Ohio Release from Liability under Guaranty

Description

How to fill out Release From Liability Under Guaranty?

Are you currently in the situation where you require documents for both business or personal reasons almost every day.

There are numerous authentic document templates accessible online, but finding forms you can trust is challenging.

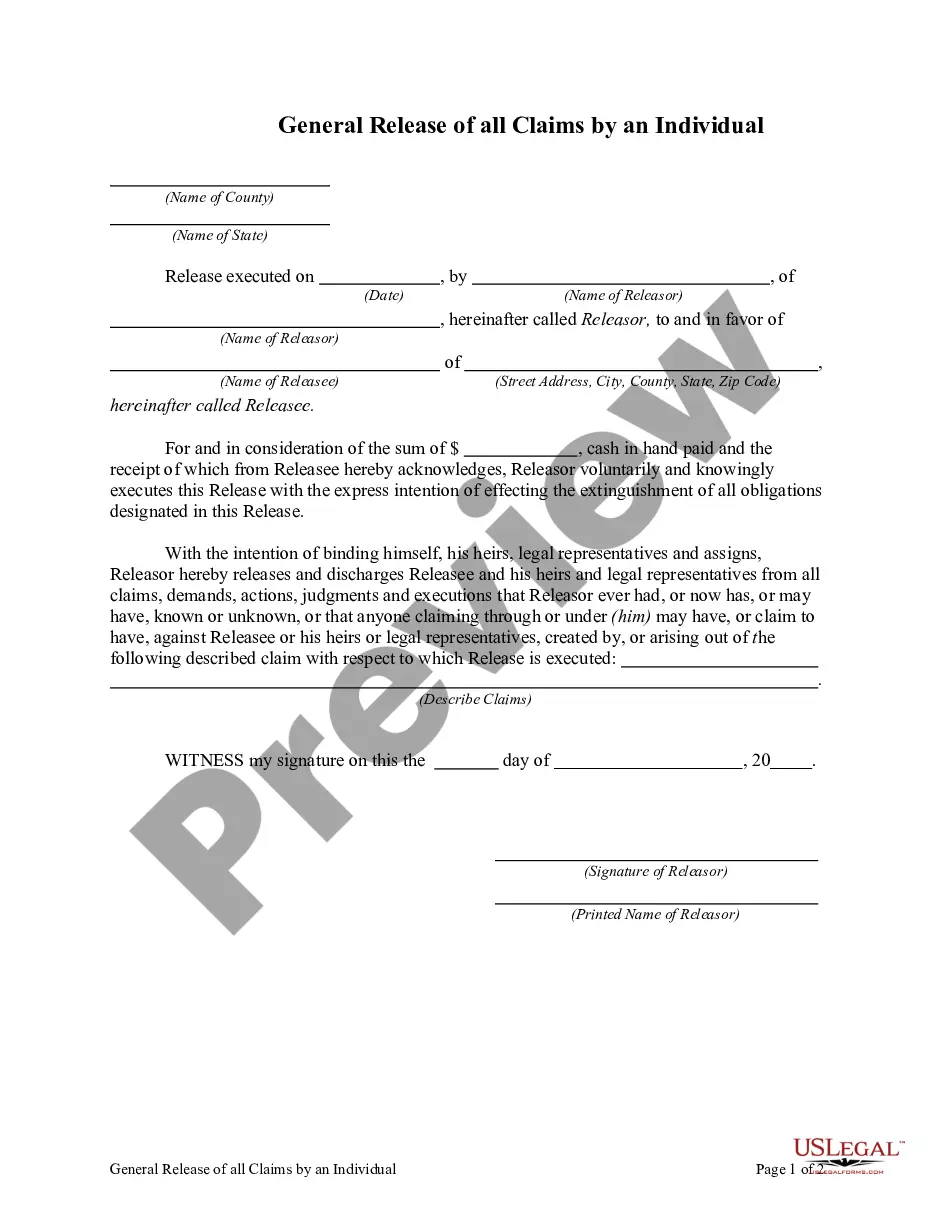

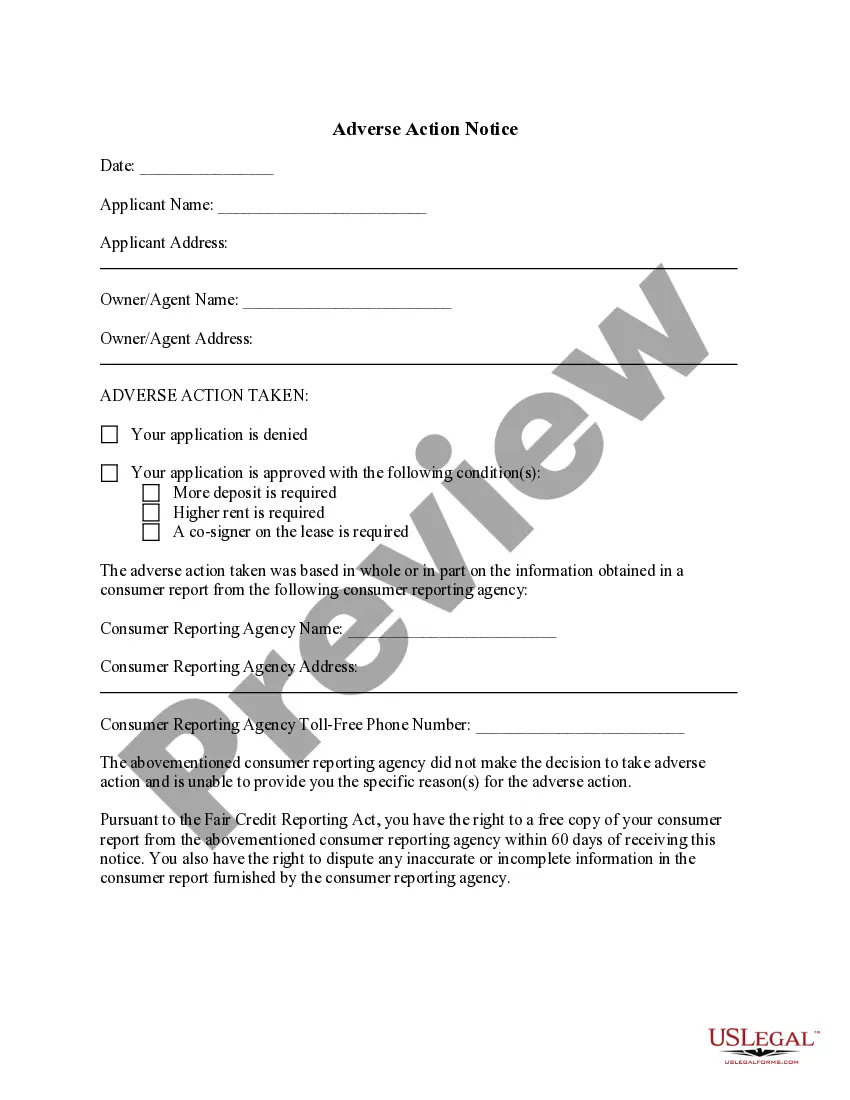

US Legal Forms offers thousands of form templates, such as the Ohio Release from Liability under Guaranty, that are designed to comply with state and federal regulations.

If you find the correct form, click Get now.

Choose the pricing plan you prefer, fill in the required information to create your account, and pay for the order using your PayPal or credit card. Select a convenient file format and download your copy. Access all the document templates you have obtained in the My documents section. You can download an additional copy of the Ohio Release from Liability under Guaranty anytime if necessary. Click on the desired form to download or print the template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that you can utilize for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- Afterward, you can download the Ohio Release from Liability under Guaranty template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct state/region.

