Kansas Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

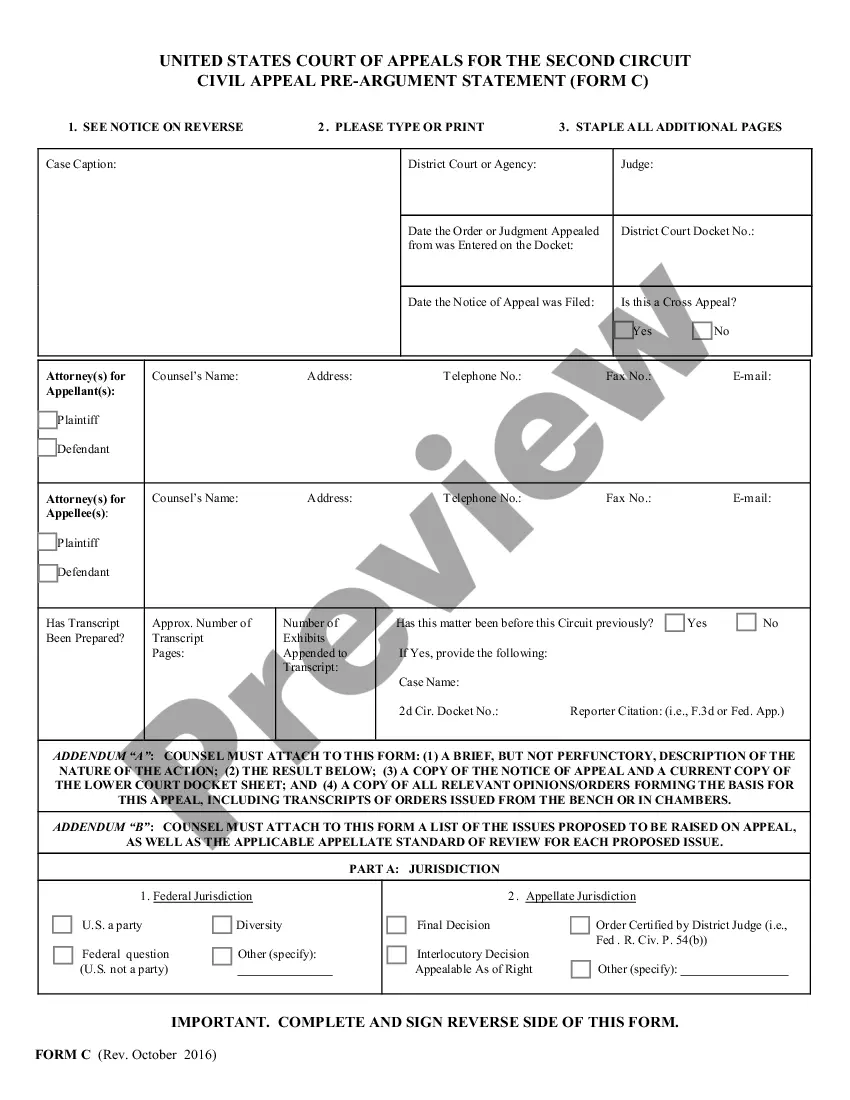

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

It is feasible to invest hours on the internet looking for the legal document format that aligns with the state and federal requirements you require.

