Affidavit That There Are No Creditors

Description

How to fill out Affidavit That There Are No Creditors?

Aren't you sick and tired of choosing from numerous templates each time you need to create a Affidavit That There Are No Creditors? US Legal Forms eliminates the lost time numerous American citizens spend exploring the internet for ideal tax and legal forms. Our expert group of lawyers is constantly modernizing the state-specific Templates library, so it always has the appropriate files for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form may be found in the My Forms tab.

Users who don't have an active subscription need to complete easy actions before being able to download their Affidavit That There Are No Creditors:

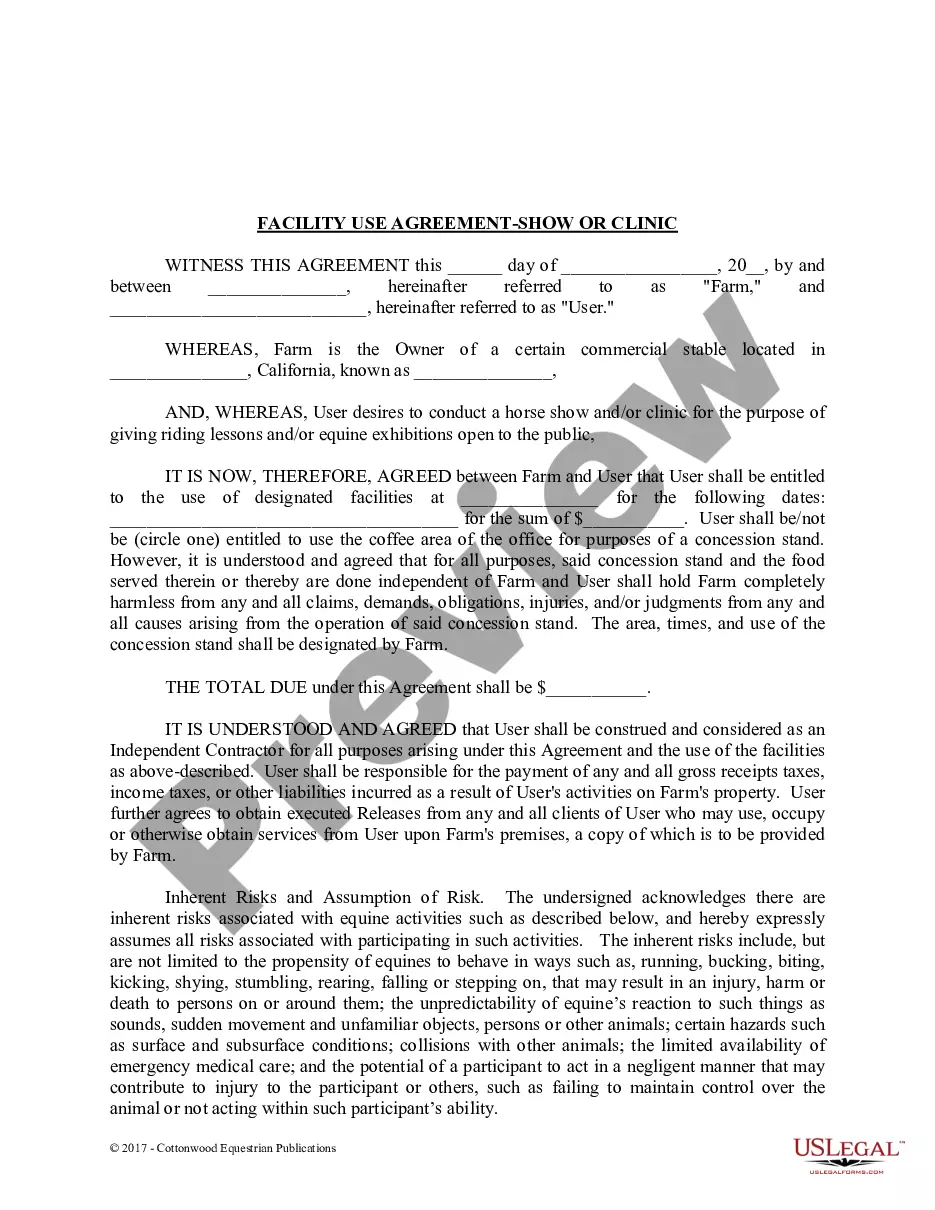

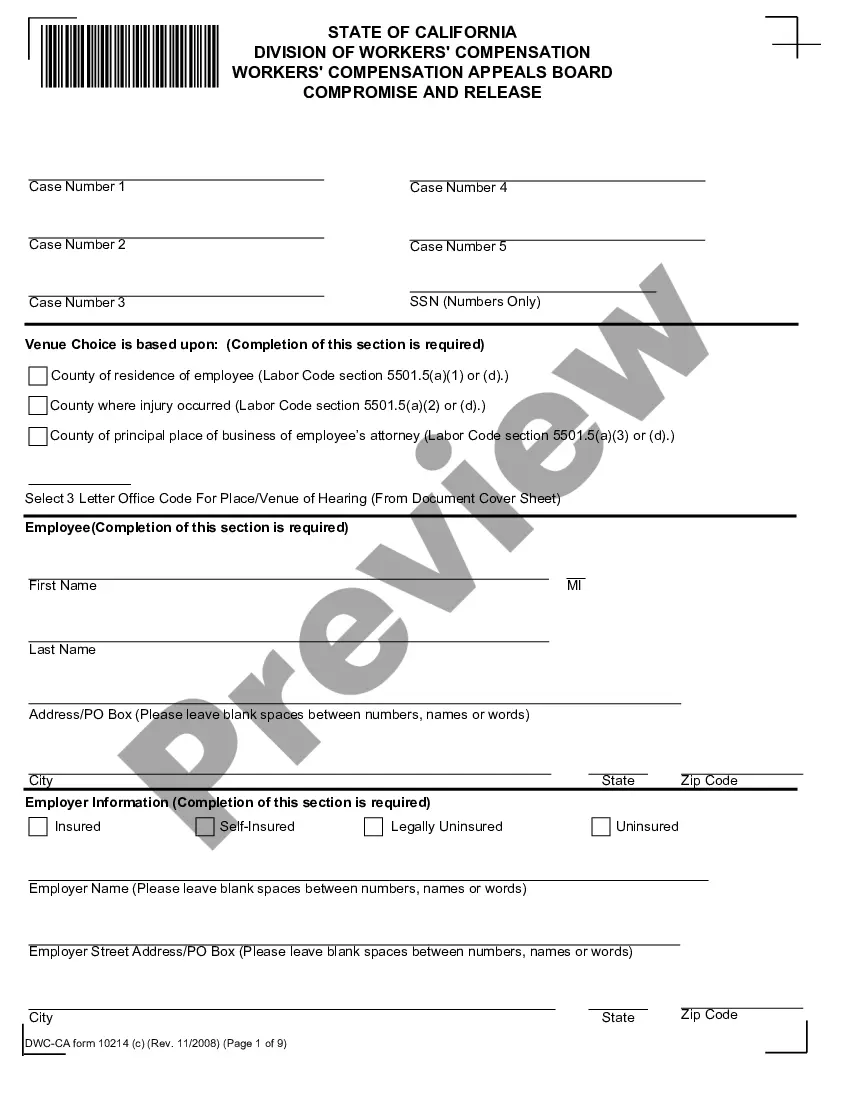

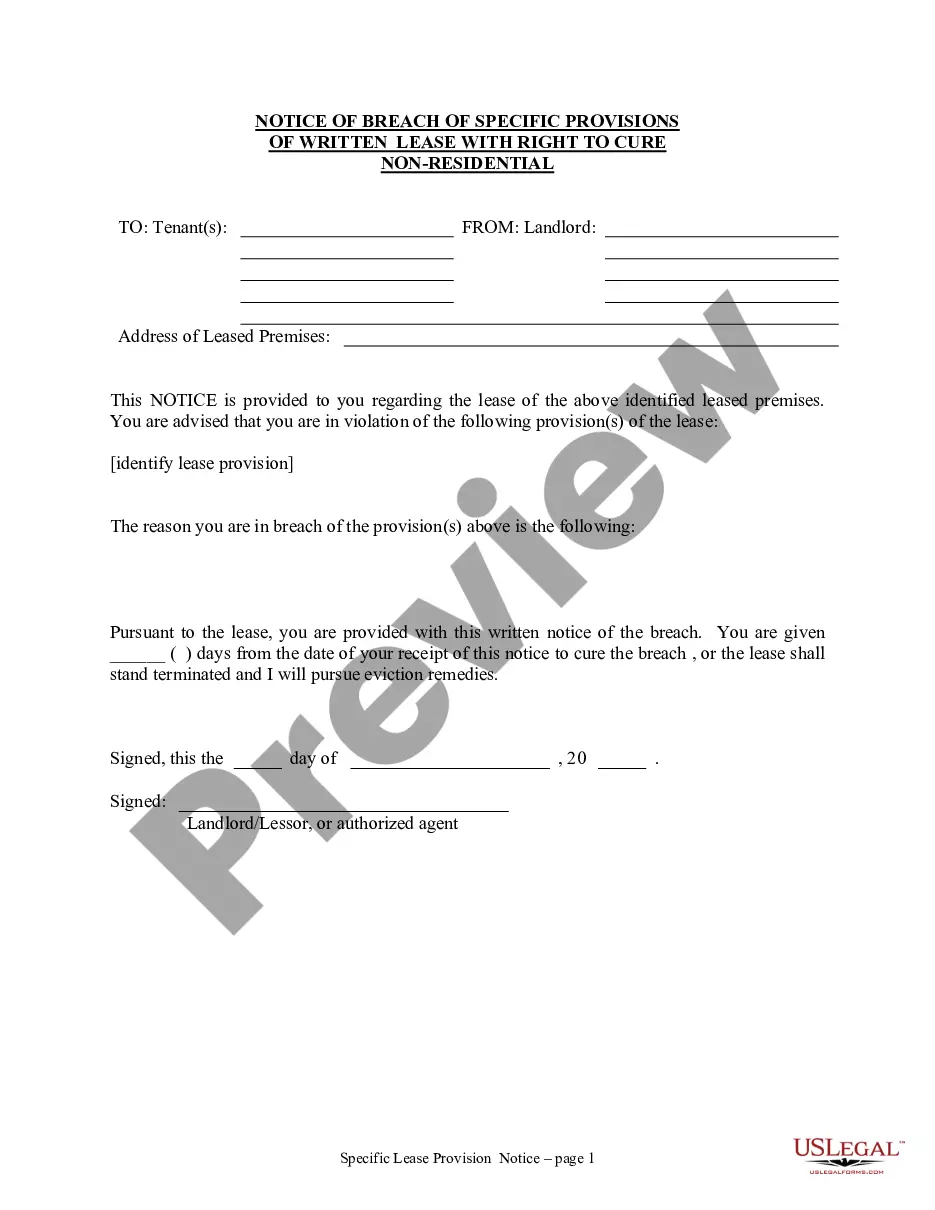

