Nevada Payroll Deduction Authorization Form for Optional Matters - Employee

Description

How to fill out Payroll Deduction Authorization Form For Optional Matters - Employee?

Have you ever been in a situation where you require documents for business or personal purposes almost daily.

There are numerous legal document templates accessible online, but finding reliable ones isn’t easy.

US Legal Forms provides thousands of template options, including the Nevada Payroll Deduction Authorization Form for Optional Matters - Employee, which are designed to meet federal and state requirements.

Once you find the correct form, click on Buy now.

Select the pricing plan you want, provide the necessary information to create your account, and complete your purchase using PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Nevada Payroll Deduction Authorization Form for Optional Matters - Employee template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct jurisdiction.

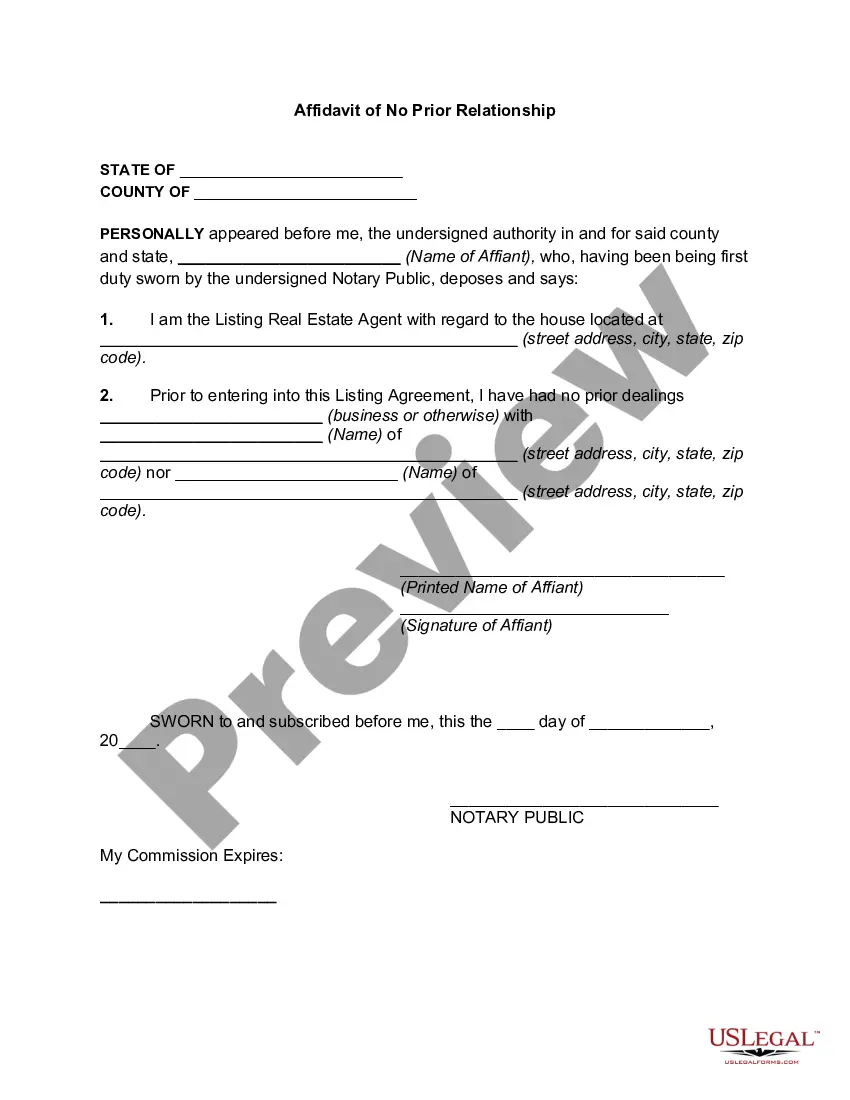

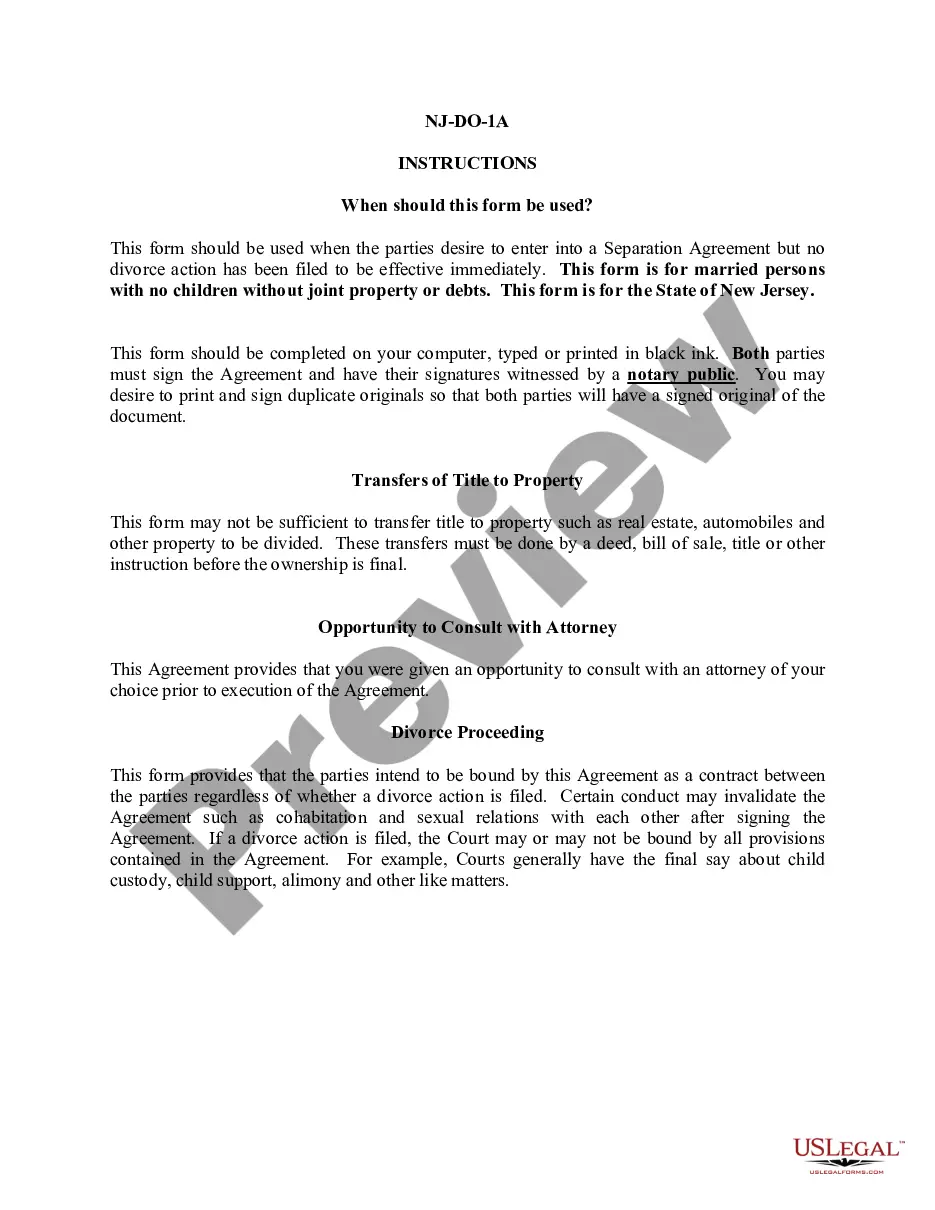

- Utilize the Review option to examine the form.

- Check the description to ensure you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

To contact Nevada MBT, you can reach them through their official website or call their customer support line for direct assistance. They provide resources and answers concerning payroll deduction inquiries, including the Nevada Payroll Deduction Authorization Form for Optional Matters - Employee. If you have specific questions about your deductions or need help, reaching out to them is a wise step.

Payroll deduction authorization is the formal consent given by an employee to allow specific amounts to be deducted from their paycheck. This authorization can apply to various deductions, such as health insurance or retirement contributions. Completing the Nevada Payroll Deduction Authorization Form for Optional Matters - Employee is crucial for ensuring that the deductions align with your personal and financial goals.

Payroll deduction refers to the process of deducting a specific amount from an employee's paycheck for various purposes, such as taxes or benefits. This system simplifies payments for both employees and employers. By utilizing the Nevada Payroll Deduction Authorization Form for Optional Matters - Employee, you can manage and select optional deductions that best fit your financial needs.

Yes, Nevada requires its employees to complete a state withholding form for tax purposes. However, the Nevada Payroll Deduction Authorization Form for Optional Matters - Employee pertains specifically to optional deductions, such as benefits or other withholdings. Be sure to have both forms completed to ensure compliance with state and company regulations.

