New York Spousal Support Only Income Withholding Order (LDSS-5038)

Description

Key Concepts & Definitions

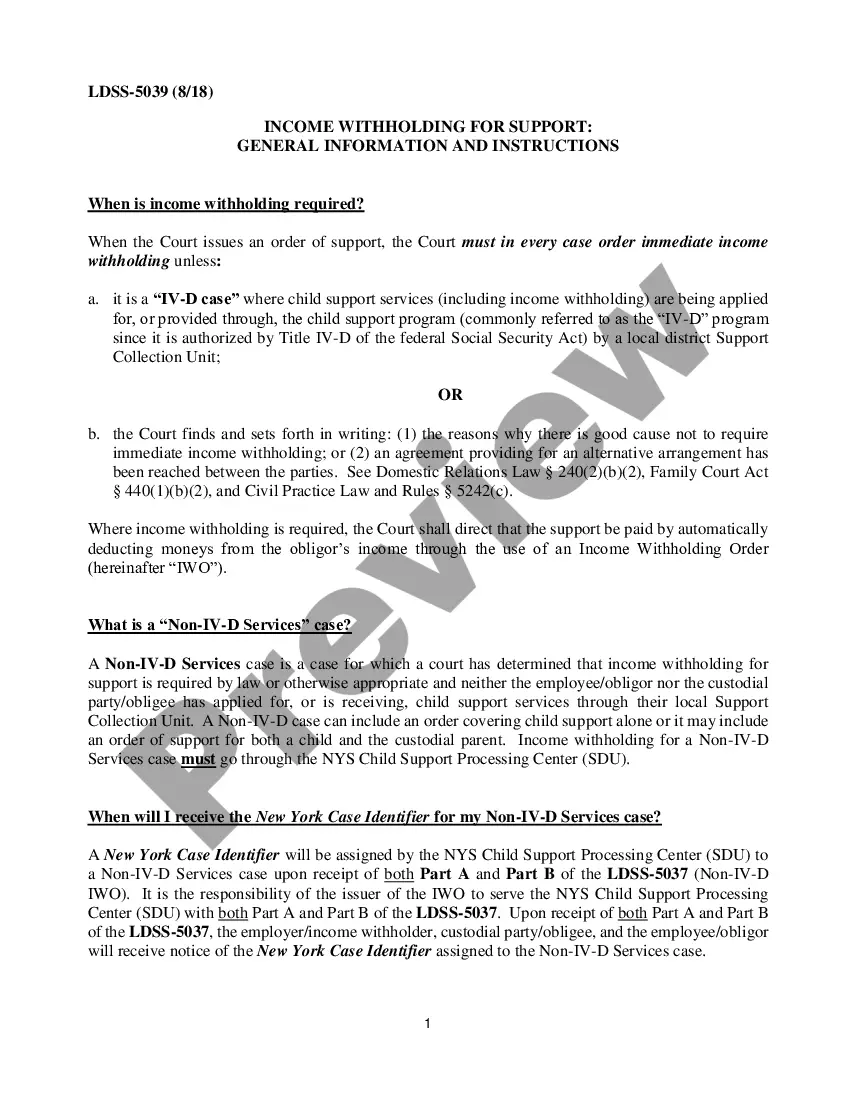

Spousal Support Only Income Withholding Order: A legal document issued by a court that requires an employer to withhold a portion of an employee's wages for payment directly to their former spouse as a form of spousal support or alimony. This order is generally used when other forms of payment have not been successful.

Step-by-Step Guide

- Assess the situation: Determine if a spousal support only income withholding order is necessary by reviewing the spousal support agreement and payment history.

- Obtain the order: File a motion with the court requesting an income withholding order if previous payment arrangements have failed.

- Notify the employer: Once the order is granted, provide the employer with a copy of the order along with instructions for withholding and sending the payments.

- Monitor compliance: Regularly check that the correct amounts are being withheld and transferred by the employer.

