Nevada Payroll Deduction Authorization Form

Description

How to fill out Payroll Deduction Authorization Form?

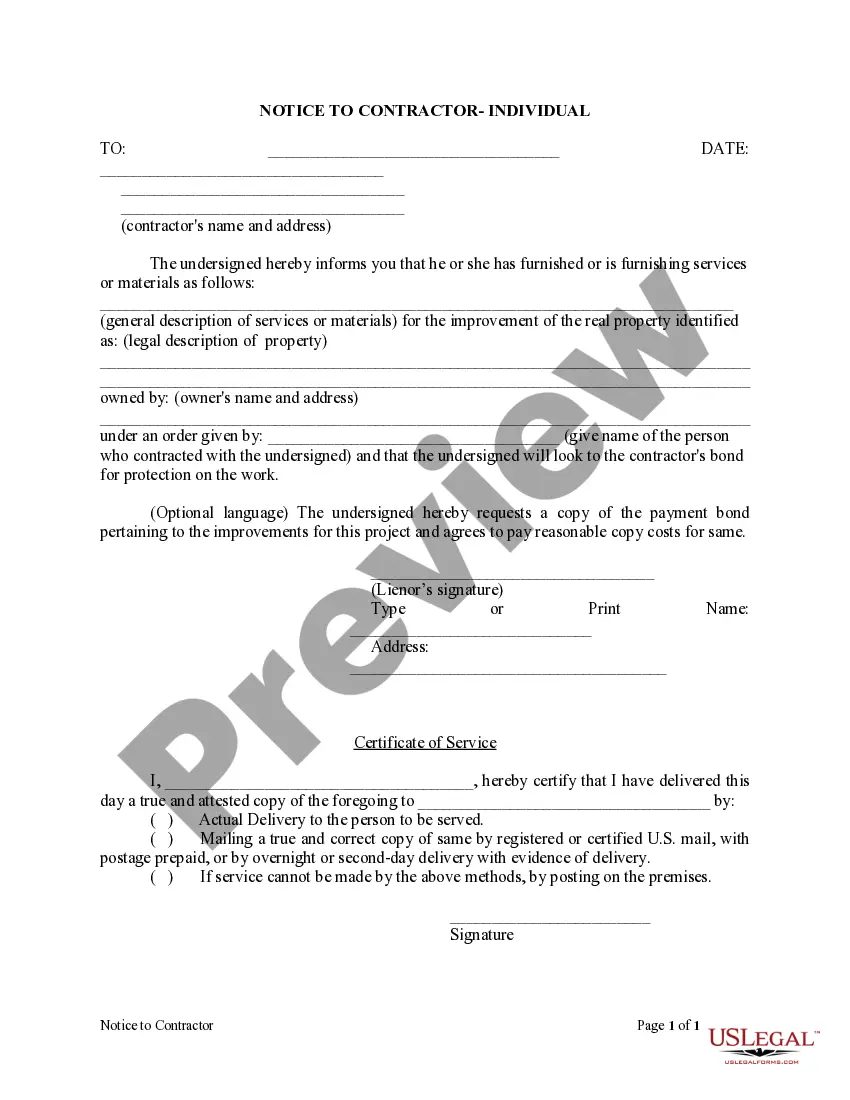

If you require to complete, download, or print legitimate document templates, utilize US Legal Forms, the largest compilation of legal forms that are accessible online.

Employ the site’s straightforward and convenient search to locate the documents you need.

Various templates for business and personal purposes are categorized by types and regions, or keywords.

Step 3. If you are dissatisfied with the form, leverage the Search box at the top of the screen to find alternative versions of the legal form template.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing option you prefer and enter your details to register for an account.

- Utilize US Legal Forms to locate the Nevada Payroll Deduction Authorization Form with just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to obtain the Nevada Payroll Deduction Authorization Form.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Confirm that you have selected the form for your appropriate state/country.

