Maryland Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

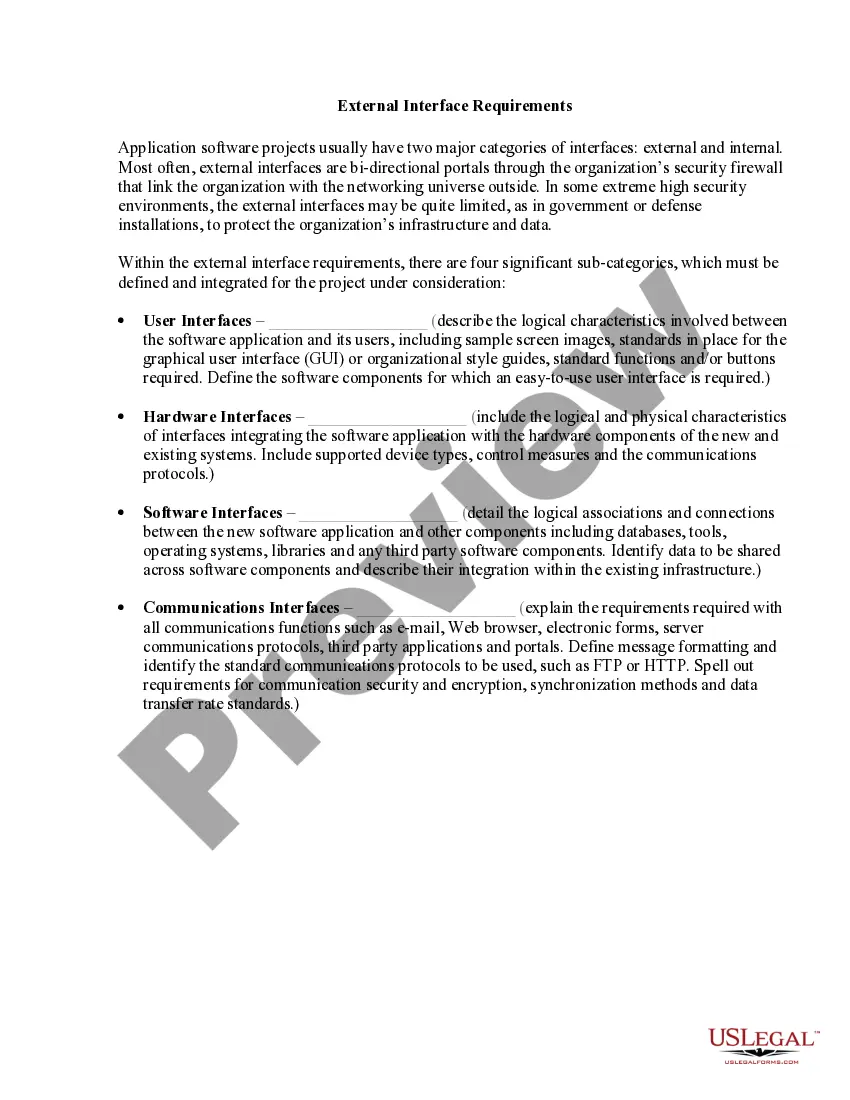

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

Selecting the optimal certified document template can be a challenge. Obviously, there are numerous templates available online, but how do you find the certified form you require? Utilize the US Legal Forms website.

The platform offers thousands of templates, such as the Maryland Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, which can be utilized for both business and personal purposes. All of the forms are reviewed by professionals and meet state and federal requirements.

If you are already registered, Log In to your account and click the Acquire button to obtain the Maryland Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption. Use your account to look through the certified forms you have purchased in the past. Navigate to the My documents tab of your account and download another version of the document you need.

Select the file format and download the certified document template to your device. Complete, modify, print, and sign the acquired Maryland Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption. US Legal Forms is the largest collection of certified forms where you can find a variety of document templates. Utilize the service to obtain professionally crafted paperwork that complies with state regulations.

