Oklahoma Franchise Registration Questionnaire

Description

How to fill out Franchise Registration Questionnaire?

If you need to comprehensive, acquire, or printing legitimate record layouts, use US Legal Forms, the largest assortment of legitimate varieties, that can be found on the Internet. Utilize the site`s easy and practical research to get the files you want. Various layouts for business and individual uses are categorized by types and says, or keywords. Use US Legal Forms to get the Oklahoma Franchise Registration Questionnaire in a few clicks.

If you are previously a US Legal Forms client, log in in your account and click the Obtain key to get the Oklahoma Franchise Registration Questionnaire. You can even accessibility varieties you previously saved in the My Forms tab of your own account.

If you are using US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have chosen the shape for your appropriate city/region.

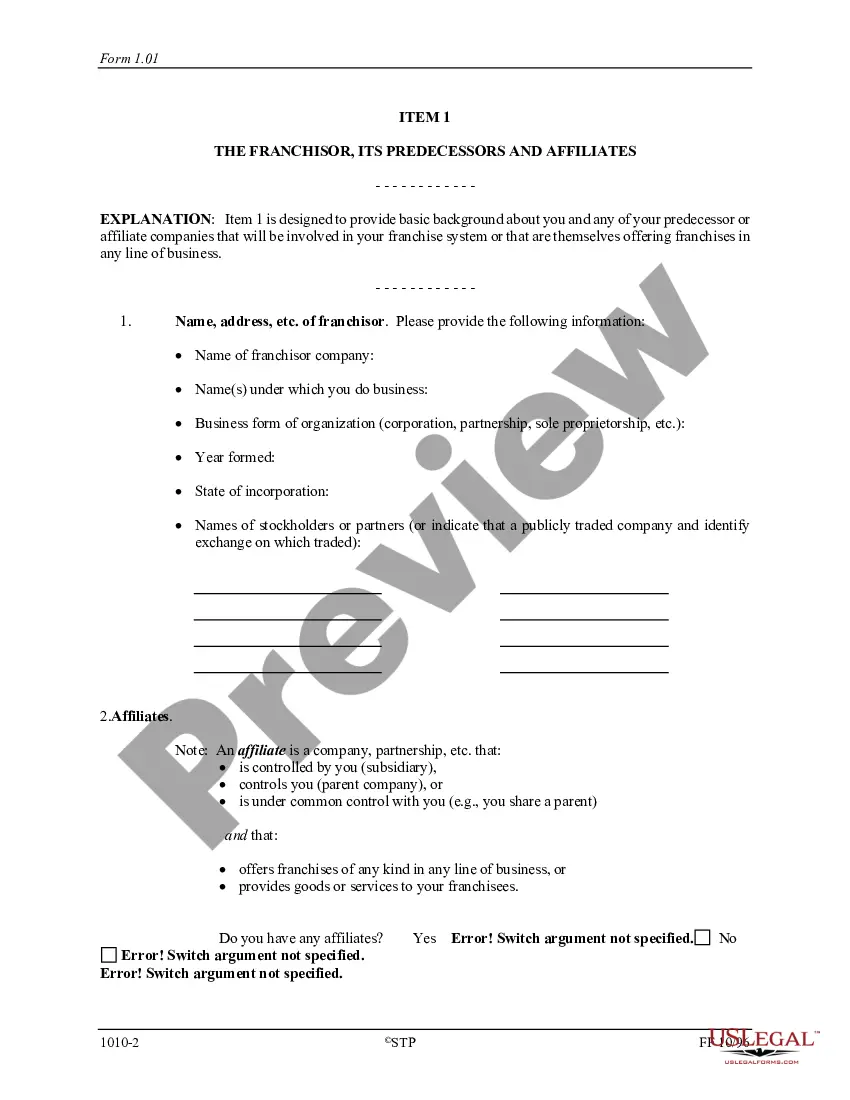

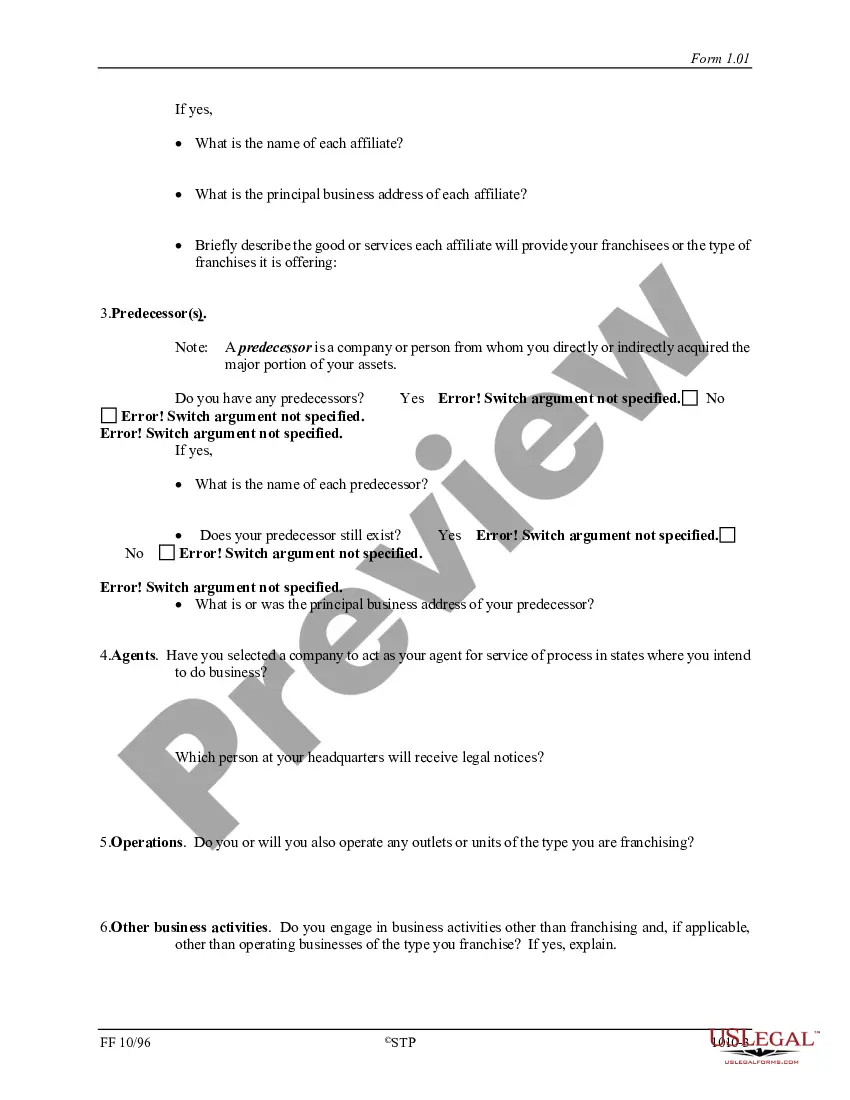

- Step 2. Use the Review solution to look over the form`s articles. Never forget to read through the outline.

- Step 3. If you are unhappy together with the type, make use of the Research discipline on top of the display screen to find other versions of the legitimate type format.

- Step 4. Once you have identified the shape you want, go through the Get now key. Pick the pricing strategy you choose and add your credentials to sign up for an account.

- Step 5. Procedure the transaction. You should use your bank card or PayPal account to perform the transaction.

- Step 6. Choose the formatting of the legitimate type and acquire it on your product.

- Step 7. Complete, edit and printing or indication the Oklahoma Franchise Registration Questionnaire.

Every single legitimate record format you purchase is your own property eternally. You might have acces to every single type you saved within your acccount. Go through the My Forms area and decide on a type to printing or acquire once more.

