New Mexico Revocable Trust Agreement with Corporate Trustee

Description

How to fill out Revocable Trust Agreement With Corporate Trustee?

Are you currently in a situation where you require documents for potentially business or personal purposes nearly every day.

There are numerous legitimate document templates accessible online, but obtaining those you can rely on isn't straightforward.

US Legal Forms offers a multitude of form templates, such as the New Mexico Revocable Trust Agreement with Corporate Trustee, that are designed to comply with federal and state regulations.

Select a convenient document format and download your copy.

Find all of the document templates you have purchased in the My documents list. You can obtain another copy of the New Mexico Revocable Trust Agreement with Corporate Trustee anytime, if needed. Just select the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the New Mexico Revocable Trust Agreement with Corporate Trustee template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/region.

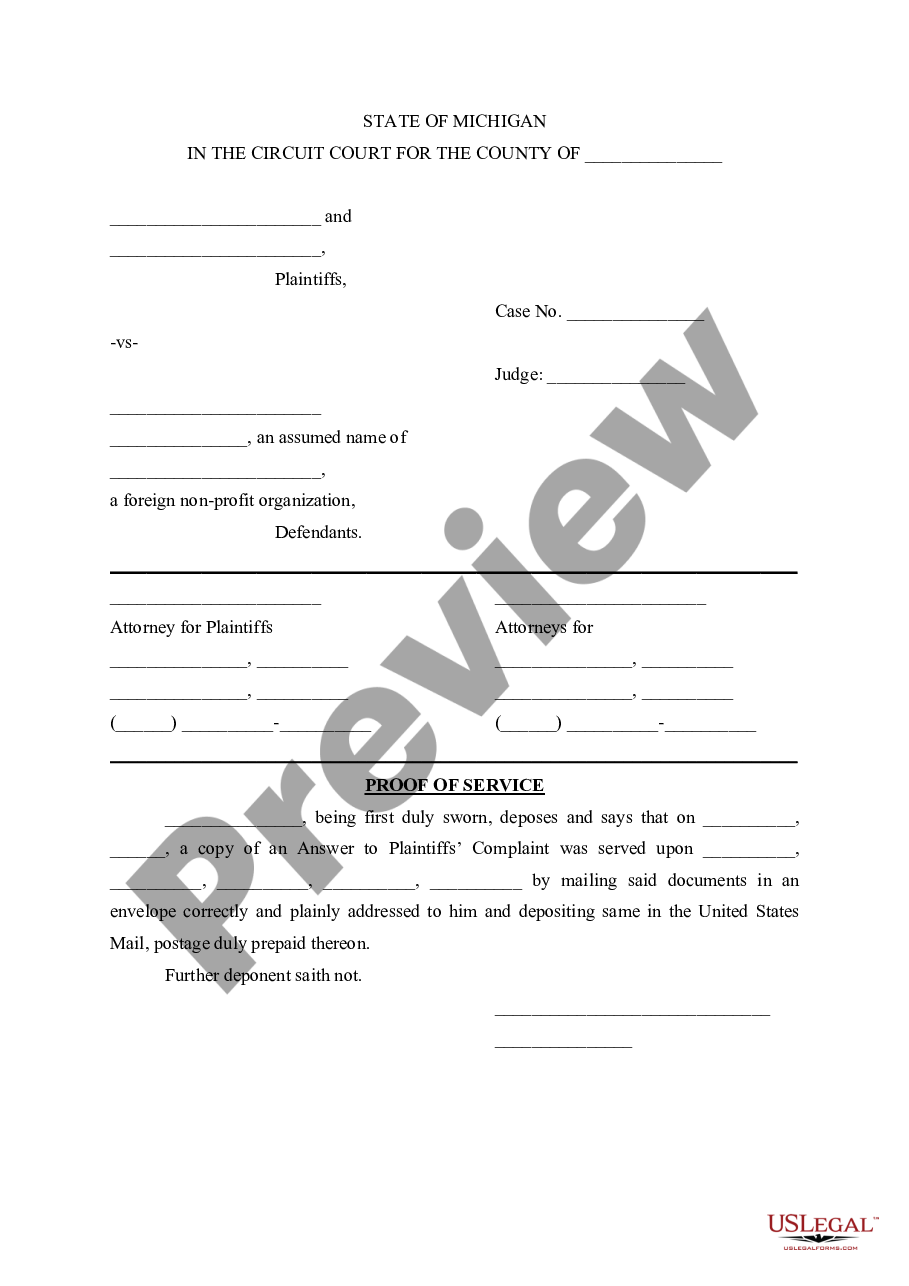

- Utilize the Review button to scrutinize the form.

- Check the description to ensure you have selected the correct form.

- If the form isn't what you are looking for, use the Research field to find the form that matches your needs and requirements.

- Once you locate the appropriate form, click Purchase now.

- Choose the pricing plan you prefer, fill in the necessary details to create your account, and complete the transaction using your PayPal or credit card.

Form popularity

FAQ

How to Create a Living Trust in New MexicoFigure out which type of trust is best for you. If you're single, a single trust is probably what you'll want.Take inventory of your assets.Choose your trustee.Write a trust document.Sign the trust in front of a notary.Fund the trust by moving property into it.

The trustee cannot fail to carry out the wishes and intent of the settlor and cannot act in bad faith, fail to represent the best interests of the beneficiaries at all times during the existence of the trust and fail to follow the terms of the trust. A trustee cannot fail to carry out their duties.

The trustee has the power to manage, control, divide, develop, improve, exchange, partition, change the character of, or abandon trust property or any interest therein. 16228.

The trustee usually has the power to retain trust property, reinvest trust property or, with or without court authorization, sell, convey, exchange, partition, and divide trust property.

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

A typical living trust can cost $2,000 or more, while a basic last will and testament can be drawn up for about $150 or so.

The trustee acts as the legal owner of trust assets, and is responsible for handling any of the assets held in trust, tax filings for the trust, and distributing the assets according to the terms of the trust. Both roles involve duties that are legally required.

The trustee cannot do whatever they want. They must follow the trust document, and follow the California Probate Code. More than that, Trustees don't get the benefits of the Trust. The Trust assets will pass to the Trust beneficiaries eventually.

A trust is a relationship where one person or company (the trustee) holds assets for the benefit of another (the beneficiary). When contracting on behalf of the beneficiaries, a trustee typically wishes to limit its liabilities to the extent to which it is indemnified out of the trust assets.

The first trustee can distribute income to the second trustee as a general beneficiary; and. the second trustee can be notified and take that income into account when planning for its own year-end distributions.