New York Headhunter Agreement - Self-Employed Independent Contractor

Description

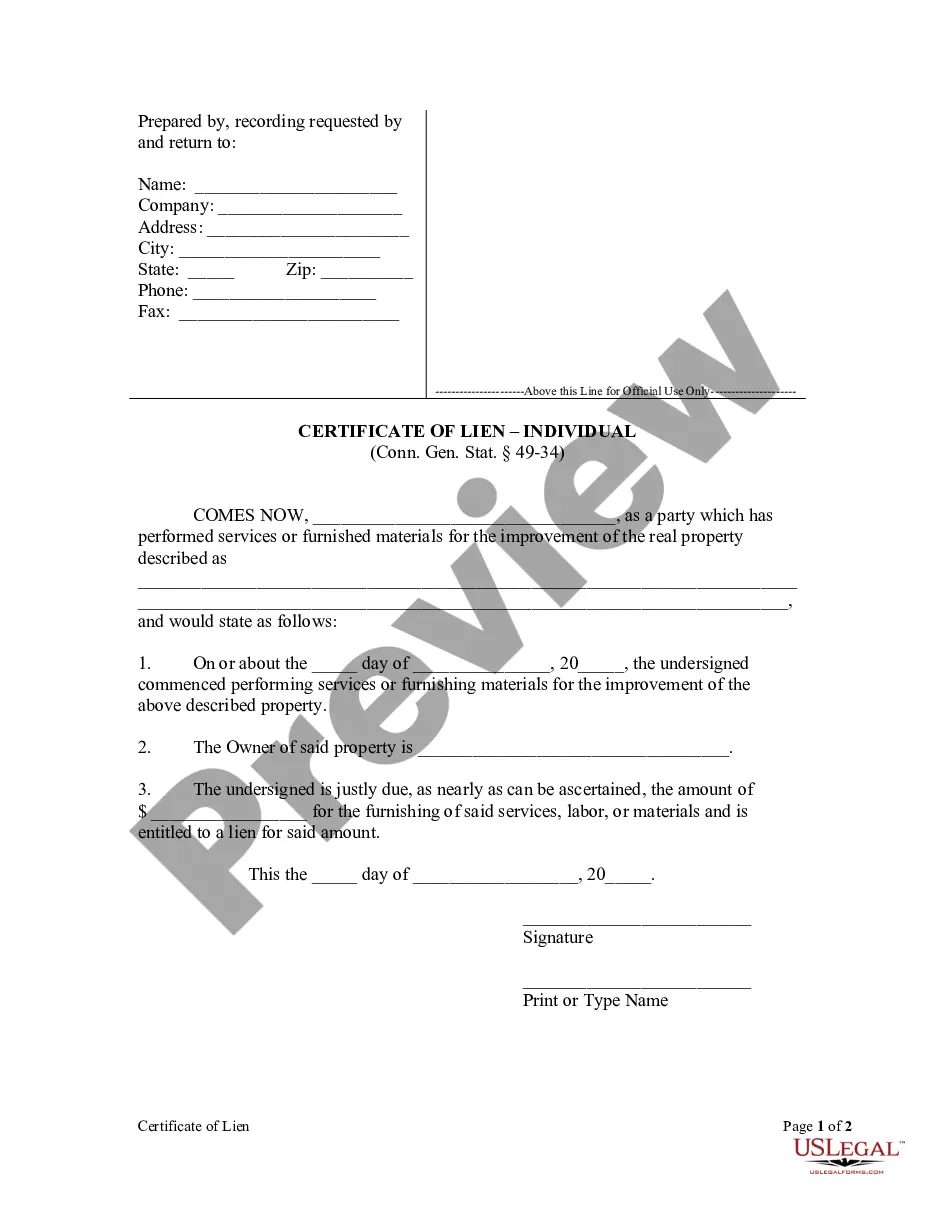

How to fill out Headhunter Agreement - Self-Employed Independent Contractor?

