Virgin Islands Employee Evaluation Form for Sole Trader

Description

How to fill out Employee Evaluation Form For Sole Trader?

Selecting the optimal legal document template can be challenging. Obviously, there is a wide range of templates accessible online, but how can you secure the legal form you require? Utilize the US Legal Forms website. This service provides thousands of templates, including the Virgin Islands Employee Assessment Document for Sole Proprietor, suitable for both business and personal needs. All templates are validated by experts and comply with federal and state regulations.

Once you are registered, Log In to your account and click the Download button to obtain the Virgin Islands Employee Assessment Document for Sole Proprietor. Use your account to view the legal documents you have previously purchased. Navigate to the My documents section of your account and retrieve another copy of the document you need.

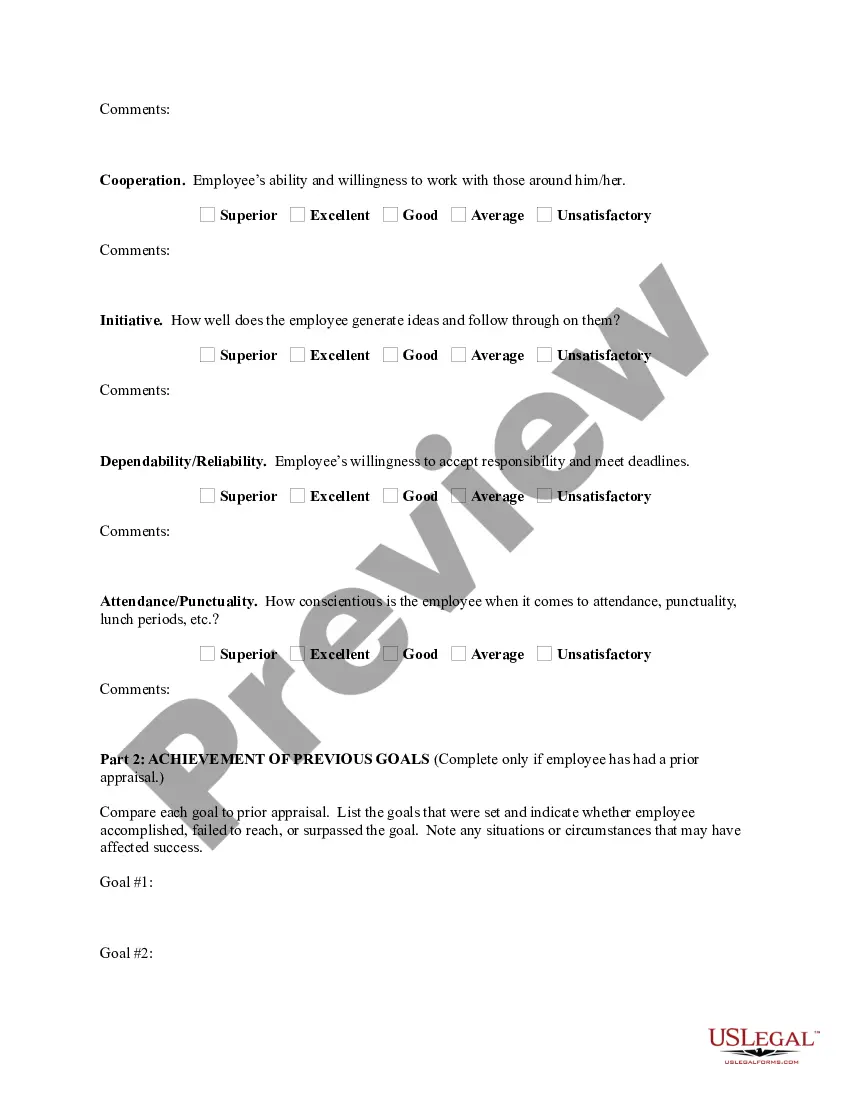

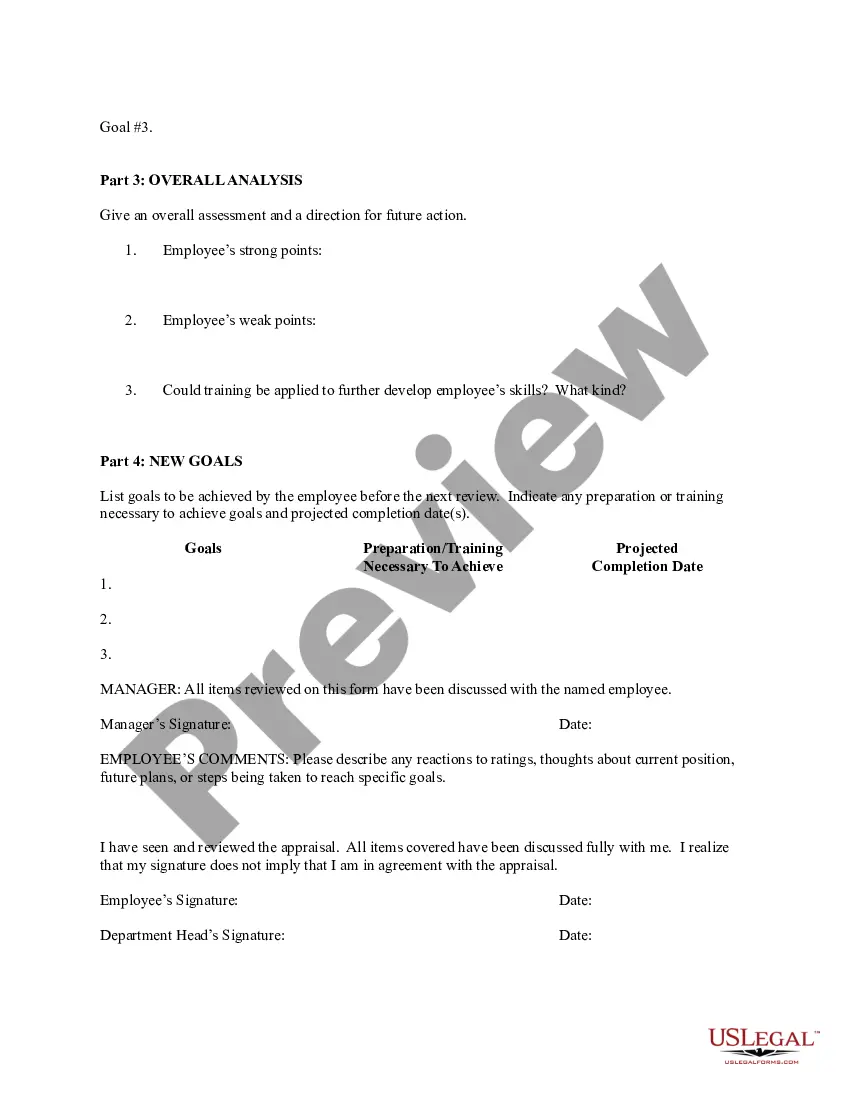

If you are a new user of US Legal Forms, here are some simple steps you can follow: First, ensure you have selected the correct form for your city/county. You can preview the document using the Review option and read the document summary to confirm it suits your needs. If the document does not fulfill your requirements, utilize the Search area to find the appropriate form. Once you are confident that the form is correct, click on the Purchase now button to obtain the form. Choose your preferred pricing plan and input the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Fill out, modify, and print and sign the acquired Virgin Islands Employee Assessment Document for Sole Proprietor.

US Legal Forms is the largest collection of legal documents where you can explore diverse record templates. Use this service to obtain professionally created documents that adhere to state regulations.

- Make sure to choose the correct form for your city/county.

- Utilize the Review option to preview the document.

- Read the document summary to confirm it meets your needs.

- Use the Search feature if the document does not meet your preferences.

- Click on Purchase now to acquire the document.

