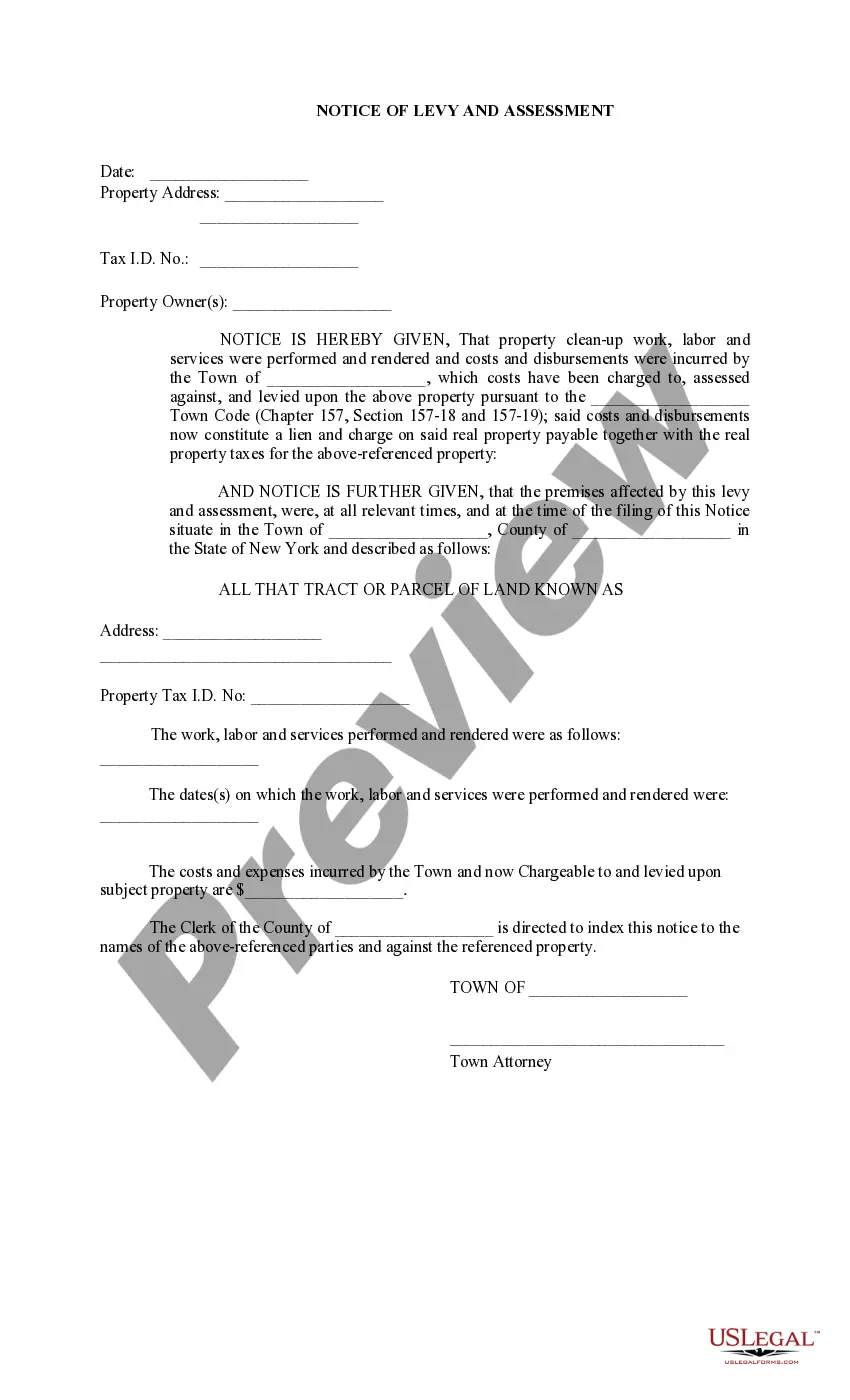

New York Notice of Levy and Assessment

Description

