This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

New Mexico Last Will and Testament for a Single Person with Minor Children

Description

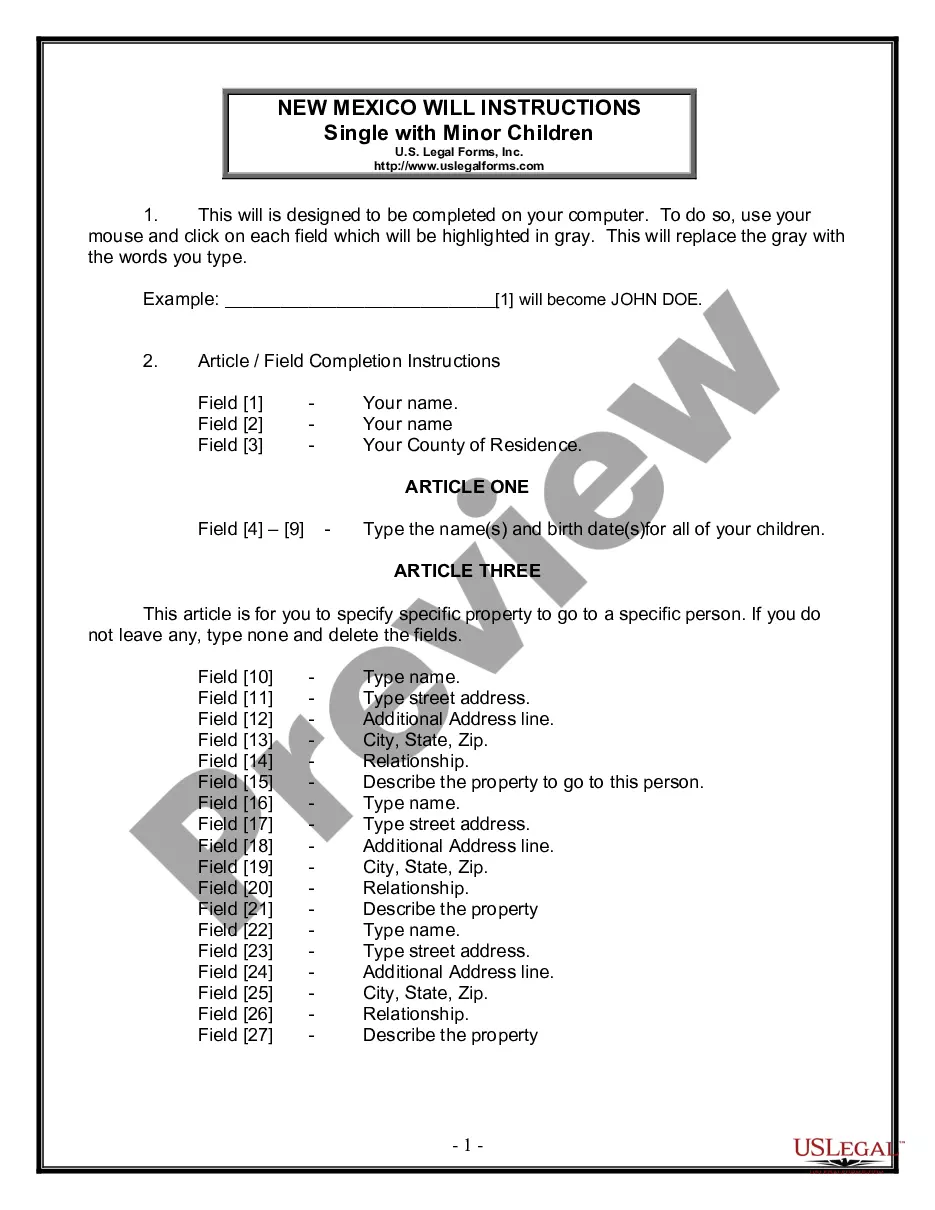

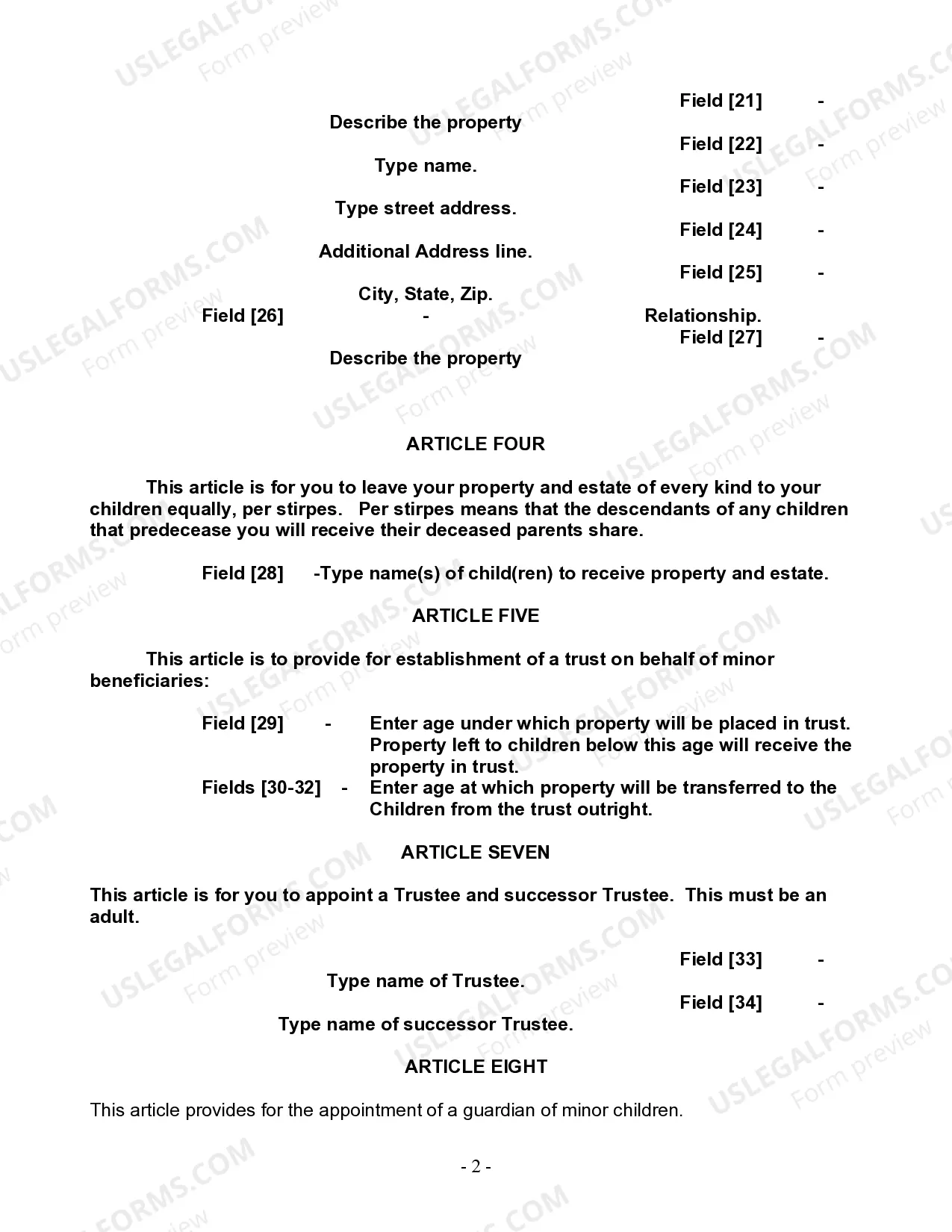

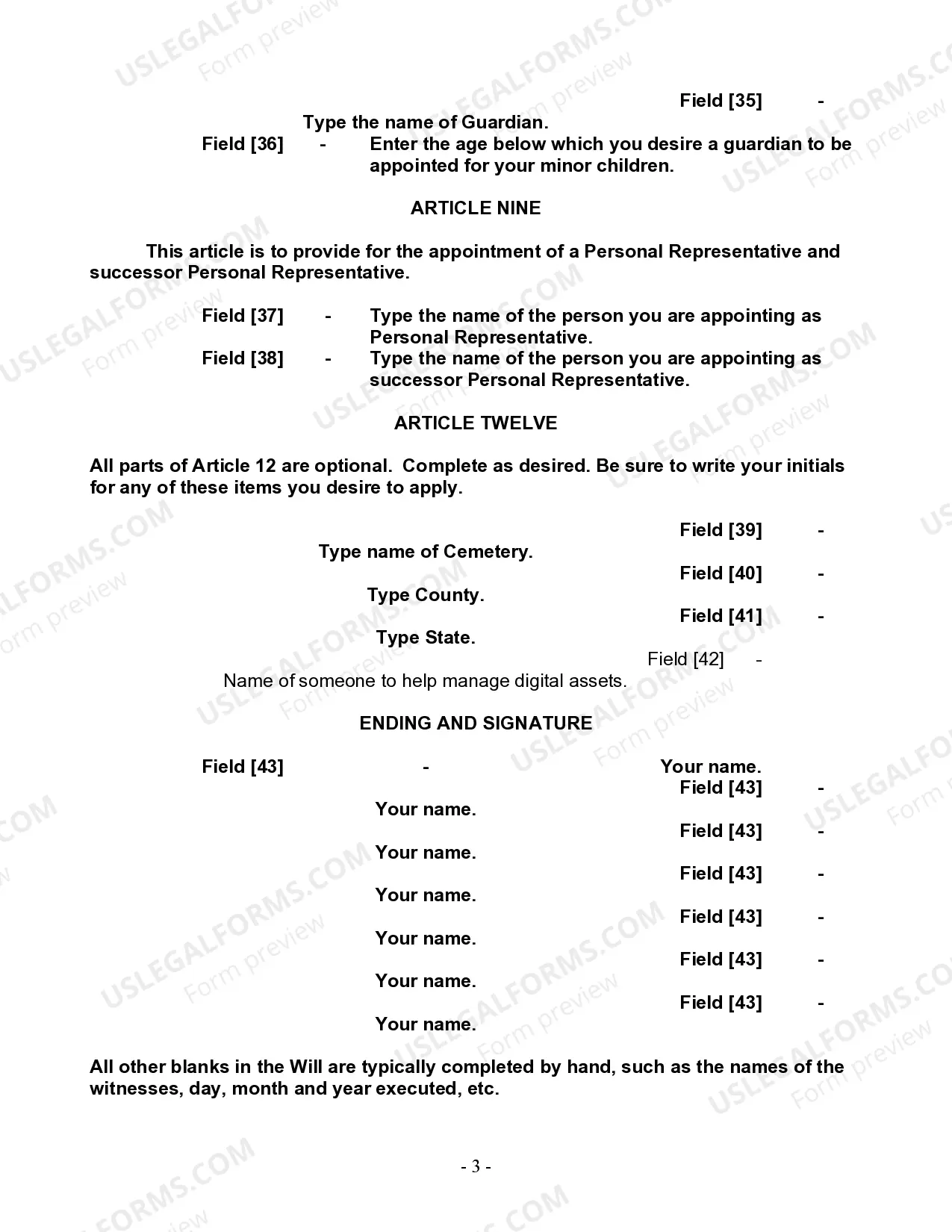

How to fill out New Mexico Last Will And Testament For A Single Person With Minor Children?

US Legal Forms is really a unique platform to find any legal or tax template for filling out, such as New Mexico Legal Last Will and Testament Form for a Single Person with Minor Children. If you’re tired with wasting time searching for perfect samples and spending money on papers preparation/legal professional fees, then US Legal Forms is precisely what you’re trying to find.

To enjoy all the service’s advantages, you don't need to install any software but simply select a subscription plan and create your account. If you have one, just log in and find an appropriate template, download it, and fill it out. Saved files are stored in the My Forms folder.

If you don't have a subscription but need New Mexico Legal Last Will and Testament Form for a Single Person with Minor Children, have a look at the guidelines listed below:

- Double-check that the form you’re taking a look at is valid in the state you need it in.

- Preview the sample and read its description.

- Simply click Buy Now to reach the sign up webpage.

- Select a pricing plan and proceed registering by providing some info.

