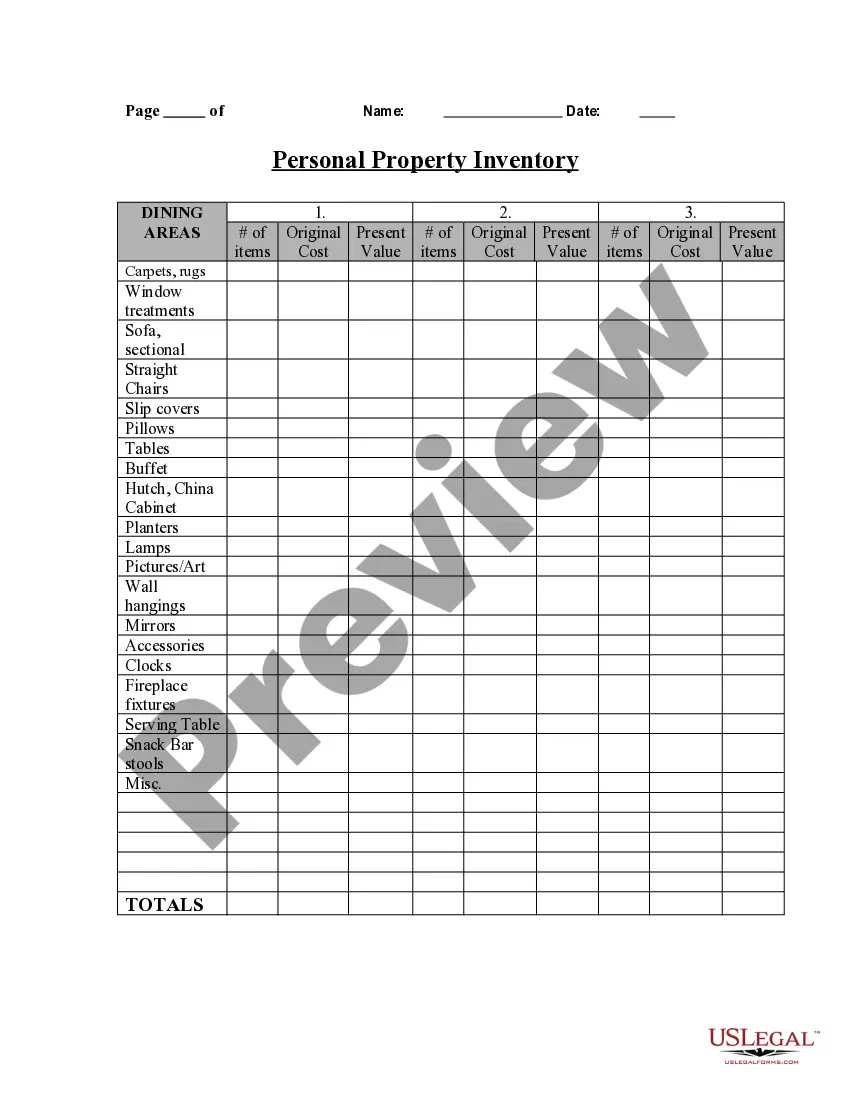

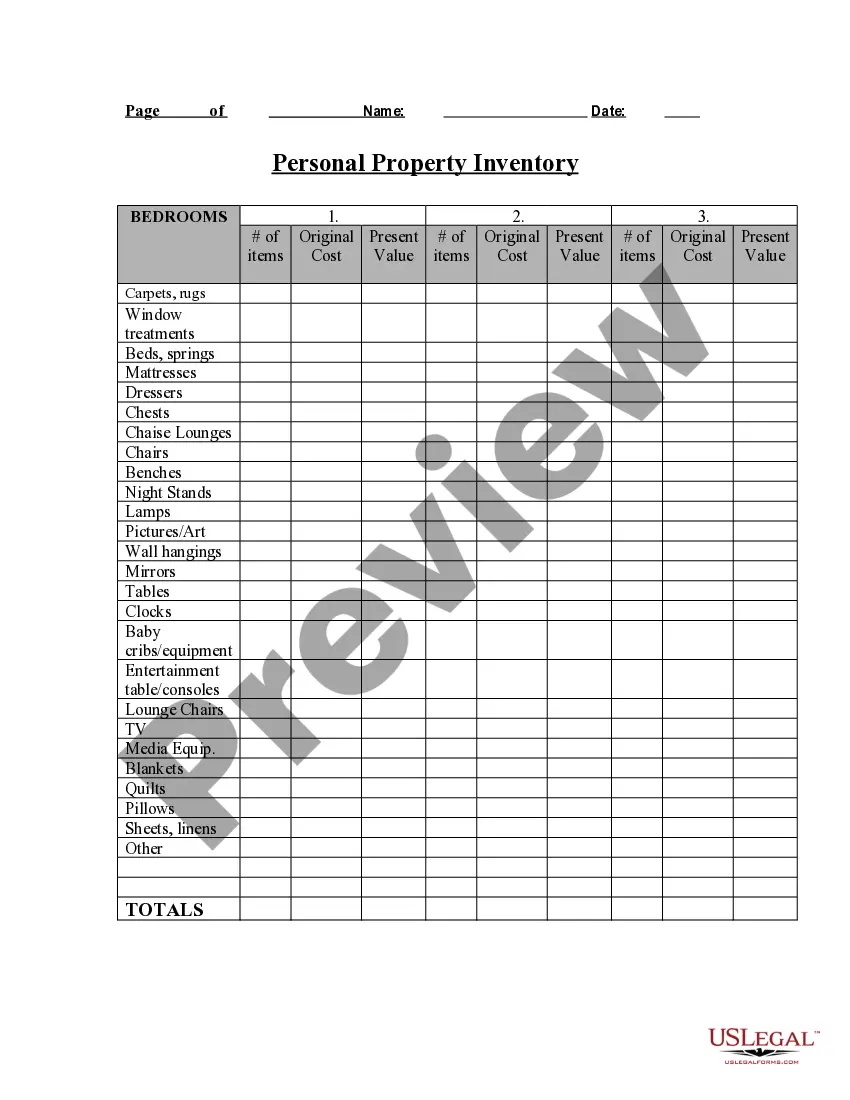

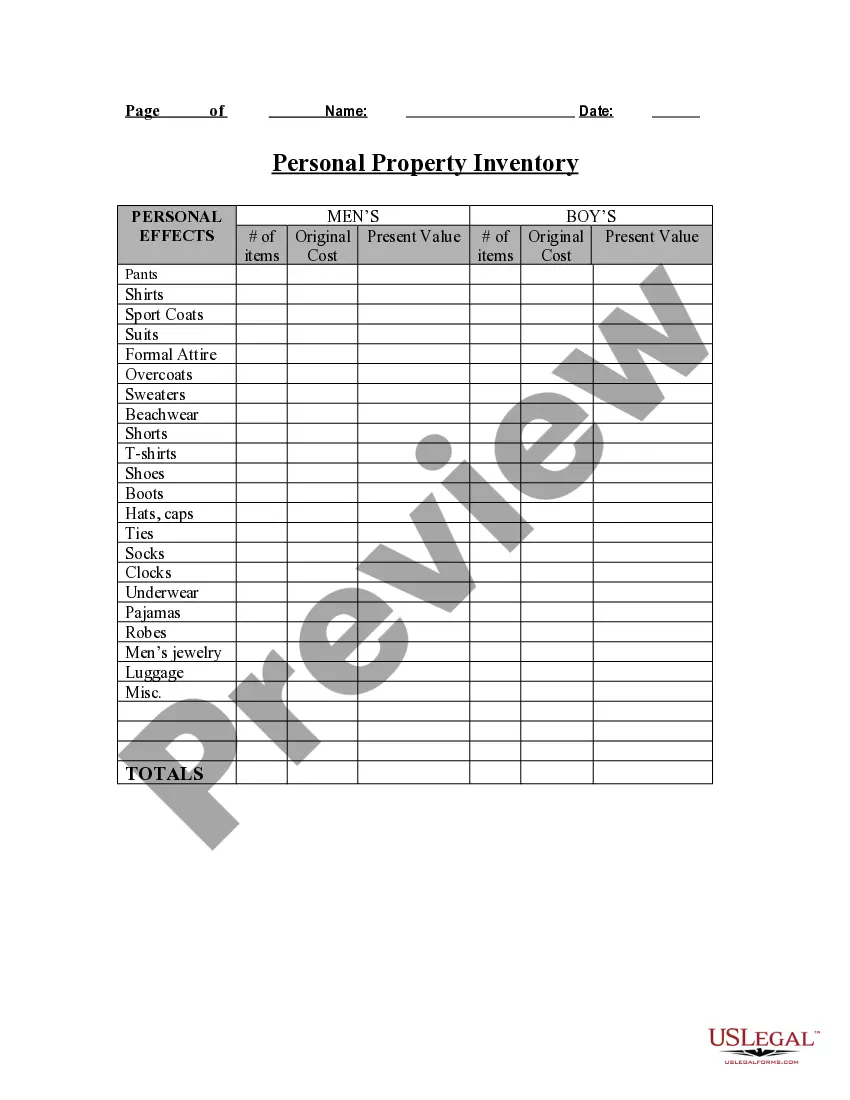

