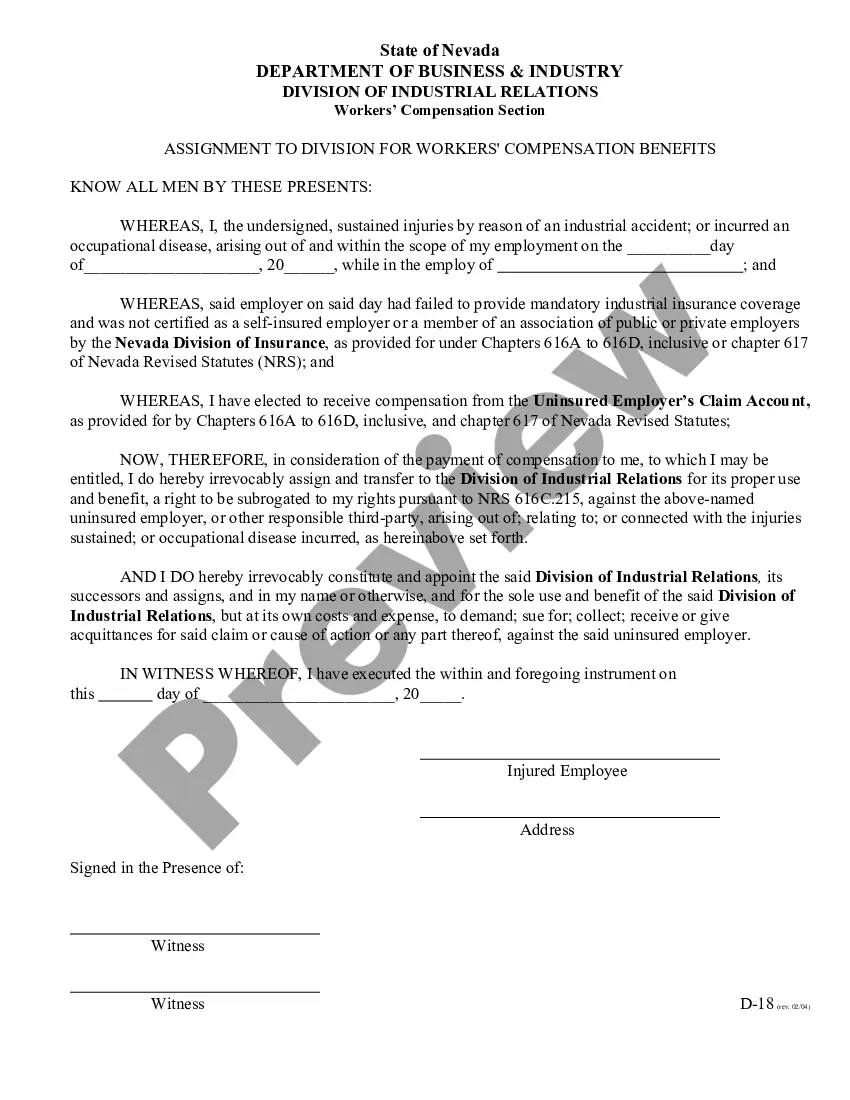

Nevada Assignment to Division for Workers Compensation Benefits is a legal process that assigns a workers' compensation claim to the Nevada Division of Industrial Relations for processing. The process is initiated when an injured worker files a claim for benefits with the Division. The Division then reviews the claim and determines whether it meets the requirements for benefits. If it does, the Division assigns a claim number to the injured worker and assigns the claim to an insurance carrier for processing. The insurance carrier is responsible for processing the claim and providing the injured worker with compensation for medical expenses, lost wages, and other costs associated with the injury. There are two types of Nevada Assignment To Division For Workers Compensation Benefits: 1. Traditional Assignment: This is the most common type of assignment and involves the Division assigning a claim to an insurance carrier for processing. 2. Alternative Assignment: This type of assignment is used when an insurance carrier is unable or unwilling to process the claim. In this case, the Division will assign the claim to the Nevada Self-Insured Employers' Fund for processing.

Nevada Assignment To Division For Workers Compensation Benefits

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Nevada Assignment To Division For Workers Compensation Benefits?

Preparing official paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them correspond with federal and state regulations and are examined by our specialists. So if you need to prepare Nevada Assignment To Division For Workers Compensation Benefits, our service is the best place to download it.

Obtaining your Nevada Assignment To Division For Workers Compensation Benefits from our library is as easy as ABC. Previously registered users with a valid subscription need only log in and click the Download button once they find the correct template. Later, if they need to, users can get the same blank from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few moments. Here’s a brief instruction for you:

- Document compliance check. You should attentively review the content of the form you want and ensure whether it suits your needs and complies with your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab above until you find a suitable template, and click Buy Now once you see the one you want.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Nevada Assignment To Division For Workers Compensation Benefits and click Download to save it on your device. Print it to complete your paperwork manually, or use a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to obtain any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

What is the Statute of Limitations on Personal Injury Claims in Nevada? Under Nevada law for most areas of practice, you have two years after the date of your accident to file a personal injury claim against the liable party.

What is ?exclusive remedy?? Exclusive remedy means that an injured employee, generally, cannot sue an employer, for work- related injuries if the employer has purchased workers' compensation insurance as required by Nevada law.

Nevada Workers' Compensation Exemptions Employment covered by private disability and death benefit plans. Casual employment that lasts no more than 20 days and has a total labor cost under $500 (casual employment means a worker only gets hired for work that's needed)

Employer must complete and file with the insurer within 6 working days of receipt of the C-4 (if the C-4 indicates the injured employee will be off work for 5 consecutive days or more or 5 days in a 20 day period) or when requested by the insurer. Insurer/TPA should supply forms.

Filing A Workers' Compensation Claim The C-4 form is titled ?Employee's Claim for Compensation/Report of Initial Treatment?. The physician fills out their part of the form, and sends a copy to your employer and the insurer. Be sure to get a copy for your records.

6 Injured Employee's Request for Compensation (7/99) 7 Explanation of Wage Calculation (7/99) 8 Employer's Wage Verification Form (10/10)

Will I be Fired if My Injury Prevents Me from Working? An employer is required to maintain an employee's job while his or her workers' compensation claim is pending, for the duration of an employee's recovery, or until the employee has reached maximum medical improvement (MMI).

Under Nevada law, you must report your injury within seven days. To make a claim, you will need to have a doctor sign off on your initial treatment. This will require a specific form. You must complete this form and have it signed and turned in within 90 days of your injury to make a workers' comp claim.