- Address modifications: If there are changes in employment or financial circumstances, petition the court to modify the order accordingly.

Risk Analysis

- Non-compliance by Employers: Failure of an employer to comply with the withholding order can lead to legal penalties.

- Financial Instability for Payor: Incorrect calculation of withholding can lead to financial hardship for the person required to pay spousal support.

- Legal Amendments: Changes in family law can affect the validity or execution of current withholding orders.

Best Practices

- Maintain clear documentation: Ensure all communications and legal documents are properly documented and stored.

- Seek legal advice: Regularly consult with a family law attorney to remain compliant with the latest laws and regulations.

- Communicate openly: Provide clear and open channels of communication with both the former spouse and the employer to avoid misunderstandings.

Common Mistakes & How to Avoid Them

- Delaying the request for an order: Make a timely request as soon as it's evident that voluntary payments are insufficient.

- Incorrect information: Verify all legal, personal, and financial information in the document to prevent errors and legal delays.

- Failing to update the order: Regularly review and update the order to cater to any changes in financial status or employment.

FAQ

- What is the process to obtain a spousal support only income withholding order? The process involves petitioning the local family court, proving the need for such order, and then notifying the employer once it is granted.

- Can a spousal support only income withholding order be modified? Yes, either party can request the court to modify the order in light of changed financial circumstances or employment status.

Summary

A Spousal Support Only Income Withholding Order is a crucial legal tool used in the enforcement of spousal support payments. It ensures that the agreed support amounts are regularly deducted from the paying spouses income by their employer and transferred to the recipient. Navigating the complexities of obtaining and maintaining such an order requires a clear understanding of the associated steps, potential risks, and best practices.