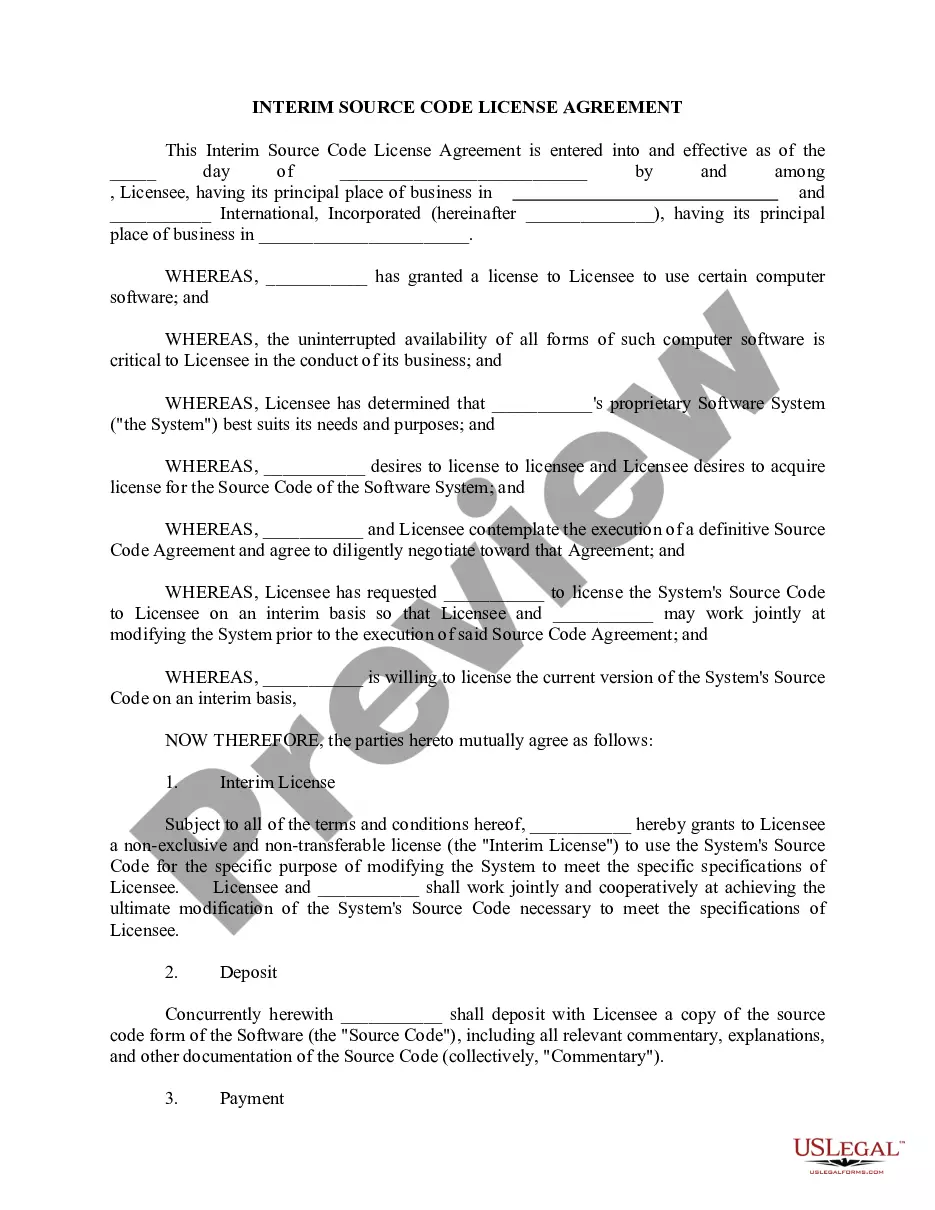

US Legal Forms provides thousands of legal forms that have been evaluated by professionals.

