New Mexico Promissory Note - Satisfaction and Release

Description

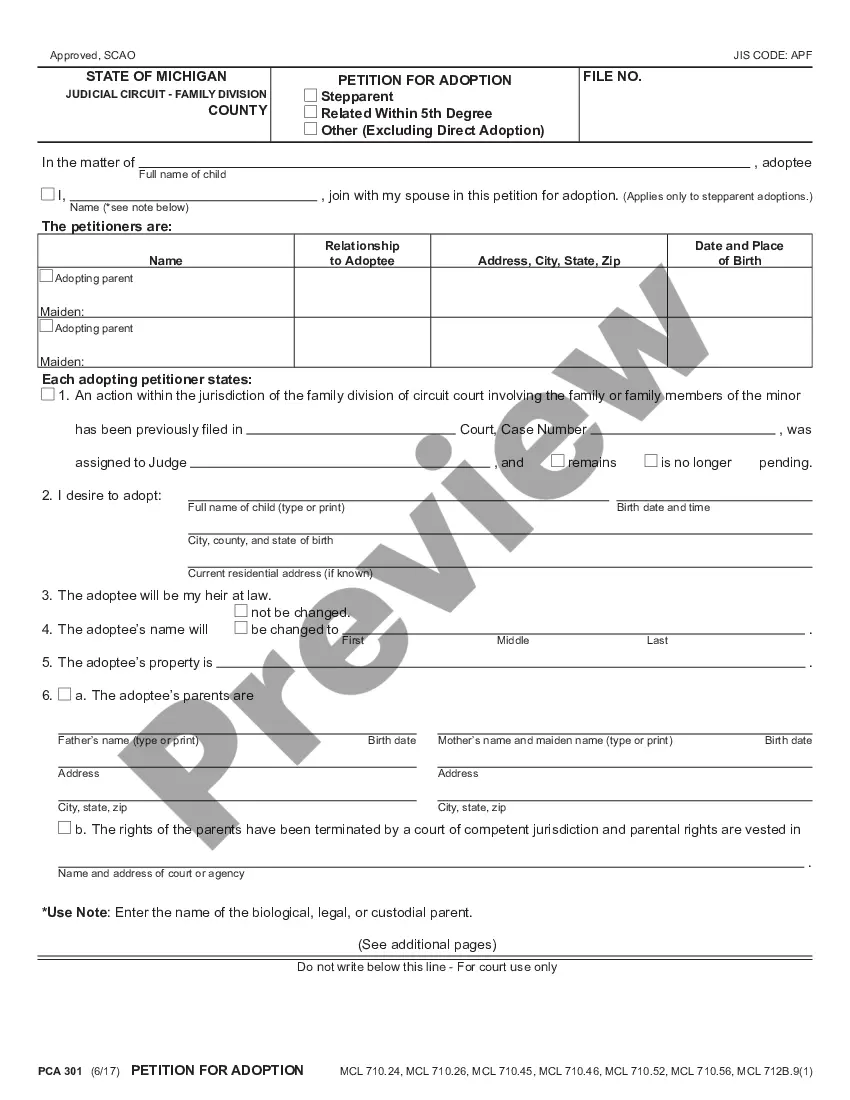

How to fill out Promissory Note - Satisfaction And Release?

You can spend hours online searching for the legal document template that complies with the state and federal requirements you need.

US Legal Forms provides thousands of legal templates that are reviewed by experts.

You can download or print the New Mexico Promissory Note - Satisfaction and Release from the service.

In order to obtain another version of the form, use the Search field to find the template that meets your needs and requirements.

- If you already have a US Legal Forms account, you may Log In and click on the Acquire button.

- Then, you can complete, modify, print, or sign the New Mexico Promissory Note - Satisfaction and Release.

- Every legal document template you obtain is yours indefinitely.

- To get an additional copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow these simple steps.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Check the form description to ensure you have chosen the correct one.

Form popularity

FAQ

While promissory notes lack a specific expiry date, it is crucial to distinguish between the maturity date and the period during which a lender may legally enforce repayment. For a New Mexico Promissory Note - Satisfaction and Release, be aware that after a certain period, known as the statute of limitations, the lender may lose their right to demand payment. Therefore, keeping track of these timelines ensures you stay informed and protected.

Yes, promissory notes typically include a maturity date. This date represents when the borrower must repay the full amount owed to the lender. In the context of a New Mexico Promissory Note - Satisfaction and Release, understanding this date is vital for managing your payments and obligations properly. Ensuring you meet this date can help you avoid default and secure your financial future.

After the death of the original borrower, a promissory note becomes part of the deceased's estate. The debt may be settled through the estate’s assets or transferred to a beneficiary, depending on the will or state laws. Understanding this process is vital for handling a New Mexico Promissory Note - Satisfaction and Release. Trusting legal experts or platforms like UsLegalForms can ease the burden of managing these transactions.

The beneficiary of a promissory note is usually the individual or entity entitled to receive payments from the borrower. This party holds all rights associated with the note, including the ability to enforce its terms. Knowing the beneficiary is key when dealing with a New Mexico Promissory Note - Satisfaction and Release, as this impacts financial responsibilities. Utilizing platforms like UsLegalForms can provide clarity on your specific rights and duties.

If the holder of a promissory note dies, the rights and obligations regarding that note typically pass to their estate or designated beneficiary. This transition can influence repayment terms and satisfaction of the note. It’s essential to consider the implications of a New Mexico Promissory Note - Satisfaction and Release in these instances. Seeking guidance from legal resources can aid in navigating this complex situation.

Certain types of debt are not forgiven after death, including secured loans, mortgages, and federal student loans. When a person passes away, these debts typically become the responsibility of their estate. It's important to understand how this affects the transfer of assets, especially when dealing with a New Mexico Promissory Note - Satisfaction and Release. Consulting with a legal expert can clarify obligations regarding these debts.

Discharging a promissory note typically involves completing all payment requirements outlined in the note. After you fulfill your obligation, you should request a discharge letter from the lender, confirming that no further payments are due. This process is essential for your records and future financial activities. For additional clarity, explore US Legal Forms to find templates for discharging a New Mexico promissory note.

To release a promissory note, you must draft and sign a release document that states the borrower has satisfied their debt. After the borrower completes their payments, the lender should provide this document, confirming that all obligations are met. Using US Legal Forms makes it simple to create the appropriate release templates that comply with New Mexico laws.

The release and satisfaction of a promissory note is a legal document that states the borrower has fulfilled their obligation under the note. This document is essential as it officially acknowledges that the debt is cleared. It protects both the borrower and lender by providing proof that the obligation no longer exists. You can easily access templates for these documents on US Legal Forms to ensure accuracy in your New Mexico promissory note - satisfaction and release.

Obtaining your promissory note is typically straightforward. If you are the borrower, you should contact the lender who issued the note. Most lenders keep copies of such documents in their records. Additionally, using the resources on US Legal Forms can help you draft a request if you need a formal way to retrieve your New Mexico promissory note.