Ohio Protecting Deceased Persons from Identity Theft

What is this form package?

The Ohio Protecting Deceased Persons from Identity Theft form package includes essential documents designed to minimize the risk and address the consequences of identity theft involving deceased individuals. This package differs from others by concentrating specifically on the steps to take after a person has passed away, ensuring that their identifying information is safeguarded from misuse.

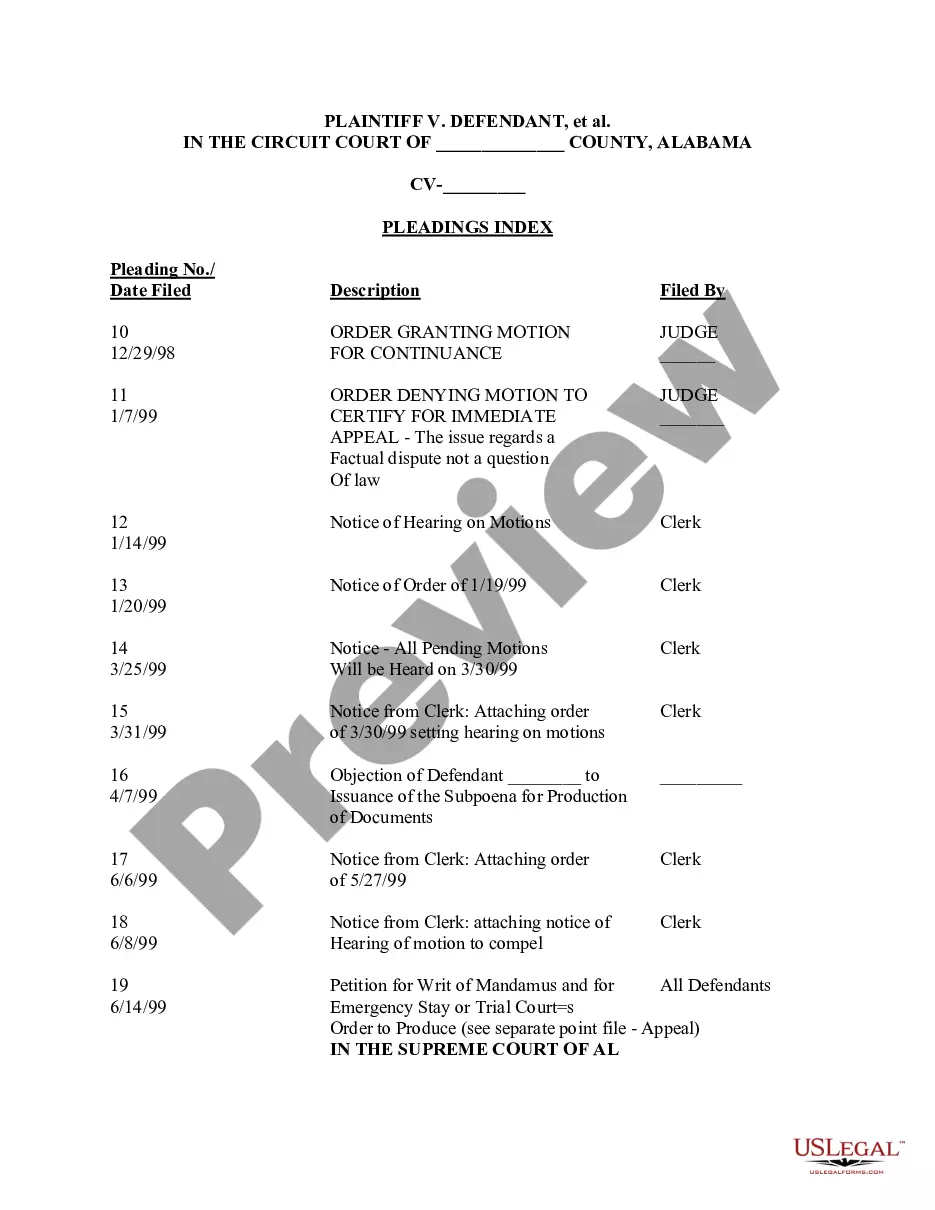

Forms included in this package