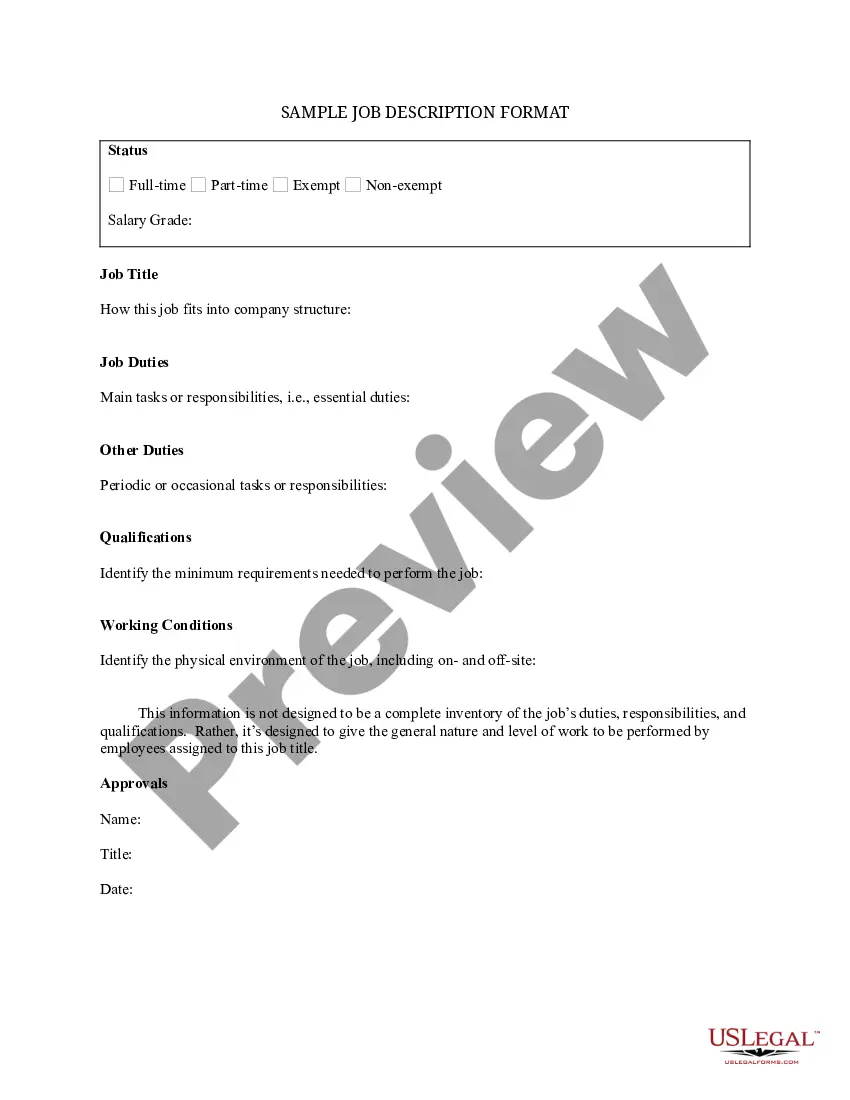

- Step 2. Utilize the Review option to inspect the form’s content. Be sure to read the description.

Form popularity

FAQ

Authorized deductions are limited to: deductions which the employer is required to withhold by law or court order; deductions for the reasonable cost of board, lodging, and facilities furnished to the employee; and.

This final paycheck should include all the wages and any other compensation that the employee has earned since the most recent paycheck. The employer may withhold a portion of the wages only for tax purposes and/or for reasons the employee agreed to (such as a corporate savings plan).

Allowable Paycheck DeductionsPersonal loans (cash advances, 401(k) or retirement loan payment, bail or bond payments, etc.)Personal purchases of a business's goods or services such as: Food purchases from the cafeteria.Employee's health, dental, vision, and other insurance payments or co-payments.

The amount the employer withholds from an employee's gross pay for taxes, wage garnishment and company benefits are called payroll deductions. Some examples include 401(k) contributions, Medicare and Social Security tax, income tax and health insurance premiums.