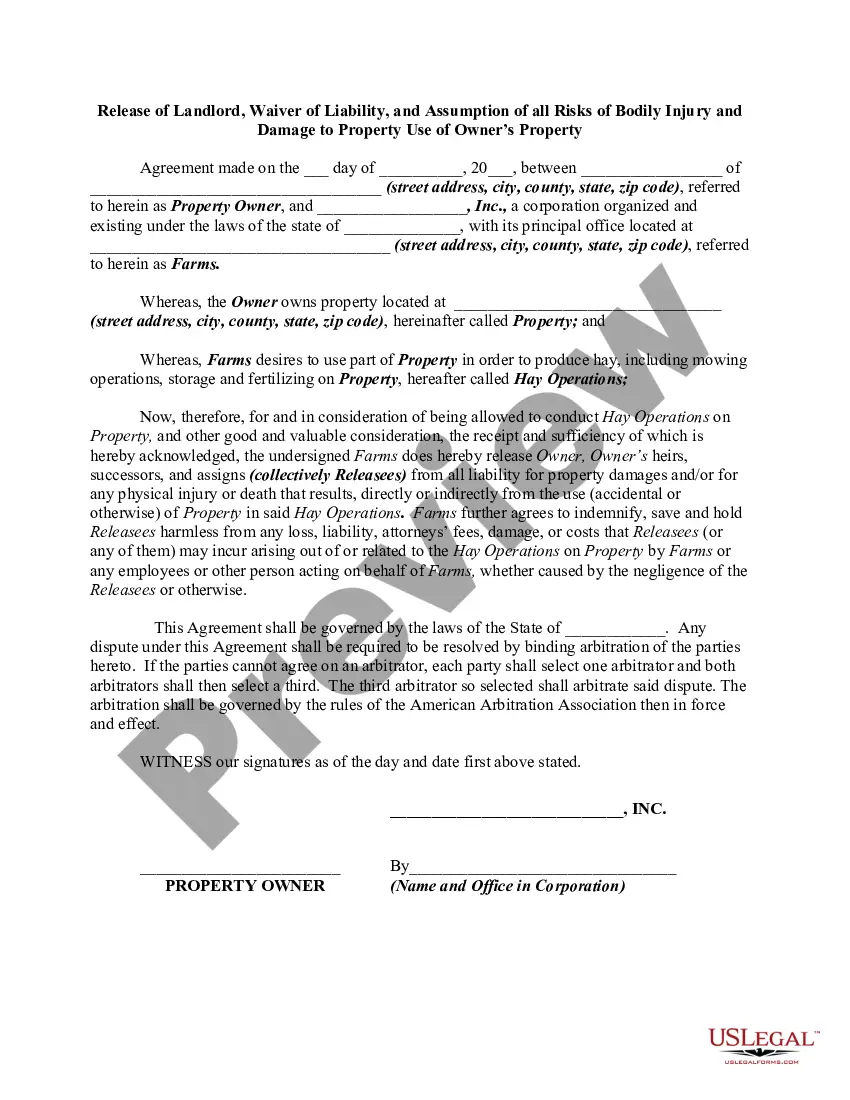

- Utilize the Preview button to review the form.

- Check the description to ensure you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Business owners can exercise their right to revoke the guarantee. Finally, business owners need to be aware that the personal guarantee may include a right to revoke. Typically, a right to revoke the guarantee does not limit the amount of the guarantor's liability as of the date of the revocation.

In general, you can cancel a guarantee at any time. However, this does not release you from the obligations of the guarantee. It simply freezes your liability to the size of the debt at that particular point in time.

A personal guarantee can be enforced the same way as any debt. If the business owner does not pay, the creditor can bring a lawsuit to receive a judgment and levy the owner's personal assets to cover the debt. The exact terms of a personal guarantee specify a creditor's options under the guarantee.

An extension granted to the debtor by the creditor without the consent of the guarantor extinguishes the guaranty. The mere failure on the part of the creditor to demand payment after the debt has become due does not of itself constitute any extension of time referred to herein.

Requesting a releaseThe Retiring Guarantor would typically send a written request for its release to the lender or, in a syndicated facility, the agent. Often the Retiring Guarantor's parent company or the borrower would also be party to the request (the Requesting Parties).

By death of surety (Section 131): A continuing guarantee is also terminated by the death of the surety unless parties have expressed contrary intention. The termination is only with respect to the future transactions and the heirs of surety are liable for transactions that have already taken place.

7 Ways to Avoid a Personal GuaranteeBuy insurance.Raise the interest rate.Increase Reporting.Increased the Frequency of Payments.Add a Fidelity Certificate.Limit the Guarantee Time Period.Use Other Collateral.

A continuing guarantee can be revoked anytime by surety for future transactions by giving notice to the creditors. However, the liability of a surety is not reduced for transactions entered into before such revocation of guarantee.

Unlimited Personal Guarantees This means they can take money from your retirement, savings, college funds, etc. The kicker here is that if there isn't enough liquid cash available to cover the entire loan, they can come after physical property as well, such as your house, car, or any other assets.

A guarantee is a secondary obligation guaranteeing the obligations of another party (usually a borrower) and depends on that other having defaulted. An indemnity on the other hand is a free standing obligation not dependent on the borrower's default but enforceable in its own right.