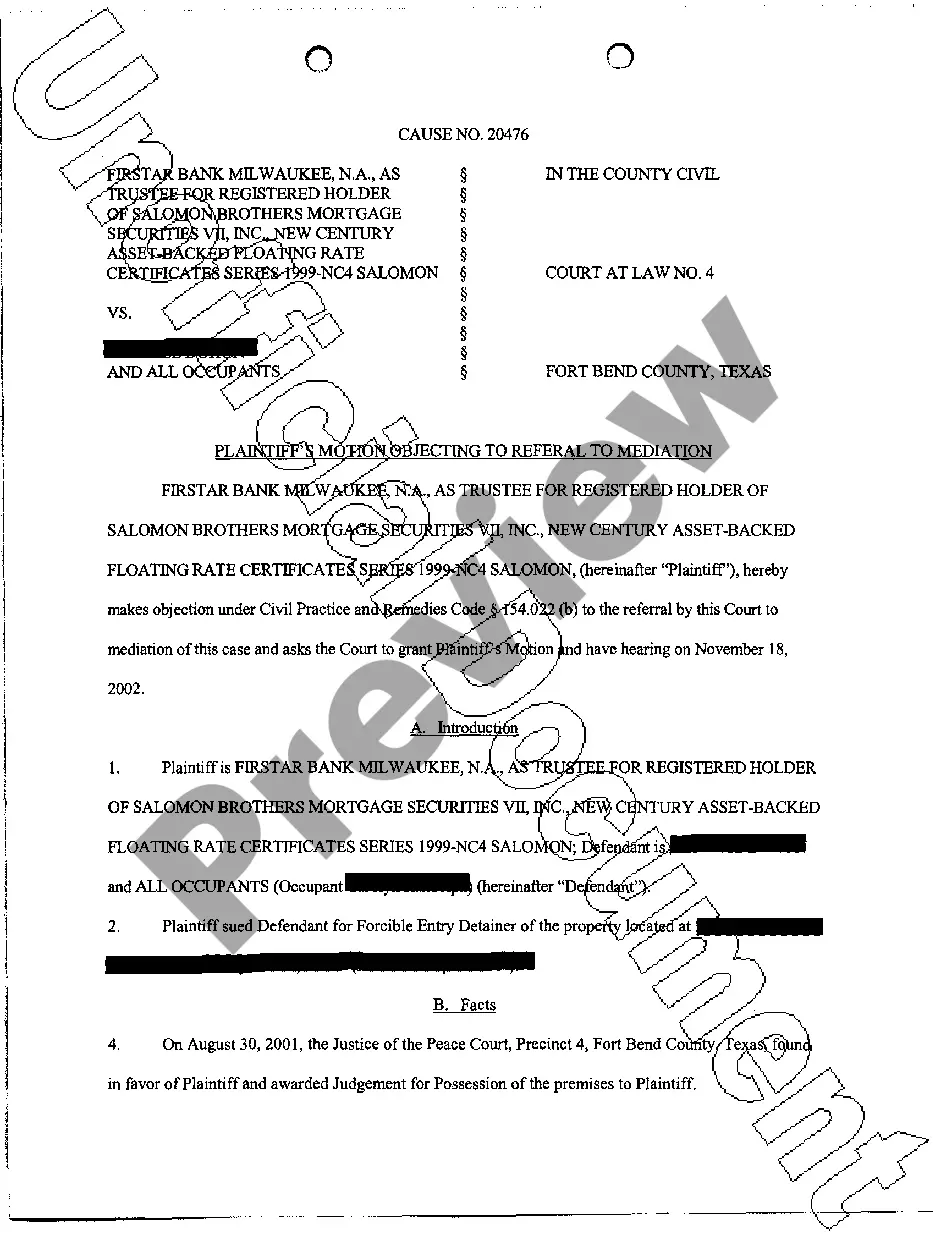

Nevada Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

What this document covers

The Fiduciary Deed is a legal document used by executors, trustees, trustors, administrators, and other fiduciaries to transfer property. This form safeguards the legal rights of the parties involved while ensuring that the property is conveyed accurately. It is distinct from other deeds because it is specifically designed for fiduciaries who are acting on behalf of another party, usually in accordance with a will or trust, and is tailored to the legal requirements of the state of Nevada.

