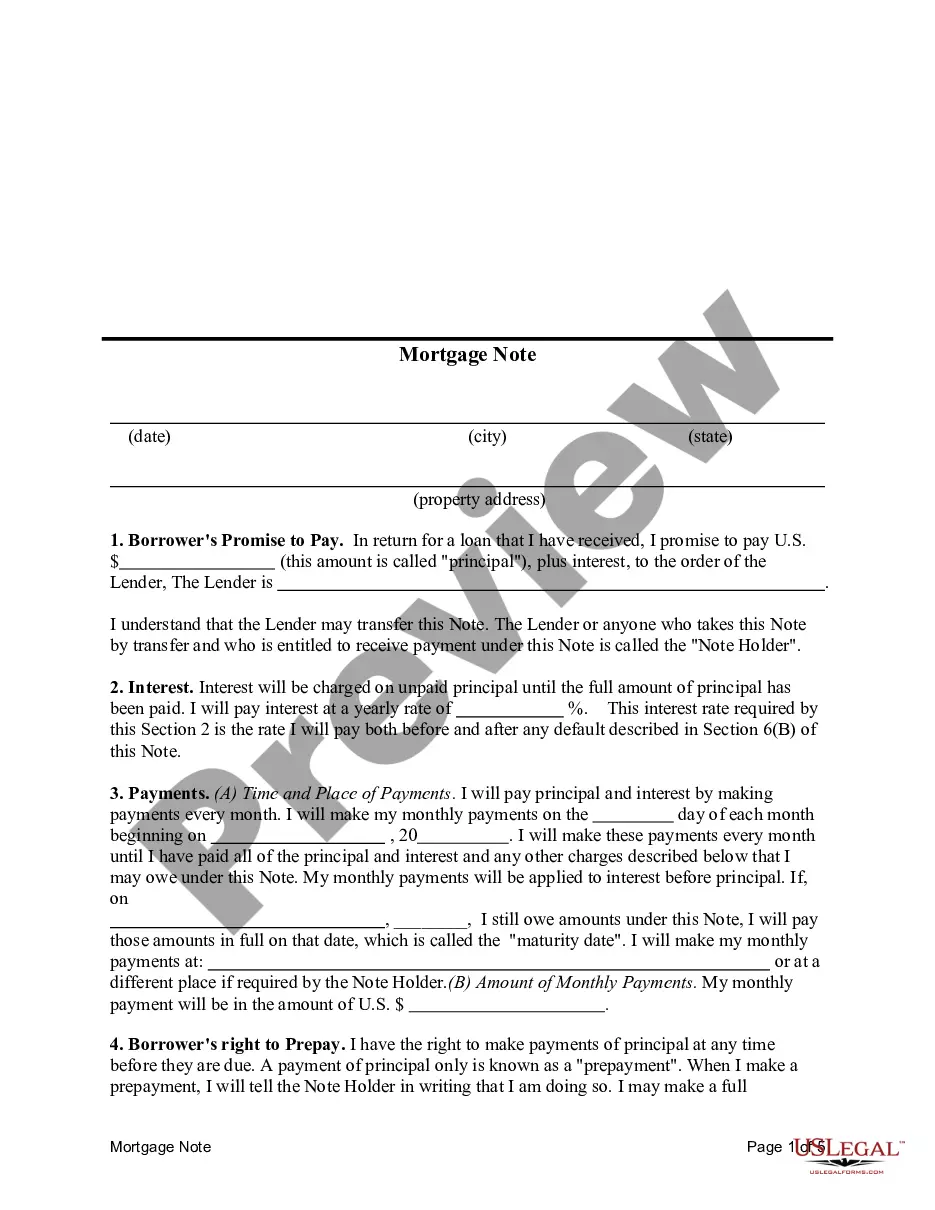

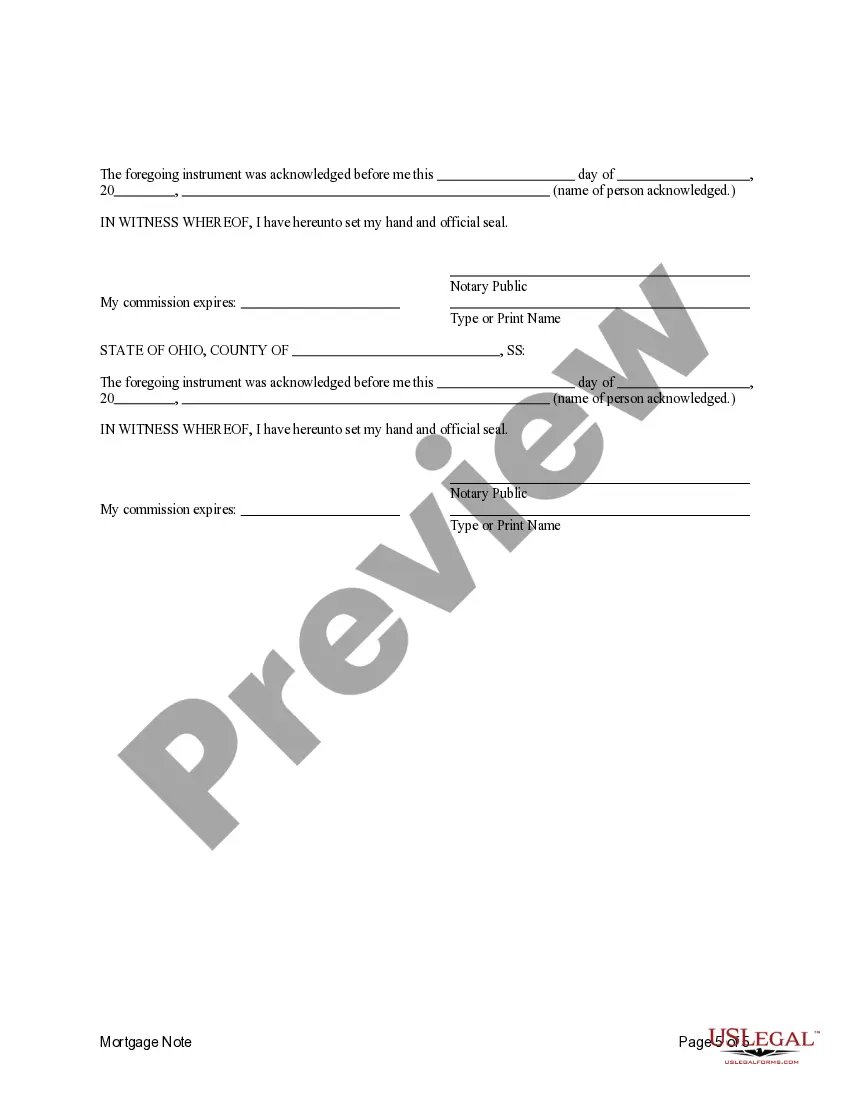

This sample form, a Mortgage Note, is for use in home financing in Ohio. Available in Word format.

