New York Technical Writer Agreement - Self-Employed Independent Contractor

Description

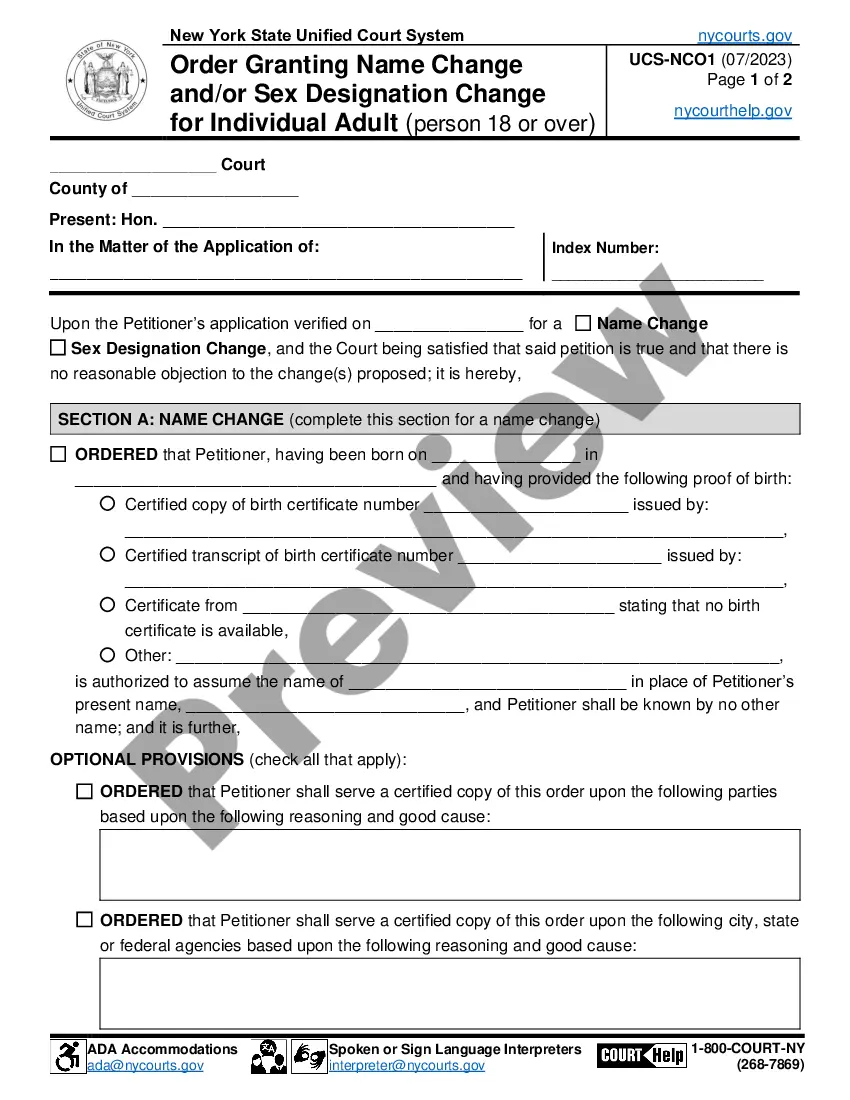

How to fill out Technical Writer Agreement - Self-Employed Independent Contractor?

If you need to obtain extensive, download, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's simple and user-friendly search to find the documents you need. Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to acquire the New York Technical Writer Agreement - Self-Employed Independent Contractor in just a few clicks.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

Step 6. Download the format of the legal form to your device. Step 7. Complete, edit, and print or sign the New York Technical Writer Agreement - Self-Employed Independent Contractor. Every legal document template you acquire is yours permanently. You will have access to each form you downloaded within your account. Click on the My documents section and select a form to print or download again. Complete and download, and print the New York Technical Writer Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of professional and state-specific forms available for your personal or business needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to obtain the New York Technical Writer Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to read the details.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the payment plan you prefer and enter your information to register for an account.

Form popularity

FAQ

Writing a New York Technical Writer Agreement - Self-Employed Independent Contractor requires you to start with the basics. Begin by clearly defining the scope of work, including the specific tasks and deadlines. Next, outline payment terms, including rates and schedules. Finally, make sure to include any necessary clauses about confidentiality and termination, ensuring both parties understand their rights and responsibilities.

Creating an independent contractor agreement is a straightforward process. Start by outlining the scope of work, including deliverables and deadlines, and specify payment terms. Utilizing a New York Technical Writer Agreement - Self-Employed Independent Contractor from uslegalforms can simplify this process, as it provides a tailored template to meet legal requirements. This ensures that both parties are protected and sets a clear foundation for the working relationship.

Yes, a freelance writer typically operates as an independent contractor. This means they manage their own business, choose their clients, and negotiate their terms, including payment. When working under a New York Technical Writer Agreement - Self-Employed Independent Contractor, they establish a clear understanding with clients about the services provided. This arrangement offers flexibility and autonomy, allowing writers to thrive in their chosen field.

An independent contractor should complete several forms, including a New York Technical Writer Agreement - Self-Employed Independent Contractor and tax forms such as the W-9. The agreement outlines the work relationship and expectations, while the W-9 provides necessary tax information to the client. In addition, you may need to submit any local business registration forms if applicable. Using a service like uslegalforms can ensure you have all the correct paperwork in order.

To fill out a New York Technical Writer Agreement - Self-Employed Independent Contractor form, begin by inputting your information and the client's details. Specify the services you will provide and the expected timeline for completion. Don't forget to include any specific payment arrangements, such as milestone payments or hourly rates. Templates available on platforms like uslegalforms can simplify this process by offering a structured format for your agreement.

Filling out a New York Technical Writer Agreement - Self-Employed Independent Contractor involves providing your personal information and outlining the terms of the project. Start by entering your name, contact details, and the name of the hiring party. Clearly define the scope of work, payment terms, and deadlines to ensure both parties understand their responsibilities. Using a comprehensive agreement template can help streamline this process and ensure you include all necessary details.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Freelancers are independent contractors who should receive 1099 from the company using their services and are subject to paying their own taxes, including self-employment tax.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.