Ohio Siding Contract for Contractor

What is this form?

The Siding Contract for Contractor is a legal document that outlines the terms and conditions between siding contractors and property owners. This contract can utilize either a cost plus or fixed fee payment arrangement, differentiating it from standard construction agreements. It addresses important aspects such as change orders, work site details, warranties, and insurance requirements, while specifically conforming to the laws of Ohio.

Key parts of this document

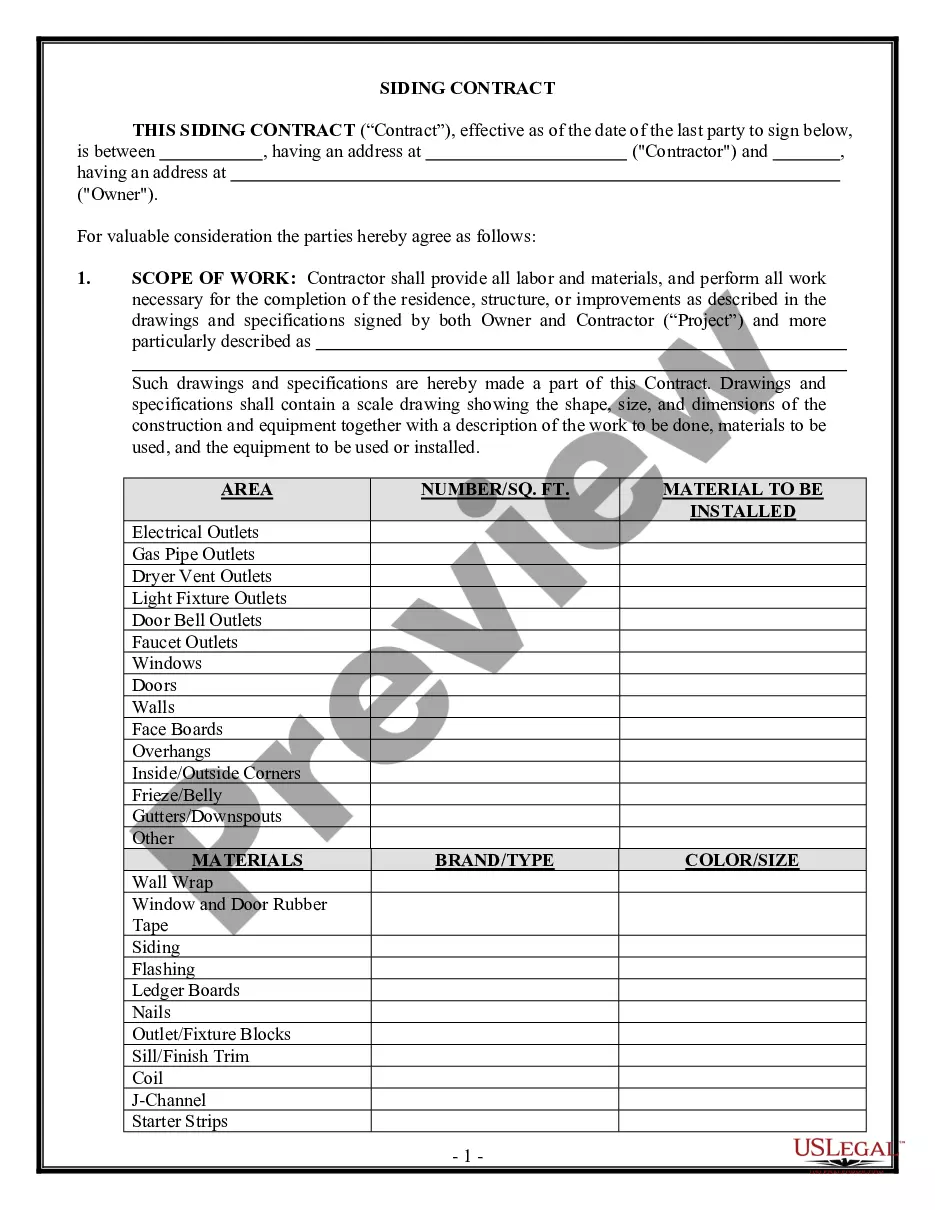

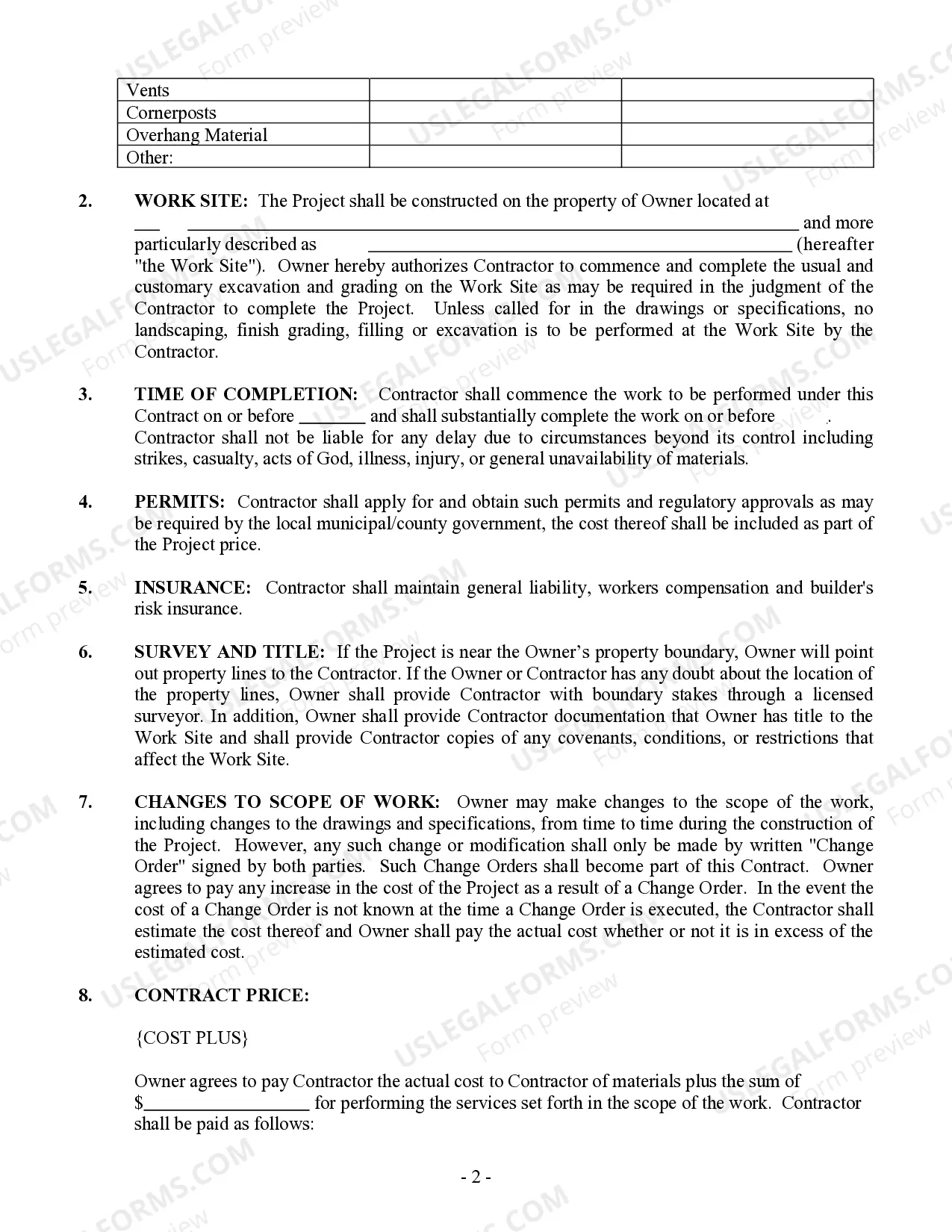

- Project specifications: Details about the area, materials, and specific tasks involved in the siding installation.

- Permits: Responsibilities regarding the application and cost of necessary local permits.

- Insurance: Requirements for general liability, workers compensation, and builders risk insurance.

- Changes to scope of work: Procedures for making alterations through written Change Orders.

- Destruction and damage: Protocol for handling damage or destruction of the project site.

- Termination and assignment: Conditions under which the contract can be terminated or assigned to another party.

When this form is needed

This form is essential when a property owner wishes to hire a siding contractor for installation or repair work. It is applicable in scenarios where clear contractual obligations are needed to define project scope, payment terms, and liability issues, ensuring both parties understand their rights and responsibilities throughout the project.

Intended users of this form

- Property owners seeking to hire a siding contractor for their home or commercial property.

- Siding contractors who require a formal agreement outlining the terms of their service.

- Individuals or businesses that need to clarify expectations, costs, and responsibilities related to siding installation.

How to complete this form

- Identify the parties: Fill in the names and contact information for both the property owner and the contractor.

- Specify the details: Enter the area to be covered, materials to be used, and the specifications for work.