A payroll deduction agreement is a formal document that outlines the specific deductions from an employee's paycheck. This agreement typically details the amount and purpose of each deduction, allowing for clarity and mutual understanding. When signing the Nevada Payroll Deduction Authorization Form for Optional Matters - Employee, you are essentially entering into this agreement, ensuring your choices are correctly reflected in your paycheck.

Payroll deductions are not universally mandatory; they often depend on your employment agreement and company policy. However, when it comes to specific deductions such as taxes, these are normally required. If you're looking at the Nevada Payroll Deduction Authorization Form for Optional Matters - Employee, it allows employees to choose what deductions they want to authorize.

An example of an optional payroll deduction is contributions to a 401(k) retirement savings plan. Employees can choose how much they would like to contribute, allowing them to save for the future. To authorize this deduction, employees must fill out the Nevada Payroll Deduction Authorization Form for Optional Matters - Employee, making the process straightforward and compliant.

An optional deduction is a type of deduction that an employee can choose to participate in based on personal preference. These deductions might include contributions to retirement funds, insurance premiums, or charitable donations. The Nevada Payroll Deduction Authorization Form for Optional Matters - Employee allows you to specify which optional deductions you want to authorize and for how much.

Yes, employees can opt out of certain payroll deductions if they do not wish to participate. However, opting out may affect the benefits they would receive, such as not contributing to a retirement plan or losing health insurance coverage. To officially opt out, employees should consult their employer and complete the necessary forms, which might involve adjusting the Nevada Payroll Deduction Authorization Form for Optional Matters - Employee.

A payroll deduction authorization form is a document that employees complete to authorize their employer to deduct specific amounts from their paychecks. This form includes details about what the deductions are for, such as health benefits or retirement contributions. In Nevada, using the Nevada Payroll Deduction Authorization Form for Optional Matters - Employee is essential for ensuring that the process is formal and complies with state regulations.