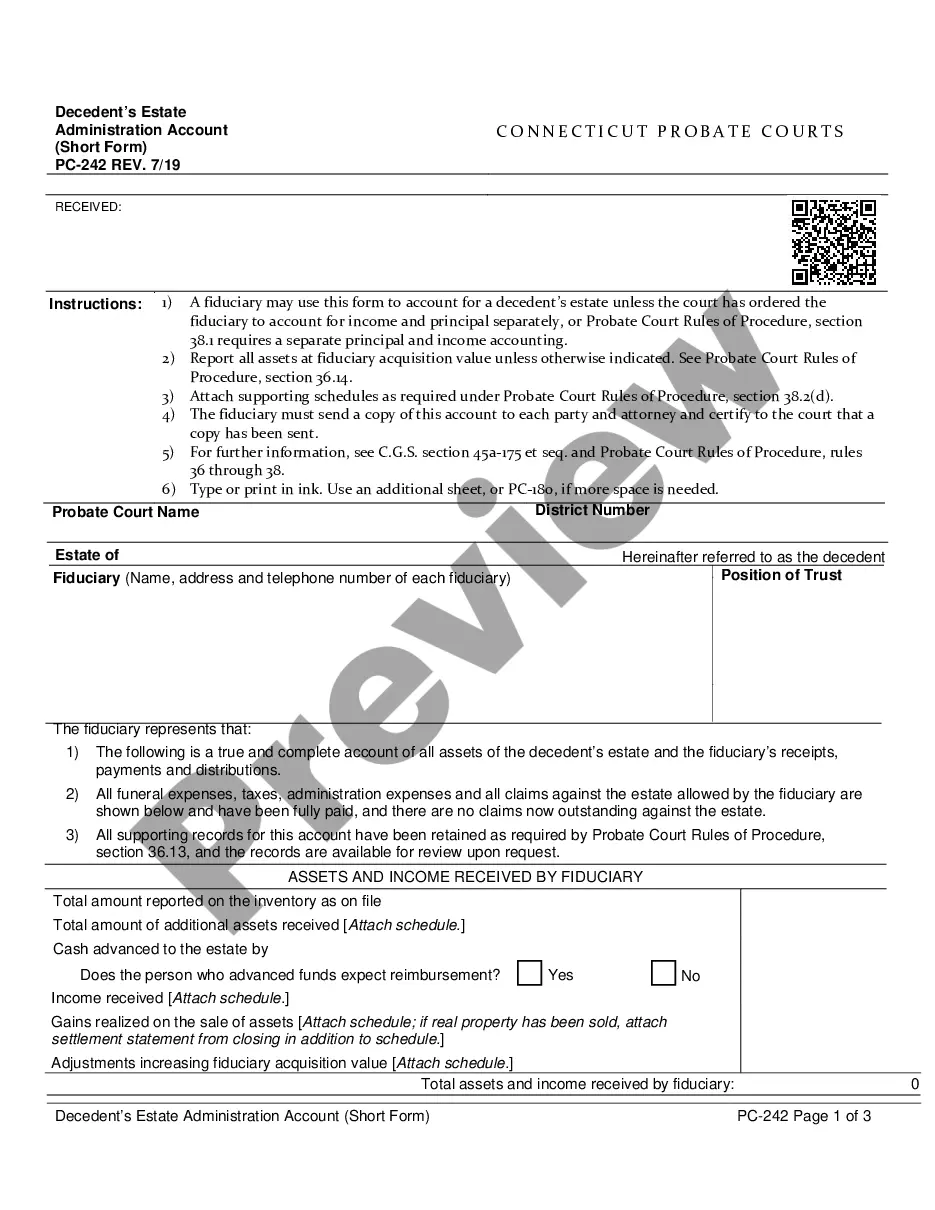

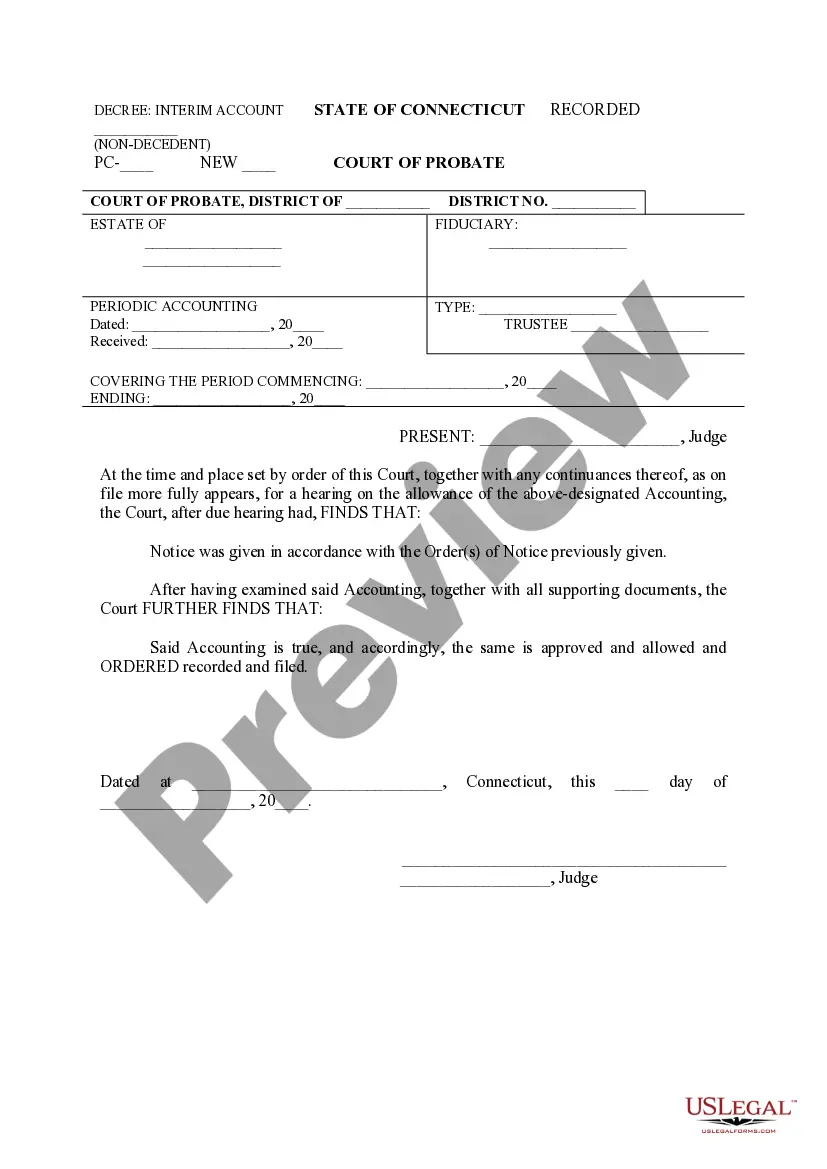

Connecticut Interim Account (Non-Decedent)

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Interim Account (Non-Decedent)?

Utilize US Legal Forms to obtain a printable Connecticut Interim Account (Non-Decedent). Our court-acceptable forms are crafted and frequently updated by experienced attorneys.

Ours is the most extensive Forms catalog available online and offers reasonably priced and precise samples for clients, lawyers, and small to medium-sized businesses.

The templates are organized into state-specific categories, and several can be previewed prior to download.

Establish your account and make the payment via PayPal or credit card. Download the form onto your device and feel free to reuse it multiple times. Utilize the Search engine if you need to locate another document template. US Legal Forms provides a vast array of legal and tax samples and packages for both business and personal requirements, including Connecticut Interim Account (Non-Decedent). Over three million users have successfully used our platform. Choose your subscription plan and obtain high-quality forms in just a few clicks.

- To download templates, clients must have a subscription and sign in to their account.

- Select Download next to any form you require and locate it in My documents.

- For users without a subscription, follow the guidelines below to swiftly find and download Connecticut Interim Account (Non-Decedent).

- Ensure that you obtain the correct template for the state you need it in.

- Examine the document by browsing the description and using the Preview feature.

- Click Buy Now if it’s the template you are looking for.

Form popularity

FAQ

Filling out an inventory for a decedent's estate involves listing all assets, including real estate, bank accounts, and personal property. Be thorough and gather documentation for each item, as accuracy is key. If you're managing this process, you might find a Connecticut Interim Account (Non-Decedent) helpful for tracking and organizing these assets efficiently.

Avoiding probate fees in Connecticut can be achieved by planning ahead. Implementing strategies such as adding your name to accounts or setting up a Connecticut Interim Account (Non-Decedent) can help. This way, you can keep costs down and ensure your loved ones receive their inheritances without unnecessary expenses.

In Connecticut, you typically need to file for probate within 30 days after the death of an individual. Timely filing is crucial to ensure the estate is settled correctly and to avoid potential legal complications. If you opt for tools like a Connecticut Interim Account (Non-Decedent), you may streamline the process and gain quicker access to estate assets.

