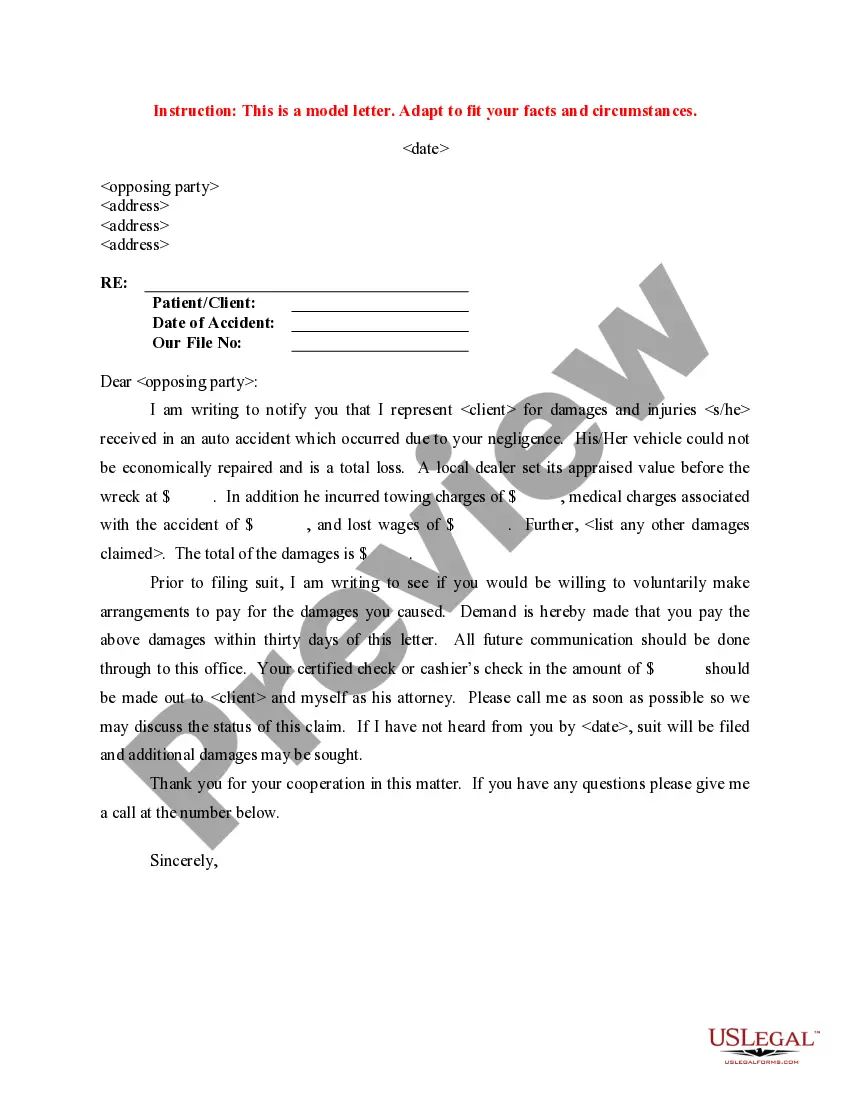

Sample Letter for Traffic Accident - Refusal to Pay Requested Damages

What is this form?

This form is a sample letter for traffic accident claims, titled "Sample Letter for Traffic Accident - Refusal to Pay Requested Damages." It serves the purpose of clearly stating your refusal to pay damages requested by another party involved in a traffic accident. Unlike standard claims forms, this letter specifically addresses disputes regarding payment requests and provides a formal means to communicate your decision.

Key parts of this document

- Date of the letter

- Your name and address

- Recipient's name and address

- Statement of refusal to pay requested damages

- Explanation of reasons for refusal

When to use this document

This form should be used when you have been involved in a traffic accident and the other party has requested damages that you do not agree to pay. It is essential when you believe that the claims made are unjustified or inflated. This letter provides a professional and documented way to express your refusal formally.

Who this form is for

Consider using this form if you are:

- A driver involved in a traffic accident who is contesting a damage claim.

- A vehicle owner who wants to notify the other party of your refusal to pay.

- An individual seeking to communicate a formal stance regarding a legal matter without legal representation.

Instructions for completing this form

- Enter the date you are sending the letter at the beginning.

- Provide your full name and contact information.

- Include the recipient's full name and address.

- Clearly state your refusal to pay the requested damages.

- Offer a concise explanation of your reasons for refusal.

Does this document require notarization?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to include the recipient's correct address.

- Not providing sufficient reasoning for the refusal.

- Using informal language instead of a professional tone.

Why complete this form online

- Convenience of downloading immediately after completion.

- Edit and customize the form to suit your specific situation.

- Access to a legally reviewed template ensures reliability.

Looking for another form?

Form popularity

FAQ

Though insurers may try to refuse payment using the tactics discussed above, if their policyholder is responsible for the accident that caused your injuries, they must pay. If the at fault person does not have insurance, you should be able to rely on your own insurance company to cover your expenses.

What to Do After the Other Party's Insurance Denies Your Claim. If your claim is denied, regardless of how valid you believe it is, you'll most likely need to hire an attorney if you choose to fight the denial. After all, insurers make a profit by taking in more money in premiums than they pay out in claims.

Outline The Incident. You will need to start by outlining the details of the accident. Detail Your Injuries. Explain All Of Your Damages. Calculate Your Settlement Demand. Attach Relevant Documents. Get Help From An Attorney.

Request Your Medical Records. One of the first things you will need to do is request copies of your medical records. Document Your injury. Establish the Extent of Property Damage. Document Your Expenses. Be Organized. Do Not Exaggerate and Do Not Be Greedy. Calculating Pain and Suffering Seek Professional Legal Advice.

Ask For an Explanation. Several car insurance companies are quick to support their own policyholder. Threaten Their Profits. Most insurance companies will do anything to increase their profits. Use Your Policy. Small Claims Court & Mediation. File a Lawsuit.

Unfortunately, insurance companies can and do deny policyholders' claims on occasion, often for legitimate reasons but sometimes not. Whether it's an accident or a stolen car insurance claim that is denied, it is important to understand the major reasons your claim might be denied and what you can do if it happens.

Outline The Incident. You will need to start by outlining the details of the accident. Detail Your Injuries. Explain All Of Your Damages. Calculate Your Settlement Demand. Attach Relevant Documents. Get Help From An Attorney.

Type your letter. Concisely review the main facts. Be polite. Write with your goal in mind. Ask for exactly what you want. Set a deadline. End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies.

You can sue your insurance company if they violate or fail the terms of the insurance policy. Common violations include not paying claims in a timely fashion, not paying properly filed claims, or making bad faith claims.