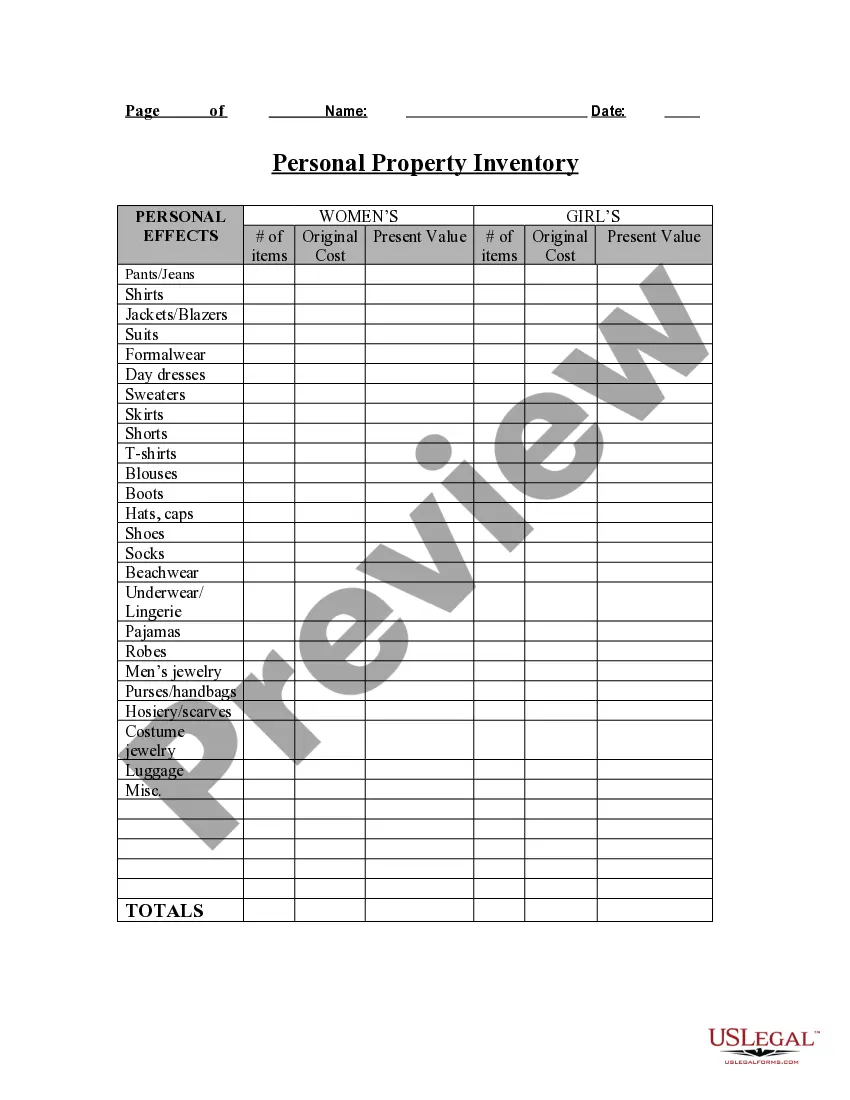

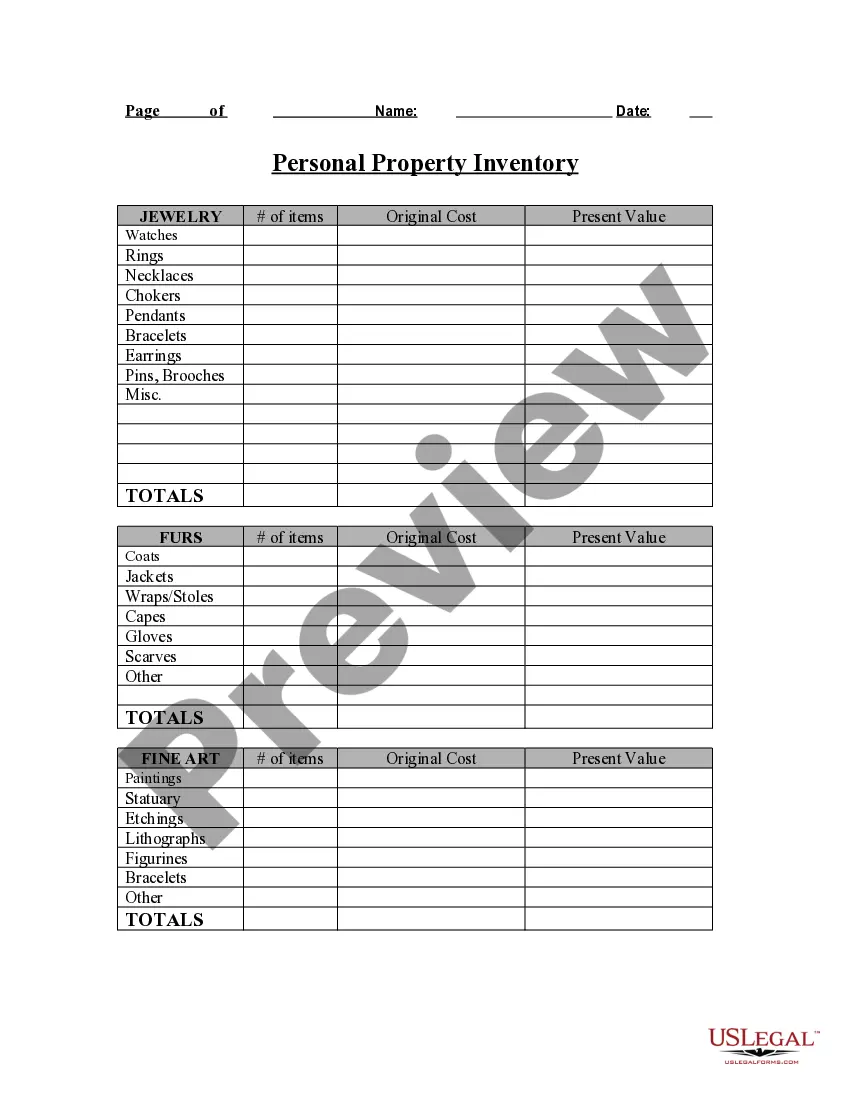

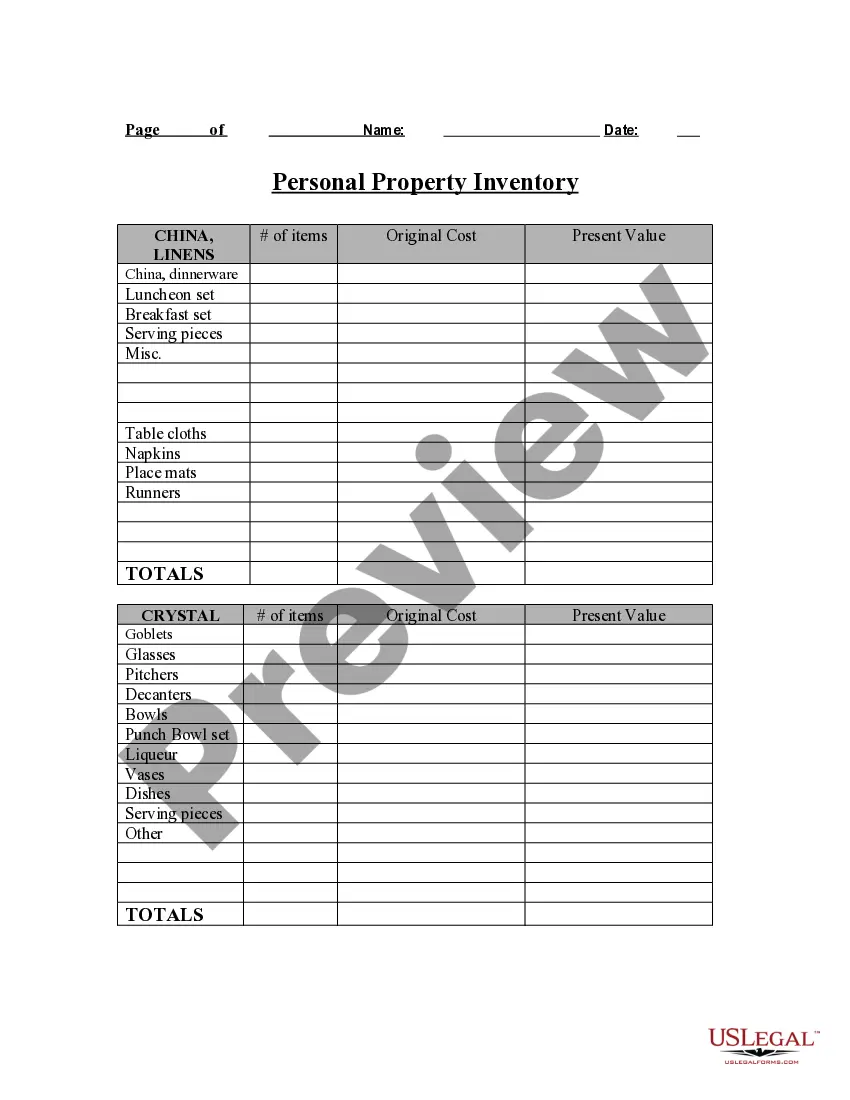

