New York Income Withholding For Support: General Information and Instructions (LDSS-5039)

Description

How to fill out New York Income Withholding For Support: General Information And Instructions (LDSS-5039)?

In terms of submitting New York General Information and Instructions for Income Withholding for Support , you probably imagine a long procedure that involves getting a perfect form among a huge selection of very similar ones then needing to pay out a lawyer to fill it out for you. On the whole, that’s a slow and expensive option. Use US Legal Forms and choose the state-specific form within clicks.

For those who have a subscription, just log in and then click Download to find the New York General Information and Instructions for Income Withholding for Support sample.

In the event you don’t have an account yet but need one, stick to the step-by-step guideline listed below:

- Be sure the file you’re downloading is valid in your state (or the state it’s required in).

- Do this by reading the form’s description and also by visiting the Preview option (if readily available) to see the form’s content.

- Click Buy Now.

- Pick the proper plan for your budget.

- Subscribe to an account and select how you want to pay: by PayPal or by credit card.

- Save the file in .pdf or .docx format.

- Get the file on your device or in your My Forms folder.

Professional legal professionals work on drawing up our templates so that after saving, you don't need to worry about enhancing content material outside of your individual information or your business’s info. Be a part of US Legal Forms and receive your New York General Information and Instructions for Income Withholding for Support sample now.