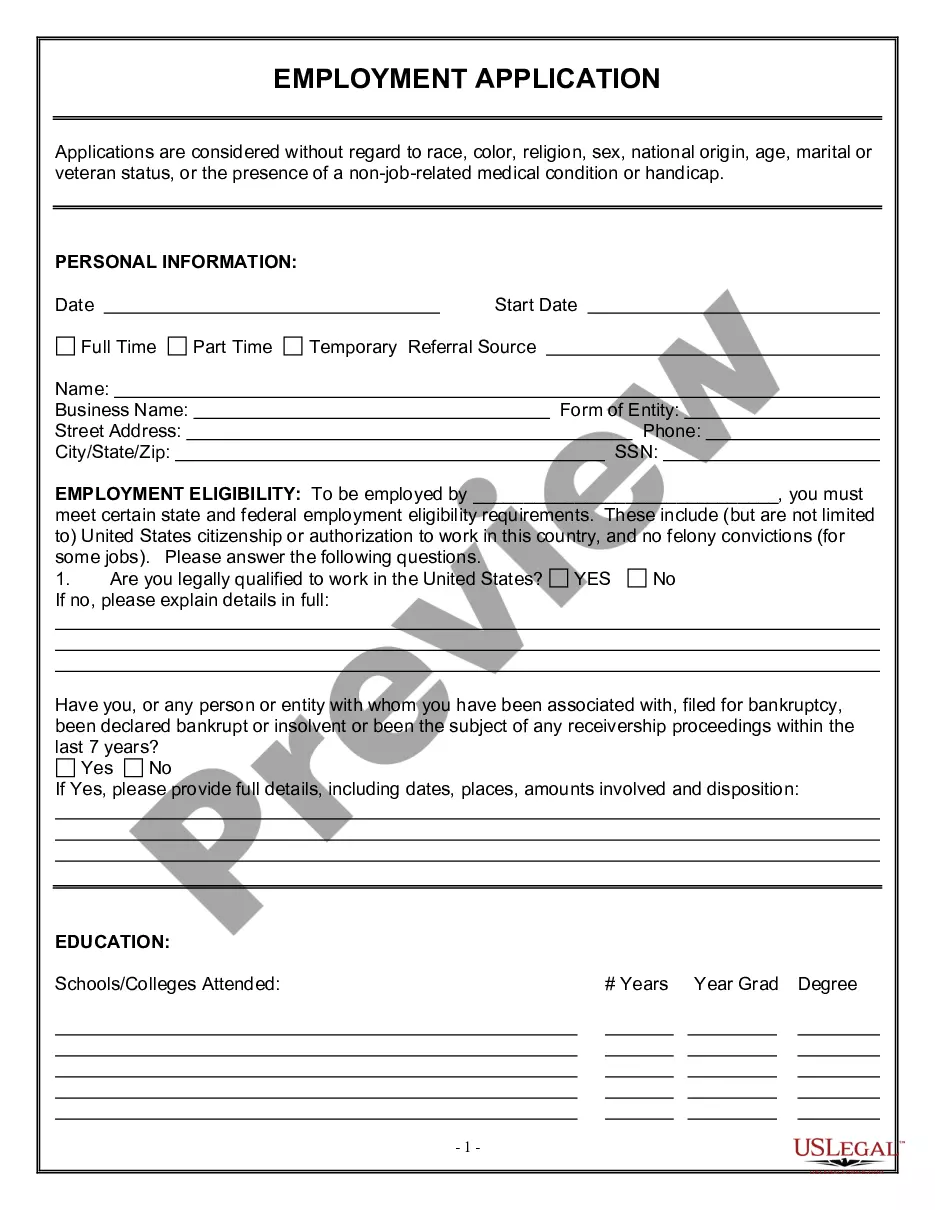

- First, ensure you have selected the correct form for your jurisdiction/region.

- You can preview the form using the Preview button and read the form description to confirm it is suitable for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are confident that the form is suitable, click the Get now button to obtain the form.

- Choose the pricing plan you prefer and enter the required information.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

FAQ

Not everyone receives a 1099-S form for the sale of a home. If you sell your primary residence and qualify for the Maryland Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, you may avoid receiving a 1099-S form altogether. It’s essential to confirm your eligibility for this exemption to ensure proper tax reporting.

Purpose. Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay. Consider completing a new Form MW507 each year and when your personal or financial situation changes.

This year you do not expect to owe any Maryland income tax and expect to have. a right to a full refund of all income tax withheld. If you are eligible to claim this exemption, complete Line 3 and your employer will. not withhold Maryland income tax from your wages.

Nonresidents who work in Maryland or derive income from a Maryland source are subject to the appropriate Maryland income tax rate for your income level, as well as a special nonresident tax rate of 1.75%.

You can find a clear explanation of the rule on this on the IRS web site under "Sale of Home - Real Estate Tax Tips." Generally, if you owned the home at least two years before the sale and lived in it as your main residence for at least two years in the last five, you do not owe income tax on the proceeds unless you

Maryland Real Estate Transfer TaxesMaryland also has a tax on buying and selling property. There is a state transfer tax of 0.5% of the purchase price. At the county level, there can be up to an additional 1.5% tax based upon the sales price of the property.

Purpose of Form Form MW506NRS is designed to assure the regular and timely collection of Maryland income tax due from nonresident sellers of real property located within the State.

The State of Maryland does recognize 1031 exchanges as tax-deferred. As a result, they offer an exemption to collecting this tax payment at closing. Taxpayers exchanging out of property in Maryland can file for the exemption on Form MW506AE.

If you claim exemption under the SCRA enter your state of domicile (legal residence) on Line 8; enter EXEMPT in the box to the right on line 8; and attach a copy of your spousal military identification card to Form MW507. In addition, you must also complete and attach form MW507M.

If you lived in your home for at least 2 years and are making less than $250,000 (or $500,000, if you're a married couple) net on the sale, you generally don't have to pay taxes on your gains.