Oklahoma Revocable Trust for Asset Protection

Description

How to fill out Revocable Trust For Asset Protection?

You might spend hours online looking for the legal form template that complies with the federal and state requirements you require.

US Legal Forms provides thousands of legal documents that are reviewed by professionals.

You can download or print the Oklahoma Revocable Trust for Asset Protection from our platform.

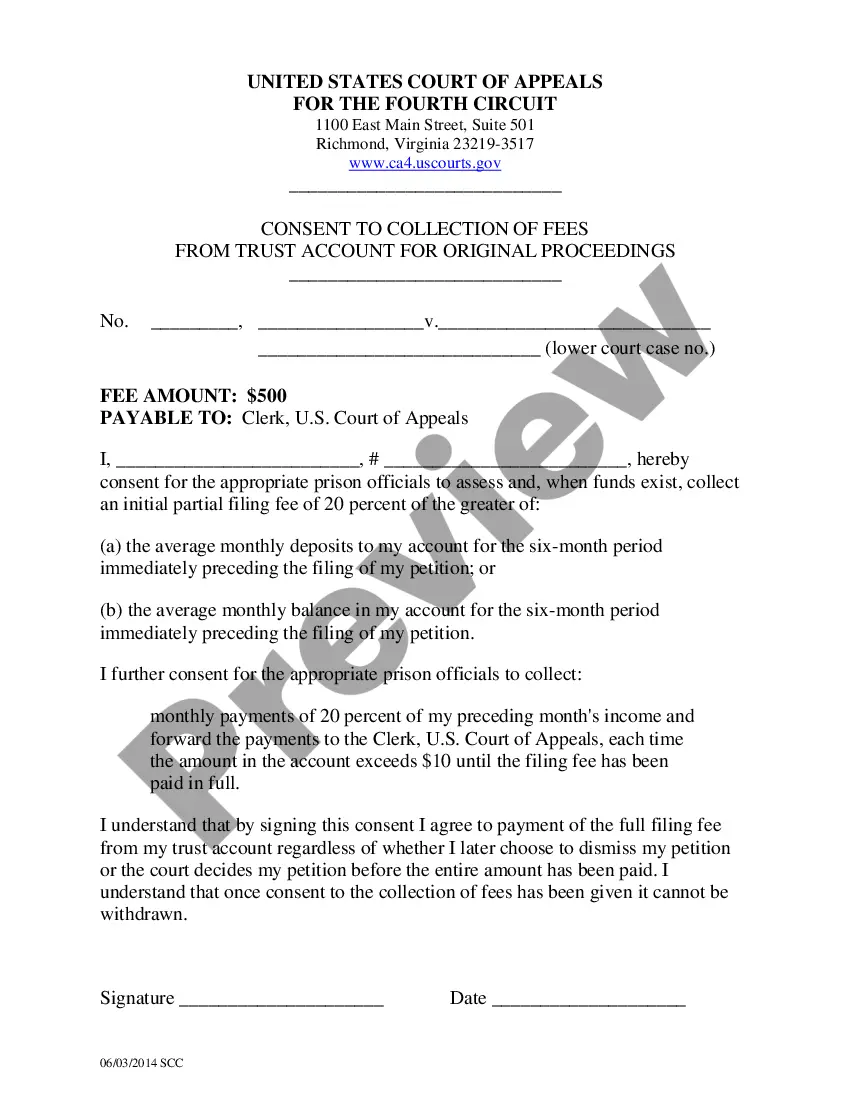

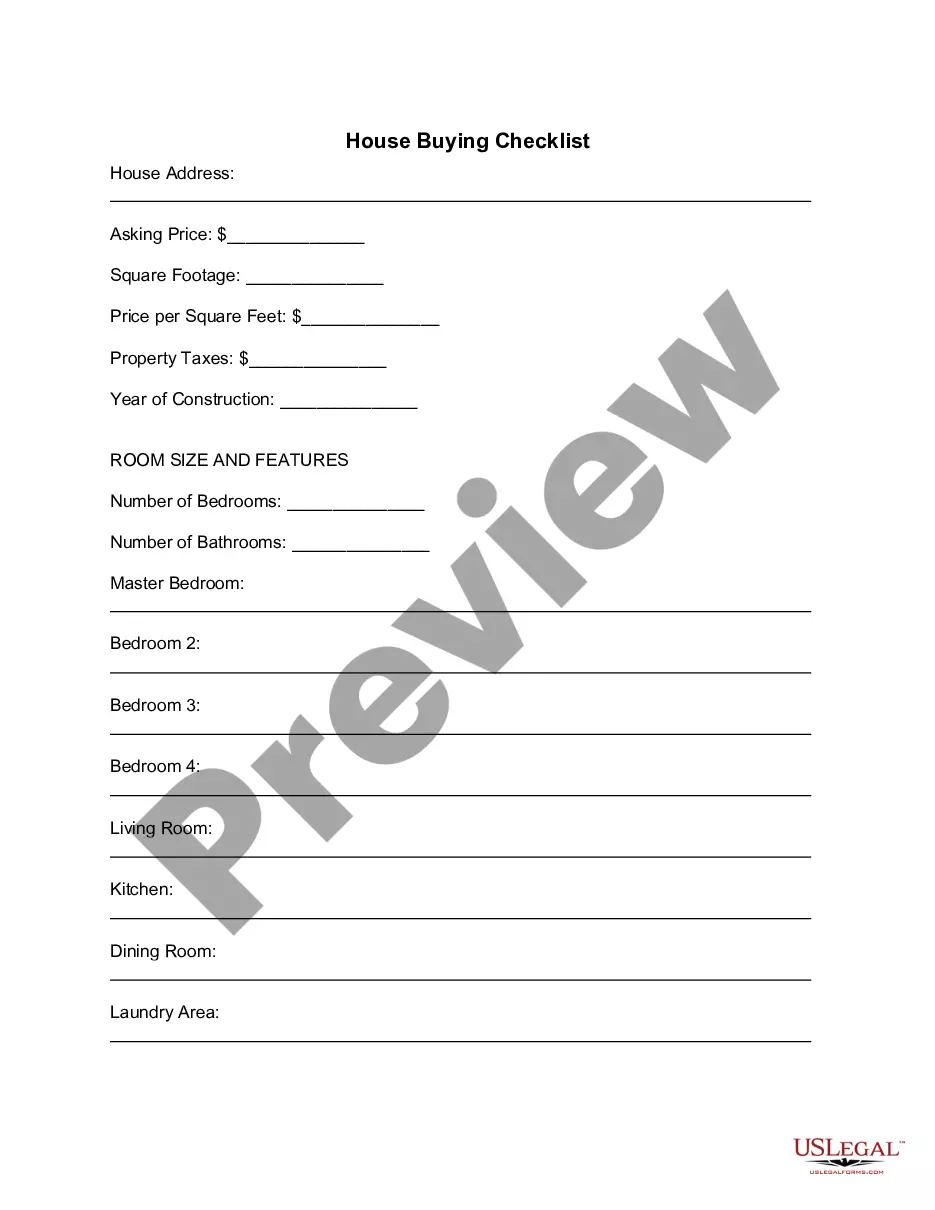

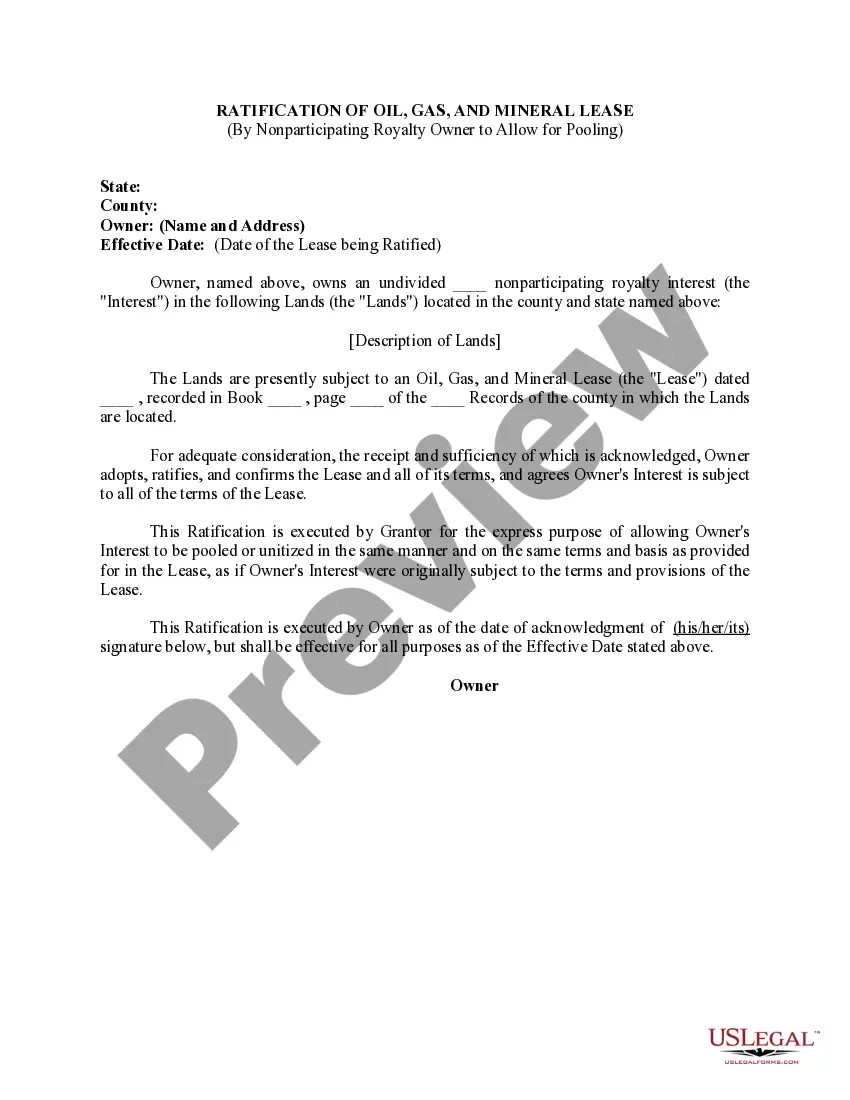

If available, use the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and click on the Acquire button.

- Afterward, you can fill out, modify, print, or sign the Oklahoma Revocable Trust for Asset Protection.

- Each legal document template you obtain is yours forever.

- To retrieve another copy of any acquired form, visit the My documents section and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct form template for your desired region/city.

- Review the form details to confirm you have chosen the right template.

Form popularity

FAQ

When considering the best trust for asset protection, many experts point to Oklahoma as a prime choice. An Oklahoma Revocable Trust for Asset Protection offers flexibility and a range of benefits that can safeguard your assets effectively. This trust allows you to maintain control of your assets while providing the necessary legal framework to protect them from creditors. By utilizing an Oklahoma Revocable Trust for Asset Protection, you can achieve peace of mind, knowing that your assets are well protected.

