Change of Beneficiary

Description

Key Concepts & Definitions

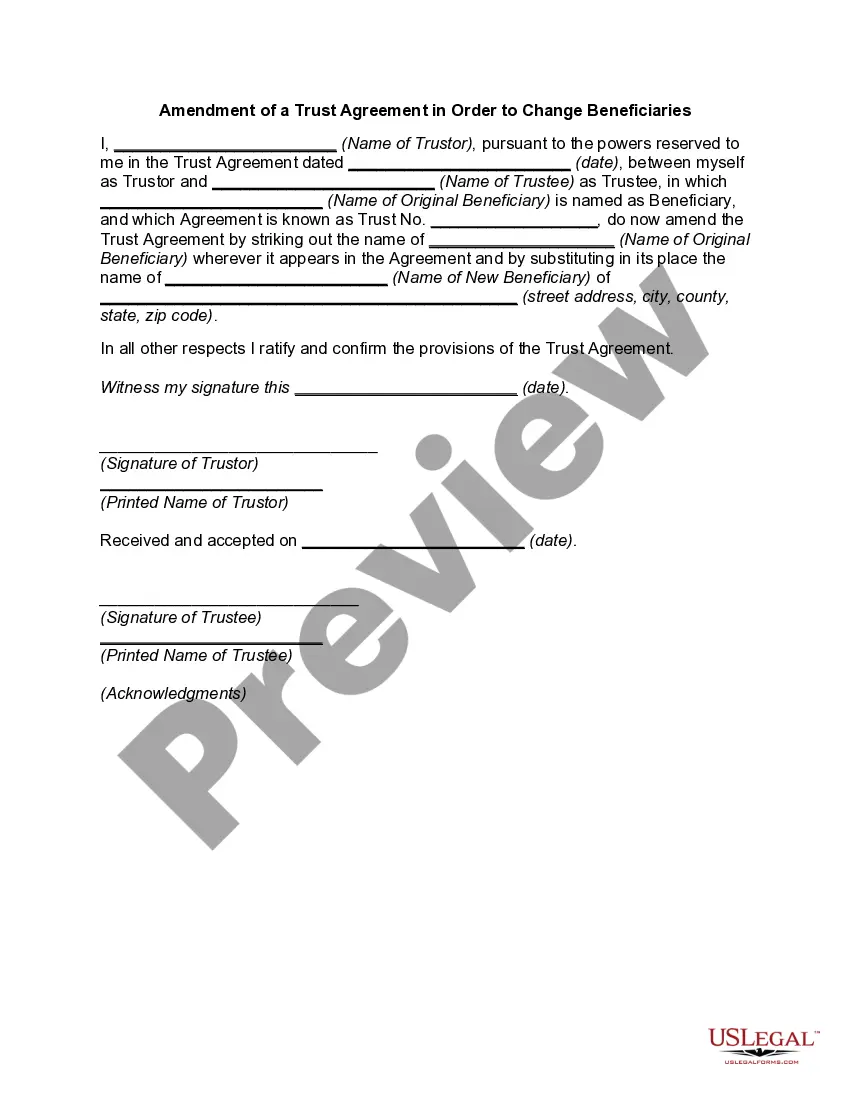

- Change of Beneficiary: This refers to the process of updating whom will receive benefits (e.g., assets, insurance proceeds) upon the death of the policyholder or account holder.

- Estate Plan: A comprehensive approach that includes the management of an individual's assets during their lifetime and distribution after death.

- Beneficiary Designations: Specifies individuals or entities entitled to receive benefits from various accounts or policies.

- Financial Planning: The process of establishing financial goals and creating strategies to meet them over a person's life, including retirement planning.

- Investment Advice: Professional recommendations concerning investment strategies tailored to individual financial goals.

Step-by-Step Guide to Changing a Beneficiary

- Review Current Policy: Start by reviewing the terms of your existing estate plan or beneficiary designations on insurance policies, retirement accounts, and other significant assets.