- Identity Theft Contact Table

- Guide for Protecting Deceased Persons from Identity Theft

- Checklist for Remedying Identity Theft of Deceased Persons

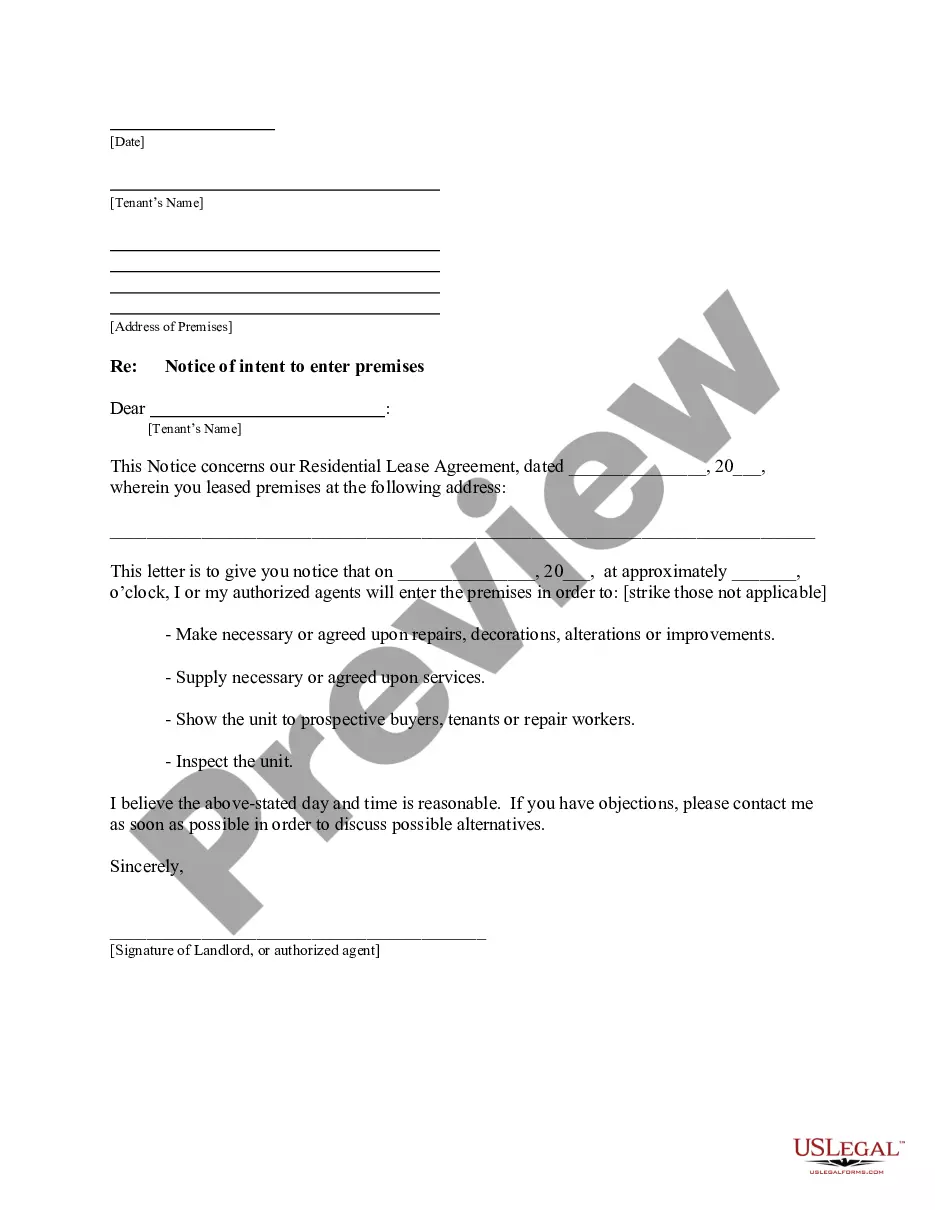

- Letter to Membership Programs Notifying Them of Death

- Letter to Report False Submission of Deceased Person's Information

- Letter to Credit Card Companies and Financial Institutions Notifying Them of Death

- Letter to Credit Reporting Bureaus or Agencies Requesting Copy of Deceased Person's Credit Report and Placement of Deceased Alert

