New York Charitable Contribution Payroll Deduction Form

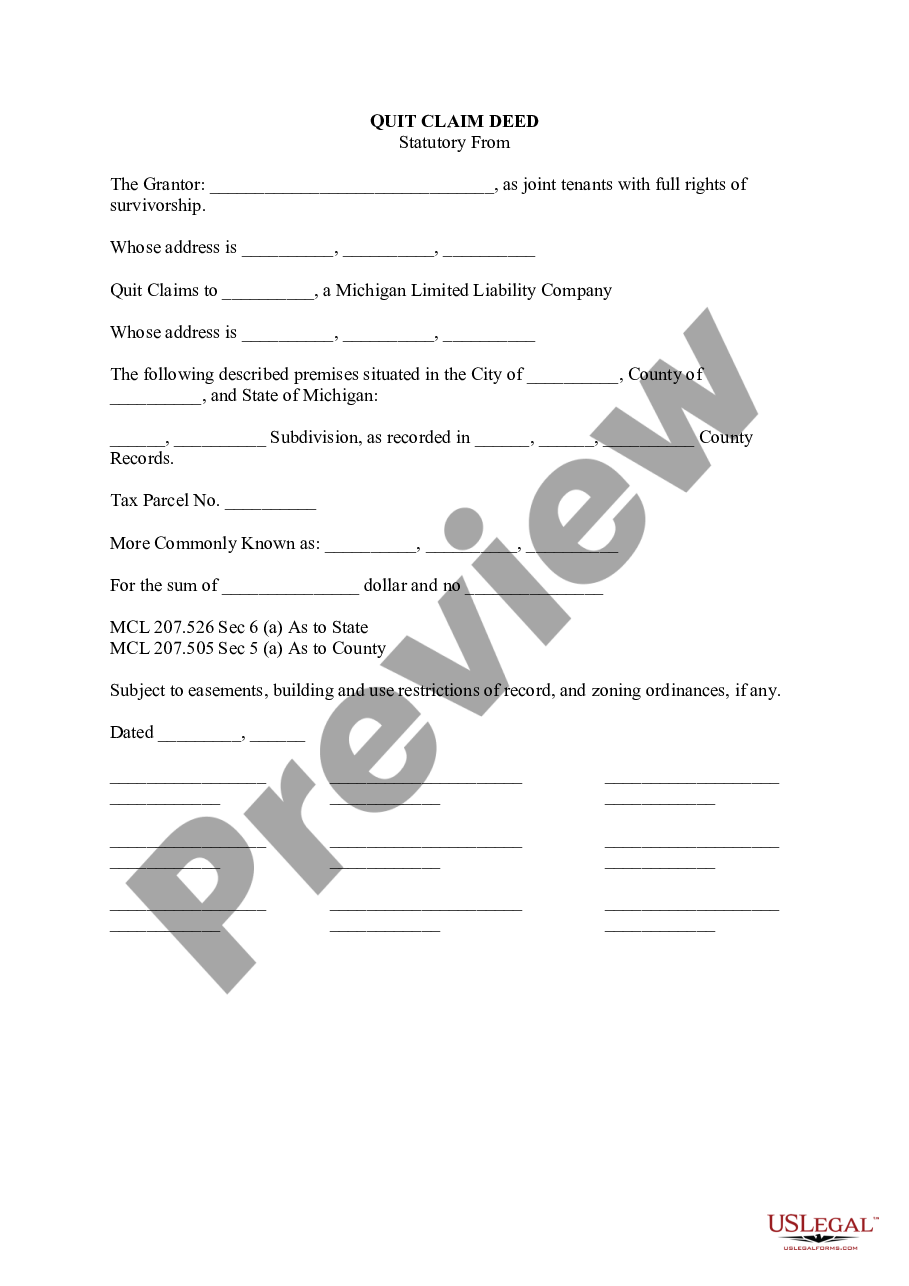

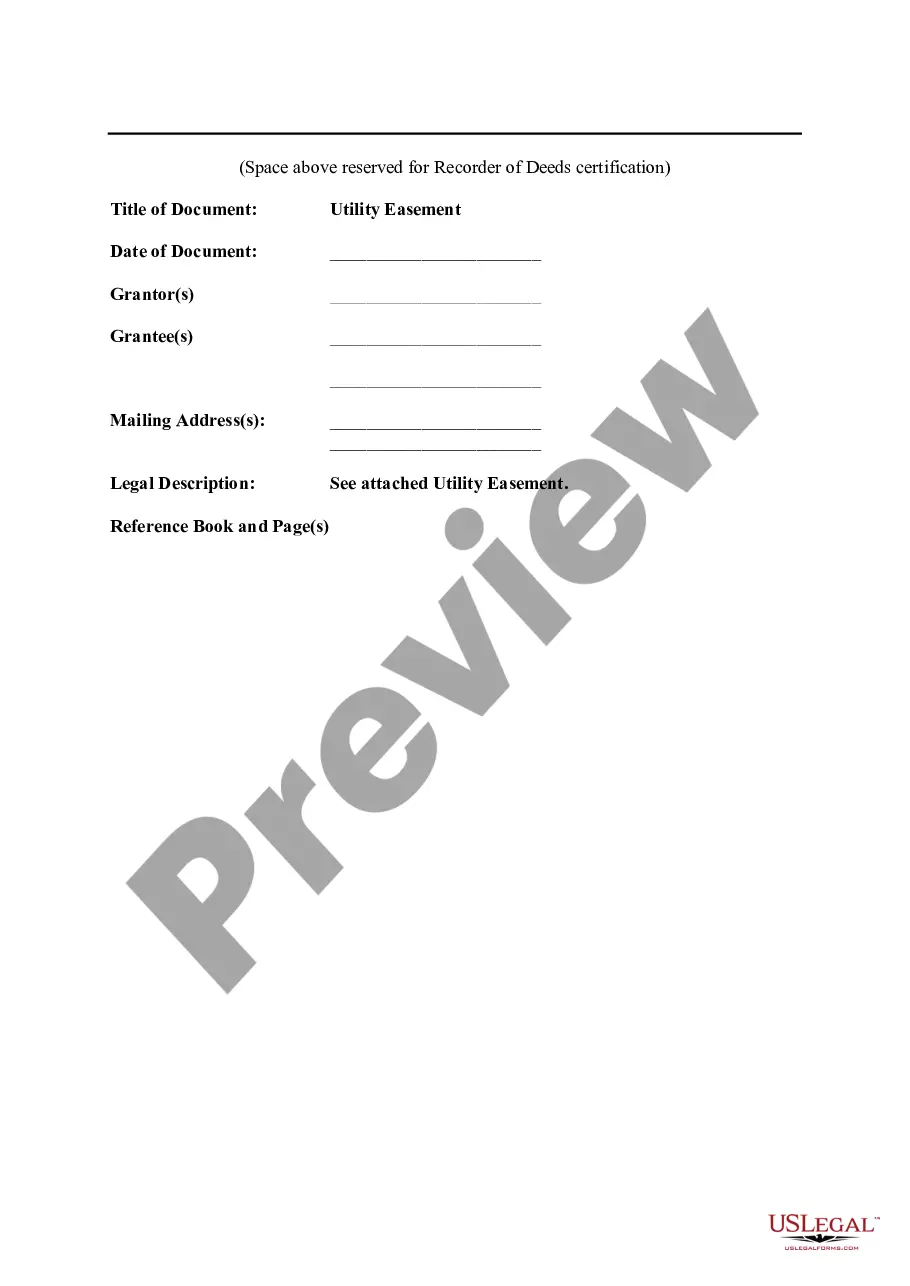

Description

How to fill out Charitable Contribution Payroll Deduction Form?

Are you currently in a situation where you frequently require documents for business or personal reasons? There are numerous legal document formats available online, but sourcing reliable ones is not easy.

US Legal Forms offers thousands of templates, such as the New York Charitable Contribution Payroll Deduction Form, designed to comply with federal and state laws.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the New York Charitable Contribution Payroll Deduction Form template.

Access all the document templates you have purchased in the My documents section. You can download another copy of the New York Charitable Contribution Payroll Deduction Form at any time. Simply click on the required form to download or print the template.

Use US Legal Forms, the largest collection of legal documents, to save time and avoid errors. The service offers professionally crafted legal templates that can be utilized for various purposes. Create your account on US Legal Forms and start simplifying your life.

- Locate the form you require and ensure it is tailored for the correct city/county.

- Utilize the Review button to assess the document.

- Examine the details to ensure you have selected the correct form.

- If the form is not what you seek, use the Lookup field to find the form that fits your needs and specifications.

- Once you find the appropriate form, click Get now.

- Select your desired pricing plan, complete the necessary information to create your account, and pay for your order using your PayPal or credit card.

- Choose a convenient document format and download your copy.

Form popularity

FAQ

The NY form IT-225 is a crucial document for anyone looking to make charitable contributions in New York. This form allows taxpayers to report their contributions and apply for any available deductions. To utilize this effectively, especially when planning your financial contributions, consider using the New York Charitable Contribution Payroll Deduction Form. This form streamlines the process, ensuring that your contributions are properly accounted for.

