New York Application Partial Tax Exemption For New Construction Or Substantial Rehabilitation is a program offered by the state of New York to provide partial tax exemptions to encourage and incentivize construction or substantial rehabilitation of residential or commercial properties. This exemption applies to the property's real estate taxes for a period of 12 years. There are three types of New York Application Partial Tax Exemption For New Construction Or Substantial Rehabilitation: 421-a Tax Exemption Program, Industrial and Commercial Abatement Program (ICAP), and Real Property Tax Law 485-b. The 421-a Tax Exemption Program provides property tax abatement for newly constructed or substantially rehabilitated residential properties. The ICAP program provides real estate tax abatement for newly constructed or substantially rehabilitated commercial or industrial properties. The Real Property Tax Law 485-b provides additional tax exemptions for certain types of residential properties.

New York Application Partial Tax Exemption For New Construction Or Substantial Rehabilitation

Description

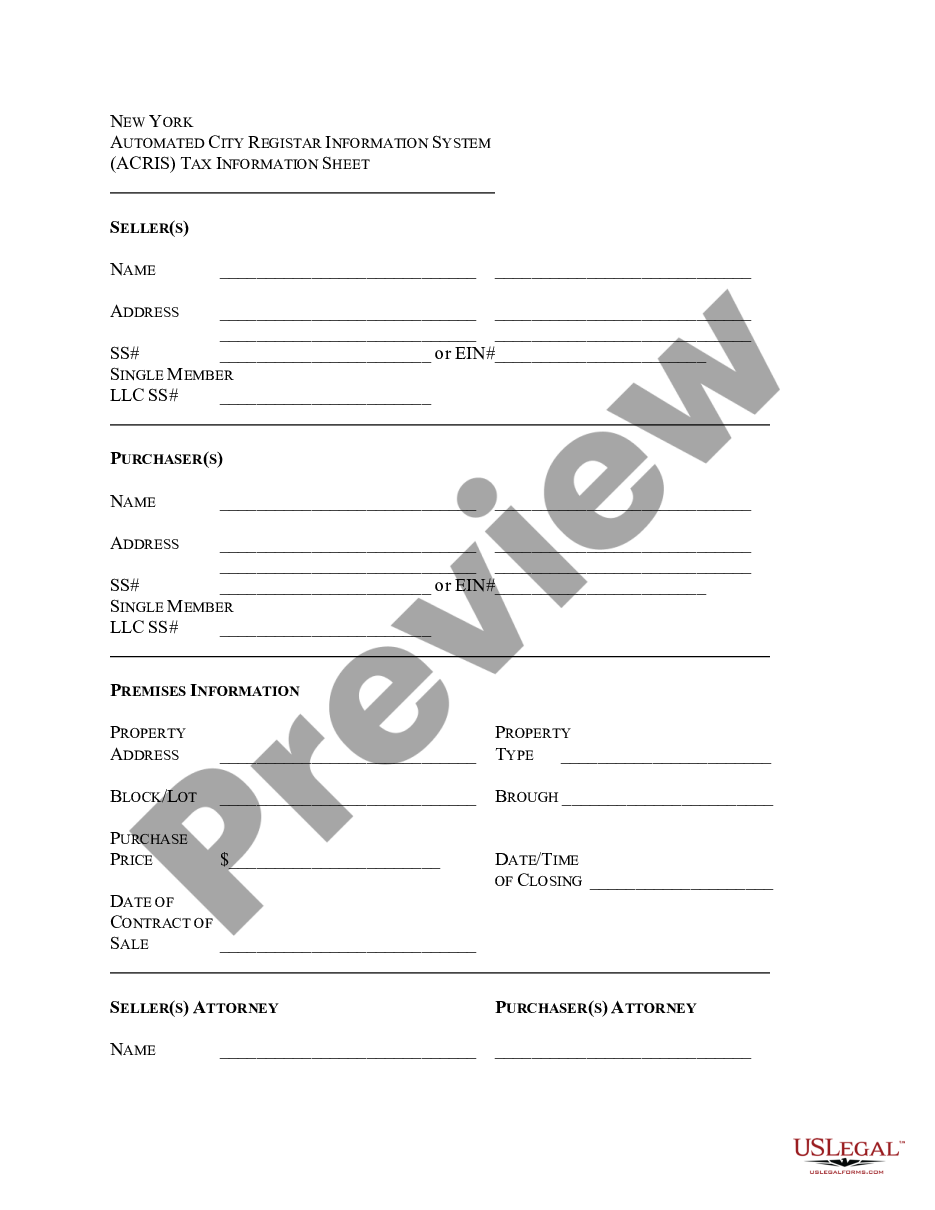

How to fill out New York Application Partial Tax Exemption For New Construction Or Substantial Rehabilitation?

Working with official paperwork requires attention, accuracy, and using well-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your New York Application Partial Tax Exemption For New Construction Or Substantial Rehabilitation template from our service, you can be certain it complies with federal and state regulations.

Dealing with our service is simple and fast. To obtain the necessary document, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to get your New York Application Partial Tax Exemption For New Construction Or Substantial Rehabilitation within minutes:

- Make sure to carefully examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for an alternative official blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the New York Application Partial Tax Exemption For New Construction Or Substantial Rehabilitation in the format you prefer. If it’s your first experience with our website, click Buy now to proceed.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to submit it electronically.

All documents are drafted for multi-usage, like the New York Application Partial Tax Exemption For New Construction Or Substantial Rehabilitation you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

Property Tax Benefits for Homeowners. The City of New York offers tax exemptions and abatements for seniors, veterans, clergy members, people with disabilities, and other homeowners. These benefits can lower your property tax bill.

Homestead Exemption New York City property tax exemptions are only available for your primary residence. If you have moved outside of New York City and have a new primary residence, you must submit a property tax exemption removal request to the NYC Department of Finance.

Failing to keep up with the property taxes on your New York home can lead to a tax foreclosure. Here's how a New York tax foreclosure works: When you don't pay the taxes, the delinquent amount, which includes the accrued taxes, interest, penalties, and costs resulting from the delinquency, becomes a lien on your home.

Homestead Exemption In New York Under New York Civil Practice Law and Rules § 5206, real or personal property, owned and occupied as the debtor's principal residence (includes condominium, co-op, or mobile home), is exempt from the enforcement of money judgments.

You can get help with property tax exemptions for homeowners, including: Clergy Property Tax Exemption. Crime Victim Property Tax Exemption. Disabled Homeowners' Exemption (DHE) School Tax Relief for Homeowners (STAR) Senior Citizen Homeowners' Exemption (SCHE) Veterans Property Tax Exemption.

Real Property Tax Law, section 467, gives local governments and public school districts the option of granting a reduction in the amount of property taxes paid by qualifying senior citizens. To qualify, seniors must be 65 years of age or older, meet certain income limitations, and other requirements.

To apply for SCHE, you must send proof of income for all owners and spouses, no matter where they reside. You should submit proof of your 2021 income, but if it is unavailable, you can submit proof of your income in 2020. Proof of income from all owners and spouses must be from the same tax year.

The Department of Finance (DOF) administers a number of benefits in the form of tax exemptions, abatements, and money-saving programs. Exemptions lower the amount of tax you owe by reducing your property's assessed value. Abatements reduce your taxes by applying credits to the amount of taxes you owe.