Oklahoma Revocable Trust for Real Estate

Description

How to fill out Revocable Trust For Real Estate?

Are you presently in a condition where you require documentation for both business or personal purposes nearly every day? There are numerous legal document templates accessible online, but finding versions you can rely on can be challenging. US Legal Forms provides an extensive collection of form templates, such as the Oklahoma Revocable Trust for Real Estate, which can be printed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Oklahoma Revocable Trust for Real Estate template.

If you do not have an account and wish to start using US Legal Forms, follow these steps.

You can find all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the Oklahoma Revocable Trust for Real Estate anytime if needed. Just select the required form to download or print the document template.

Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start making your life a little easier.

- Search for the form you need and make sure it is for the correct city/state.

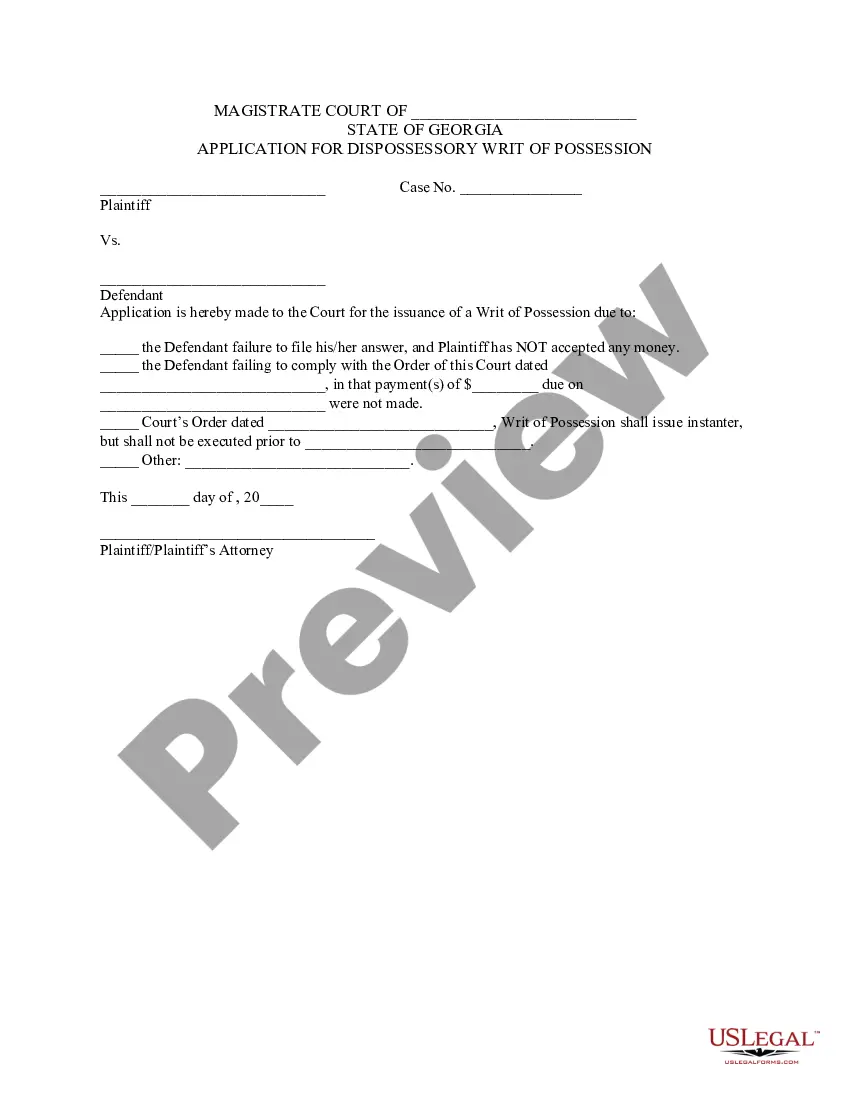

- Use the Preview button to examine the form.

- Check the description to ensure you have selected the right form.

- If the form does not meet your expectations, utilize the Lookup field to find the form that matches your needs and requirements.

- Once you find the right form, click on Get now.

- Choose the pricing plan you prefer, fill in the required information to create your account, and pay for your order using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

When it comes to filing taxes for an Oklahoma Revocable Trust for Real Estate, the trust usually does not file its own tax return, as it is considered a pass-through entity. Instead, any income generated by the trust will be reported on the grantor's personal tax return. It's important to keep accurate records of the trust's income and expenses. If you want detailed guidance, using services like US Legal Forms can help you navigate the tax obligations efficiently.

To register an Oklahoma Revocable Trust for Real Estate, you will need to draft the trust document outlining the terms and conditions. Once created, you should sign the document in front of a notary to ensure its validity. After that, you can fund the trust by transferring properties or assets into it. Utilizing a reliable platform like US Legal Forms can simplify this process, providing you with proper templates and guidance.

Putting your home in an Oklahoma Revocable Trust for Real Estate can be a good idea for many people. This option provides a way to manage your property during your lifetime and ensures a smoother transfer to your heirs. It also allows you to maintain flexibility, as you can alter the trust as your needs change. However, it's advisable to consult with a legal expert to determine if this approach suits your specific situation.

Setting up an Oklahoma Revocable Trust for Real Estate involves several straightforward steps. First, you need to determine your assets and beneficiaries. Next, you can draft the trust document, which outlines how you want your property managed and distributed. Finally, transferring your real estate into the trust will complete the process. Platforms like US Legal Forms can provide you with the necessary templates and guidance to simplify this process.

While an Oklahoma Revocable Trust for Real Estate has many benefits, it does come with some disadvantages. Setting up a trust can involve upfront legal fees and ongoing maintenance costs. Additionally, you may lose personal control over the property if you do not name yourself as the trustee. It's important to weigh these factors carefully and consider your individual circumstances when deciding on this option.

The best way to leave a house to your children is often through an Oklahoma Revocable Trust for Real Estate. This method allows you to maintain control over your property while you are alive, and it simplifies the transfer process after your death. By placing your home in a revocable trust, you can ensure that your children inherit your property without the lengthy probate process. This approach also offers flexibility, as you can change the trust at any time.

An Oklahoma Revocable Trust for Real Estate does not provide estate tax avoidance. Since you retain control over the trust and its assets, they remain part of your taxable estate. To explore more effective tax strategies, consulting a tax professional can help you understand your options and create a comprehensive plan.

Several assets generally should not be placed in an Oklahoma Revocable Trust for Real Estate. This includes assets with named beneficiaries, such as life insurance policies and certain retirement accounts. Additionally, assets with ownership titles that do not align with the trust's structure can create complications and are better left outside the trust.

Yes, placing your house in an Oklahoma Revocable Trust for Real Estate can be beneficial. It helps avoid probate, making the transfer of ownership smoother for your beneficiaries. Furthermore, you retain the right to live in and manage the property, providing flexibility while securing your home within the trust's framework.

Including all your bank accounts in an Oklahoma Revocable Trust for Real Estate can streamline asset management. However, it may be wise to keep some accounts outside the trust for daily transaction convenience. You can also maintain an account for expenses, ensuring you have easy access to funds without needing to go through the trust.