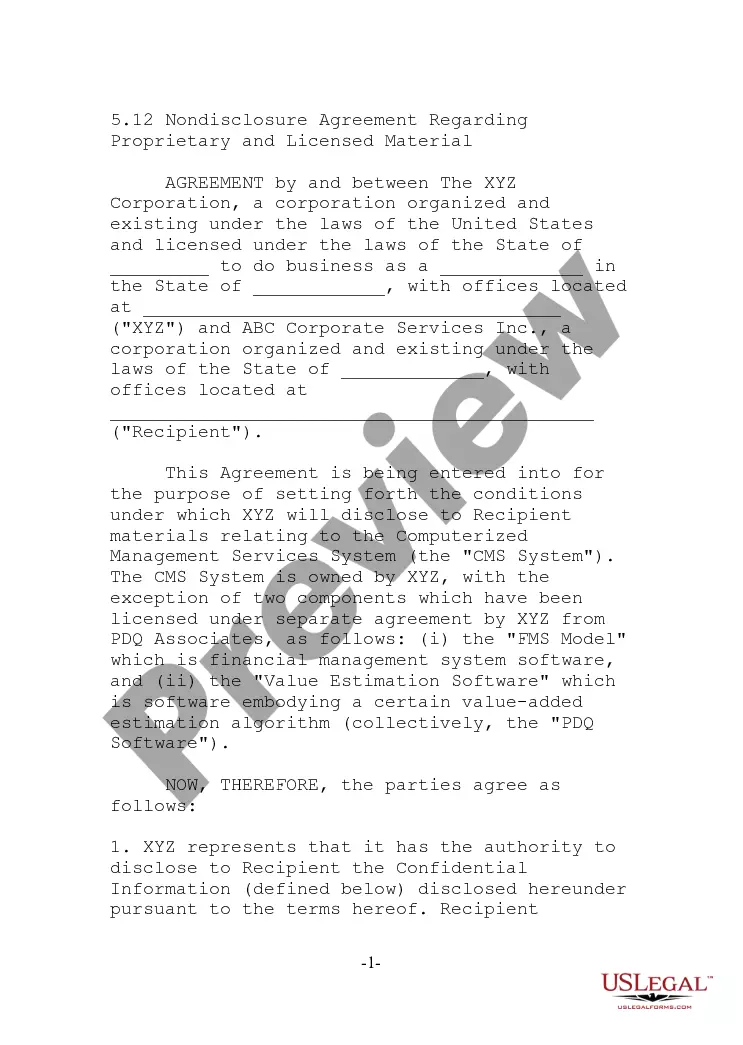

How to fill out New York Notice Of Levy And Assessment?

