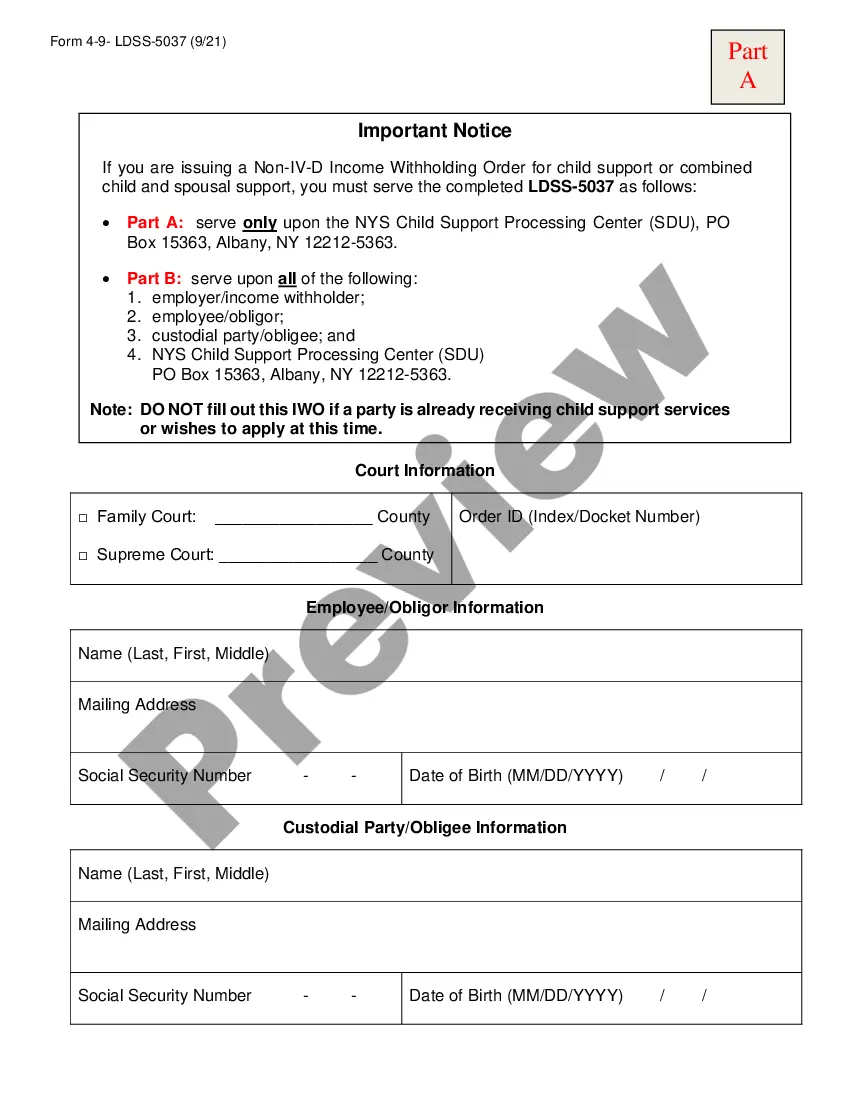

New York Income Withholding For Support (Non-IV-D b) is a process in which an employer is legally obligated to withhold money from the wages of an employee to be used towards child support payments. Non-IV-D b stands for Non-Interstate/Intergovernmental income withholding. This type of income withholding is used when the child support order does not involve two states or the federal government. There are two types of New York Income Withholding For Support (Non-IV-D b): 1. New York State Income Withholding for Support (Non-IV-D b): This type of income withholding is used when the child support order was issued in New York State. 2. New York Out-of-State Income Withholding for Support (Non-IV-D b): This type of income withholding is used when the child support order was issued by a state other than New York.

New York Income Withholding For Support (Non-IV-D b)

Description

How to fill out New York Income Withholding For Support (Non-IV-D B)?

How much time and resources do you normally spend on drafting official documentation? There’s a better option to get such forms than hiring legal specialists or wasting hours searching the web for a suitable template. US Legal Forms is the top online library that provides professionally drafted and verified state-specific legal documents for any purpose, including the New York Income Withholding For Support (Non-IV-D b).

To obtain and complete a suitable New York Income Withholding For Support (Non-IV-D b) template, follow these simple instructions:

- Look through the form content to ensure it complies with your state regulations. To do so, check the form description or utilize the Preview option.

- If your legal template doesn’t satisfy your needs, find another one using the search bar at the top of the page.

- If you already have an account with us, log in and download the New York Income Withholding For Support (Non-IV-D b). If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is absolutely reliable for that.

- Download your New York Income Withholding For Support (Non-IV-D b) on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously purchased documents that you safely store in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as often as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most trustworthy web services. Join us today!

Form popularity

FAQ

Description: Title IV Section D (IV-D) of the Social Security Act was established to: secure and enforce child support and medical support from absent parents; establish paternity when necessary; and to provide a parent locator service.

When Can I Collect Retroactive Child Support Payments In New York? In New York, child support may be collected retroactively for up to two years before the child support petition is filed with the court.

In certain cases of willful nonpayment of child support, the delinquent parent may go to jail for up to six months. Noncustodial parents who owe child support arrears equal to or more than four months of current support may be eligible to have their state-issued licenses suspended through the court process.

A child support order handled by a private attorney as opposed to the State/local child support enforcement (IV-D) agency.

New York has a 20-year statute of limitations. A parent must provide the child support they owe to the parent who was financially responsible for the child for 20 years after the date of default if they do not pay the total amount of child support they owe by the time the child turns 21.

A willful violation means that the parent did not pay support and he/she had the ability to pay or should have had the ability to pay. There will be a money judgment in the amount of the support owed and the parent might be incarcerated for up to six months.

Ing to the New York Civil Practice Law and Rules (CPLR) section 5241 and the Consumer Credit Protection Act (CCPA), the maximum amount that can be withheld for child support is between 50% - 65% of your disposable earnings, depending on your situation.

After the child support order is established in Family Court, OCSS monitors, collects, and distributes the payments. If payments fall behind, OCSS has the authority to enforce the child support order through administrative means. FAMILY COURT is part of the New York State Unified Court System.