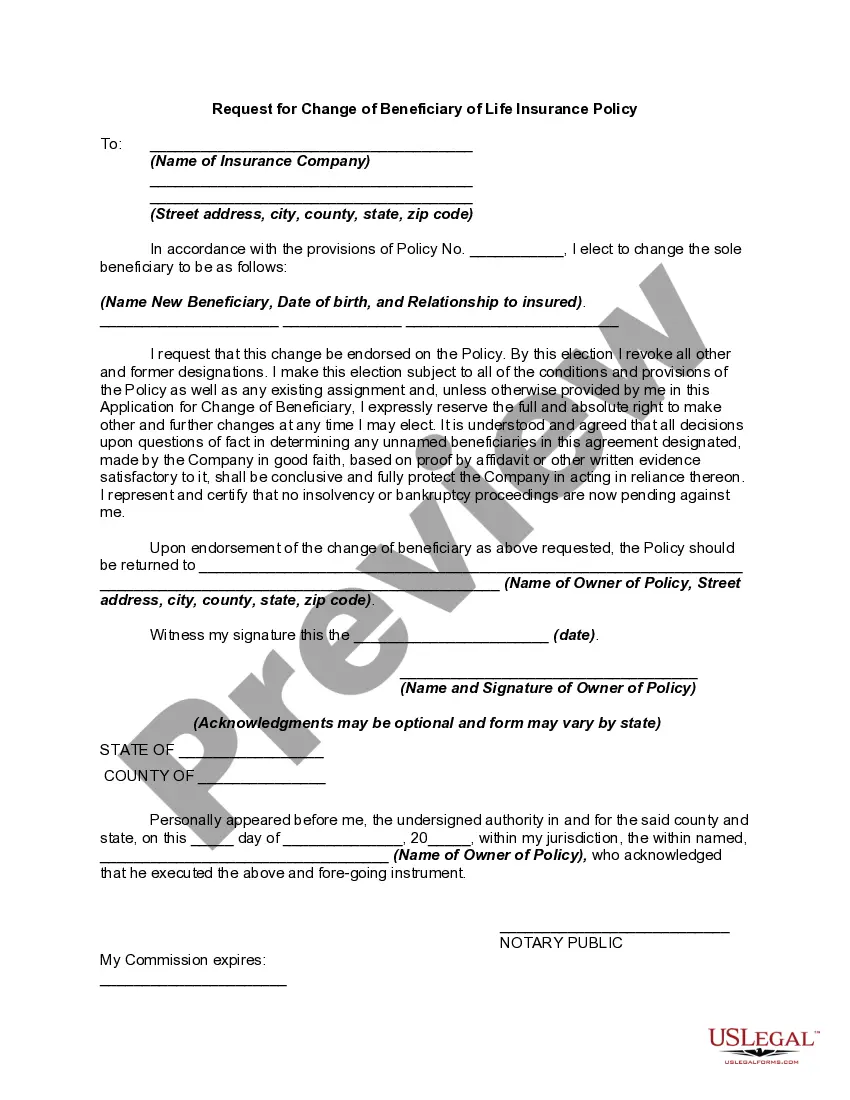

- Contact Customer Service: Reach out to the institution (like your insurance company or retirement account manager) to request the necessary forms for a change of beneficiary.

- Complete the Forms Accurately: Fill out the forms ensuring all required details are correct to prevent processing delays or errors.

- Submit Documentation: Return the completed forms to the appropriate entity, along with any required legal documentation such as a marriage certificate or death certificate, if applicable.

- Confirm Changes: Follow up to ensure that the beneficiary changes have been processed correctly and reflect your current wishes.

- Securely Store Records: Keep a copy of the updated documents in a safe place and consider sharing the location with trusted family members or legal advisors.