Yes, you can avoid probate in Connecticut by using certain strategies. Establishing a trust or designating beneficiaries for accounts can help you keep your assets out of probate. Additionally, utilizing a Connecticut Interim Account (Non-Decedent) can serve as an efficient alternative, allowing for easier asset management.

To avoid probate in Connecticut, consider establishing a revocable living trust, designating payable-on-death beneficiaries for accounts, or using joint ownership arrangements. Each of these strategies can help assets transfer without going through probate. The Connecticut Interim Account (Non-Decedent) can assist you in organizing your estates accordingly, minimizing delays and complications.

In Connecticut, all wills must be submitted for probate, but not all aspects of an estate may require the same level of scrutiny. Once a will is validated, the probate court oversees the distribution of assets as specified. The Connecticut Interim Account (Non-Decedent) is a helpful tool to manage estate accounts and ensure everything is in order for a smooth process.

You can avoid probate in Connecticut by employing strategies like creating trusts, naming beneficiaries on accounts, or holding property in joint tenancy. These methods ensure that your assets bypass the probate process and reach your loved ones directly. Learning about the Connecticut Interim Account (Non-Decedent) can also offer insights into managing your assets efficiently without the need for prolonged court proceedings.

There is no specific minimum value for an estate to go through probate in Connecticut. However, estates with significant assets may warrant probate to resolve debts and distribute property according to a will. The Connecticut Interim Account (Non-Decedent) can provide you with guidance on whether your estate needs to enter probate, regardless of its value.

In Connecticut, joint bank accounts generally do not go through probate upon the death of one account holder. The surviving account holder typically retains immediate access to the funds. If you're looking to manage the distribution of accounts effectively and avoid complications, consider understanding the benefits of the Connecticut Interim Account (Non-Decedent).

Certain assets, such as life insurance policies, retirement accounts, and property held in joint tenancy, typically do not go through probate. These assets pass directly to the named beneficiaries. Understanding the nuances of the Connecticut Interim Account (Non-Decedent) can help you identify which assets are exempt from probate and streamline your estate planning.