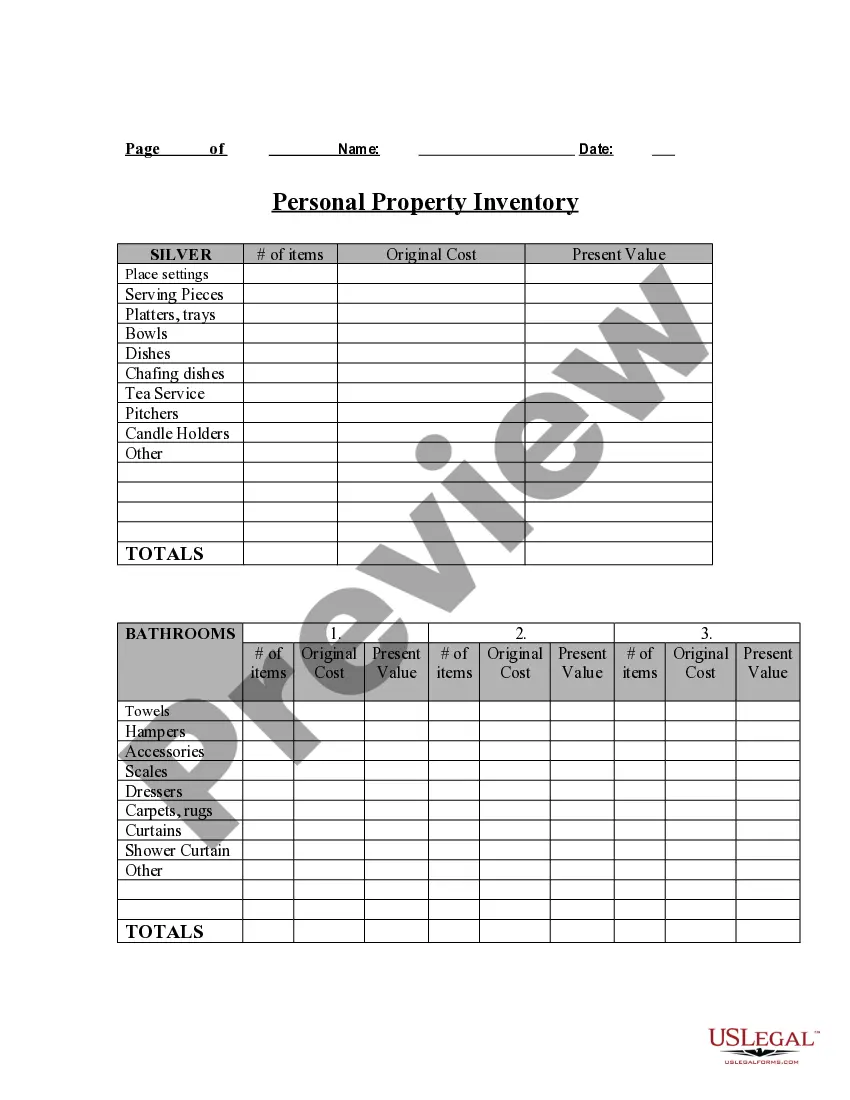

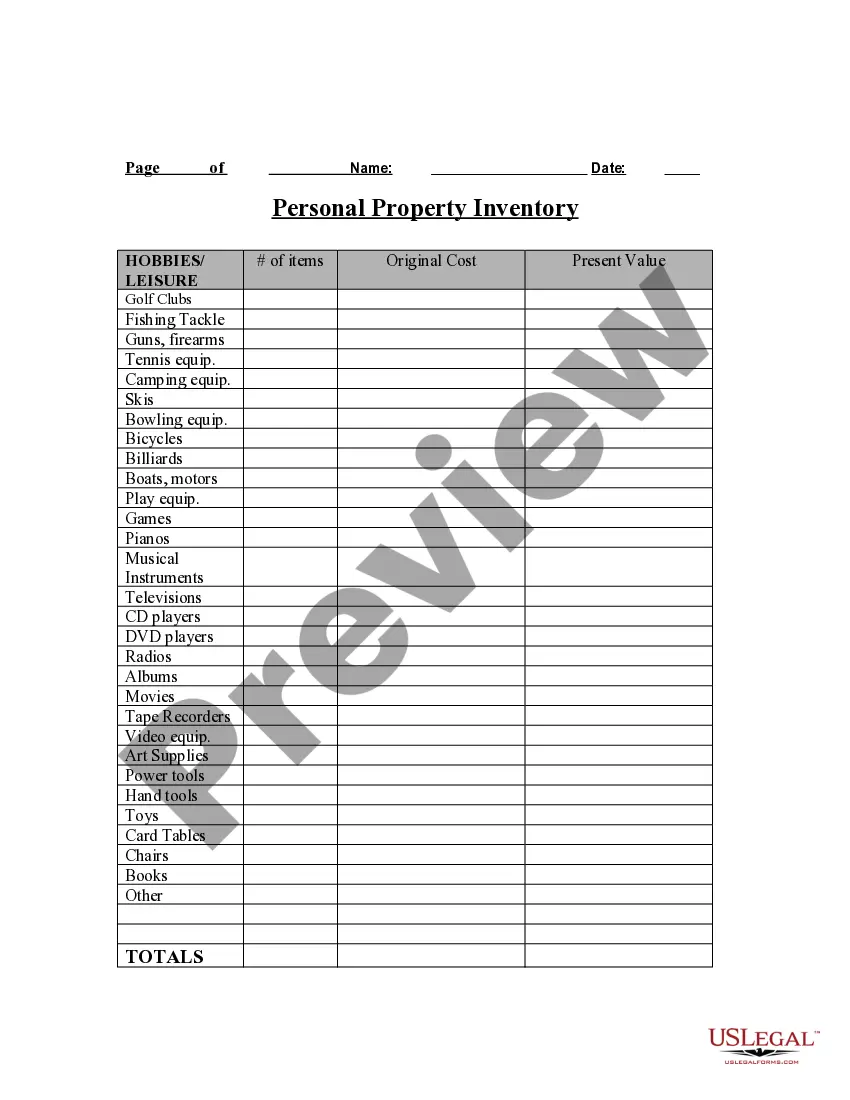

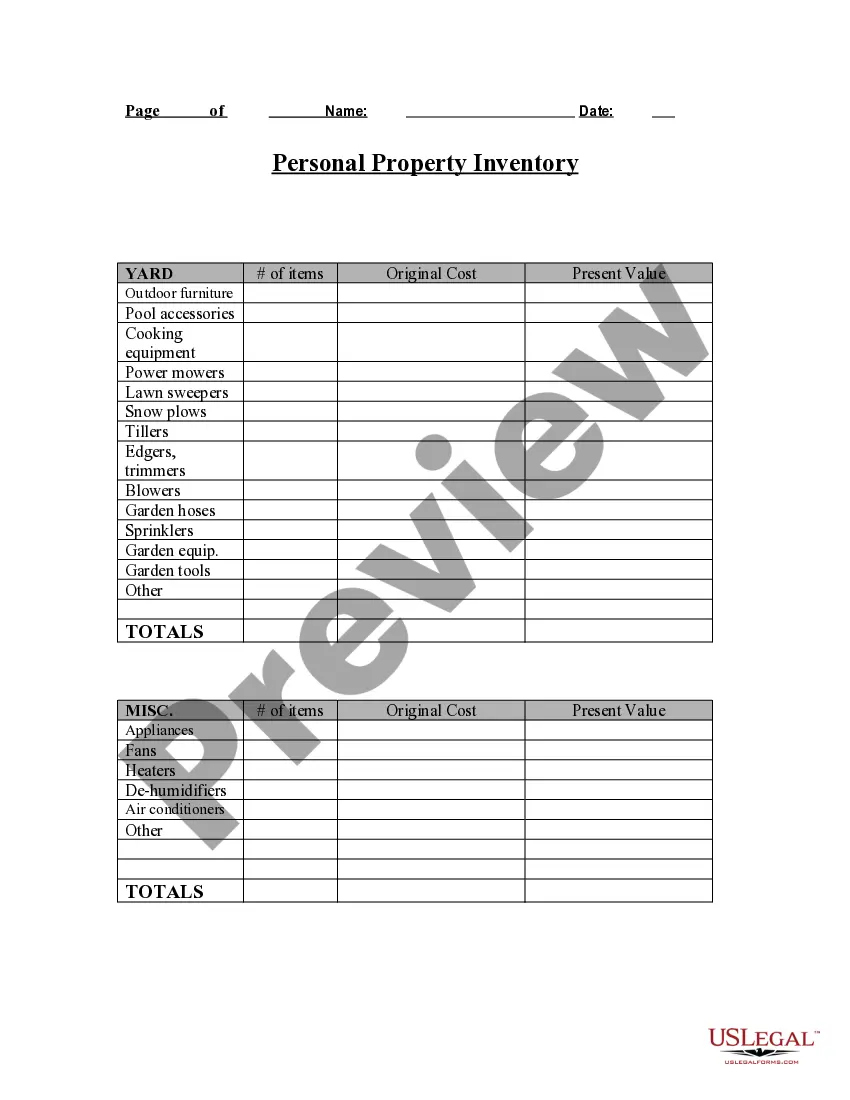

This form addresses important considerations that may effect the legal rights and obligations of the parties in a property-related matter, such as insurance and estate planning. This questionnaire enables those seeking legal help to effectively identify and value their personal property in an organized manner. Thorough advance preparation enhances the attorney’s case evaluation and can significantly reduce costs associated with case preparation.

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client’s needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.