- Outline payment terms: Choose the payment structure (cost plus or fixed fee) and specify the total costs involved.

- Review and sign: Ensure both parties understand the terms, then sign and date the contract to make it legally binding.

- Keep copies: Retain a signed copy for both parties for future reference and compliance.

Does this document require notarization?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to specify project details, leading to misunderstandings about the work to be performed.

- Not obtaining required permits before starting the project, which can result in legal issues.

- Neglecting to document changes to the scope of work with signed Change Orders.

- Overlooking insurance requirements, leaving either party vulnerable to liability.

Why complete this form online

- Convenience: Easily download and fill out the contract from the comfort of your home or office.

- Editability: Customize the form specific to your project needs before finalizing.

- Accessibility: Instant access at any time without the need for physical visits or appointments.

Looking for another form?

Form popularity

FAQ

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Get it in writing. Keep it simple. Deal with the right person. Identify each party correctly. Spell out all of the details. Specify payment obligations. Agree on circumstances that terminate the contract. Agree on a way to resolve disputes.

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

Unless there are custom or specialty orders for materials, the contractor cannot ask for more than 10% upfront before work starts.

Name of contractor and contact information. Name of homeowner and contact information. Describe property in legal terms. List attachments to the contract. The cost. Failure of homeowner to obtain financing. Description of the work and the completion date. Right to stop the project.

Identifying/Contact Information. Title and Description of the Project. Projected Timeline and Completion Date. Cost Estimate and Payment Schedule. Stop Work Clause and Stop Payment Clause. Act of God Clause. Change Order Agreement. Warranty.