Main sections of this form

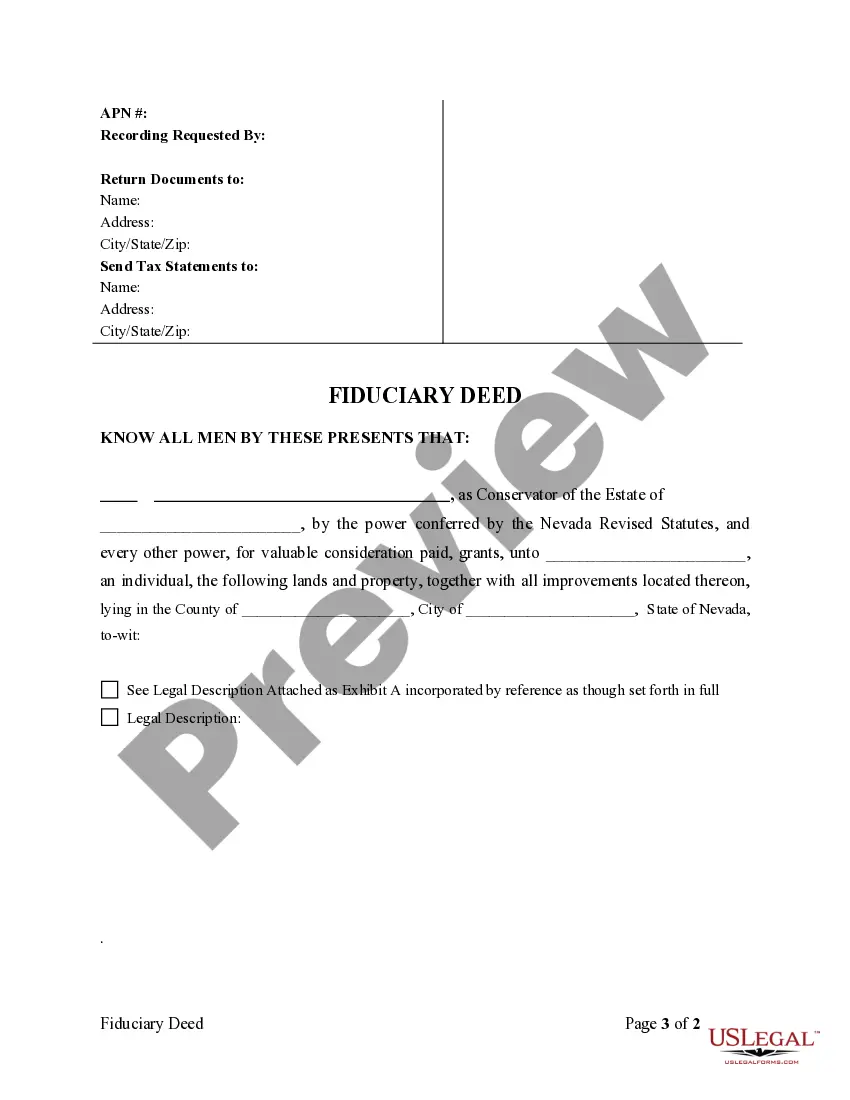

- Identification of the grantor and their capacity (e.g., executor, trustee).

- Legal description of the property being transferred.