Risk Analysis

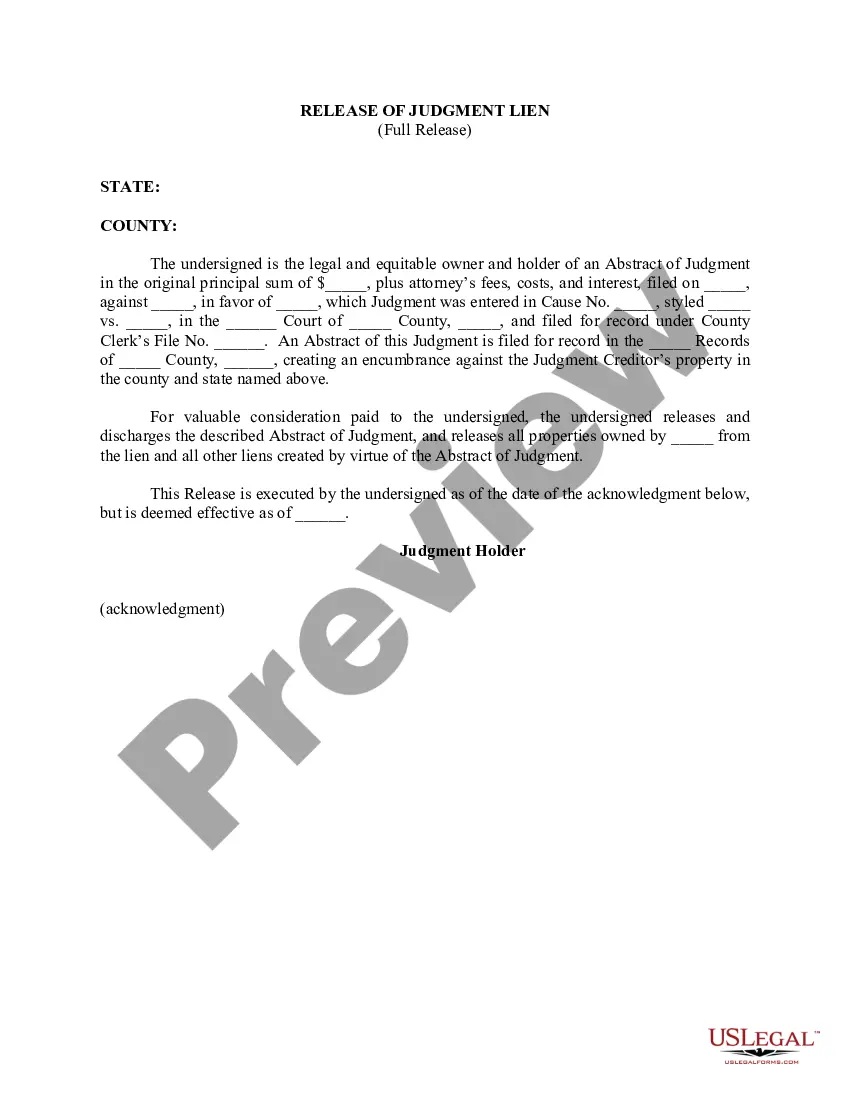

- Legal Disputes: Incorrectly updated beneficiary designations can result in family disputes or legal challenges, impacting the distribution of your assets.

- Delayed Processing: Failing to submit accurate and complete documentation may delay the beneficiary change process.

- Financial Impact: Inadequate estate planning and beneficiary designations might lead to unintended tax implications and financial loss.

Best Practices

- Regularly Review Beneficiary Designations: Reassess beneficiary designations annually or after major life events such as marriage, divorce, or the birth of a child.

- Seek Professional Advice: Consult with estate planning experts to ensure that your plan aligns with current laws and personal circumstances.

- Use Clear Identifiers: When designating beneficiaries, use specific identifiers to prevent ambiguity and ensure the right individuals receive your assets.

Common Mistakes & How to Avoid Them

- Not Updating Regularly: Avoid this by reviewing and dating your designations periodically. Treat these revisions as part of your essential financial or estate planning process.

