 40 in a workweek (as well as any state overtime provisions). Nonexempt employees may be paid on a salary, hourly or other basis.

The FLSA exemption test refers to the status of a job as outlined in the Fair Labor Standards Act. The FLSA determines whether a job is exempt or nonexempt as it relates to overtime obligations.

Standards Act (FLSA) However, Section 13(a)(1) of the FLSA provides an exemption from both minimum wage and overtime pay for employees employed as bona fide executive, administrative, professional and outside sales employees.

Standards Act (FLSA) However, Section 13(a)(1) of the FLSA provides an exemption from both minimum wage and overtime pay for employees employed as bona fide executive, administrative, professional and outside sales employees.

Many instructors on the college level allow their students to exempt (which means 'not take') the final exam if they have an A average going into the final exam. Many students have trouble finding the information they need on their final assignments in order to be exempted from the final exam.

To be considered FLSA exempt, all of the below must be true for an employee:The employee receives pay on a salary basis (rather than hourly).The employee earns at least $35,568 per year, or $684 per week.The employee performs exempt job duties.

With few exceptions, to be exempt an employee must (a) be paid at least $23,600 per year ($455 per week), and (b) be paid on a salary basis, and also (c) perform exempt job duties. These requirements are outlined in the FLSA Regulations (promulgated by the U.S. Department of Labor).

An exempt employee must be paid at least $23,600 per year ($455 per week), be paid on a salary basis, and perform exempt job duties. Page 2. Exempt job duties consists of three typical categories. The three categories are executive, professional and administrative.