New Mexico Charitable Contribution Payroll Deduction Form

Description

How to fill out Charitable Contribution Payroll Deduction Form?

Are you located in a space where you require documents for potential business or personal purposes almost every day.

There are numerous legal document templates accessible online, but obtaining versions you can trust is challenging.

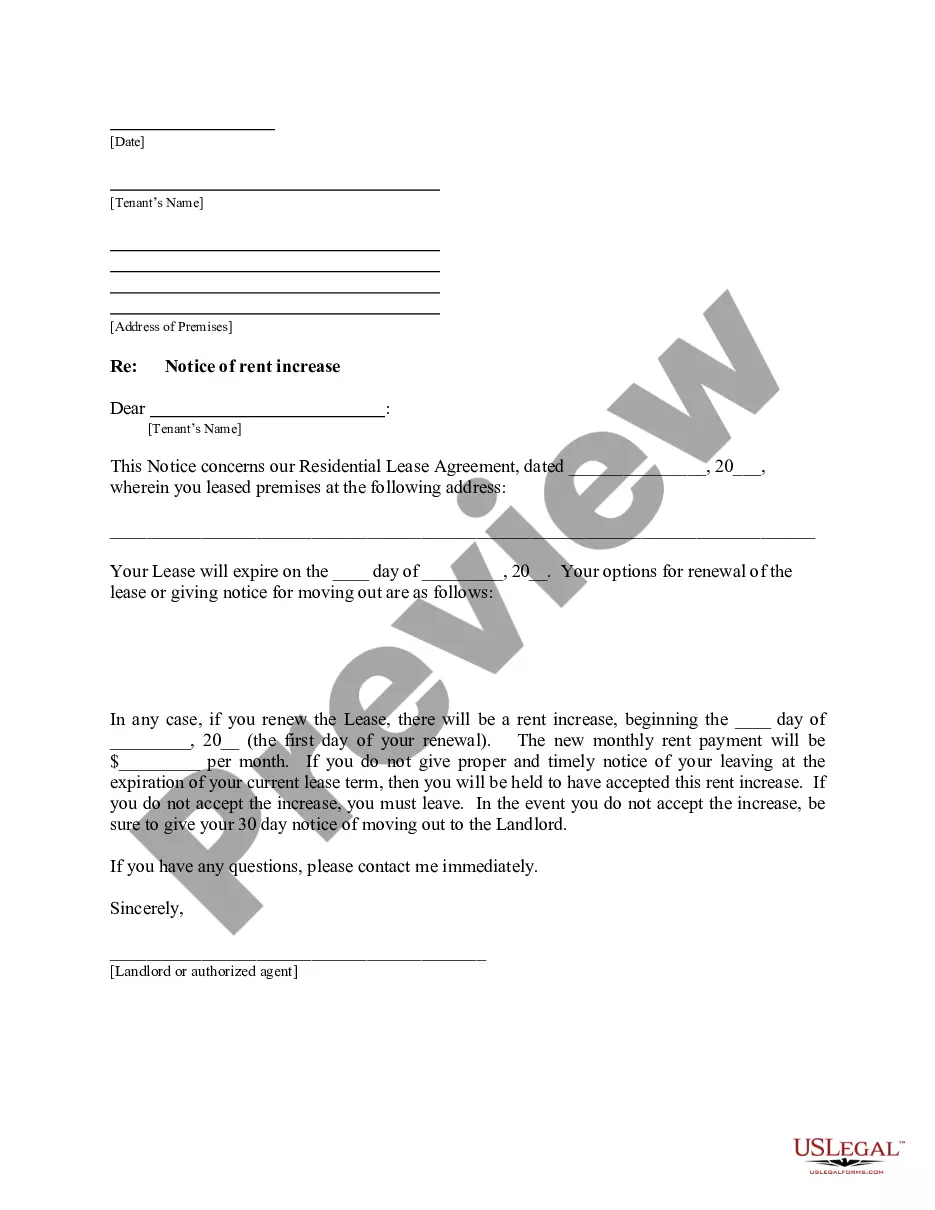

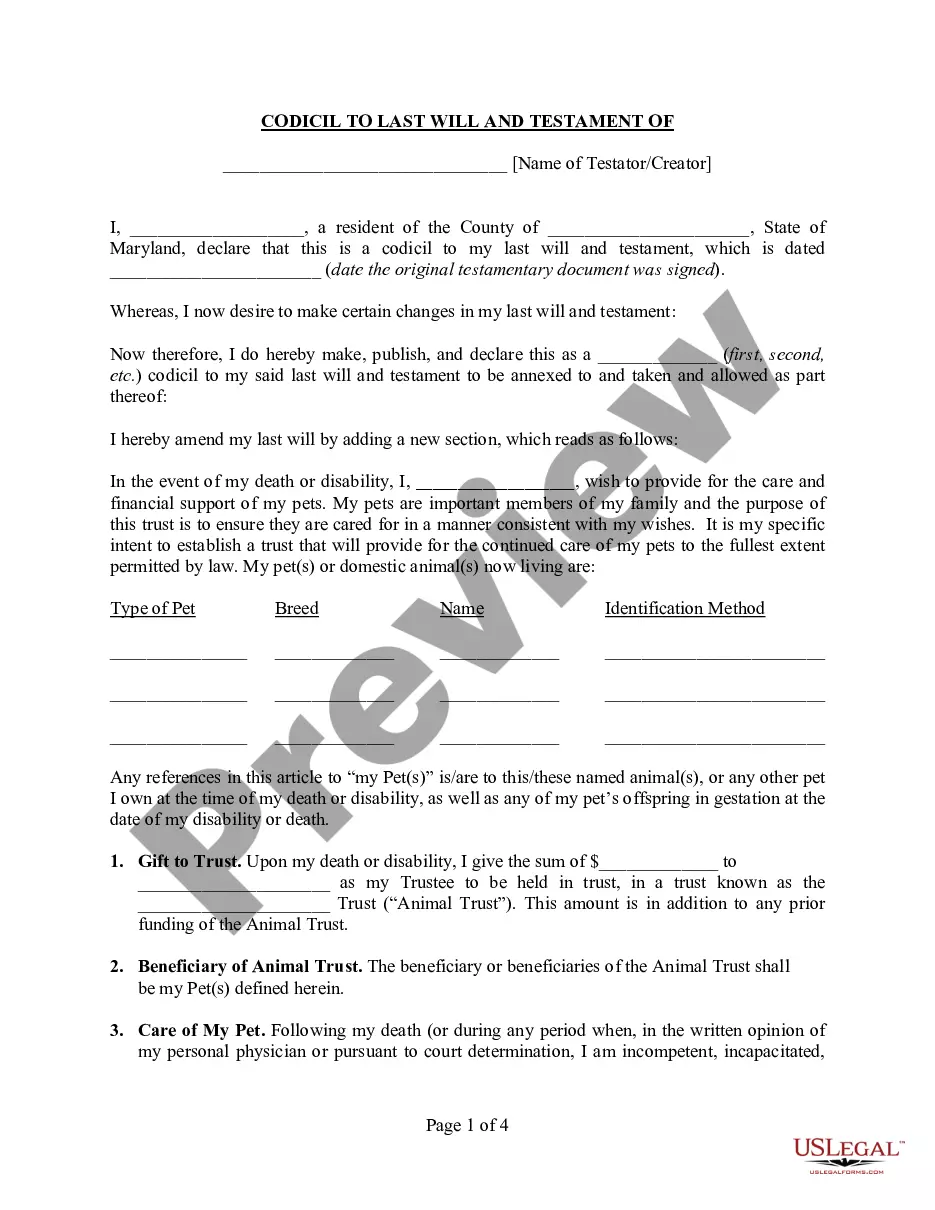

US Legal Forms offers thousands of template forms, including the New Mexico Charitable Contribution Payroll Deduction Form, which are designed to comply with both state and federal requirements.

Once you locate the right form, click on Acquire now.

Choose the payment plan you prefer, enter the necessary information to complete your payment, and settle the order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms site and have your account, simply Log In.

- After that, you may download the New Mexico Charitable Contribution Payroll Deduction Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is appropriate for the correct city/region.

- Utilize the Review button to scrutinize the form.

- Read the description to confirm you have selected the correct form.

- If the form is not what you’re looking for, use the Search box to find the form that meets your needs.

Form popularity

FAQ

The qualified charitable distribution (QCD) rule allows traditional IRA owners to deduct their required minimum distributions (RMDs) on their tax returns if they give the money to a charity. By lowering your adjusted gross income (AGI), the QCD rule can effectively reduce your income taxes.

You can carry over your contributions that you are not able to deduct in the current tax year because they exceed your adjusted-gross-income limits. You can deduct the excess in each of the next 5 years until it is all used, but not beyond that time.