- Letter to Social Security Administration Notifying Them of Death

- Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death

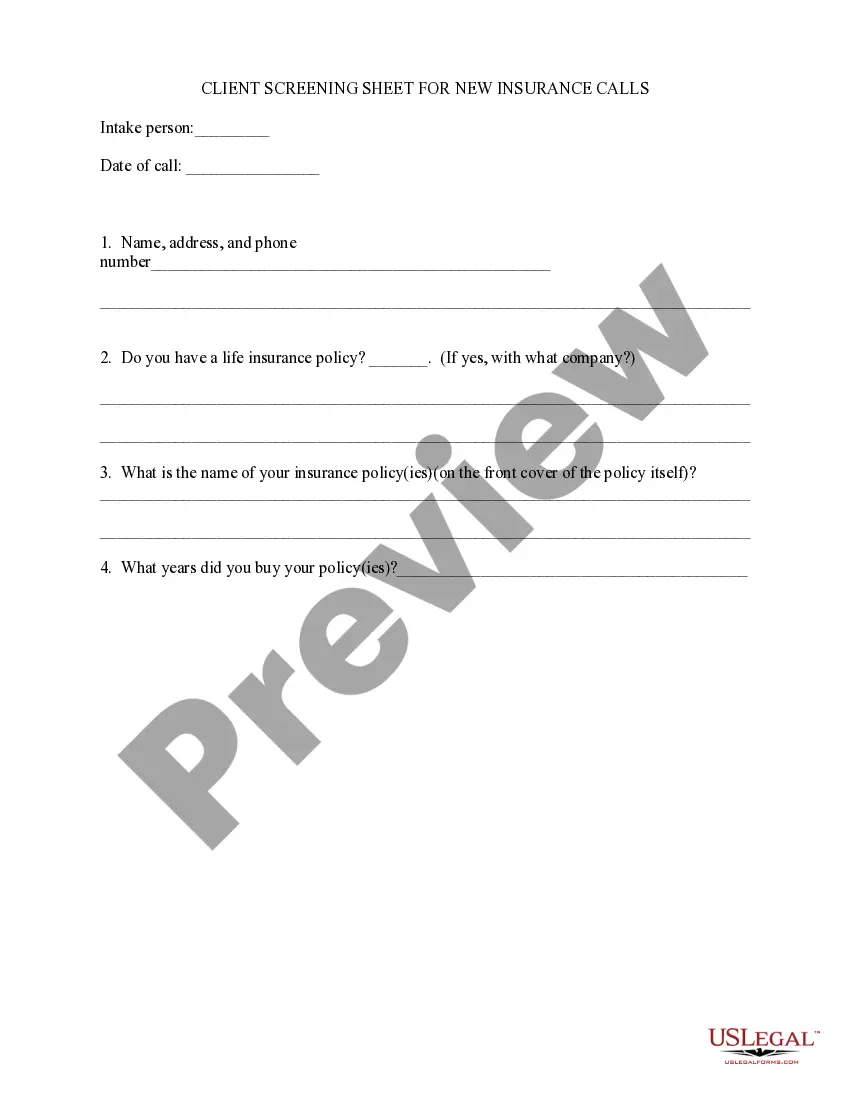

- Letter to Insurance Company Notifying Them of Death

- Letter to Department of Motor Vehicles Notifying Them of Death

- Letter to Other Entities Notifying Them of Death

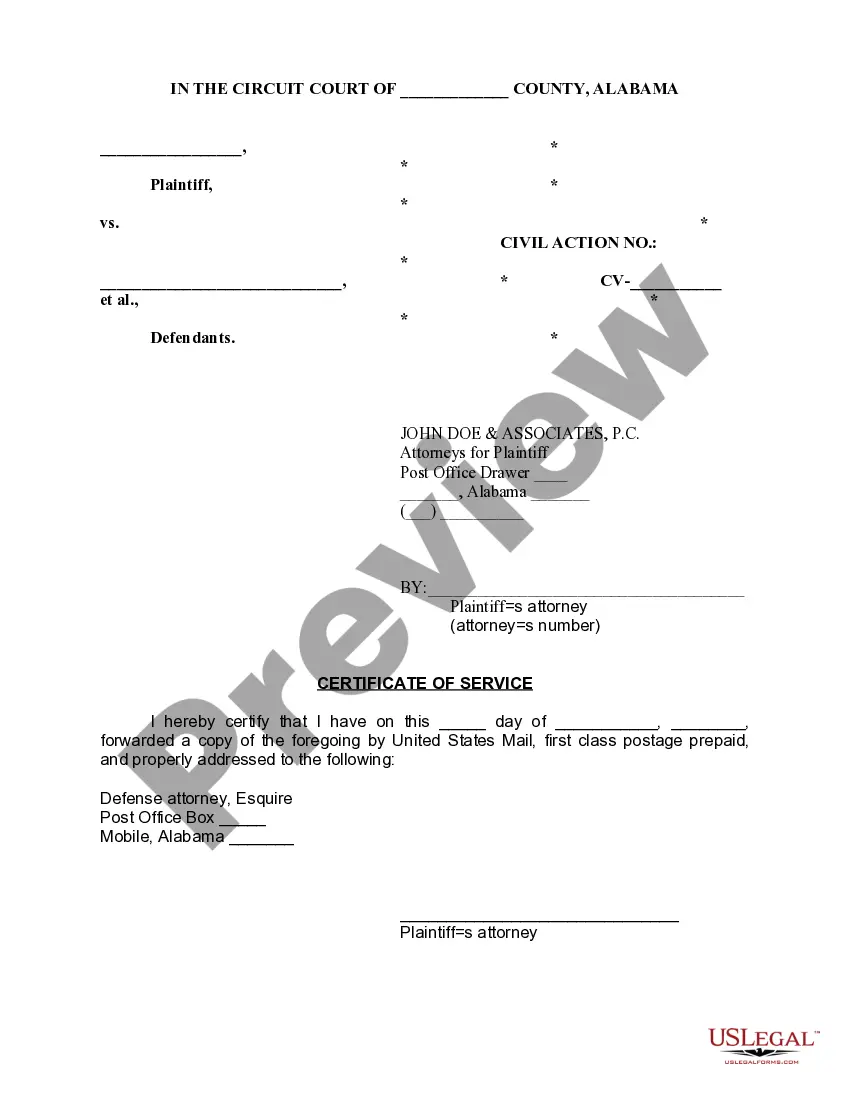

- Letter to Law Enforcement Notifying Them of Identity Theft of Deceased Person

When to use this form package

This form package should be utilized when a loved one has died, and there is a need to inform creditors, government agencies, and other entities about the death. It is especially relevant if you suspect identity theft of the deceased person's information or are managing their estate. Examples include:

- Notifying financial institutions and credit card companies of the death

- Reporting identity theft if the deceasedâs information is being misused

- Requesting credit reports to monitor any fraudulent activities

Who needs this form package

- Family members or executors handling the deceased person's estate

- Individuals who suspect identity theft involving a deceased individual

- Anyone responsible for managing the debts and financial matters of a deceased person

Steps to complete these forms

- Review the included forms carefully to understand their purpose and use.

- Gather necessary information about the deceased, including personal details and any relevant documents.

- Complete each form, ensuring all required information is entered accurately.

- Send the completed forms to the appropriate agencies and organizations as outlined in the package.

- Keep copies of all submitted forms and correspondence for your records.

Do forms in this package need to be notarized?

Notarization is not commonly needed for forms in this package. However, if your state’s laws require it, our notarization service, powered by Notarize, allows you to finalize documents online 24/7 without in-person visits.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to notify all relevant creditors and agencies about the deceasedâs death.

- Not keeping copies of submitted forms for your records.

- Overlooking details in the forms that could lead to delays in processing claims or reports.

Why complete this package online

- Convenience of downloading forms immediately after purchase.

