New Mexico Payroll Deduction Authorization Form

Description

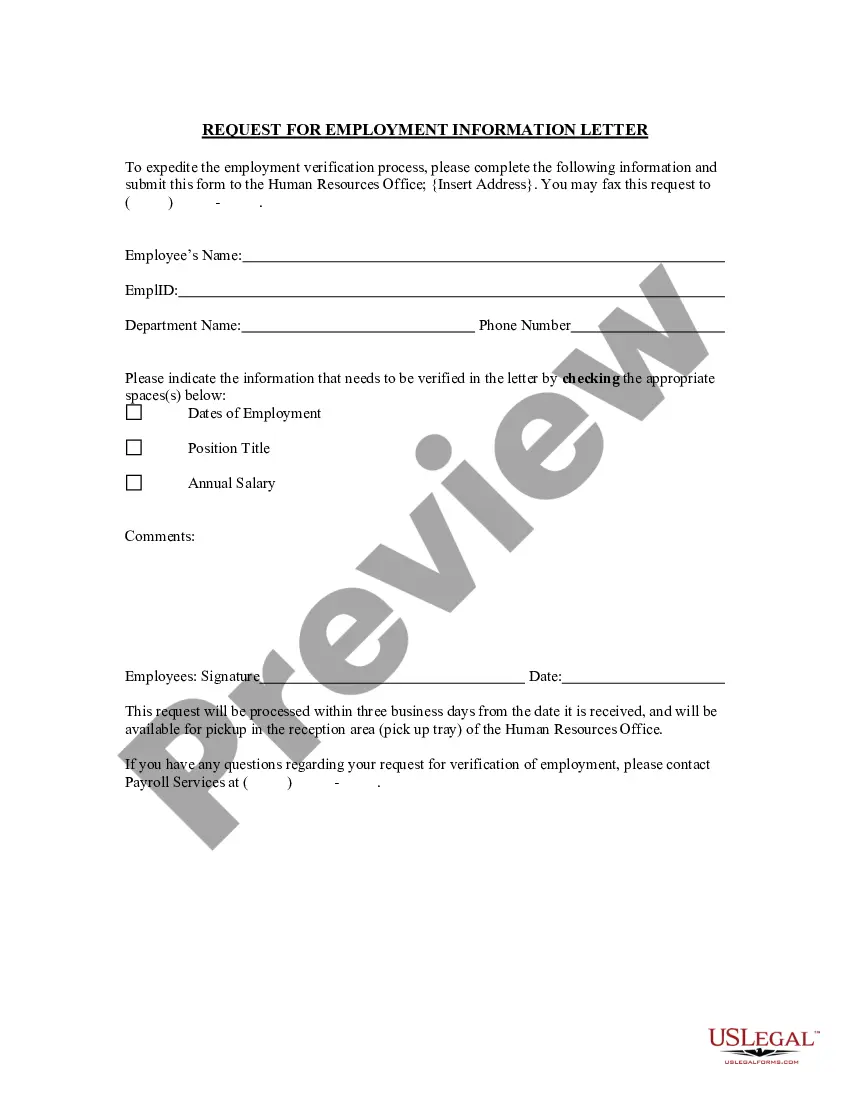

How to fill out Payroll Deduction Authorization Form?

If you wish to aggregate, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site's user-friendly and accessible search to find the documents you require.

Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you've located the document you want, click the Acquire now option. Select the pricing plan you prefer and enter your details to register for the account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to obtain the New Mexico Payroll Deduction Authorization Form in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click on the Download button to get the New Mexico Payroll Deduction Authorization Form.

- You can also access forms you previously acquired in the My documents tab of your account.

- If you're using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the content of the form. Remember to check the summary.

- Step 3. If you're not satisfied with the document, use the Search field at the top of the screen to discover other variations of the legal document template.

Form popularity

FAQ

Apply online at the NM Taxpayer Access Point portal to receive the ID number in 2 days. This number is also used for NM Worker's Compensation payments and filing.Find an existing CRS ID Number: On Form CRS-1, Combined Report System. By contacting the Dept. of Taxation and Revenue.12-Mar-2021

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

New Mexico does not have a form equivalent to the federal Form W-Q. For New Mexico withholding tax you should use a federal W-4 and write across the top of that form: For New Mexico Withholding Tax Only. New Mexico does not have a form equivalent to the federal Form W-4.

Running Payroll in New Mexico: Step-by-Step InstructionsStep 1: Set up your business as an employer.Step 2: Register with New Mexico state.Step 3: Set up your payroll.Step 4: Collect employee payroll forms.Step 5: Collect, review, and approve time sheets.Step 6: Calculate payroll and pay employees.More items...?

Change Your WithholdingComplete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer.Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer.Make an additional or estimated tax payment to the IRS before the end of the year.29-Mar-2022

All new employees for your business must complete both a federal Form W-4. Unlike some other states, New Mexico does not have a separate state equivalent to Form W-4, but instead relies on the federal form. You can download blank Forms W-4 from irs.gov.

New Mexico does not have a form equivalent to the federal Form W-4. For New Mexico withholding tax, you should use a federal W-4 and write across the top of that form: For New Mexico Withholding Tax Only. Retain it in your files for reference.

Apply online at the NM Taxpayer Access Point portal to receive the ID number in 2 days. This number is also used for NM Worker's Compensation payments and filing.Find an existing CRS ID Number: On Form CRS-1, Combined Report System. By contacting the Dept. of Taxation and Revenue.

The form must be submitted on the 10th calendar date after the month the tax has been withheld. EFPS users (i.e. those who pay their taxes online) can file up to the 15th of the month.

Employers must withhold a part of the employee's wages for payment of income tax. New Mexico bases its withholding tax on an estimate of an employee's State income tax liability. The State credits taxes withheld against the employee's actual income tax liability on the New Mexico personal income tax return.