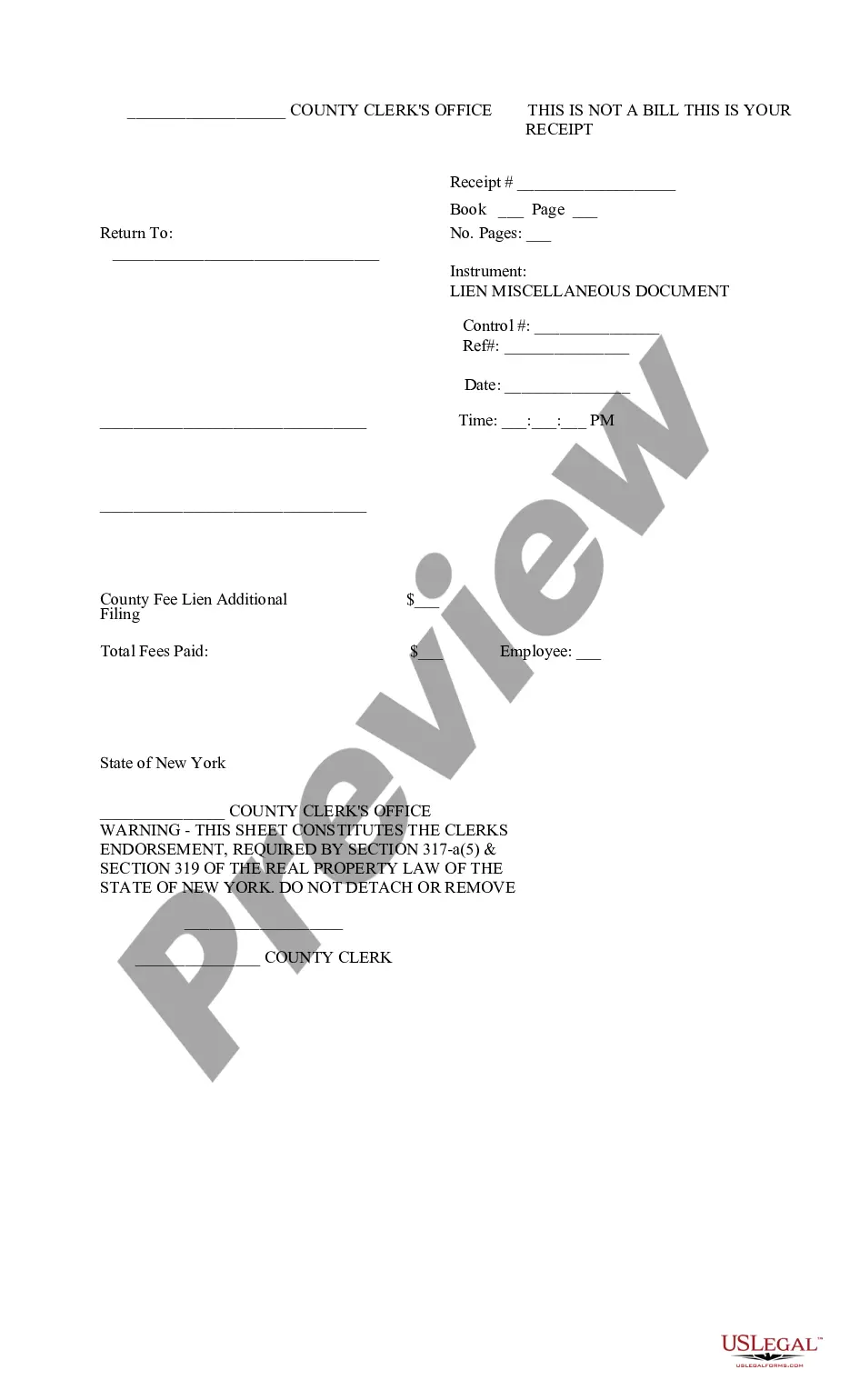

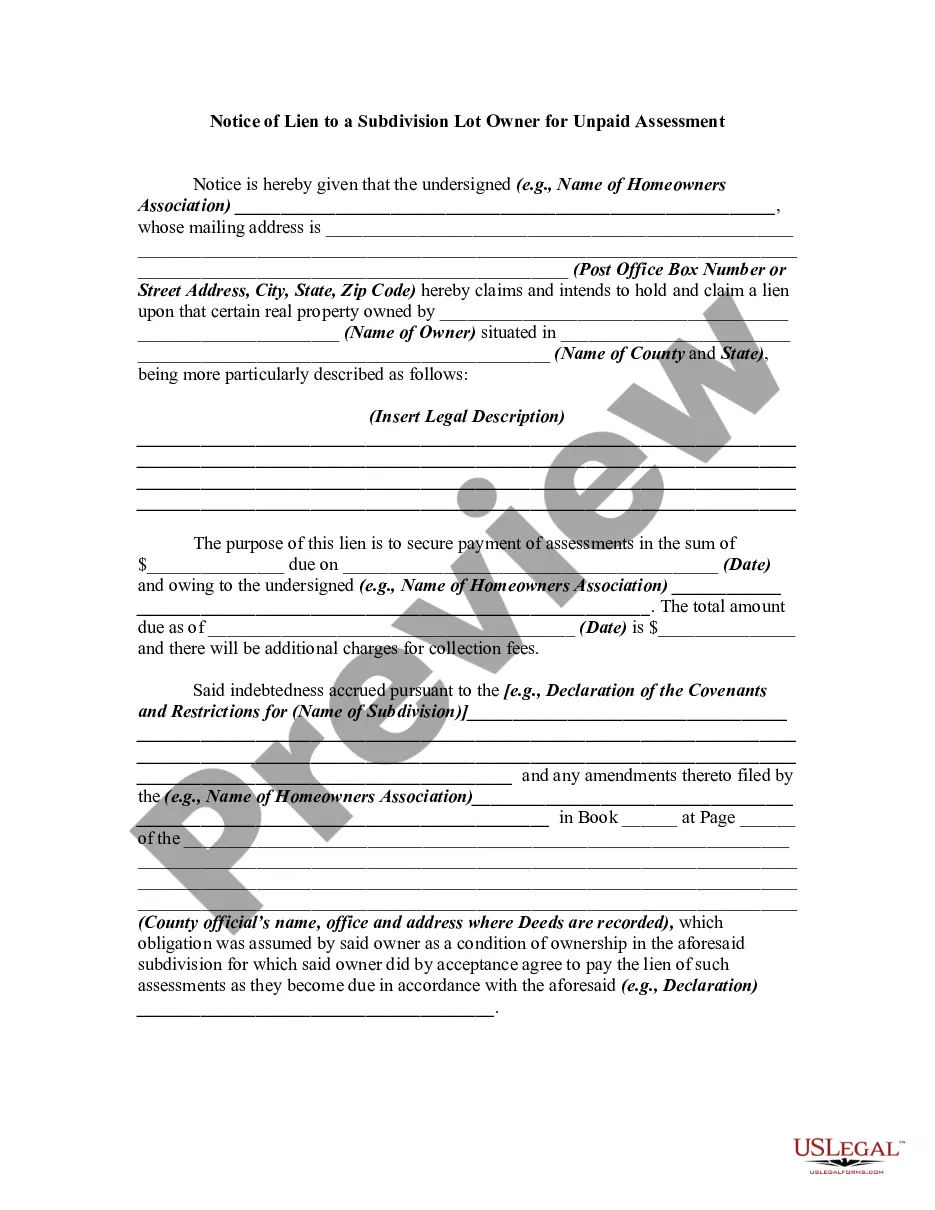

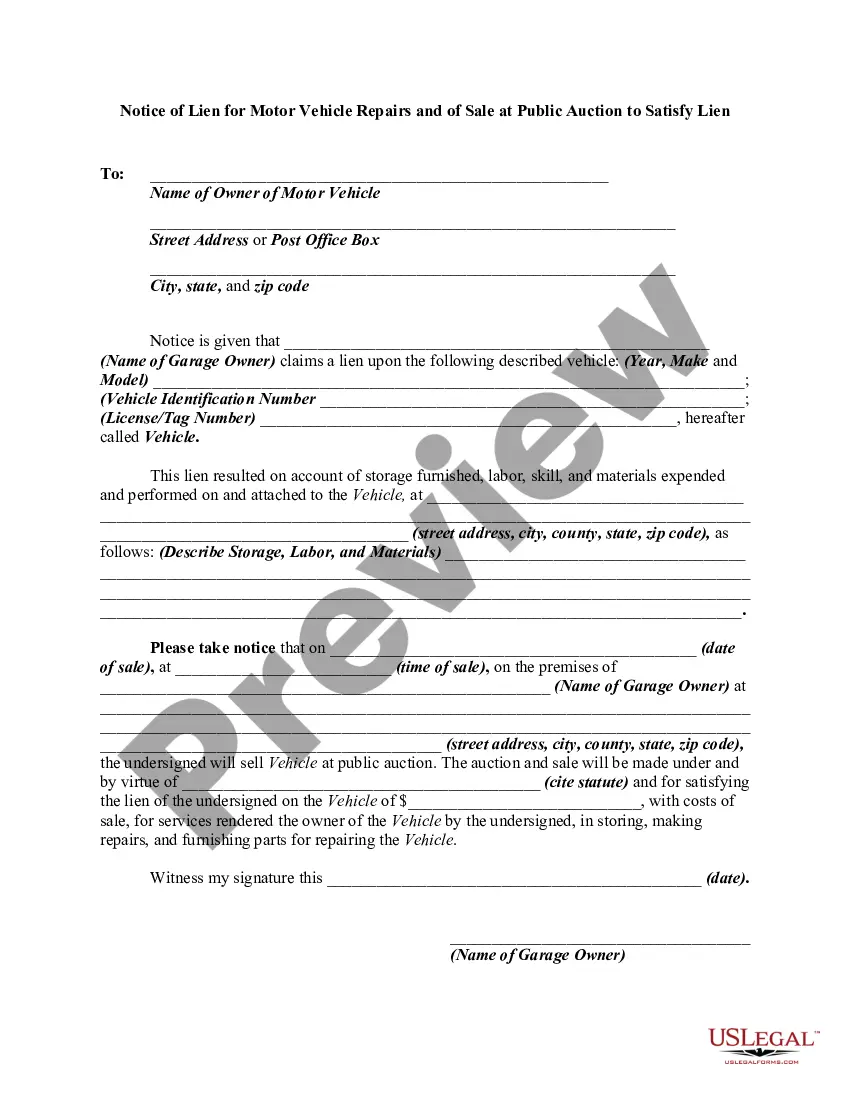

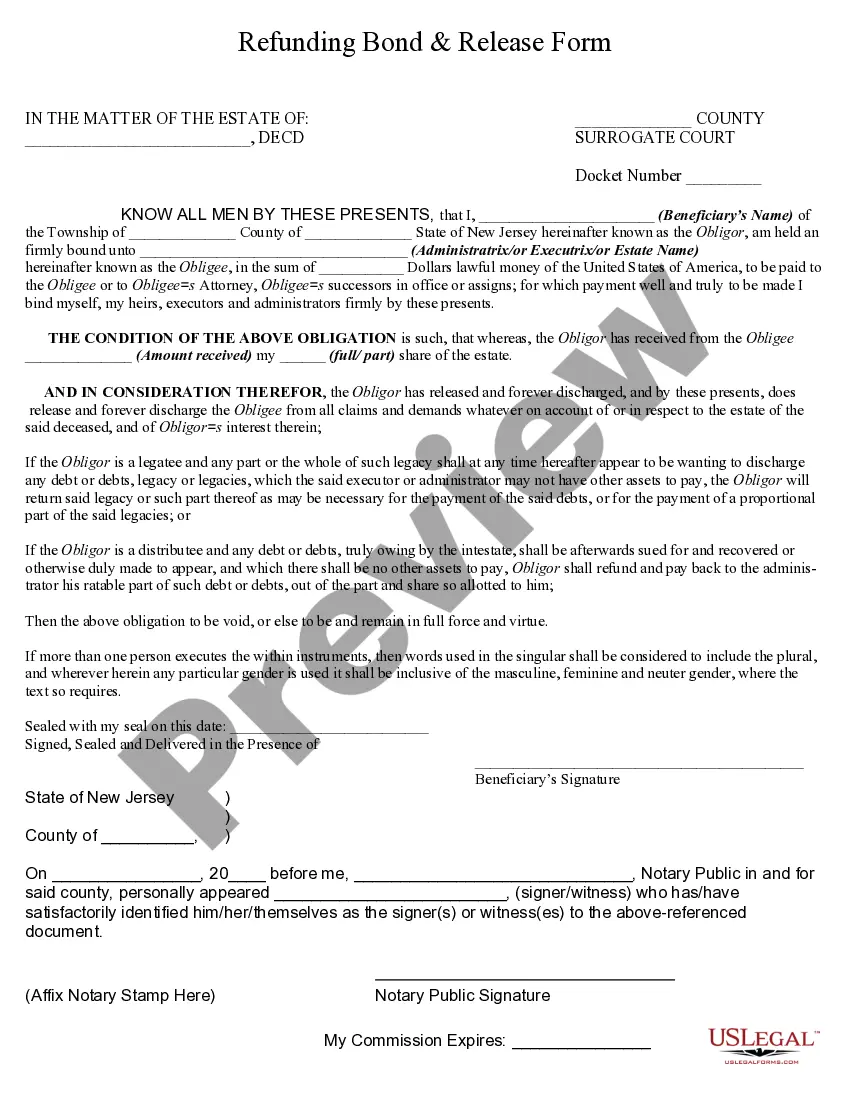

In terms of filling out New York Notice of Levy and Assessment, you almost certainly think about a long process that consists of getting a ideal sample among a huge selection of very similar ones and after that being forced to pay an attorney to fill it out to suit your needs. On the whole, that’s a slow and expensive choice. Use US Legal Forms and pick out the state-specific template within clicks.

In case you have a subscription, just log in and then click Download to have the New York Notice of Levy and Assessment template.

In the event you don’t have an account yet but need one, follow the point-by-point guide listed below:

- Be sure the document you’re getting is valid in your state (or the state it’s required in).