If you itemize deductions, you will be able to use the amount in Box 14 as a charitable deduction. Depending on the code you enter, the program may enter it automatically. Enter the Box 14 description/code from your Form W-2 in the first field in the row for Box 14 (e.g. NONTX PK).

Five-Year Contribution Carryover Carryover contributions are subject to the original percent- age limits in the carryover years and are deducted after deducting allowable contributions for the current year. If there are carryovers from two or more years, use the earlier year carryover first.

An after-tax payroll deduction, such as for charitable donations, doesn't reduce the amount reported on your W-2 and is reported as income on your tax returns.

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income....To qualify, the contribution must be:a cash contribution;made to a qualifying organization;made during the calendar year 2020.08-Mar-2022

The total charitable deduction that you will report on Schedule A is equal to the sum of the total cash donations you calculate plus the fair market value of all property donations.

Charitable Donation Limits: Special 2021 Rules. For 2021, single taxpayers who claim the standard deduction on their tax returns can deduct up to $300 of charitable contributions made in cash. Married couples filing joint returns can claim up to $600 for cash contributions.

When you donate cash to a public charity, you can generally deduct up to 60% of your adjusted gross income. Provided you've held them for more than a year, appreciated assets including long-term appreciated stocks and property are generally deductible at fair market value, up to 30% of your adjusted gross income.

To get the potential tax benefits, nonitemizers must claim the charitable contribution deduction on IRS Form 1040. Except for the special benefit for nonitemizers, which expires after 2021, charitable contributions must be claimed as itemized deductions on Schedule A.