Ohio Mortgage Note

Description

Key Concepts & Definitions

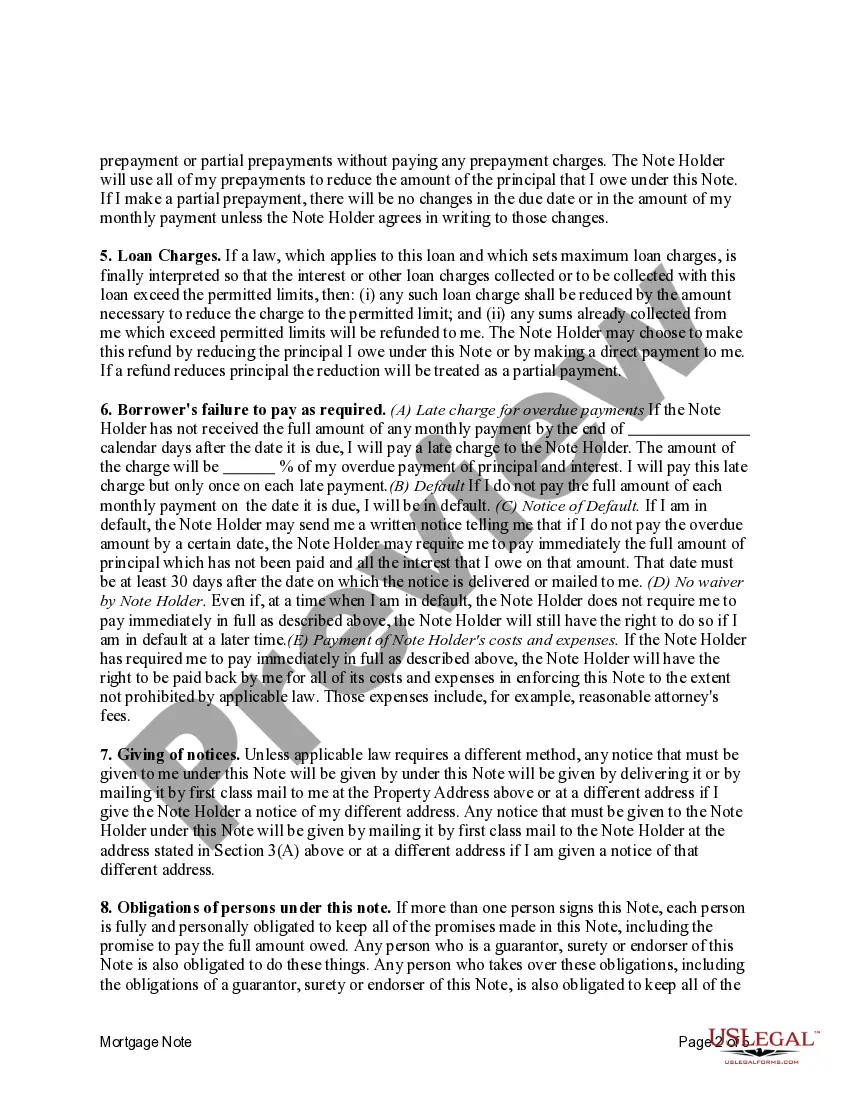

Mortgage Note: A legal document that outlines the terms and conditions of a mortgage loan, including the loan amount, interest rate, and repayment schedule. It is also commonly referred to as a promissory note. Personal finance: Factor in managing personal assets and liabilities, especially important in home equity and credit loans. Real estate: Pertains to the ownership and management of land and buildings, a primary sector for the application of mortgage notes.

Step-by-Step Guide

- Understanding the Basics: Learn about how mortgage notes function as a promissory note tied to real estate.

- Evaluating Personal Finance: Assess your personal financial status, focusing on home equity and ability to manage credit loans.

- Seeking Guidance: Consult with financial experts to get guidance on the best investments and interest rates based on your loan amount.

- Finalizing the Deal: Execute the mortgage note, ensuring all legal requisites are thoroughly addressed and understood.

Risk Analysis

- Interest Rate Changes: Variations in interest rates can significantly affect repayment amounts.

- Credit Risk: The borrowers ability to repay the mortgage notes can lead to default risks.

- Real Estate Market Fluctuation: Shifts in market conditions can impact the property's value tied to the mortgage.

How to fill out Ohio Mortgage Note?

When it comes to completing Ohio Mortgage Note, you most likely think about an extensive process that requires choosing a appropriate sample among countless very similar ones after which being forced to pay legal counsel to fill it out for you. Generally speaking, that’s a slow-moving and expensive option. Use US Legal Forms and choose the state-specific document within just clicks.

For those who have a subscription, just log in and click on Download button to have the Ohio Mortgage Note template.

In the event you don’t have an account yet but want one, keep to the step-by-step guideline listed below:

- Be sure the file you’re downloading is valid in your state (or the state it’s required in).

- Do it by reading through the form’s description and through clicking on the Preview function (if accessible) to view the form’s content.

- Click on Buy Now button.

- Select the proper plan for your financial budget.

- Sign up for an account and select how you want to pay out: by PayPal or by card.

- Save the document in .pdf or .docx file format.

- Get the file on the device or in your My Forms folder.

Professional lawyers draw up our samples so that after downloading, you don't need to bother about editing and enhancing content outside of your personal details or your business’s information. Be a part of US Legal Forms and receive your Ohio Mortgage Note sample now.

Form popularity

FAQ

If you lose your closing papers or they get destroyed, you can obtain a copy of your mortgage note by searching the county's records or contacting the registry of deeds. It's also possible to obtain a copy from the company who services your loan (that is, the company you get billing statements from).

A mortgage holder, more accurately called a note holder or simply the holder, is the owner of your loan. The holder has the right to enforce the loan agreement.

The Note is signed by the people who agree to pay the debt (the people that will be making the mortgage payments). The Deed and the Deed of Trust are signed by those who will own the property that is being mortgaged.The Note itself has virtually nothing to do with the property.

A mortgage note is the document that you sign at the end of your home closing. It contains all the terms of the agreement between the borrower and the lender and accurately reflects all the terms of the mortgage.

A mortgage note is the document that you sign at the end of your home closing. It contains all the terms of the agreement between the borrower and the lender and accurately reflects all the terms of the mortgage.

Once documents such as deeds, mortgage notes, or satisfaction of mortgage or judgment are recorded they become an official public record. Countrywide Process has the capability of completing document recordings quickly and efficiently throughout California.

The lender can provide copies of the documents signed at closing. If the loan has changed hands, contact the most current servicer for a copy of your mortgage or deed of trust documents. A lender is required under the Federal Servicer Act to provide you copies of your loan documents if you submit a written request.

The Mortgage Follows the Note Further, perfection of a security interest in the mortgage note (whether in favor of a buyer or a lender with a security interest to secure an obligation) also perfects the security interest in the buyer's or lender's security interest in the seller's or borrower's rights in the mortgage.