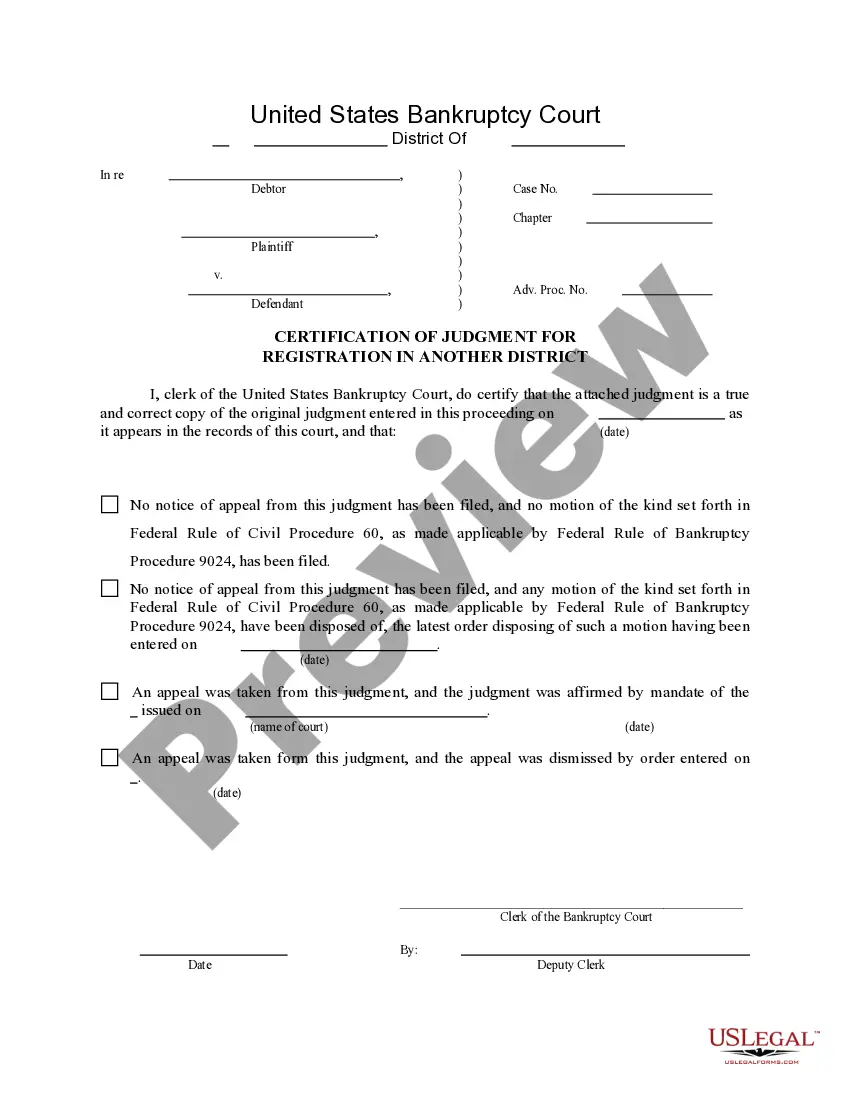

You can download or print the Kansas Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption from our offerings.

If available, utilize the Review button to preview the document format as well. When you want to find another version of the document, use the Search field to locate the template that fits your needs and requirements. Once you have found the template you want, click Purchase now to proceed. Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Choose the format of the document and download it to your system. Make adjustments to your document if necessary. You can complete, edit, sign, and print the Kansas Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption. Download and print thousands of document templates using the US Legal Forms site, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can complete, edit, print, or sign the Kansas Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

- Every legal document format you acquire is yours permanently.

- To get another copy of any document obtained, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions listed below.

- First, confirm that you have chosen the correct document format for your state/city of preference.

- Review the template outline to ensure you have selected the appropriate document.

Form popularity

FAQ

You do not always receive a 1099 when you sell your house. If the sale qualifies for the Kansas Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, you may not need to report the income from the sale. Always check the eligibility requirements to ensure proper compliance and avoid unnecessary tax implications.