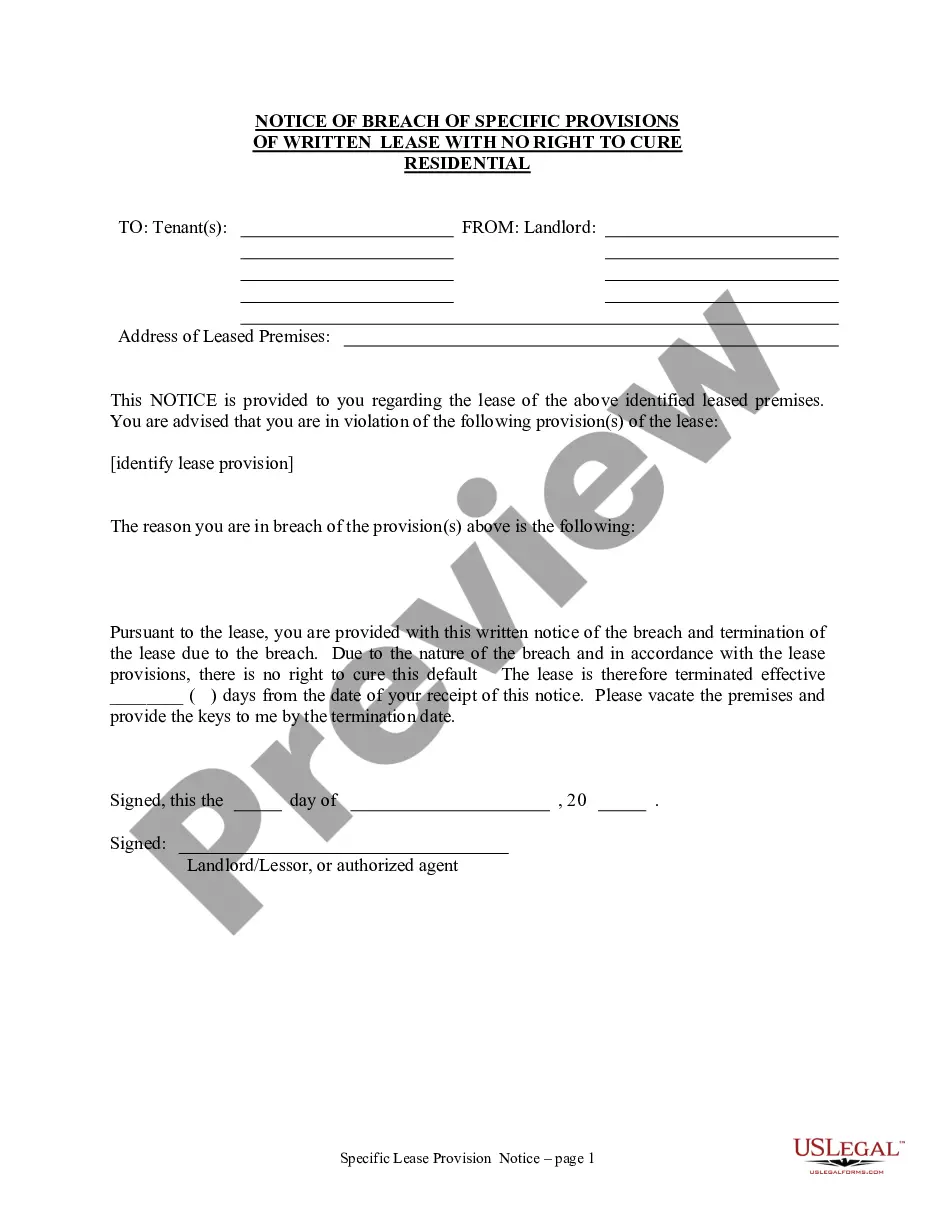

- Utilize the Preview function and read the form description (if available) to make certain that it’s the appropriate document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the correct example for the state and situation.

- Use the Search field at the top of the page if you want to look for another document.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Get your document in a required format to complete, create a hard copy, and sign the document.

Once you have followed the step-by-step guidelines above, you'll always be able to log in and download whatever document you need for whatever state you need it in. With US Legal Forms, finishing Affidavit That There Are No Creditors samples or other official documents is not hard. Get started now, and don't forget to examine your examples with accredited attorneys!

Form popularity

FAQ

In the sentence, the person writing the statement must state that he or she is stating that the information is accurate. (Example: I, Jane Doe, solemnly swear that the contents of this document are true and correct, and that I agree to abide by the terms in this affidavit.)

In a nutshell, an affidavit is a sworn statement that is in writing. Affidavits are usually used in a court or in negotiations. They are common in family law cases and bankruptcy cases. They are also used in civil and criminal cases, though not as often as family or bankruptcy law cases.

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

The main purpose of a financial affidavit is to provide the court with an explanation of a party's financial circumstances. Without this information, the court would be unable to make financial orders or orders concerning property distribution.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

I am _____ and my name _______, appearing on the enclosed ID proof, is single name.Both names denote one and the same person. I solemnly state that the contents of this affidavit are true to the best of my knowledge and belief and that it conceals nothing and that no part of it is false.

Guadalupe County Small Estate Affidavit Checklist Individuals then fill out a form without reading the statute and without understanding Texas intestacy law. They pay a $261 filing fee and expect approval.

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

Full name of the deponent and their signature. Statement indicating whether the affidavit has been sworn or not. Date and place where the affidavit is being signed. Designation and full name of the Notary or Magistrate (person attesting the affidavit)