New York Form IT-225 is the New York State Charitable Contribution Credit form. It is used to calculate the amount of state credit for charitable contributions made. Meeting the requirements outlined on this form allows you to benefit from tax savings. You can easily find this form on the US Legal Forms platform and use it along with your New York Charitable Contribution Payroll Deduction Form.

You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases.

New York's fiscal 2021 budget decoupled the state's personal income tax from any amendments made to the IRC after March 1, 20202 including changes under the Coronavirus Aid, Relief, and Economic Security Act (P.L. 116-36) and any other federal amendments to the IRC.

The availability of charitable and other allowable itemized deductions is limited to resident taxpayers who itemize their federal income tax deductions in DC, GA, ID, KS, LA, ME, MD, MO, NE, NM, ND, OK, SC and VA; other states permit resident taxpayers to itemize state income tax deductions and deduct qualified

Complete Form IT-558 and submit it with your return to report any New York State addition and subtraction adjustments required to recompute federal amounts using the rules in place prior to any changes made to the IRC after March 1, 2020.

Yes, the NY Form IT-558 is required to report any New York State addition and subtraction adjustments required to re-compute federal amounts using the rules in place prior to any changes made to the Internal Revenue Code after March 1, 2020.

New York State Charitable Gifts Trust Fund Starting in 2018, donating taxpayers may claim a deduction on their New York State income tax returns equaling the full donation amount of any contribution for the tax year in which the donation is made.

Use Form 588, Nonresident Withholding Waiver Request, to request a waiver or a reduced withholding rate on payments of California source income to nonresident vendors/payees.

Complete Form IT-196 to compute your New York State itemized deduction. In most cases, your New York State and New York City income tax will be less if you take the larger of your New York itemized deductions or New York standard deduction.