Minnesota Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

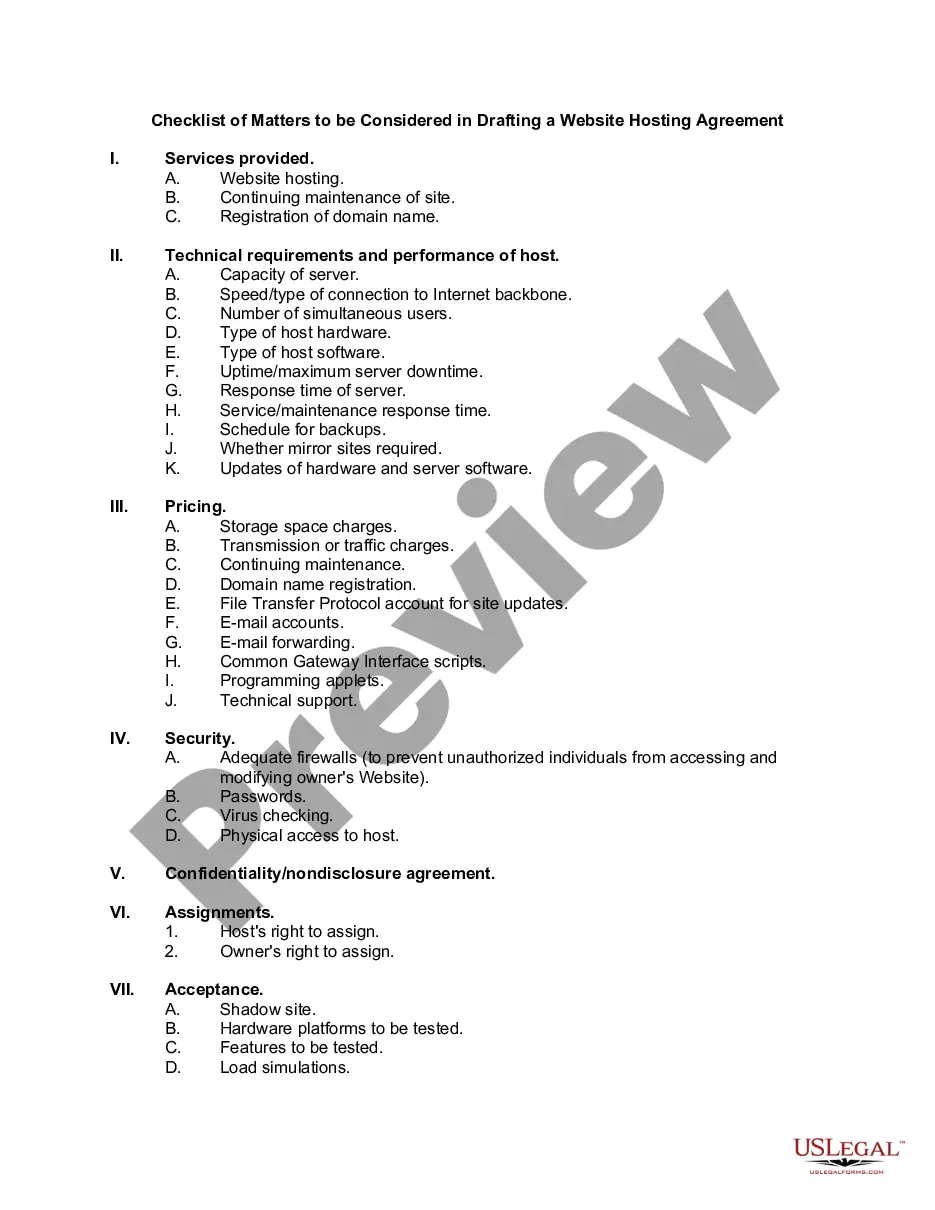

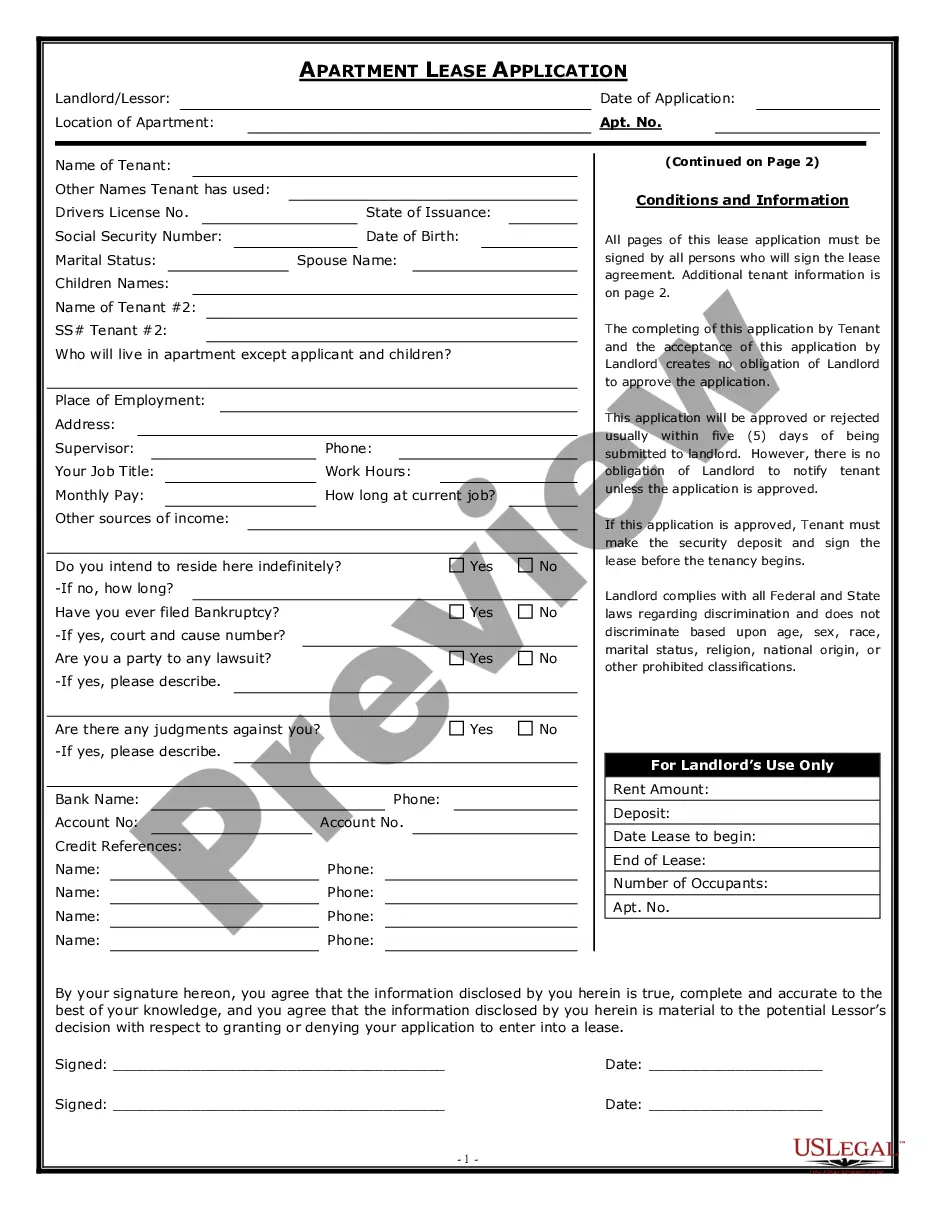

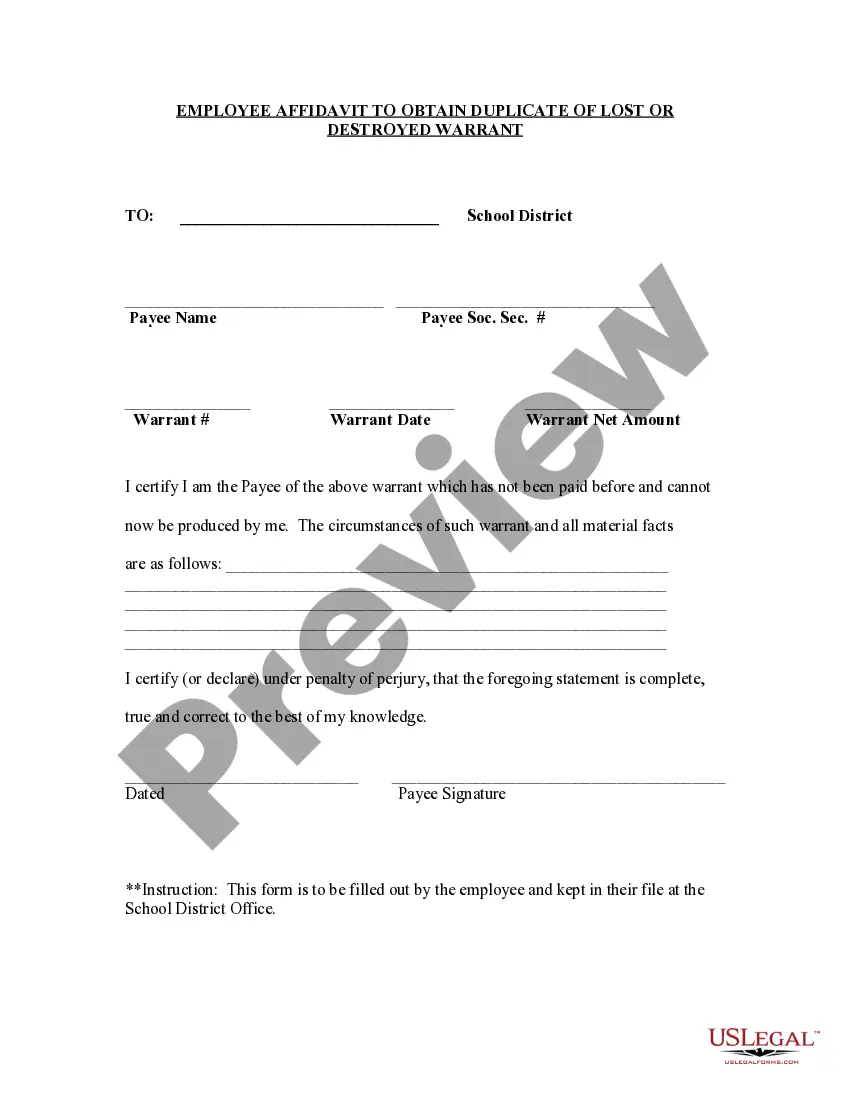

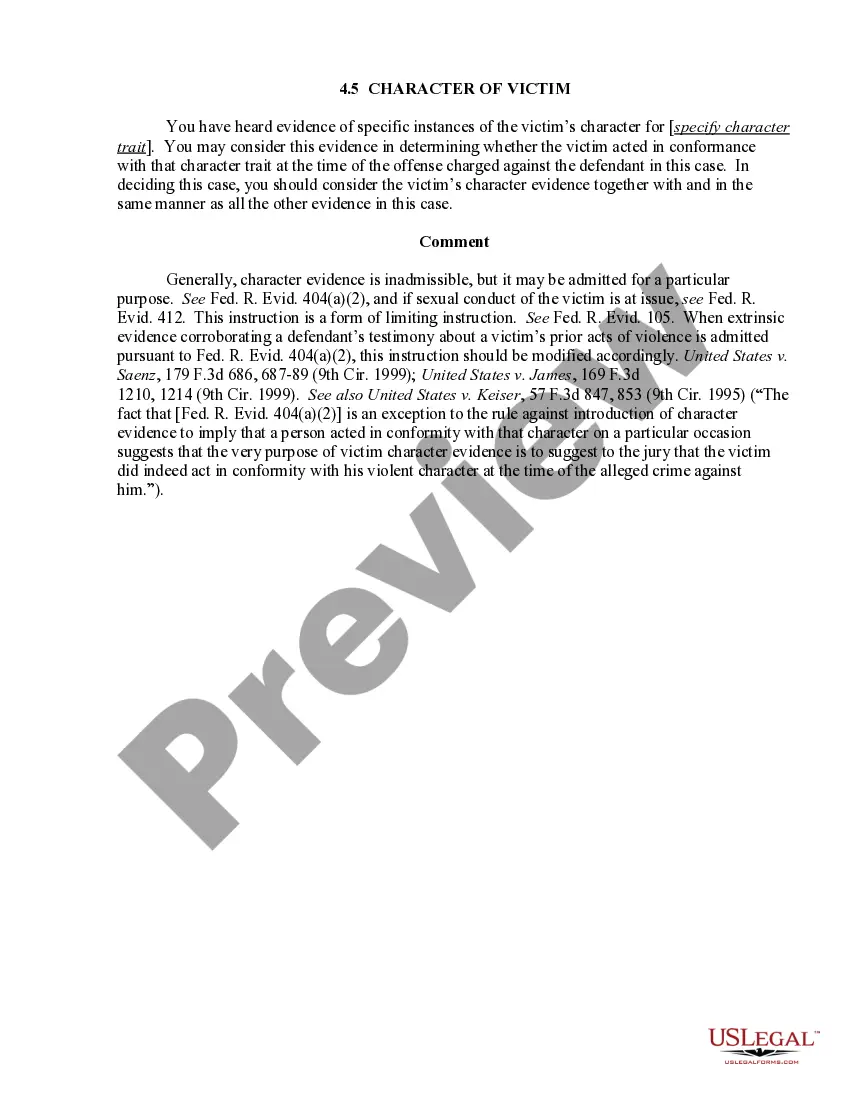

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

Selecting the finest legal document design can be challenging.

As is obvious, there are numerous templates accessible online, but how can you find the legal form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Minnesota Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, which you can use for business and personal purposes.

You can preview the document using the Review option and read the form description to confirm it is suitable for your needs.

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to acquire the Minnesota Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

- Use your account to search for the legal forms you have previously purchased.

- Navigate to the My documents tab in your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some straightforward instructions to follow.