Certain assets are generally not suitable for inclusion in a revocable trust, like retirement accounts and life insurance policies. Placing these assets in a revocable trust can complicate their management and distribution. By understanding these nuances, you can effectively utilize an Oklahoma Revocable Trust for Asset Protection to organize your estate while keeping critical assets outside of the trust.

The best trust for asset protection often depends on your individual goals and circumstances. For many, an irrevocable trust provides greater security against creditors. Nevertheless, an Oklahoma Revocable Trust for Asset Protection can still offer valuable management options for your estate while allowing for changes as needed.

The best state for establishing an asset protection trust typically includes those with robust laws designed to shield assets, such as Nevada and South Dakota. While Oklahoma does not have specific domestic asset protection trust provisions, residents can benefit from an Oklahoma Revocable Trust for Asset Protection. Consider consulting with an expert to determine the most effective options based on your needs.

Multiple states have enacted laws allowing for domestic asset protection trusts, including Nevada, South Dakota, and Alaska. While Oklahoma does not specifically offer a domestic asset protection trust, an Oklahoma Revocable Trust for Asset Protection can still serve many of the same purposes. It's important to evaluate the best strategy based on your personal circumstances and state laws.

Yes, you can set up a trust specifically designed for asset protection. An Oklahoma Revocable Trust for Asset Protection allows you to manage your assets during your lifetime while ensuring that your wishes are honored after you pass away. This process provides not only flexibility but also an organized strategy for your beneficiaries.

To protect your assets from Medicaid in Oklahoma, consider establishing a trust that complies with specific legal requirements. An Oklahoma Revocable Trust for Asset Protection can be part of your strategy, especially if you plan ahead. It’s wise to consult with a legal professional to ensure your assets are effectively safeguarded from potential Medicaid claims.

A revocable trust, while it can be modified during your lifetime, offers various protections for your assets. It allows for the seamless transfer of property upon death, potentially avoiding probate. Although it does not provide the same level of protection as an irrevocable trust, utilizing an Oklahoma Revocable Trust for Asset Protection ensures your assets are organized and can help minimize estate taxes.

Yes, Oklahoma allows for the creation of asset protection trusts. However, these trusts are typically irrevocable. Individuals seeking to protect their assets in Oklahoma can benefit from establishing an Oklahoma Revocable Trust for Asset Protection, which can provide flexibility and security while managing assets.

Determining whether your parents should place their assets in a trust largely depends on their financial situation and goals. If they are looking for a way to manage assets effectively and ensure a smooth transition to heirs, an Oklahoma Revocable Trust for Asset Protection can be beneficial. It is advisable for them to consult with a legal expert to assess the most suitable strategy for their unique circumstances.