New Mexico Sample Letter transmitting Cancellation and Satisfaction of Promissory Notes

Description

How to fill out Sample Letter Transmitting Cancellation And Satisfaction Of Promissory Notes?

Are you in a scenario where you require documentation for either business or personal purposes almost every day.

There are many legal document templates available online, but locating reliable ones is not easy.

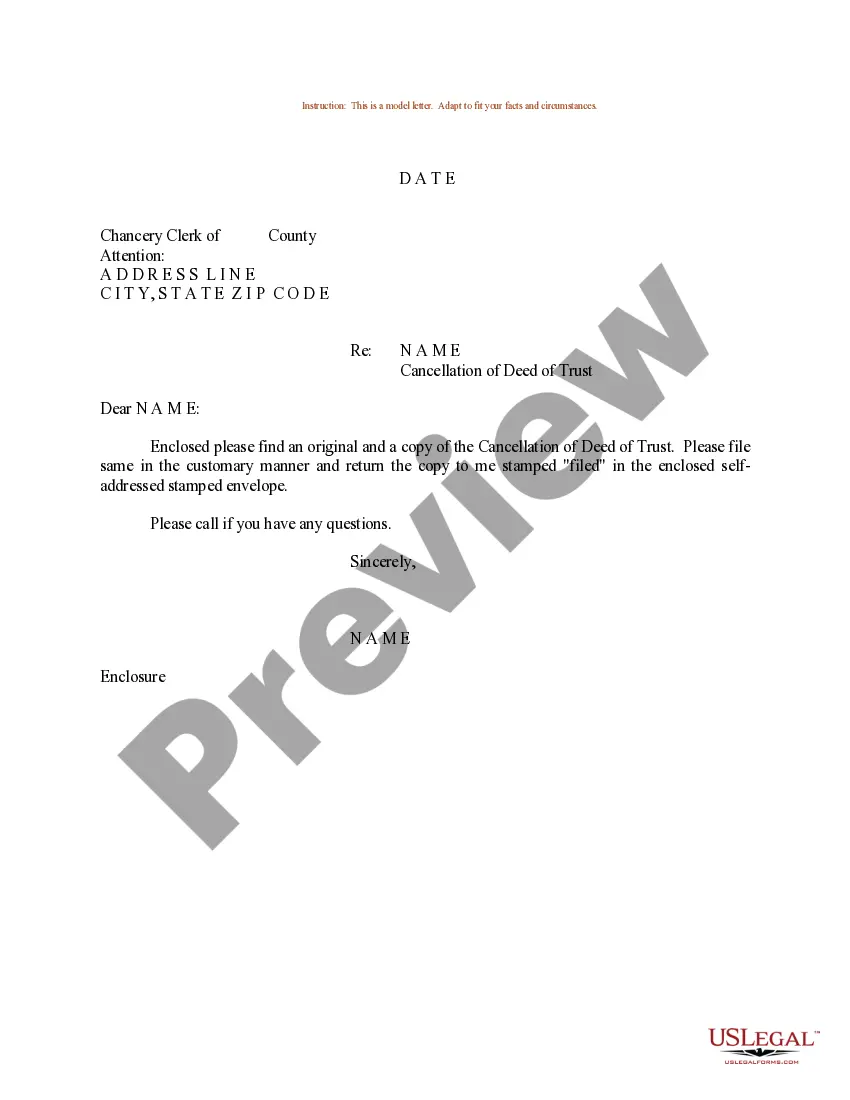

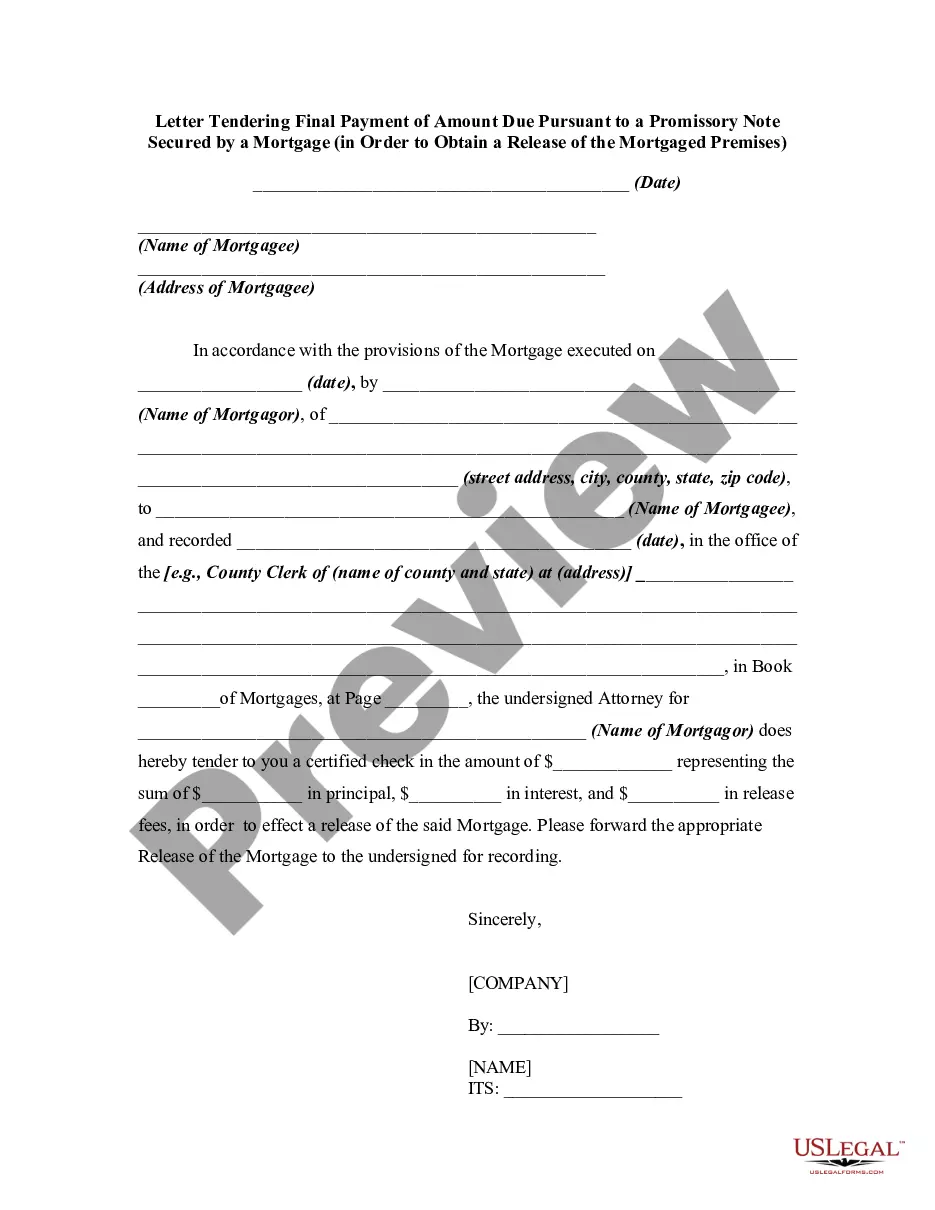

US Legal Forms provides thousands of form templates, such as the New Mexico Sample Letter for Cancellation and Satisfaction of Promissory Notes, which is designed to comply with both federal and state regulations.

Choose a convenient document format and download your copy.

You can find all the document templates you have purchased in the My documents section. You can get another copy of the New Mexico Sample Letter for Cancellation and Satisfaction of Promissory Notes anytime, if needed. Simply click on the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. This service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Mexico Sample Letter for Cancellation and Satisfaction of Promissory Notes template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Use the Review button to examine the form.

- Check the summary to confirm you've chosen the correct form.

- If the form isn't what you're looking for, use the Search field to find the form that meets your needs and specifications.

- When you find the correct form, click on Get now.

- Select the payment plan you want, fill in the required information to create your account, and complete your order using PayPal or a credit card.

Form popularity

FAQ

Write a "Cancellation of Promissory Note" letter or have the attorney write one for you. The note should include details of the original promissory note and also indicate that the original promissory note is canceled at the request of both parties. Have the promisee sign the document in the presence of a notary.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A promissory note must also offer fair terms in order for it to be legally binding. For example, most states limit the amount of interest that can be charged on different kinds of loans. Therefore, an unusually high-interest rate could invalidate a promissory note.

Before a promissory note can be canceled, the lender must agree to the terms of canceling it. A well-drafted and detailed promissory note can help the parties involved avoid future disputes, misunderstandings, and confusion. When canceling the promissory note, the process is referred to as a release of the note.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note.Accept full payment of the loan.Mark paid in full on the promissory note.Place a signature beside the paid in full notation.Mail the original promissory note to the borrower.

If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest. Even if the note had been originally valid, you can void it by altering it.

What invalidates promissory notes?Incomplete signatures. Both parties must sign the promissory note.Missing payment amount or schedule.Missing interest rate.Lost original copy.Unclear clauses.Unreasonable terms.Past the statute of limitations.Changes made without a new agreement.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.