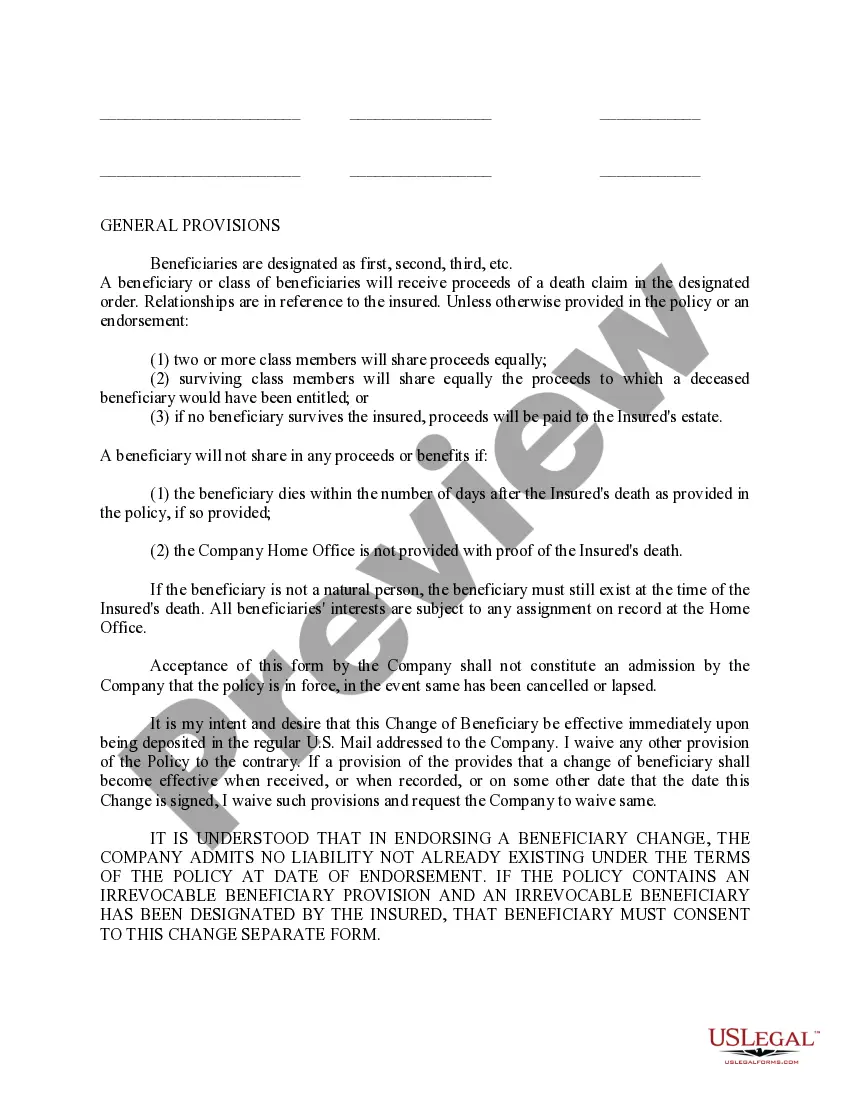

- Overlooking Forms: Always complete the right forms for each account or policy distinctly; never assume one form covers all assets.

- Assuming Defaults Are Adequate: Consult a professional instead of relying on policy defaults, as they may not reflect your personal wishes or current relationships.

How to fill out Change Of Beneficiary?

Aren't you tired of choosing from hundreds of templates every time you require to create a Change of Beneficiary? US Legal Forms eliminates the lost time millions of American people spend exploring the internet for ideal tax and legal forms. Our expert crew of lawyers is constantly upgrading the state-specific Forms library, so that it always has the appropriate documents for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have a subscription need to complete easy steps before being able to download their Change of Beneficiary:

- Utilize the Preview function and read the form description (if available) to be sure that it is the right document for what you are looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the appropriate example for your state and situation.

- Use the Search field at the top of the site if you want to look for another file.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Download your sample in a required format to complete, print, and sign the document.

When you have followed the step-by-step instructions above, you'll always be capable of sign in and download whatever document you require for whatever state you require it in. With US Legal Forms, completing Change of Beneficiary samples or other official files is not difficult. Get started now, and don't forget to recheck your examples with accredited lawyers!

Form popularity

FAQ

Withdraw the money in the account, or. Go to the bank and change the paperwork. Fill out, sign, and deliver to the bank a new account registration card that names a different beneficiary or removes the POD designation altogether.

An Executor can override a beneficiary and stay compliant to their fiduciary duty as long as they remain faithful to the Will as well as any court mandates, which include paying state and federal back taxes, debts, and that the estate has assets to pay out to the beneficiary.

Revocable beneficiaries: The owner of the life insurance policy has the right to change the beneficiary designation at any time without the consent of the previously named beneficiary.

The beneficiaries cannot change it either. Legitimate wills are executed as they are. The exception is when beneficiaries agree to change certain aspects of the will or if a beneficiary wins in court after contesting a will.

You simply need to contact your insurer and request a change of beneficiary form and fill out the form accurately and completely. Make sure to spell out the complete names of all your beneficiaries and provide their Social Security numbers to facilitate payout of benefits in the event of your death.

Such last-minute beneficiary changes happen when the insured is gravely ill, in the hospital or nursing home, or of diminished mental capacity. Most of the time they occur a day or two before the insured's death.

The short answer is no. The beneficiary can't be "changed" after death. However, the beneficiary can disclaim an interest in the policy and then it would go to the contingent beneficiary...

Once a life insurance policyholder dies, little can be done to change the beneficiary designation and prevent a dispute. However, policyholders can protect their loved ones and beneficiaries by keeping their policies up-to-date. When life changes happen, changes in the life insurance policy should reflect them.