Ohio Heirship Affidavit - Descent

Overview of this form

The Heirship Affidavit - Descent is a legal document that declares the heirs of a deceased person. Its primary purpose is to establish rightful ownership of the deceasedâs assets, including both personal and real property. Unlike a will, which designates inheritance while the individual is alive, the heirship affidavit is often used when someone dies intestate (without a will) to facilitate the transfer of property upon their death.

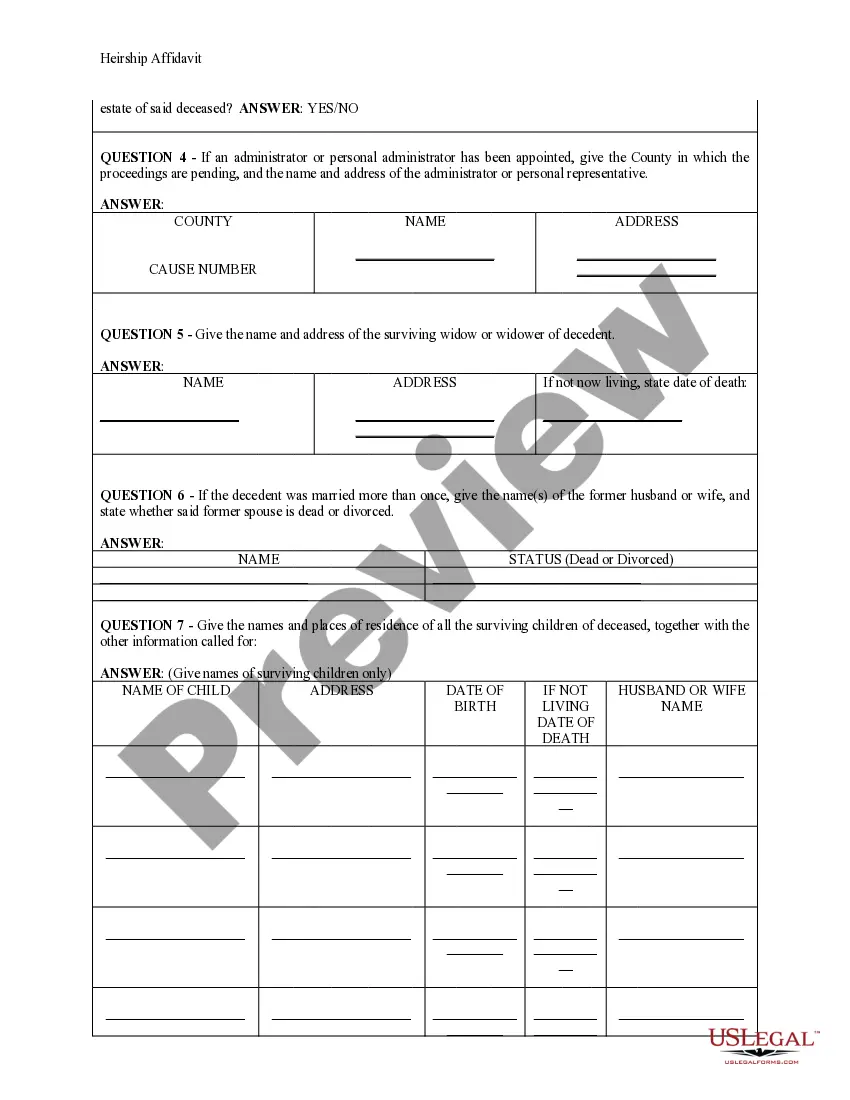

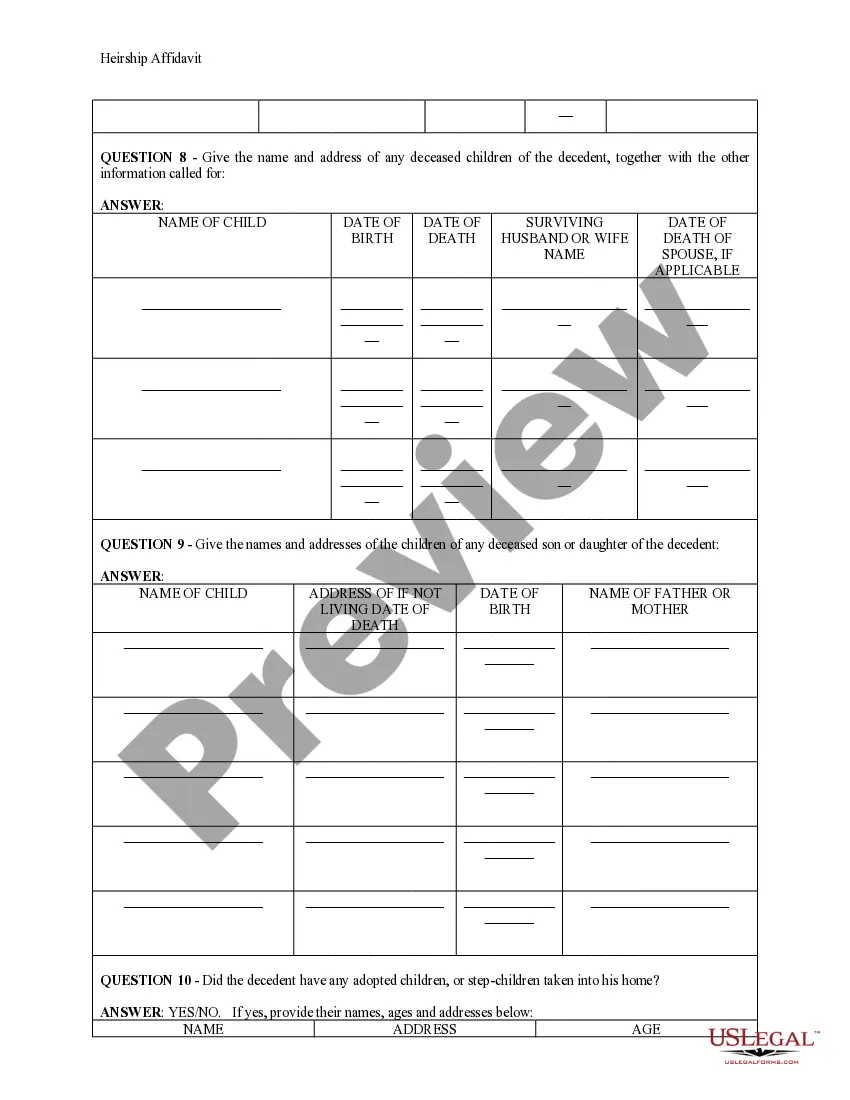

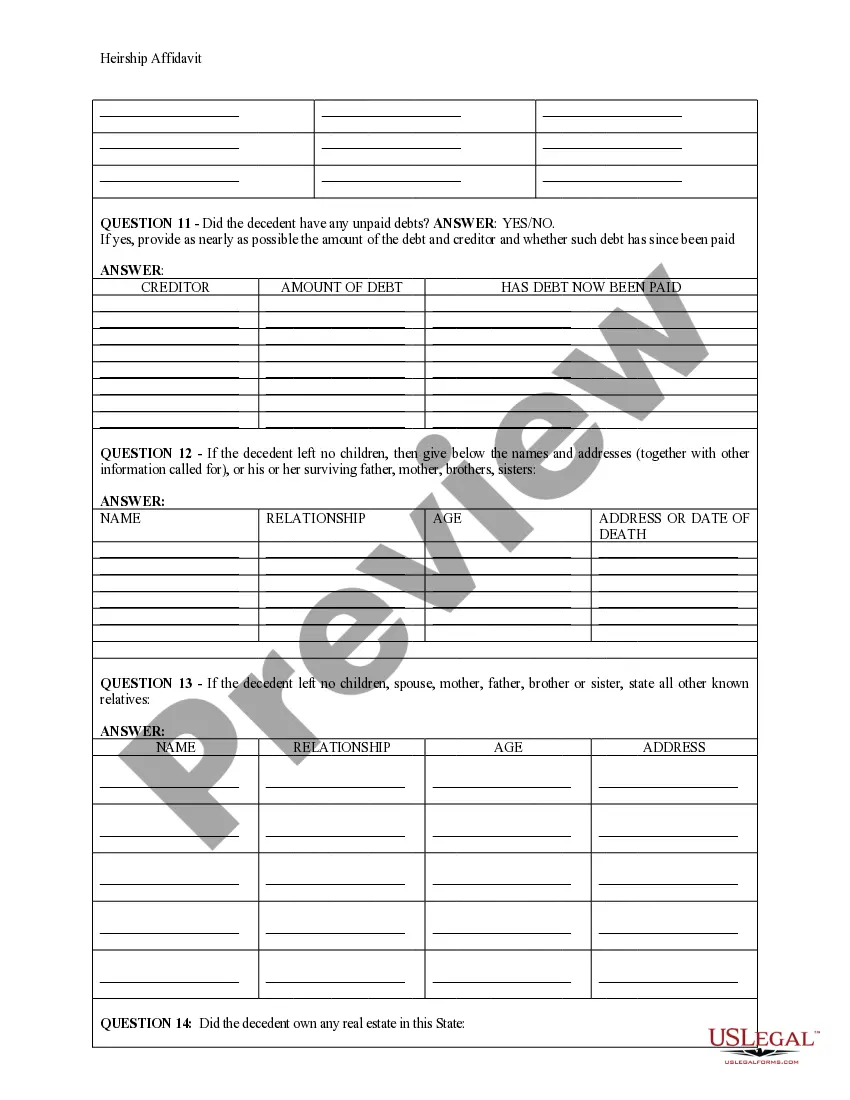

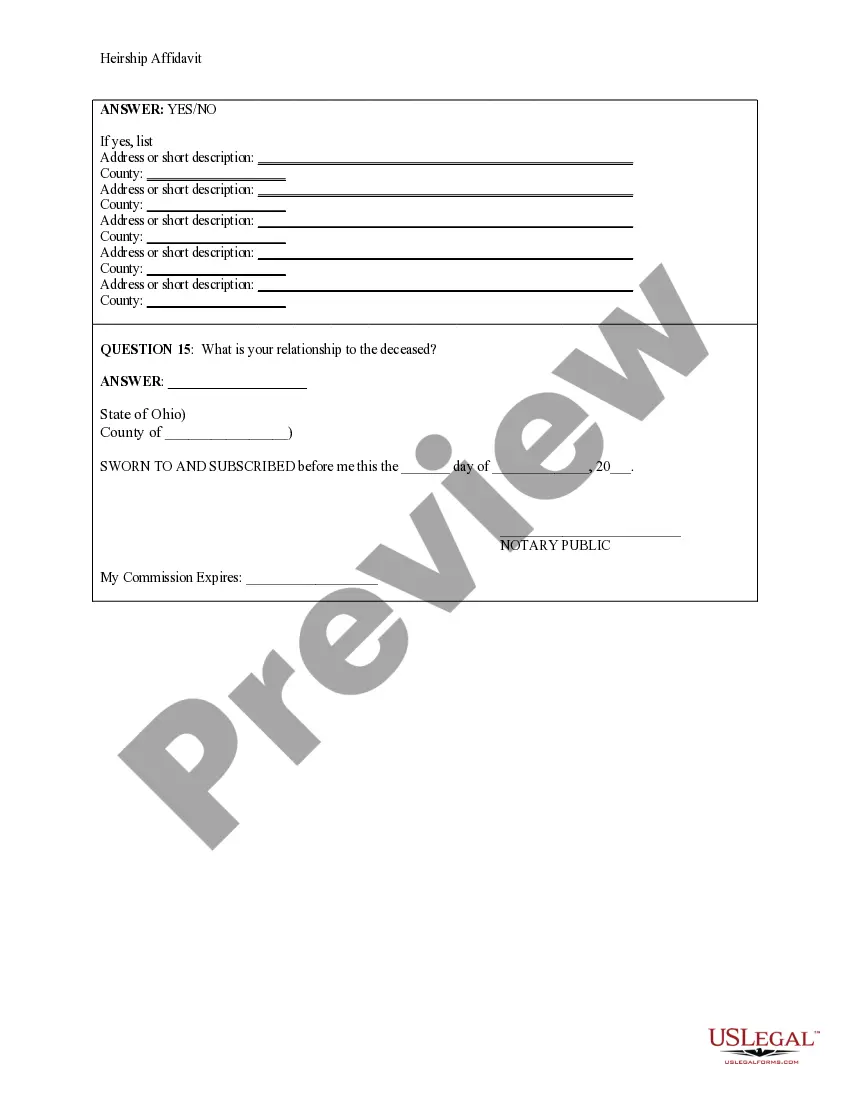

Key components of this form

- Affiant's identification details (name and address)

- Information about the decedent, including name and date of death

- Questions regarding the existence of a will and its probate status

- Details about surviving family members and their relationships to the decedent

- Information on any real estate owned by the decedent

- Affiantâs signature and notary acknowledgment

Situations where this form applies

