New York Grant Writer Agreement - Self-Employed Independent Contractor

Description

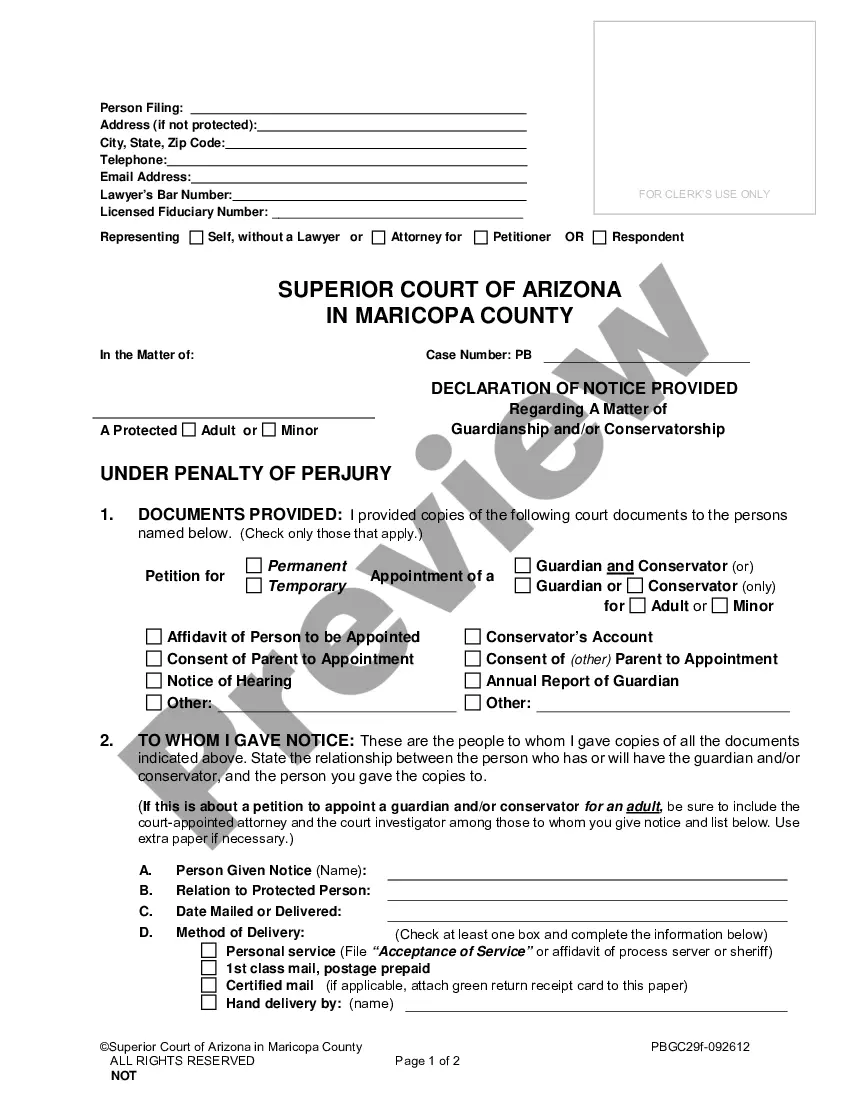

How to fill out Grant Writer Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a variety of legal form templates that you can download or print. By using the website, you will find thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can access the latest forms such as the New York Grant Writer Agreement - Self-Employed Independent Contractor within minutes. If you already have a subscription, Log In and download the New York Grant Writer Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously downloaded forms in the My documents section of your account.

If you wish to use US Legal Forms for the first time, here are simple steps to assist you in getting started: Ensure you have selected the correct form for your city/county. Click the Review button to examine the form's content. Check the form summary to confirm that you have chosen the correct form. If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking on the Purchase now button. Then, choose the payment plan you prefer and provide your information to register for the account. Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the transaction. Select the format and download the form to your device. Edit. Complete, modify, print, and sign the downloaded New York Grant Writer Agreement - Self-Employed Independent Contractor.

- Each template you added to your account has no expiration date and is your property indefinitely.

- Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

- Access the New York Grant Writer Agreement - Self-Employed Independent Contractor with US Legal Forms, the most comprehensive library of legal document templates.

- Utilize a multitude of professional and state-specific templates that meet your business or personal needs and requirements.

- Make the process seamless with easy navigation and access to essential forms.

Form popularity

FAQ

Yes, 1099 employees can be subject to non-compete agreements, but the enforceability varies by state and specific terms. If you operate under a New York Grant Writer Agreement - Self-Employed Independent Contractor, it is crucial to review any non-compete clauses carefully. These agreements can limit your ability to work with competitors after your contract ends. Consulting with a legal professional can help clarify your obligations and rights.

While it is not mandatory for freelance writers to establish an LLC, doing so can provide several benefits. An LLC can protect your personal assets and may enhance your credibility in the industry, especially under a New York Grant Writer Agreement - Self-Employed Independent Contractor. If you plan to work with multiple clients or seek liability protection, forming an LLC can be a wise decision. Always consult a legal expert to explore the best option for your situation.

Yes, an independent contractor is classified as self-employed. When you engage in a New York Grant Writer Agreement - Self-Employed Independent Contractor, you operate your own business and manage your taxes accordingly. This classification allows you greater flexibility and control over your work. However, it also means you are responsible for your own benefits, taxes, and business expenses.

Freelancing and being an independent contractor are similar but not identical. Both roles often involve self-employment, such as in a New York Grant Writer Agreement - Self-Employed Independent Contractor. However, freelancers typically work on a project basis for multiple clients, while independent contractors might have a more formal agreement with a single client. Understanding these distinctions can help you navigate your work arrangements more effectively.

Yes, the New York State Human Rights Law does apply to independent contractors, but there are specific conditions. As an independent contractor under the New York Grant Writer Agreement - Self-Employed Independent Contractor, you may have certain protections against discrimination. However, these protections can vary based on the nature of your work and your relationship with the hiring party. It is important to understand these nuances to ensure your rights are upheld.

Filling out an independent contractor agreement involves entering specific details about the project and the parties involved. Start by detailing the services to be provided, the payment schedule, and any confidentiality terms. By using the New York Grant Writer Agreement - Self-Employed Independent Contractor from US Legal Forms, you can easily navigate the required sections and create a legally sound document.

Filling out an independent contractor form requires you to provide essential details such as your name, address, and the nature of the work. Make sure to specify the payment rate and method, along with any tax identification numbers. If you're using a template like the New York Grant Writer Agreement - Self-Employed Independent Contractor, follow the prompts carefully to ensure accuracy and completeness.

To write an independent contractor agreement, start by clearly defining the scope of work, payment terms, and deadlines. Include both parties' names and contact information, along with any specific project requirements. Using a template, like the New York Grant Writer Agreement - Self-Employed Independent Contractor from US Legal Forms, can simplify this process and ensure you include all necessary components.

Yes, a freelance writer is typically considered an independent contractor. This classification allows them to work on multiple projects for different clients without being tied to a single employer. When setting up a professional relationship, using a New York Grant Writer Agreement - Self-Employed Independent Contractor helps clarify the terms of the engagement. This agreement protects both the writer and the client by outlining responsibilities and payment details.

To create an independent contractor agreement, start by clearly defining the scope of work, payment terms, and deadlines. It’s essential to include clauses that outline confidentiality and ownership of work, ensuring both parties understand their rights. Using a template like the New York Grant Writer Agreement - Self-Employed Independent Contractor can simplify this process. Platforms like USLegalForms provide customizable templates that meet legal standards and can save you time.