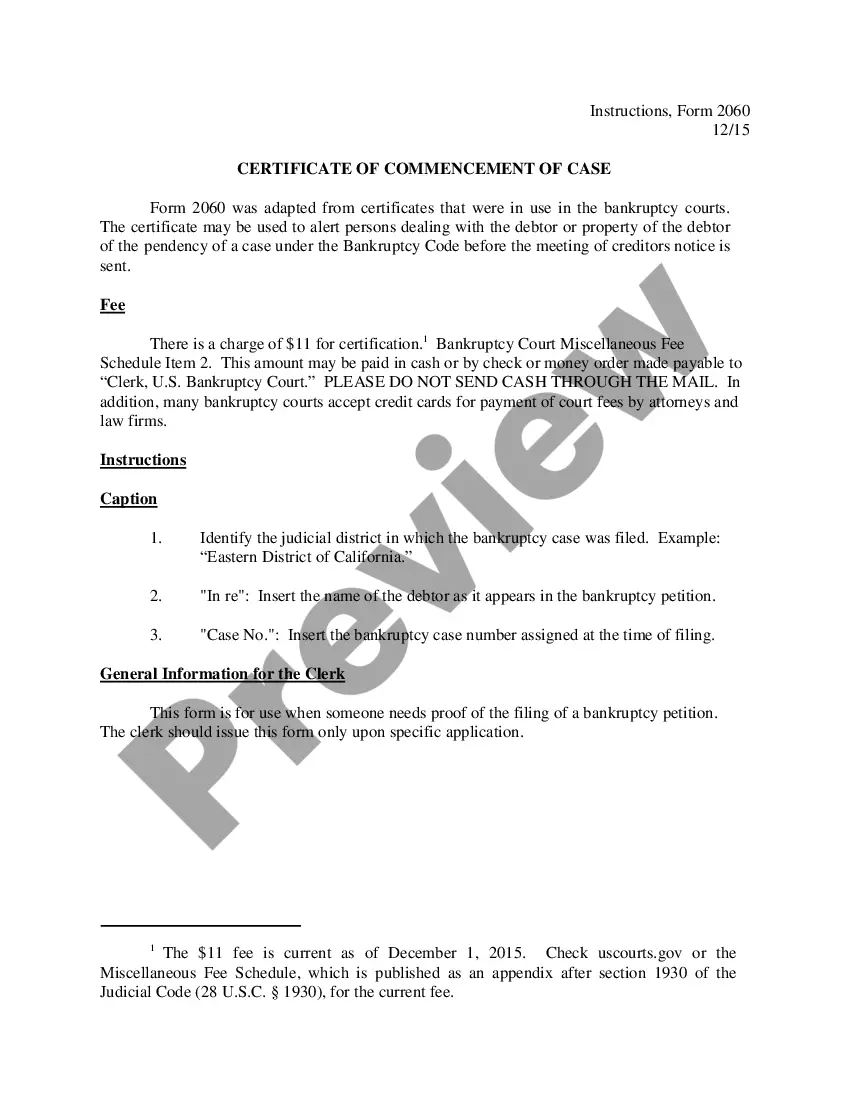

A Certificate of Tax Clearance is a comprehensive review to determine and ensure that the applicant's account is in current compliance with all applicable: Kansas tax laws administered by the director of taxation within the Kansas Department of Revenue.

All tax clearance requests must be submitted using the online application. If you are unable to print the Kansas Department of Revenue tax clearance form CM-21 (Adobe Acrobat required), you can request a copy of the forms by contacting our Special Events department.

You will need to:Sign-in or register with the Kansas Department of Revenue Customer Service Center.Select one of the below exemption certificate types.Complete and submit an exemption certificate application.

Most businesses operating in or selling in the state of Kansas are required to purchase a resale certificate annually. Even online based businesses shipping products to Kansas residents must collect sales tax. Obtaining your sales tax certificate allows you to do so.

With the introduction of the new tax compliance status system, one can now print a tax clearance certificate online. Once a successful application has been done via SARS efiling, the system will generate a valid tax clearance certificate for the use by the tax payer.

Before entering a new contract or a continuing contract with the Government, its Department, Agencies and Instrumentalities, one of the requirements is to submit a Tax Clearance Certificate (TCC) from the Bureau of Internal Revenue (BIR) to prove full and timely payment of taxes, and compliance with tax laws.

How to request your Tax Compliance Status via eFilingSelecting the Tax Compliance Status Request option and the type of TCS for which you would like to apply. You will have the following options: Good standing. Tender.Complete the Tax Compliance Status Request and submit it to SARS.

The following documents is required when applying for a Tax Clearance Certificate for your company an income tax reference number for the company, the director or also known as the public officer of the company must have a certified copy of his/her ID or a valid passport if the applicant is a foreign, a signed SARS

A tax clearance certificate (TCC) is a document issued by SARS confirming that the applicant's tax affairs are in order. TCCs are required for tender applications, to reflect "good standing, for foreign investment, and for emigration purposes.