Form popularity

FAQ

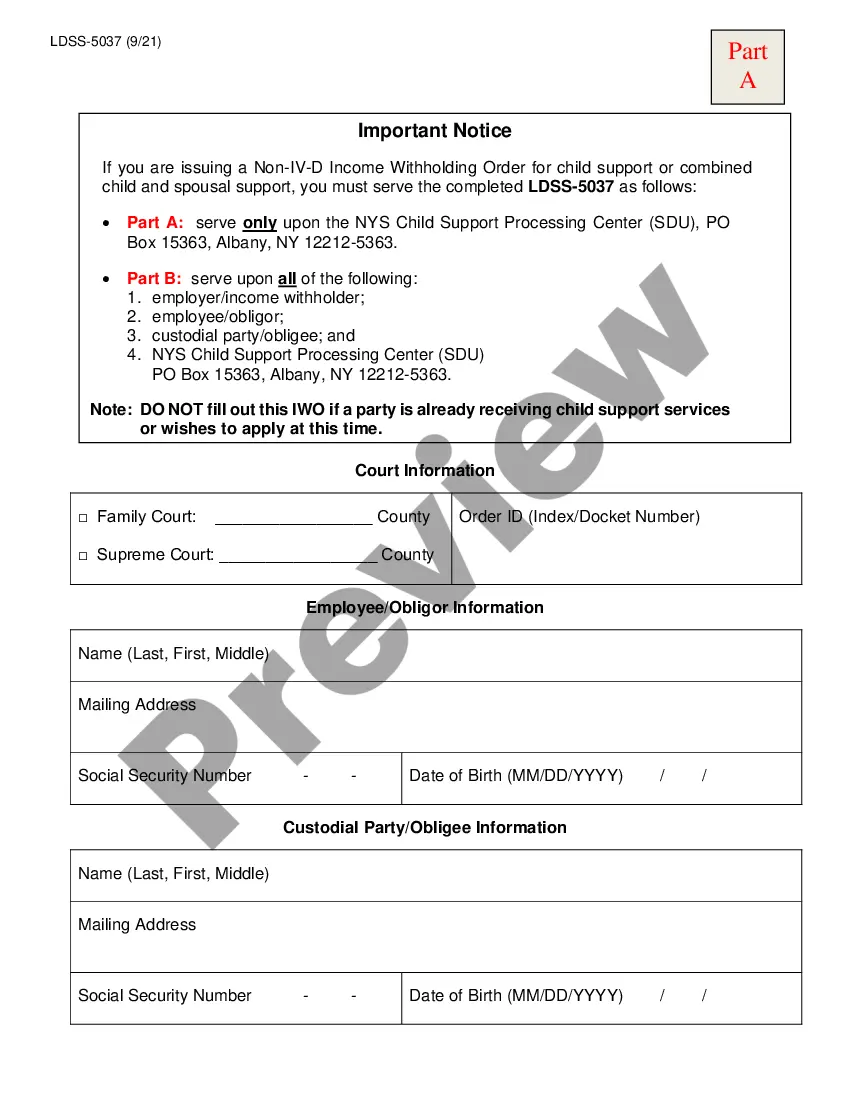

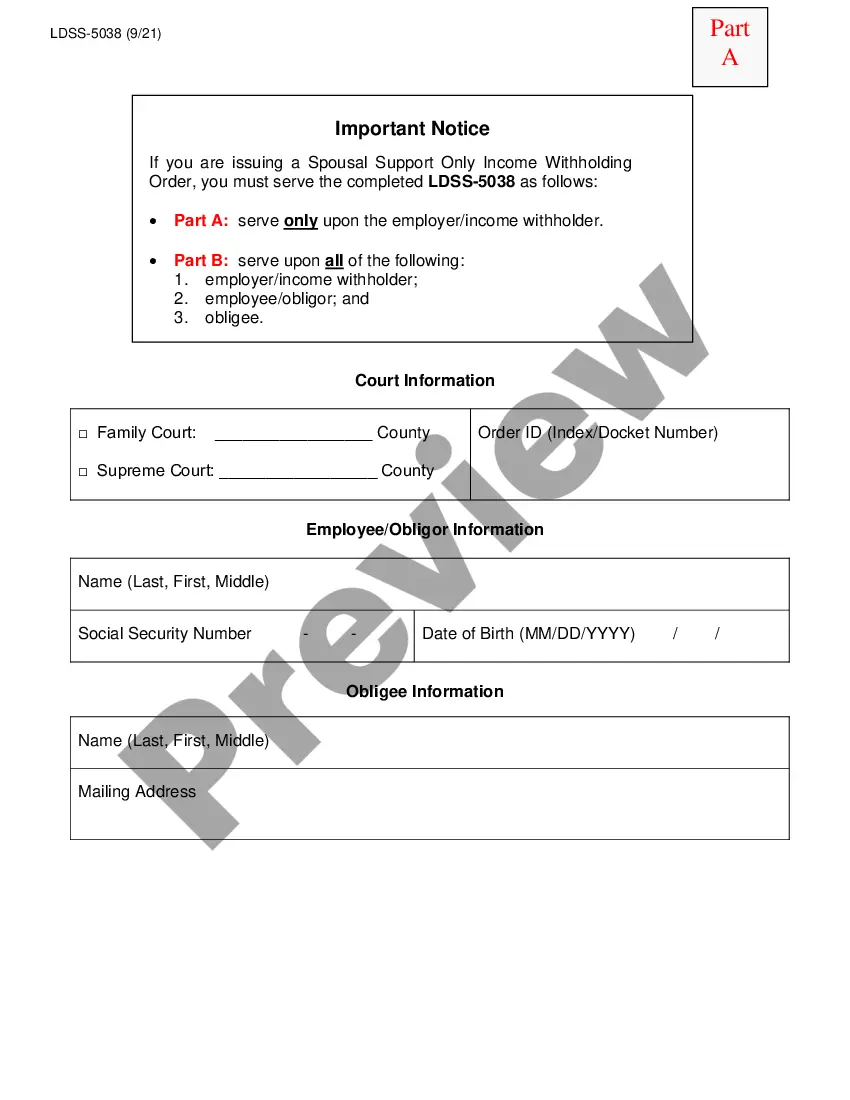

Child support withholding is a court-mandated payroll deduction. You will receive a withholding notice if you are required to make child support deductions from an employee's wages. Typically, an employee's disposable income is used to determine the limits of child support deductions.

An income withholding order (IWO) is a document sent to employers to tell them to withhold child support from an employee's wages. The IWO can come from a state, tribal, or territorial agency; a court; an attorney; or an individual.

Login to your NY.Gov account. If you do not have a NY.Gov ID, you need to create a NY.gov ID. If you have only one account, the balance / payment information will be displayed. If you have more than one account, select which account you'd like to view.

Income withholding is a deduction of a payment for child support from a parent's income. This order can be from a court or administratively ordered by a child support agency.

An income withholding is sent to an employer to withhold the amount of support ordered to pay by the court. If your IWO says amended, more than likely it is because your employment situation changed.

Once you receive an IWO, you should withhold child support as soon as possible. Most states require that you start withholding no later than the pay period beginning 14 days after the agency mailed the IWO. If you don't withhold child support after receiving an income withholding order, you will face penalties.

You can search Supreme Court cases and documents e-filed in NYSCEF (New York State Courts Electronic Filing ) system even if you do not have an e-filing account. Visit the link and click on Search as Guest. Since 1787, probate records like wills are filed and kept by the Surrogate's Court in each county.

The New York Case Identifier is your child support account number or Case ID (e.g., AB12345C6). This number is printed on court documents or official notices from the child support agency. You must include your account number. Only your e-mail address is optional; otherwise, all the information is required.

Fill out the income withholding order, mark the appropriate boxes, mark you're terminating support, file it with the court, get the order from the judge, and then serve it on the employer by certified mail. That's the way you would terminate the support.