Ohio Mortgage Note

About this form

A Mortgage Note is a legal document that outlines the borrower's obligation to repay a loan used to purchase a property. This specific form is tailored for use in home financing in Ohio. Unlike other loan agreements, a Mortgage Note focuses on the borrower's promise to repay the loan, detailing the terms including interest rates, payment schedules, and repercussions for non-payment. This document is a critical component of a mortgage agreement, providing legal protection for the lender while establishing the borrower's repayment responsibilities.

Common use cases

This form should be used when entering into a mortgage agreement for a property in Ohio. It is essential when a borrower is financing the purchase of a home or refinancing an existing mortgage. Additionally, homeowners looking to establish clear repayment terms for a loan secured by their property will find this form necessary.

Who should use this form

- Homebuyers seeking to secure a mortgage for purchasing a residential property.

- Current homeowners looking to refinance their existing mortgage.

- Individuals or entities providing loans backed by real estate.

- Legal professionals needing to draft mortgage agreements for clients in Ohio.

Completing this form step by step

- Identify the parties involved, including the borrower and the lender.

- Specify the loan amount, interest rate, and payment schedule.

- Indicate the property address used as collateral for the mortgage.

- Include all required signatures, ensuring each signatory understands their obligations.

- Review the completed form for accuracy before submission.

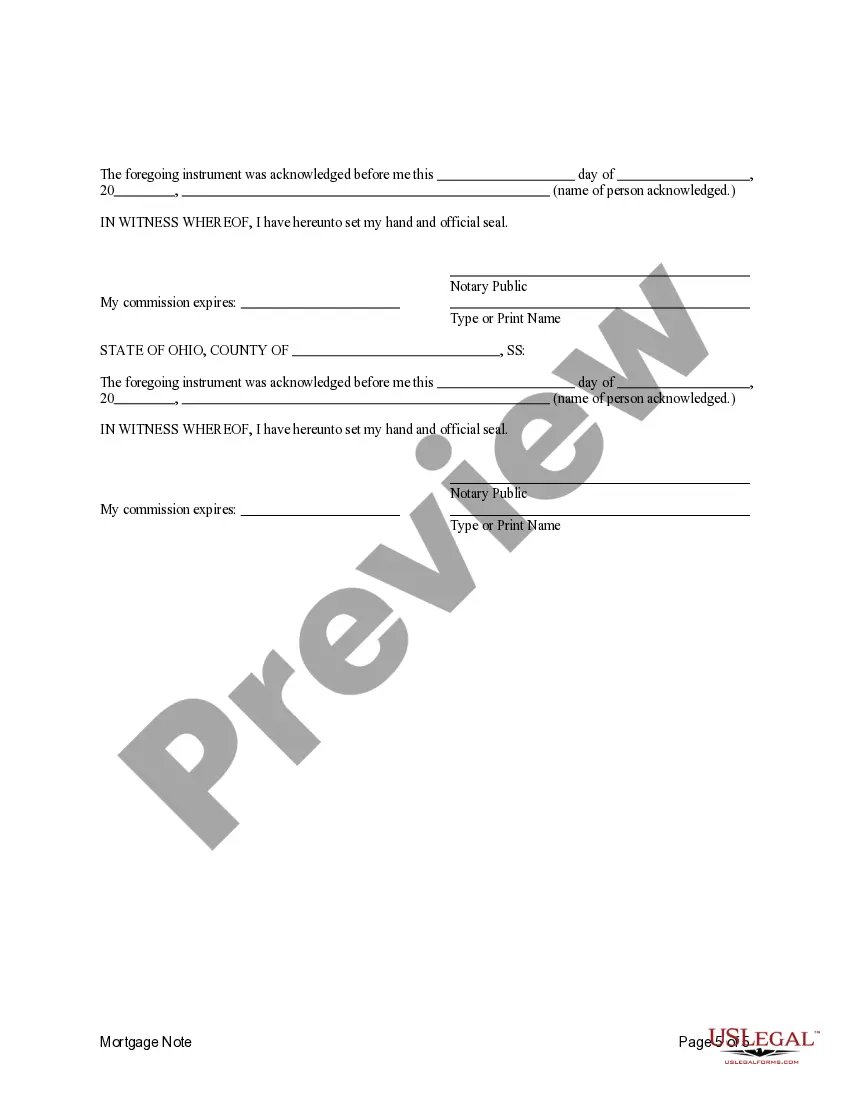

Notarization guidance

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include the correct property address, which can lead to legal complications.

- Neglecting to specify interest rates and payment terms clearly, creating ambiguity.

- Not obtaining all required signatures, potentially invalidating the document.

- Overlooking local legal requirements or statutes specific to Ohio.

Benefits of completing this form online

- Convenience of downloading the template instantly from anywhere.

- Editability allows for quick adjustments based on specific needs.

- Reliability of using a form drafted by licensed attorneys to ensure compliance.

Looking for another form?

Form popularity

FAQ

If you lose your closing papers or they get destroyed, you can obtain a copy of your mortgage note by searching the county's records or contacting the registry of deeds. It's also possible to obtain a copy from the company who services your loan (that is, the company you get billing statements from).

A mortgage holder, more accurately called a note holder or simply the holder, is the owner of your loan. The holder has the right to enforce the loan agreement.

The Note is signed by the people who agree to pay the debt (the people that will be making the mortgage payments). The Deed and the Deed of Trust are signed by those who will own the property that is being mortgaged.The Note itself has virtually nothing to do with the property.

A mortgage note is the document that you sign at the end of your home closing. It contains all the terms of the agreement between the borrower and the lender and accurately reflects all the terms of the mortgage.

A mortgage note is the document that you sign at the end of your home closing. It contains all the terms of the agreement between the borrower and the lender and accurately reflects all the terms of the mortgage.

Once documents such as deeds, mortgage notes, or satisfaction of mortgage or judgment are recorded they become an official public record. Countrywide Process has the capability of completing document recordings quickly and efficiently throughout California.

The lender can provide copies of the documents signed at closing. If the loan has changed hands, contact the most current servicer for a copy of your mortgage or deed of trust documents. A lender is required under the Federal Servicer Act to provide you copies of your loan documents if you submit a written request.

The Mortgage Follows the Note Further, perfection of a security interest in the mortgage note (whether in favor of a buyer or a lender with a security interest to secure an obligation) also perfects the security interest in the buyer's or lender's security interest in the seller's or borrower's rights in the mortgage.