- Edit forms electronically for easier completion and accuracy.

- Access to professionally drafted documents created by licensed attorneys.

Looking for another form?

Form popularity

FAQ

Financial identity theft. Tax identity theft. Medical identity theft. Employment identity theft. Child identity theft. Senior identity theft.

Financial Identity Theft. Financial identity theft is by far the most common type of identity theft. Medical Identity Theft. Criminal Identity Theft. Child Identity Theft. Identity Cloning & Concealment. Synthetic Identity Theft. Mitigate Your Risk.

Account Takeover Fraud. Debit Card Fraud or Credit Card Fraud. Driver's License Identity Theft. Mail Identity Theft. Online Shopping Fraud. Social Security Number Identity Theft. Senior Identity Theft and Scams. Child Identity Theft.

Financial identity theft. This is the most common form of identity theft -- when someone uses another person's information for financial gain. For instance, a fraudster may use your bank account or credit card numbers to steal money or make purchases, or use your Social Security number to open a new credit card.

1Limit the amount of personal information you share about the deceased in newspaper and online obituaries.2Notify the Social Security Administration of the death.3Send the IRS a copy of the death certificate so that the agency can note that the person is deceased.What is Ghosting? One More Form of Identity Theft - LifeLock\nwww.lifelock.com > learn-identity-theft-resources-what-is-ghosting-one-m...

Identity thieves can also use your identity when they commit other crimes, such as entering (or exiting) a country illegally, trafficking drugs, smuggling other substances, committing cyber crimes, laundering money and much more. In fact, they can use your identity to commit almost any crime imaginable in your name.

The four types of identity theft include medical, criminal, financial and child identity theft.

Identity Theft of a Deceased PersonIdentity thieves can get personal information about deceased individuals by reading obituaries, stealing death certificates, or searching genealogy websites that sometimes provide death records from the Social Security Death Index.

Financial Identity Theft. Driver's License Identity Theft. Criminal Identity Theft. Social Security Identity Theft. Medical Identity Theft. Insurance Identity Theft. Child Identity Theft. Synthetic Identity Theft.