- Choose a payment method to finish the registration.

- Save the document by choosing your preferred file format (.docx or .pdf)

Now, complete the file online or print it. If you are uncertain concerning your New Mexico Legal Last Will and Testament Form for a Single Person with Minor Children template, speak to a legal professional to check it before you decide to send or file it. Start without hassles!

Form popularity

FAQ

Property in a living trust. One of the ways to avoid probate is to set up a living trust. Retirement plan proceeds, including money from a pension, IRA, or 401(k) Stocks and bonds held in beneficiary. Proceeds from a payable-on-death bank account.

You can make your own will in California, using Nolo's do-it-yourself online will or will software. You may, however, want to consult a lawyer in some situations; for example, if you suspect your will might be contested or if you want to disinherit your spouse, you should talk with an attorney.

1Create the initial document. Start by titling the document Last Will and Testament" and including your full legal name and address.2Designate an executor.3Appoint a guardian.4Name the beneficiaries.5Designate the assets.6Ask witnesses to sign your will.7Store your will in a safe place.

You don't have to have a lawyer to create a basic will you can prepare one yourself. It must meet your state's legal requirements and should be notarized.But be careful: For anything complex or unusual, like distributing a lot of money or cutting someone out, you'd do best to hire a lawyer.

A will can also be declared invalid if someone proves in court that it was procured by undue influence. This usually involves some evil-doer who occupies a position of trust -- for example, a caregiver or adult child -- manipulating a vulnerable person to leave all, or most, of his property to the manipulator instead

Bank accounts. Brokerage or investment accounts. Retirement accounts and pension plans. A life insurance policy.

Include personal identifying information. Include a statement about your age and mental status. Designate an executor. Decide who will take care of your children. Choose your beneficiaries. List your funeral details. Sign and date your Last Will and Testament.

An executor of a will cannot take everything unless they are the will's sole beneficiary.However, the executor cannot modify the terms of the will. As a fiduciary, the executor has a legal duty to act in the beneficiaries and estate's best interests and distribute the assets according to the will.

You and your spouse may have one of the most common types of estate plans between married couples, which is a simple will leaving everything to each other. With this type of plan, you leave all of your assets outright to your surviving spouse. The kids or other beneficiaries only get something after you are both gone.