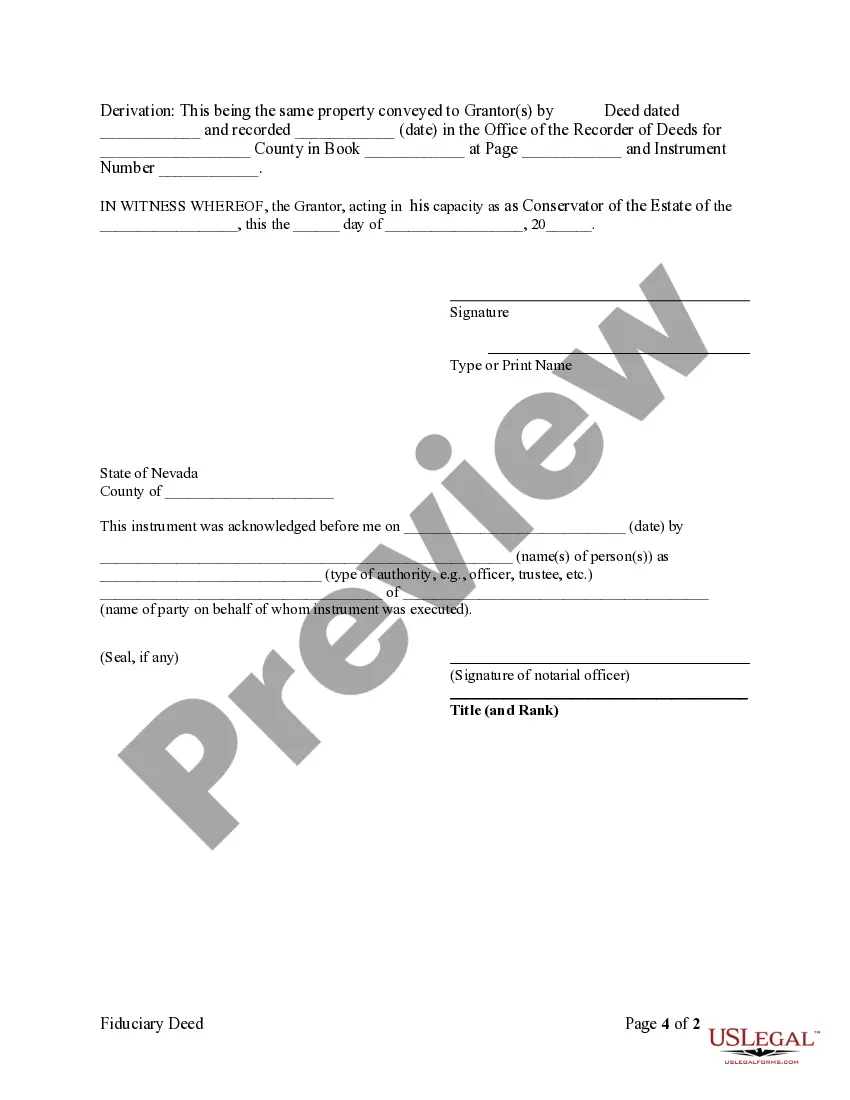

- Signatures of the parties involved to legitimize the transaction.

- Date of execution to establish the timeline of the deed.

- Additional terms or conditions specific to the transaction.

When this form is needed

You should use the Fiduciary Deed when you need to formally transfer property from an estate or trust to a new owner. This is particularly necessary after the passing of an individual where the executor or trustee must fulfill their responsibilities to administer the property. Situations like settling an estate, managing a trust, or transferring guardianship property also require this form to ensure compliance with legal standards.

Intended users of this form

- Executors of a will responsible for managing an estate.

- Trustees managing trust property on behalf of beneficiaries.

- Trustors transferring their property into a trust.

- Administrators appointed by the court to handle an estate.

- Guardians or conservators managing the property of a minor or incapacitated individual.

How to complete this form

- Identify the grantor by filling in their name and capacity (executor, trustee, etc.).

- Provide a full legal description of the property being transferred.

- Enter the date on which the deed is being executed.

- Secure the necessary signatures from all parties involved in the transfer.

- Review the document for accuracy and ensure it meets all legal requirements before submitting or recording it.

Does this form need to be notarized?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to accurately identify the legal description of the property.

- Not including required signatures or having unauthorized individuals sign.

- Neglecting to date the Fiduciary Deed correctly.

- Using outdated or incorrect templates that do not comply with state laws.

Advantages of online completion

- Convenient access to legal forms anytime and anywhere.

- Editable fields for easy completion using a computer.

- Guidance on legal requirements reduces the risk of errors.

- Secure storage of completed forms for future reference.

Looking for another form?

Form popularity

FAQ

Fiduciary - An individual or bank or trust company that acts for the benefit of another. Trustees, executors, and personal representatives are all fiduciaries.

A fiduciary is a person or organization that acts on behalf of another person or persons, putting their clients' interest ahead of their own, with a duty to preserve good faith and trust. Being a fiduciary thus requires being bound both legally and ethically to act in the other's best interests.

It is harder to be impartial when the fiduciary is also a beneficiary. As a beneficiary, the fiduciary usually wants to favor himself. Acting as fiduciary, however, the fiduciary must treat himself no better than any other beneficiary.

A fiduciary is a person who stands in a position of trust with you (or your estate after your death) and your beneficiaries. There are different types of fiduciaries depending on the context: an executor or executrix is named in a will; a trustee is named by a trust; an agent is appointed by a power of attorney.

Fiduciary - An individual or trust company that acts for the benefit of another.Executor - (Also called personal representative; a woman is sometimes called an executrix) An individual or trust company that settles the estate of a testator according to the terms of the will.

Fiduciary - An individual or trust company that acts for the benefit of another.Executor - (Also called personal representative; a woman is sometimes called an executrix) An individual or trust company that settles the estate of a testator according to the terms of the will.

The personal representative and the trustee named in such wills are sometimes the same person. In the case of a revocable trust containing a testamentary trust, the trustee continues on as the trustee of the trust after your affairs are settled and the trusts are funded.

An executor has a fiduciary duty to act in the best interests of the estate and its beneficiaries. They can face legal liability if they fail to meet this duty, such as when they act in their own interests or allow the assets in the estate to decay.

It is harder to be impartial when the fiduciary is also a beneficiary. As a beneficiary, the fiduciary usually wants to favor himself. Acting as fiduciary, however, the fiduciary must treat himself no better than any other beneficiary.