Some of the types of deductions which are authorized under federal and state law include: meals, housing and transportation, debts owed the employer, debts owed to third parties (through the process of garnishment); debts owed to the government (such as back taxes and federally-subsidized student loans), child support

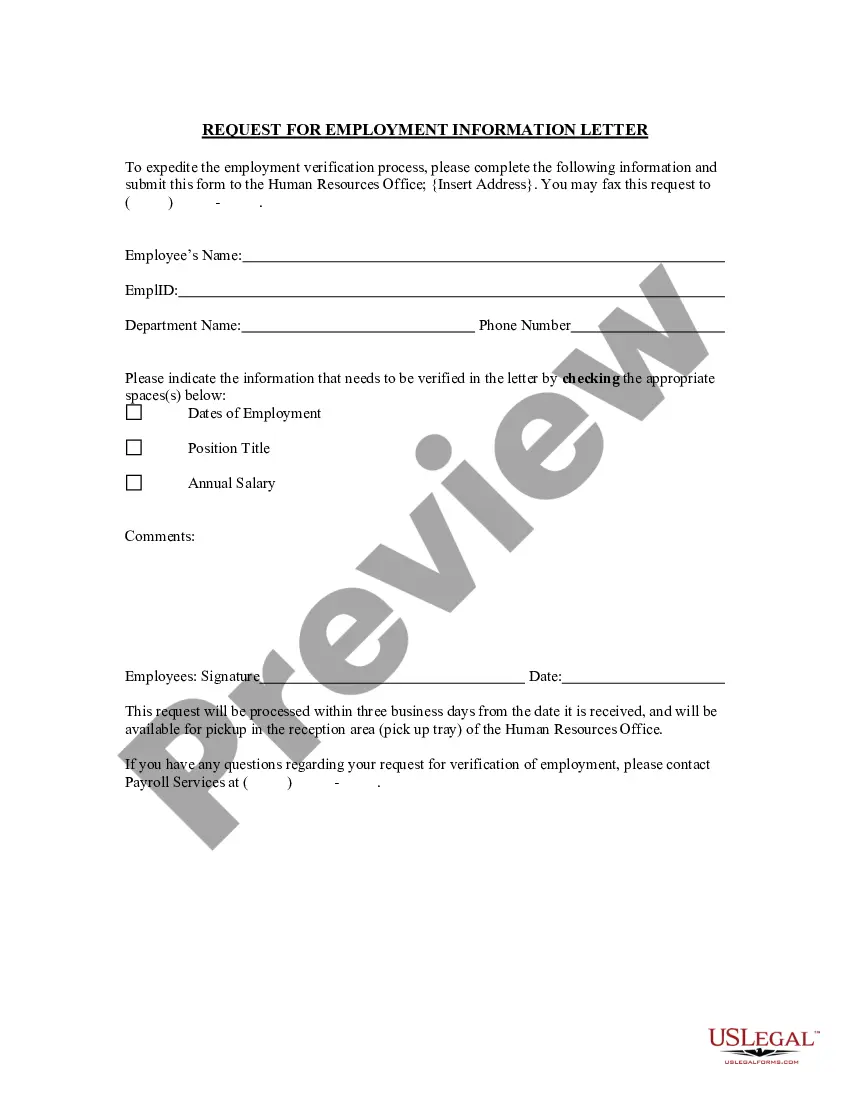

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

What are payroll deductions?Income tax.Social security tax.401(k) contributions.Wage garnishments.Child support payments.

Mandatory Payroll Tax DeductionsFederal income tax withholding.Social Security & Medicare taxes also known as FICA taxes.State income tax withholding.Local tax withholdings such as city or county taxes, state disability or unemployment insurance.Court ordered child support payments.

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

Withholding Taxes For every payroll period, employers must withhold (i.e. deduct) taxes from the payroll of their employees. Withholding tax is a mandatory tax on the gross value of an employee's salary. Gross means the value before any payroll deductions have been made.