- Complete the necessary details and make your payment.

Form popularity

FAQ

More In Forms and Instructions Taxpayers filing a Form CT-1, Employer's Annual Railroad Retirement Tax Return, may submit a Form 7200 up to the earlier of March 1, 2021, or the date they file the Form CT-1 for 2020.

The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

More In Forms and Instructions One purpose of the form is to report net earnings from self-employment (SE) to the United States and, if necessary, pay SE tax on that income. The Social Security Administration (SSA) uses this information to figure your benefits under the social security program.

To order by phone, call 800-908-9946 and follow the prompts in the recorded message. To request a 1040, 1040A or 1040EZ tax return transcript through the mail, complete IRS Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript.

Purpose of Form Use Form 8898 to notify the IRS that you became or ceased to be a bona fide resident of a U.S. possession in accordance with section 937(c). See Bona Fide Residence, later.

The IRS has issued a new version of Form 7200 (Advance Payment of Employer Credits Due to COVID-19) and the instructions to that form. The new form is to be used for the 2nd through 4th quarters of 2021. IRS has also warned taxpayers not to use any earlier version of Form 7200 for those quarters.

To qualify as a bona fide resident of the U.S Virgin Islands, a person must meet the physical presence test. They cannot have a tax home outside of the Virgin Islands or have a closer connection to the mainland U.S. or another country than they do with the U.S. Virgin Islands.

How to File Form 7200 Electronically with TaxBandits?1 Enter Your Employer Details.2 Choose Applicable calendar quarter.3 Choose your Employment Tax Return Type.4 Enter your Credits and Advance Requested.5 Send it to the IRS by FAX.

How to Complete Your IRS Form 7200: InstructionsEnter Your Business Information.Complete Your Employee Tax Returns.Enter Your Credits and Advance Requested.Indicate Your Third-Party Designee (If any)Sign the Document for Authorization.

Form 1040 is used by U.S. taxpayers to file an annual income tax return.