Finding the appropriate legal document format can be quite a challenge. Clearly, there are numerous templates available online, but how can you locate the legal form you require? Utilize the US Legal Forms website. The service offers thousands of templates, including the New York Headhunter Agreement - Self-Employed Independent Contractor, which you can use for business and personal purposes. All of the forms are vetted by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to retrieve the New York Headhunter Agreement - Self-Employed Independent Contractor. Use your account to browse through the legal forms you have previously purchased. Visit the My documents tab in your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/area. You can review the form using the Review button and read the form description to confirm this is indeed the right one for you. If the form does not meet your requirements, use the Search section to find the appropriate form. Once you are confident that the form is correct, select the Get now button to obtain the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document format to your device. Complete, edit, print, and sign the obtained New York Headhunter Agreement - Self-Employed Independent Contractor.

Take advantage of US Legal Forms to simplify your document creation process and ensure compliance with legal standards.

- US Legal Forms is the largest collection of legal forms where you can view various document templates.

- Utilize the service to acquire appropriately designed documents that adhere to state requirements.

- You can find numerous templates for different legal needs.

- All templates are reviewed for accuracy and compliance.

- Access your purchased forms easily through your account.

- Ensure you select the right form for your specific needs.

Form popularity

FAQ

Creating a New York Headhunter Agreement - Self-Employed Independent Contractor involves several key steps. First, outline the scope of work and expectations clearly to ensure both parties understand their responsibilities. Next, include payment terms and any confidentiality clauses that protect sensitive information. Finally, consider using platforms like USLegalForms to access templates and legal guidance, simplifying the process and ensuring compliance with New York laws.

Independent contractors generally do not qualify for workers' compensation benefits, as they are considered separate from traditional employees. However, this can vary depending on the nature of the work and specific state regulations. It is wise to consult with a legal expert or review your New York Headhunter Agreement - Self-Employed Independent Contractor to ensure compliance with applicable laws. Understanding your rights can help you make informed decisions about coverage and liability.

Independent contractors should consider obtaining general liability insurance to protect themselves from potential claims. Depending on their industry, they may also need professional liability insurance or other specialized coverage. Having the right insurance can provide peace of mind and safeguard their business. A well-structured New York Headhunter Agreement - Self-Employed Independent Contractor can specify insurance requirements, ensuring all parties are adequately protected.

Yes, an independent contractor is typically considered self-employed. This classification means they are responsible for their own taxes, benefits, and business expenses. When drafting a New York Headhunter Agreement - Self-Employed Independent Contractor, it is crucial to clearly define the relationship to avoid any misclassification issues. This clarity helps both parties understand their rights and responsibilities.

In New York, certain independent contractors may be exempt from workers' compensation coverage. Specifically, individuals who are self-employed and do not employ others may not need to carry this insurance. However, it's essential to review the specific details of your situation, as some industries have different requirements. Utilizing a comprehensive New York Headhunter Agreement - Self-Employed Independent Contractor can help clarify these obligations.

To protect yourself when hiring an independent contractor, ensure you have a clear and detailed New York Headhunter Agreement - Self-Employed Independent Contractor in place. This agreement should outline the scope of work, payment terms, and confidentiality clauses. Additionally, consider conducting thorough background checks and requesting references to verify their qualifications. By taking these steps, you can establish a solid foundation for your working relationship.

In New York, independent contractors typically do not need workers' compensation insurance unless they are working in certain high-risk industries. However, many businesses require this coverage to protect themselves and their contractors. If you are operating under a New York Headhunter Agreement - Self-Employed Independent Contractor, it is wise to consider obtaining a policy, as it can provide crucial financial protection against workplace injuries. For further guidance, you can explore resources on the US Legal Forms platform, which offers templates and information tailored to independent contractors.

To fill out an independent contractor form, start with your basic information, including your name and contact details. Clearly indicate your work status under the New York Headhunter Agreement - Self-Employed Independent Contractor. Provide a brief description of the services you will offer and any relevant payment details. For assistance, consider using US Legal Forms, which provides easy-to-use templates to guide you through the process.

Filling out an independent contractor agreement involves several essential steps. Begin by entering your information and that of the client, followed by the specific services you will provide under the New York Headhunter Agreement - Self-Employed Independent Contractor. Clearly state payment terms and deadlines. Finally, review the agreement for accuracy and both parties should sign to make it legally binding.

Writing an independent contractor agreement begins with outlining the key details, such as the scope of work and payment terms. Incorporate the New York Headhunter Agreement - Self-Employed Independent Contractor to clarify your status and responsibilities. Include provisions for confidentiality and dispute resolution to protect both parties. Using a template from US Legal Forms can simplify the process and ensure all critical elements are covered.