New York Income Withholding For Support (Non-IV-D a — Spousal Support Only) is the process by which an employer withholds money from an employee's wages to be used for spousal support payments. This process is applicable only to non-IV-D cases, which are cases not handled by the Child Support Enforcement Office. The types of New York Income Withholding For Support (Non-IV-D a — Spousal Support Only) include: Wage Garnishment, Lump Sum Wage Withholding, and Retirement Plan Withholding. With wage garnishment, the employer will deduct a percentage of the employee’s wages each pay period and remit the money to the spousal support recipient. With lump sum wage withholding, the employer will deduct the full amount of the spousal support payments from a single paycheck. With retirement plan withholding, the employer will withhold money from the employee’s retirement account and remit it to the spousal support recipient.

New York Income Withholding For Support (Non-IV-D a - Spousal Support Only)

Description

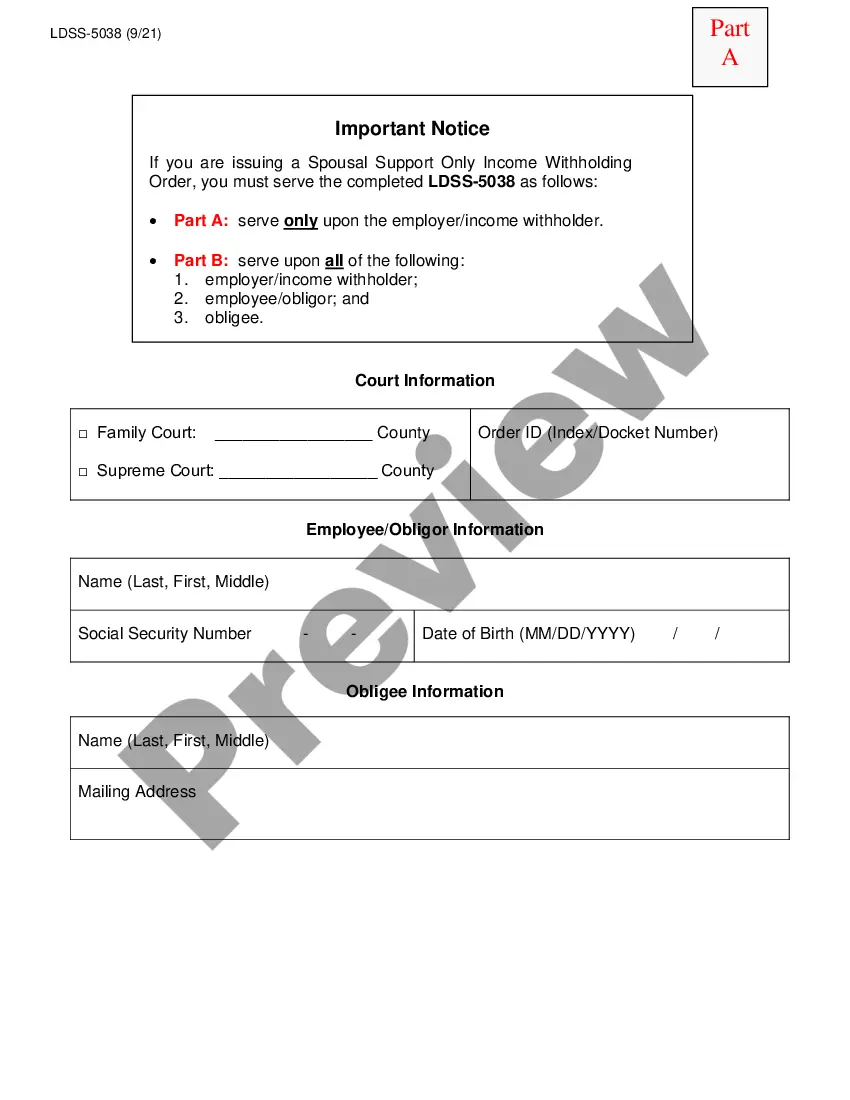

How to fill out New York Income Withholding For Support (Non-IV-D A - Spousal Support Only)?

US Legal Forms is the most simple and affordable way to find suitable formal templates. It’s the most extensive online library of business and personal legal documentation drafted and checked by lawyers. Here, you can find printable and fillable blanks that comply with national and local regulations - just like your New York Income Withholding For Support (Non-IV-D a - Spousal Support Only).

Obtaining your template requires just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the document on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a professionally drafted New York Income Withholding For Support (Non-IV-D a - Spousal Support Only) if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to ensure you’ve found the one corresponding to your requirements, or locate another one using the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and select the subscription plan you prefer most.

- Create an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Decide on the preferred file format for your New York Income Withholding For Support (Non-IV-D a - Spousal Support Only) and save it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual fill-out or upload it to an online editor to fill it out and sign more effectively.

Take advantage of US Legal Forms, your trustworthy assistant in obtaining the required official documentation. Give it a try!

Form popularity

FAQ

For marriages from 0 to 15 years, it is 15-30% of the duration of the marriage. If you've got a 10-year marriage, it would be 1.5 to 3 years of maintenance. If you have a 15-20-year marriage, it is 30-40% of the duration of the marriage. And more than 20 years, it is 35-50% of the duration of the marriage.

California and the federal government have different tax laws about spousal support (also known as alimony). For California income taxes, the person paying support can deduct the payments. The person receiving support must report the payments as income.

Ing to the New York Civil Practice Law and Rules (CPLR) section 5241 and the Consumer Credit Protection Act (CCPA), the maximum amount that can be withheld for child support is between 50% - 65% of your disposable earnings, depending on your situation.

For marriages lasting 15 to 20 years, maintenance is expected to last 30% to 40% of the length of the marriage. For marriages lasting more than 20 years, maintenance is expected to last 35% to 50% of the length of the marriage. If the recipient former spouse remarries or either spouse dies, the payments will also end.

Yes. New York state did not elect to change its tax laws when the federal government did, so you will file spousal maintenance that you pay or receive differently on your state taxes. In New York, alimony is still tax-deductible for the payor and tax-includable for the recipient.

Income Execution (IEX) is the process by which payments for current and/or overdue support are deducted from a noncustodial parent's wages or other income by the noncustodial parent's employer or income payor.

For marriages from 0 to 15 years, it is 15-30% of the duration of the marriage. If you've got a 10-year marriage, it would be 1.5 to 3 years of maintenance. If you have a 15-20-year marriage, it is 30-40% of the duration of the marriage. And more than 20 years, it is 35-50% of the duration of the marriage.

Tax Implications in New York State New York Tax Law § 612(w) (2022) stipulates that alimony or spousal maintenance will be subtracted from the payors federal adjusted gross income whereas it will be added to the federal adjusted gross income of the payee.