Nevada Notice to Debt Collector - Posing Lengthy Series of Questions or Comments

Description

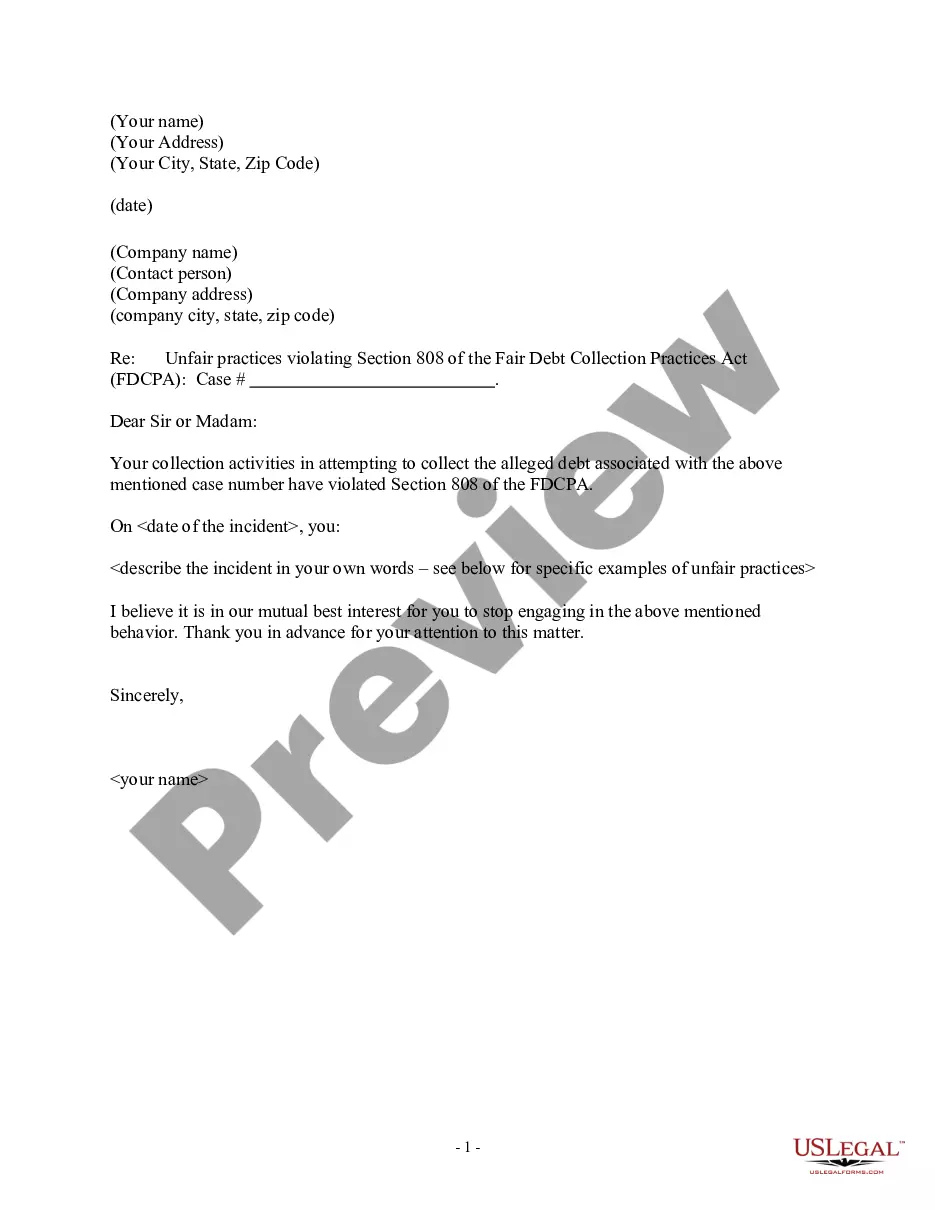

Section 806 of the Fair Debt Collection Practices Act says a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes posing a lengthy series of questions or comments to the consumer without giving the consumer a chance to reply.

How to fill out Notice To Debt Collector - Posing Lengthy Series Of Questions Or Comments?

If you wish to complete, obtain, or print sanctioned document templates, utilize US Legal Forms, the premier collection of legal documents available online.

Take advantage of the site's user-friendly and convenient search to find the documents you need.

A wide range of templates for business and personal use are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Step 4. Once you have found the form you need, click the Get now button. Choose the payment plan you prefer and enter your credentials to register for an account.

- Use US Legal Forms to acquire the Nevada Notice to Debt Collector - Posing Lengthy Series of Questions or Comments with just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to retrieve the Nevada Notice to Debt Collector - Posing Lengthy Series of Questions or Comments.

- You can also access documents you previously obtained from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the contents of the form. Don't forget to read the description.

Form popularity

FAQ

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

The FDCPA forbids harassing, oppressive, and abusive conductno matter what kind of communication media the debt collector uses. So, this prohibition applies to in-person interactions, telephone calls, audio recordings, paper documents, mail, email, text messages, social media, and other electronic media.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

If you choose not to speak with a debt collector over the phone or in writing about a debt, collection activity can still take place. You continue to run the risk of fees and finance charges, as well as being sued or the debt being reported as delinquent to the credit reporting companies.

Top 7 Debt Collector Scare TacticsExcessive Amount of Calls.Threatening Wage Garnishment.Stating You Have a Deadline.Collecting Old Debts.Pushing You to Pay Your Debt to Improve Your Credit ScoreStating They Do Not Need to Prove Your Debt ExistsSharing Your Debt With Family and Friends.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

Debt collectors have a reputationin some cases a well-deserved onefor being obnoxious, rude, and even scary while trying to get borrowers to pay up. The federal Fair Debt Collection Practices Act (FDCPA) was enacted to curb these annoying and abusive behaviors, but some debt collectors flout the law.

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L. Kraninger, took effect Tuesday, Nov.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

You only need to say a few things:This is not a good time. Please call back at 6.I don't believe I owe this debt. Can you send information on it?I prefer to pay the original creditor. Give me your address so I can send you a cease and desist letter.My employer does not allow me to take these calls at work.