Ohio Expense Report

Description

How to fill out Expense Report?

You might spend hours online trying to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms provides a vast array of legal forms that have been reviewed by experts.

You can easily download or print the Ohio Expense Report from the service.

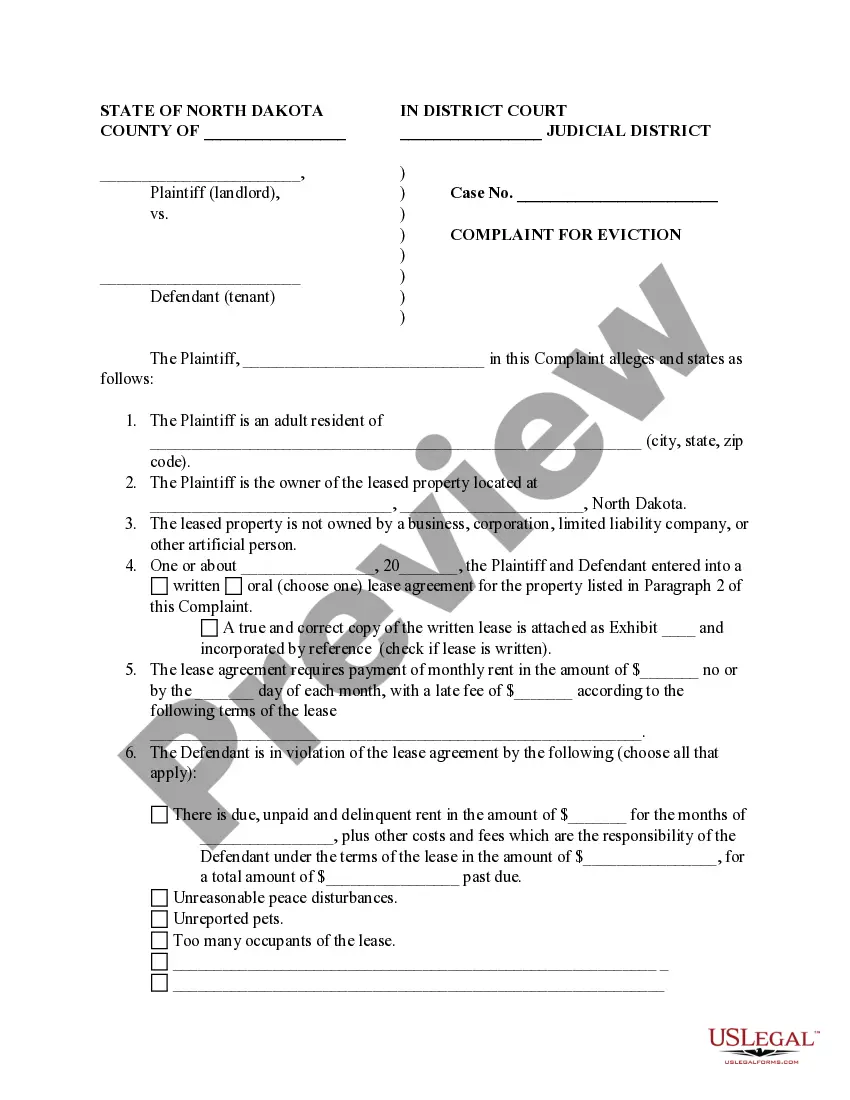

If available, use the Review button to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you can fill out, modify, print, or sign the Ohio Expense Report.

- Each legal document template you download is yours to keep indefinitely.

- To obtain another copy of a purchased form, visit the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/region of your choice.

- Review the form details to confirm you have chosen the right form.

Form popularity

FAQ

Expense reports, such as an Ohio Expense Report, should ideally be submitted at the end of each month or as defined by company guidelines. Maintaining a consistent schedule assists in keeping your financial records up to date. Always keep your receipts organized and ready to facilitate quick submissions.

The 60-day rule for an Ohio Expense Report suggests that expenses should be submitted within 60 days of being incurred to qualify for reimbursement. This rule helps in maintaining proper accounting and encourages timely filing. If you exceed this timeframe, you may risk not being reimbursed, so check your company’s policies to stay compliant.

You should submit your Ohio Expense Report shortly after incurring business-related expenses. Many organizations advise submitting reports monthly or as specified in their reimbursement policy. By doing so, you help prevent delays in reimbursement and keep your finances organized.

To report expenses on an Ohio Expense Report, prepare a detailed list of all expenses incurred during your business activities. Include pertinent information such as dates, purpose, and amounts spent. Utilize platforms like US Legal Forms for an easy-to-use template, ensuring you capture every necessary detail for accurate reimbursement.

The timeline for an Ohio Expense Report can vary by organization, but generally, most expenses should be reported within 30 days of incurrence. Many companies implement a specific deadline for reports to expedite approval and payment. Consider checking with your company's policy to ensure you meet their submission timeline.

You should report expenses regularly, preferably within a specific timeframe after incurring them. For an Ohio Expense Report, it is best practice to submit your report at least once a month or as your company's policy dictates. Timely reporting helps in maintaining accurate financial records and ensures that reimbursements occur promptly.

Filing an Ohio Expense Report involves gathering all relevant receipts and documentation first. After compiling these items, either utilize an online platform, like US Legal Forms, to fill out the report electronically or print it out for manual submission. Finally, ensure that you submit your report to the correct department or supervisor to expedite processing.

To format an Ohio Expense Report effectively, start by organizing your information clearly. Use headers for sections such as date, category, description, and amount. Additionally, maintain consistency in how you present your data, ensuring that it is easy to read and understand. This structured approach helps in the quick review and approval of your expenses.

The IRS generally requires receipts for any single expense over $75. However, even casual expenses need to be documented, especially if they aggregate over this threshold in your Ohio Expense Report. Keeping detailed records can help streamline your tax filing process and provide evidence in case of an audit. Using platforms like UsLegalForms can streamline this documentation process for you.

The IRS requires that an expense report includes specific details, such as the date, amount, purpose, and recipient of the payment. For your Ohio Expense Report, you should include supporting documents like receipts and invoices to validate your expenses. Proper documentation not only safeguards you during audits but also helps ensure accuracy in your filing. Tools like UsLegalForms can assist you in organizing and managing these reports efficiently.