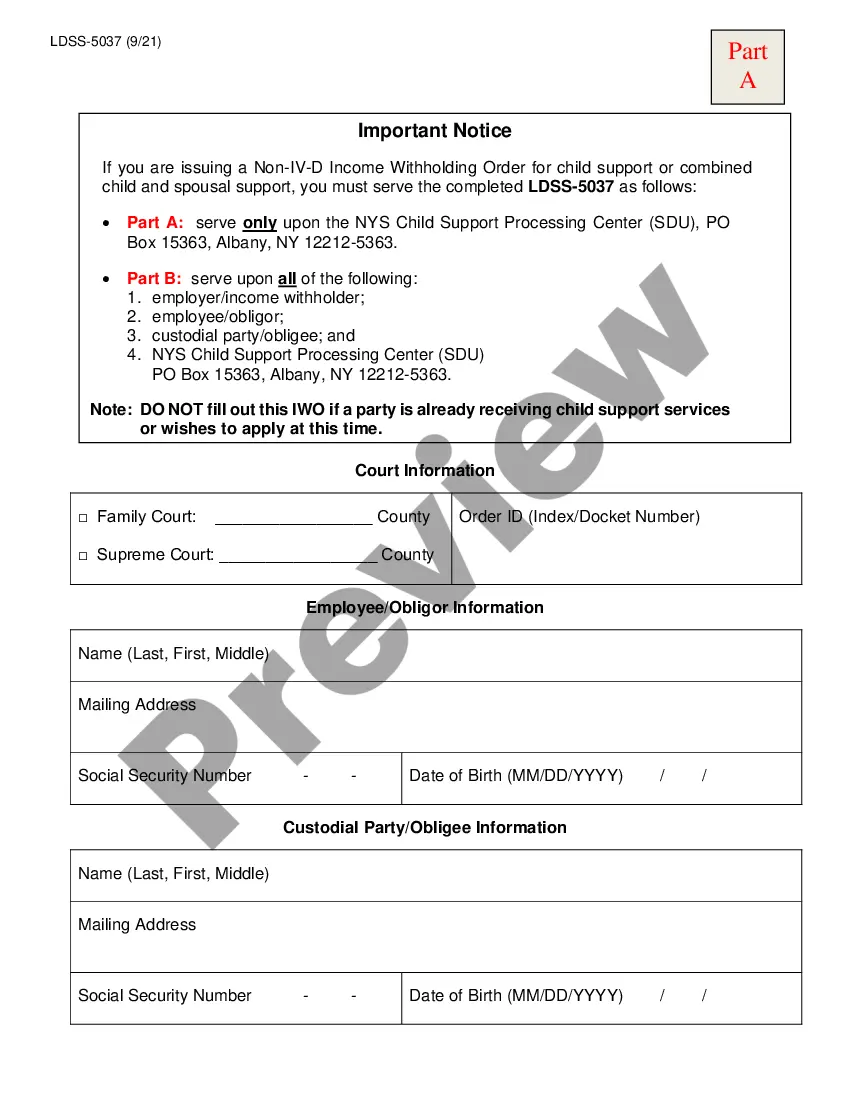

How to fill out New York Spousal Support Only Income Withholding Order (LDSS-5038)?

In terms of filling out New York Spousal Support Only Income Withholding Order, you most likely think about a long procedure that requires finding a ideal form among a huge selection of similar ones and after that needing to pay out a lawyer to fill it out for you. On the whole, that’s a sluggish and expensive option. Use US Legal Forms and pick out the state-specific document within just clicks.

For those who have a subscription, just log in and click Download to have the New York Spousal Support Only Income Withholding Order sample.

In the event you don’t have an account yet but want one, stick to the step-by-step manual listed below:

- Be sure the file you’re downloading is valid in your state (or the state it’s required in).

- Do so by reading through the form’s description and also by visiting the Preview function (if readily available) to see the form’s content.

- Simply click Buy Now.

- Choose the suitable plan for your financial budget.

- Join an account and choose how you want to pay out: by PayPal or by card.

- Download the document in .pdf or .docx file format.

- Get the document on the device or in your My Forms folder.

Professional attorneys work on drawing up our templates so that after downloading, you don't have to worry about editing content material outside of your individual info or your business’s information. Join US Legal Forms and receive your New York Spousal Support Only Income Withholding Order document now.

Form popularity

FAQ

Process. If you owe back alimony, your former spouse can garnishee your Social Security retirement benefits by obtaining a judgment against you for the debt and a court order for garnishment.

Fill out the income withholding order, mark the appropriate boxes, mark you're terminating support, file it with the court, get the order from the judge, and then serve it on the employer by certified mail. That's the way you would terminate the support.

In every case ordering spousal or partner support, the court will order that an earnings assignment (also called wage garnishment) be issued and served. The earnings assignment tells the employer of the person ordered to pay support to take the support payments out that person's wages.

Once you receive an IWO, you should withhold child support as soon as possible. Most states require that you start withholding no later than the pay period beginning 14 days after the agency mailed the IWO. If you don't withhold child support after receiving an income withholding order, you will face penalties.

An ex-spouse's failure to pay court-ordered alimony payments can have considerable legal consequences in California.If your ex-spouse still does not comply with the alimony order and make payments as scheduled, a judge can hold your ex in contempt of court, and in some cases, even order jail time.

No assignment of wages is valid in California unless certain conditions are met. In addition, only a certain percentage of an employee's disposable wages can be withheld from each paycheck. Unlike a garnishment order, which is required to be honored by law, an employer has no obligation to honor an assignment.

A refusal to pay spousal support is essentially a violation of court orders. To remedy this, courts have a substantial amount of discretion when it comes to punishments. A judge might impose a fine on your former spouse or even order jail time if he or she continues to disobey the court order.

Income withholding is a deduction of a payment for child support from a parent's income. This order can be from a court or administratively ordered by a child support agency.

An income withholding order (IWO) is a document sent to employers to tell them to withhold child support from an employee's wages.If the IWO is on an official Income Withholding for Support form, you must honor the requested withholding.