Nevada Default is the process by which a debtor, typically a resident of Nevada, fails to meet their financial obligations. This can include not paying debts on time, not making payments on loans or not meeting other financial obligations. Nevada Default can be divided into two categories: voluntary and involuntary. Voluntary Nevada Default occurs when the debtor willfully fails to make payments on their debt. Involuntary Nevada Default occurs when the creditor takes action to recover the money owed, such as filing a lawsuit or obtaining a judgment. In either case, the debtor's credit score can be significantly impacted. Once an individual has entered Nevada Default, the only way to recover financially is to either pay off the debt in full or negotiate a repayment plan with the creditor.

Nevada Default

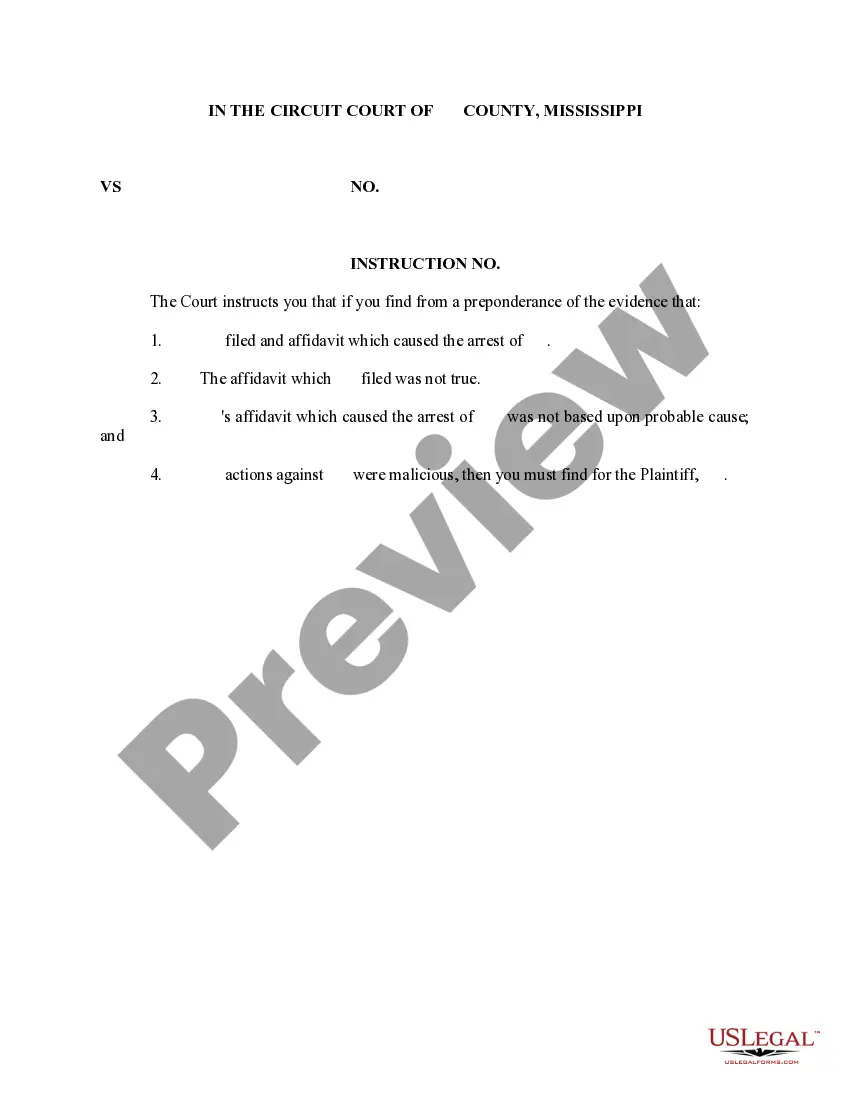

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Nevada Default?

If you’re searching for a way to appropriately complete the Nevada Default without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every individual and business situation. Every piece of documentation you find on our online service is designed in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Adhere to these simple instructions on how to obtain the ready-to-use Nevada Default:

- Ensure the document you see on the page corresponds with your legal situation and state laws by checking its text description or looking through the Preview mode.

- Enter the form title in the Search tab on the top of the page and choose your state from the dropdown to find an alternative template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your Nevada Default and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it rapidly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

A participant meets the Rule of 60 if his or her age plus full years of service equal at least 60 and he or she either: (i) is at least age 50 with at least five full years of service; or (ii) is under age 50 with at least 20 full years of service.

(B) The court must dismiss an action for want of prosecution if a plaintiff fails to bring the action to trial within 5 years after the action was filed.

Rule 55 - Default; Default Judgment (a)Entering a Default. When a party against whom a judgment for affirmative relief is sought has failed to plead or otherwise defend, and that failure is shown by affidavit or otherwise, the clerk must enter the party's default.

(B) The court must dismiss an action for want of prosecution if a plaintiff fails to bring the action to trial within 5 years after the action was filed.

Rule 60(b)(2) allows for relief from a final judgment based on newly discovered evidence that could not have been discovered in time to move for a new trial. Newly discovered evidence is new evidence that could not have, with reasonable diligence, been produced at trial.

Q: What is Rule 60? A: Rule 60 of the Rules of Civil Procedure authorizes a section 2255 movant to ask the court for relief from a judgment. Rule 60 differs from Rule 59 in that Rule 60 may be used after the 28 day timeframe for filing a Rule 59(e) motion has run.

Rule 60 - Relief From a Judgment or Order (a)Corrections Based on Clerical Mistakes; Oversights and Omissions. The court may correct a clerical mistake or a mistake arising from oversight or omission whenever one is found in a judgment, order, or other part of the record.

The Three Day Notice of Intent to Default in Nevada is a necessary notice prior to defaulting any party who has not responded to a lawsuit. At Rise Legal ? Steve Dixon Law, our office has years of experience dealing with default judgments. We have also helped clients with collection issues on both sides of the coin.