- Do so by reading the form’s description and by visiting the Preview option (if available) to see the form’s content.

- Click Buy Now.

- Choose the appropriate plan for your financial budget.

- Sign up for an account and select how you would like to pay out: by PayPal or by card.

- Download the document in .pdf or .docx file format.

- Find the file on your device or in your My Forms folder.

Professional lawyers draw up our templates to ensure that after saving, you don't have to worry about editing content outside of your individual info or your business’s info. Sign up for US Legal Forms and receive your New York Notice of Levy and Assessment document now.

Form popularity

FAQ

SSI payments cannot be levied or garnished. Treasury's Financial Management Service can also offset, or reduce, your Social Security benefits to collect delinquent debts owed to other Federal agencies, such as student loans owed to the Department of Education.

In general, pension income enjoys the same protection as Social Security benefits -- off limits to most creditors, except for government debts and child support. And pension income is protected from garnishments before it's given to you, but not after you receive it.

You must file an Assessment Appeal Application, form BOE-305-AH, obtained from the clerk of the board of the county where your property is located. Some counties have this form available on the website of either the clerk of the board or the county assessor, or both.

While debt collectors can't directly touch your Social Security benefits, they can get a court order to tap your bank accounts to recover the amount owed.However, if you transfer the money to a different account, or the money remains in your account for more than two months, it could be fair game for debt collectors.

Generally, Social Security benefits are exempt from execution, levy, attachment, garnishment, or other legal process, or from the operation of any bankruptcy or insolvency law.

A levy is a legal seizure of your property to satisfy a tax debt. Levies are different from liens. A lien is a legal claim against property to secure payment of the tax debt, while a levy actually takes the property to satisfy the tax debt.

No, your Social Security benefits are exempt from collection by New York State. However, do not commingle any other funds with your Social Security benefits or they will lose that protection.

To stop a state tax levy, you will need to act quickly.Once you start a payment plan, the IRS will stop the levy. Submit a counteroffer: Your tax lawyer can submit an offer in compromise to the IRS. This offer will request that you pay less than the amount you owe in taxes.

Filing the grievance form Outside of New York City and Nassau County, use Form RP-524 Complaint on Real Property Assessment to grieve your assessment. The form is available from our website (www.tax.ny.gov) or from your assessor's office.