- First, ensure you have selected the correct form for the city/county.

Form popularity

FAQ

Typically, the closing agent handling the sale of your property fills out the 1099-S form. This entity is responsible for reporting the sale to the IRS, detailing the transaction's specifics. Understanding your obligations regarding the Minnesota Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption can help clarify whether a 1099-S applies in your case.

Not every homeowner receives a 1099-S when selling their house. The issuance depends on various factors, including whether the gain from the sale is reportable. If you qualify for the Minnesota Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, this may exempt you from receiving a form.

To report the sale of a timeshare on your tax return, you must include any gain or loss on Schedule D. Accurately calculate the adjusted basis of the timeshare to determine any capital gain or loss incurred from the sale. For clarity, familiarizing yourself with the Minnesota Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption can help you navigate the reporting process seamlessly.

You do not always receive a 1099-S when you sell your house, but you will if the transaction meets certain criteria. For instance, if the sale results in a gain, you should expect to receive this form. Being informed about the Minnesota Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption can help you understand if you need to report your sale.

How do you register for a sales tax permit in Minnesota? You may register for a Minnesota tax ID number online at Minnesota e-Services. You may register with a paper form here. You may register by telephone by calling 651-282-5225 or 1-800-657- 3605.

The process for qualifying to use this certificate in Minnesota involves setting up your business properly, obtaining necessary tax identification numbers and registering to pay sales and use tax in the state. You'll then complete Form ST3 for each vendor from whom you plan to buy for resale purposes.

Online Go to Business Tax Registration. By phone Call 651-282-5225 or 1-800-657-3605 (toll-free)...Registering Your BusinessExpected filing schedule (monthly, quarterly, or annual).Accounting method (cash or accrual)More items...?

Minnesota uses form ST3 Certificate of Exemption as a resale certificate. To complete form ST3 you will need to provide either your Minnesota Tax ID number, your Federal Employer Identification Number, or your state Driver's License or Identification Card number.

To apply for sales tax exemption, organizations must complete and submit Form ST16 Application for Certificate of Exempt Status to the Minnesota Department of Revenue. For sales and use tax, the Minnesota Department of Revenue Sales and Use Tax Division makes the initial exemption decision.

While the certificates do not ever expire, they should certainly be updated every three to five years. It must be noted that the certificates do not cover sales for resales in most situations. They may be utilized in accordance with items which will be used only once.