New York Application Tax Exemption And Abatement For Residential Rehabilitation Or Conversion is a program that provides tax relief for property owners who have rehabbed or converted residential buildings into condominiums, co-ops, or rental housing. The program provides a property tax exemption and/or abatement on the assessed value of the rehabilitated or converted dwelling unit, for a specified period of time. The abatement amount is determined by the local city or town government. There are three types of tax exemptions and abatement available: 1) the Senior Citizens Homeowners' Exemption (SHE), 2) the Real Property Tax Exemption (RPT EX), and 3) the Affordable Housing Exemption (ALEX). The provides a full property tax exemption for residential buildings converted to condominiums, co-ops, or rental housing units for senior citizens. The RPT EX provides a partial property tax exemption for residential buildings converted to condominiums, co-ops, or rental housing units for individuals and families with incomes below certain thresholds. The ALEX provides a full property tax exemption for residential buildings converted to condominiums, co-ops, or rental housing units for individuals and families with incomes below certain thresholds.

New York Application Tax Exemption And Abatement For Residential Rehabilitation Or Conversion

Description

How to fill out New York Application Tax Exemption And Abatement For Residential Rehabilitation Or Conversion?

If you’re looking for a way to properly complete the New York Application Tax Exemption And Abatement For Residential Rehabilitation Or Conversion without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every individual and business scenario. Every piece of documentation you find on our online service is drafted in accordance with nationwide and state laws, so you can be sure that your documents are in order.

Adhere to these straightforward guidelines on how to get the ready-to-use New York Application Tax Exemption And Abatement For Residential Rehabilitation Or Conversion:

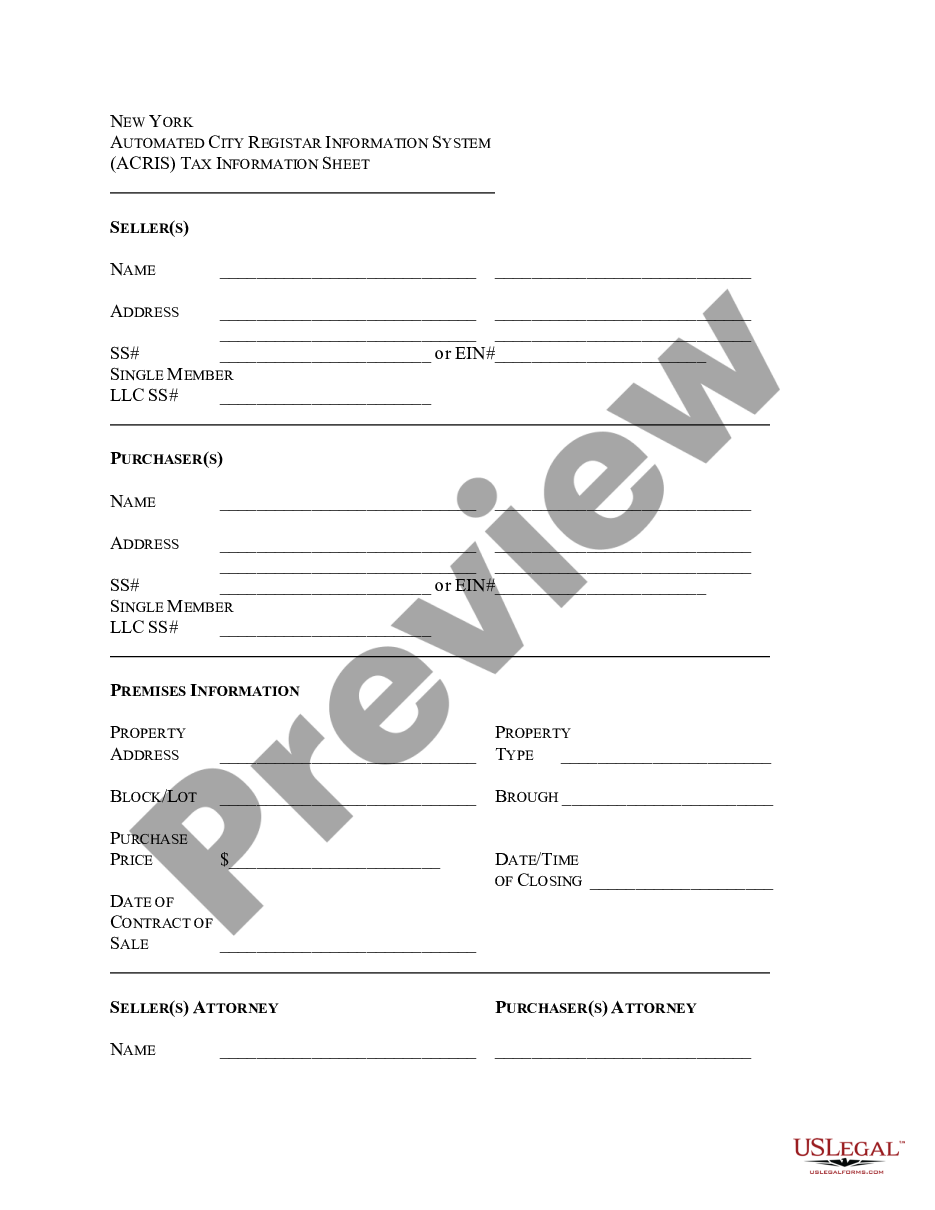

- Ensure the document you see on the page complies with your legal situation and state laws by checking its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and choose your state from the dropdown to locate another template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Create an account with the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to get your New York Application Tax Exemption And Abatement For Residential Rehabilitation Or Conversion and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it rapidly or print it out to prepare your hard copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

The 421-a tax exemption is a property tax exemption in the U.S. state of New York that is given to real-estate developers for building new multifamily residential housing buildings in New York City.

Pros of 421a Tax Abatements for NYC Home Buyers For example, if an owner has a 20-year tax abatement, they will pay pennies on the dollar for the first 12 years of the abatement. After that, the tax will jump by 20% of the whole amount every two years.

What is a 421a Tax Abatement In NYC? A 421a tax abatement lowers your property tax bill by applying credits against the total amount you owe. It is most commonly granted to property developers in exchange for including affordable housing and the benefit lasts for 10 to 25 years.

Co-Op and condo unit owners may be eligible for a property tax abatement. Abatements reduce your taxes after they've been calculated by applying dollar credits to the amount of taxes owed.

Owners of cooperative units and condominiums who meet the eligibility requirements for the Cooperative and Condominium Property Tax Abatement can have their property taxes reduced. The amount of the abatement is based on the average assessed value of the residential units in the development.

421-a Tax Abatement Enhanced 35-year Benefit Benefits are available primarily for rental projects. The benefit includes 100% real estate tax exemption for up to three years during the construction period and an additional 35 years after construction.

The amount of a 421a abatement is determined by the percentage of property tax that is abated in the benefit year. For all term lengths, the abatement percentage starts at 100% in benefit year 1 and phases out based on a set schedule over the 10-year, 15-year, 20-year, or 25-year term.