This form is commonly needed in situations where an individual passes away without a will, leaving behind heirs. It may be required when the heirs need to sell inherited property or claim other assets of the deceased. For example, if the decedent's child wishes to sell real estate inherited from the parent, this affidavit can be recorded to demonstrate ownership. Additionally, it may be used in probate court proceedings or for settling the estate outside of formal probate when no estate has been opened.

Intended users of this form

- Individuals declaring heirs for a deceased relative (affiants)

- Heirs who need to establish their rights to inherited property

- Families navigating the estate of someone who died intestate

- Attorneys assisting clients with estate matters

Instructions for completing this form

- Identify yourself as the affiant by providing your name and address.

- Enter the decedent's details, including full name and date of death.

- Answer all questions regarding the existence of a will and other family members.

- Provide information about any real estate owned by the decedent.

- Sign the form in front of a notary public to authenticate it.

Notarization guidance

Yes, this form must be notarized to be legally valid. Having a notary public witness the affiant's signature adds credibility to the document and ensures that it is recognized by official entities. US Legal Forms provides integrated online notarization services, ensuring you can complete this step securely and conveniently from home.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide accurate information about the decedent or heirs.

- Not answering all required questions on the form.

- Submitting the form without a notarized signature, if required.

- Overlooking the requirement for additional documentation like property deeds.

Why use this form online

- Immediate access to professionally drafted legal templates.

- Easy download and editing options to customize the document.

- A cost-effective alternative to hiring an attorney for simple heirship issues.

- Guidance through the completion process with clear instructions.

Looking for another form?

Form popularity

FAQ

An affidavit of heirship is needed to transfer a deceased person's interest in real or personal property to his or her heirs when the decedent dies without leaving a last will and testament or without disposing of all of his or her property in a will.

An affidavit is used for the purpose of proving in court that a claim is true, and is typically used in conjunction with witness statements and other corroborating evidence. Through an affidavit, an individual swears that the information contained within is true to the best of their knowledge.

An affidavit of heirship (in some states referred to as a declaration of heirship) is a legal document used to determine the right to inheritance of a deceased individual's assets.

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

Maximum $100,000 for spouses, $35,000 for non-spouses. Laws R.C. 2113.03. Step 1 Enter the name of the person who died. Step 2 Enter the date of death. Step 3 Enter the address of decedent's address at the time of death.

Heirship Proceedings in Texas An heirship proceeding is a court proceeding used to determine who an individual's heirs are.This process involves a court-appointed attorney who investigates the deceased individual's family history and confirms to the court the identity of the heirs.

An Ohio estate qualifies as a small estate if the value of the probate estate is: $35,000 or less; OR. $100,000 or less and the entire estate goes to the decedent's surviving spouse whether under a valid will or under intestacy.

An Affidavit of Heirship is a sworn statement that heirs can use in some states to establish property ownership when the original owner dies intestate. Affidavits of Heirship are generally used when the decedent only left real property, personal property, or had a small estate.