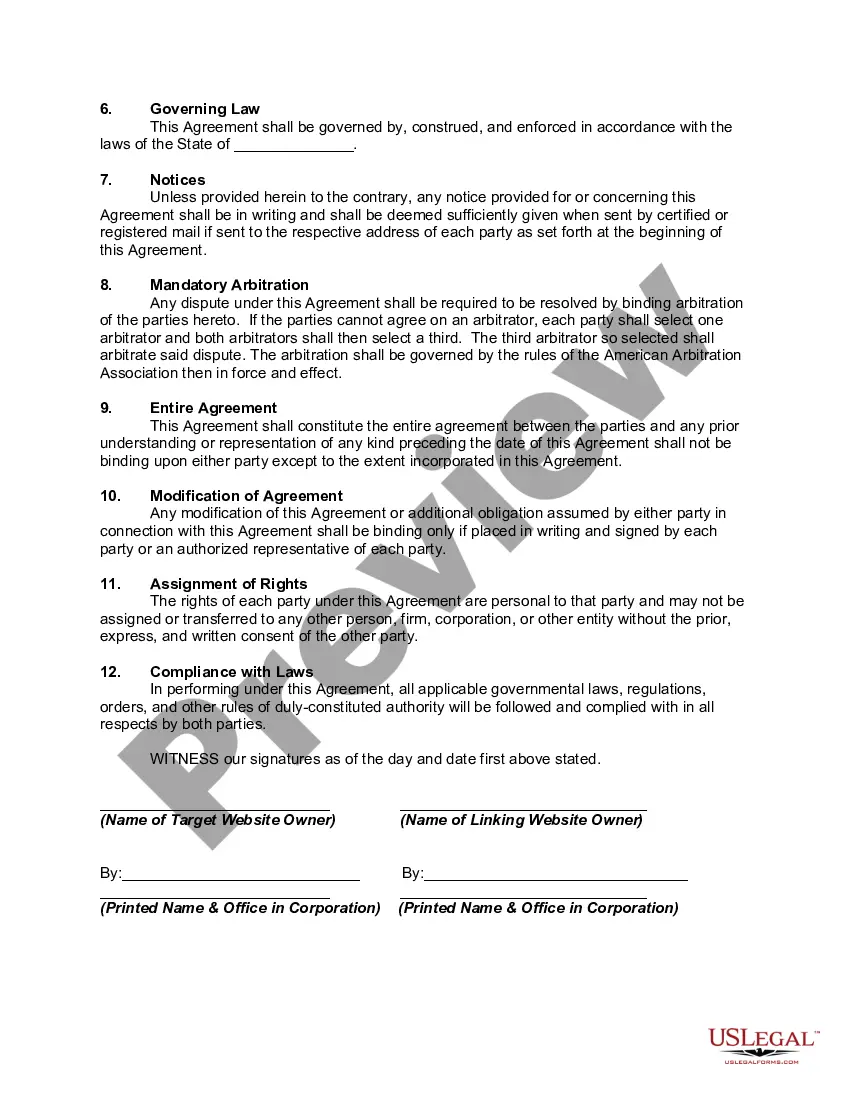

Nevada Free Linking Agreement

Description

How to fill out Free Linking Agreement?

If you wish to finalize, obtain, or print sanctioned documents templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Take advantage of the website's straightforward and convenient search to find the documents you require.

Various templates for business and personal purposes are categorized by groups and states, or keywords.

Every legal document template you obtain is yours permanently. You will have access to every form you downloaded within your account.

Navigate to the My documents section and select a document to print or download again. Compete and obtain, and print the Nevada Free Linking Agreement with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to locate the Nevada Free Linking Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Nevada Free Linking Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for your specific city/state.

- Step 2. Use the Review option to check the form's details. Remember to read through the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Nevada Free Linking Agreement.

Form popularity

FAQ

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

It costs $425 to form an LLC in Nevada. Filing the Articles of Organization costs $75. The state business license costs $200, and the list of managers and members costs $150. Your LLC is not official and open for business until you complete the filings and pay the required fees.

In the state of Nevada, there is no legal obligation to draft/create an operating agreement. While not a requirement, an operating agreement serves as documentation outlining the relationship between the officials of the LLC and the business itself.

How long does it take to form an LLC in Nevada? Filing the Articles of Organization can take about two business days online or up to two weeks by mail.

Advantages to Forming an LLC in Nevada Nevada offers a wide range of benefits as a state of incorporation, including its ease of registration, relatively low corporate taxes and lack of state taxes. Nevada also offers strong privacy protections to business owners and a business-friendly environment.

Are Operating Agreements Legally Required in Nevada? No, Operating Agreements are not legally required in Nevada. According to the Nevada Revised Statutes (NRS) 86.286 Operating Agreement clause, A limited-liability company may, but is not required to, adopt an operating agreement.

Advantages to Forming an LLC in NevadaNo state income, corporate or franchise taxes.No taxes on corporate shares or profits.Privacy protection for owners choosing to be anonymous.No operating agreements or annual meetings requirements.Low business registration fees and quick turnarounds.More items...?19-Mar-2020

How much does it cost to form an LLC in Nevada? The Nevada Secretary of State charges $75 to file the Articles of Organization. You can reserve your LLC name with the Nevada Secretary of State for $25.

Depending on how fast the state processes business filings, it can generally take between a week to ten business days. In some states, once your intake information is received, the state agency often issues approval for the limited liability company within only three business days.