Be competitive and acquire, and printing the Oklahoma Franchise Registration Questionnaire with US Legal Forms. There are millions of expert and express-specific varieties you may use for the business or individual demands.

Form popularity

FAQ

The Oklahoma franchise tax is mandatory for all for-profit corporations, including S-corporations, partnerships, and limited liability companies, organized and maintained in Oklahoma.

The Oklahoma franchise tax is mandatory for all for-profit corporations, including S-corporations, partnerships, and limited liability companies, organized and maintained in Oklahoma.

Oklahoma residents are required to file an Oklahoma income tax return when they have enough income that they must file a federal income tax return. Nonresidents are also required to file an Oklahoma income tax return if they have at least $1,000 of income from an Oklahoma employer or other source.

Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. To make this election, file Form 200-F.

While Oklahoma does have a franchise tax, it only applies to corporations. Limited liability companies are exempt from paying the Oklahoma Franchise Tax.

If a federal consolidated return is filed, an Oklahoma consolidated return may be required or permitted under certain circumstances. ( Instructions, Form 512, Oklahoma Corporation Income Tax Return) The election to file a separate return or a consolidated return is made with the timely filing of the return.

A Form 500-B must be completed for each nonresident member to whom the pass-through entity has made an Oklahoma taxable distribution and paid withholding to Oklahoma. Form 500-B should not report withhold- ing paid by sources other than the pass-through entity.

Corporations pay franchise tax if they meet any of the following: Incorporated or organized in California. Qualified or registered to do business in California. Doing business in California, whether or not incorporated, organized, qualified, or registered under California law.