New Mexico Sample Letter for Letter Requesting Extension to File Business Tax Forms

Description

How to fill out Sample Letter For Letter Requesting Extension To File Business Tax Forms?

Are you currently in a scenario where you require documents for either a business or individual use nearly every day.

There are numerous authentic document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers a vast selection of forms, including the New Mexico Sample Letter for Letter Requesting Extension to File Business Tax Forms, which can be tailored to meet both state and federal obligations.

Once you find the right form, click Purchase now.

Select the pricing plan you prefer, provide the necessary information to create your account, and complete your order using PayPal or a credit card.

- If you are already acquainted with the US Legal Forms site and have a merchant account, simply Log In.

- After logging in, you can download the New Mexico Sample Letter for Letter Requesting Extension to File Business Tax Forms template.

- If you don't have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/region.

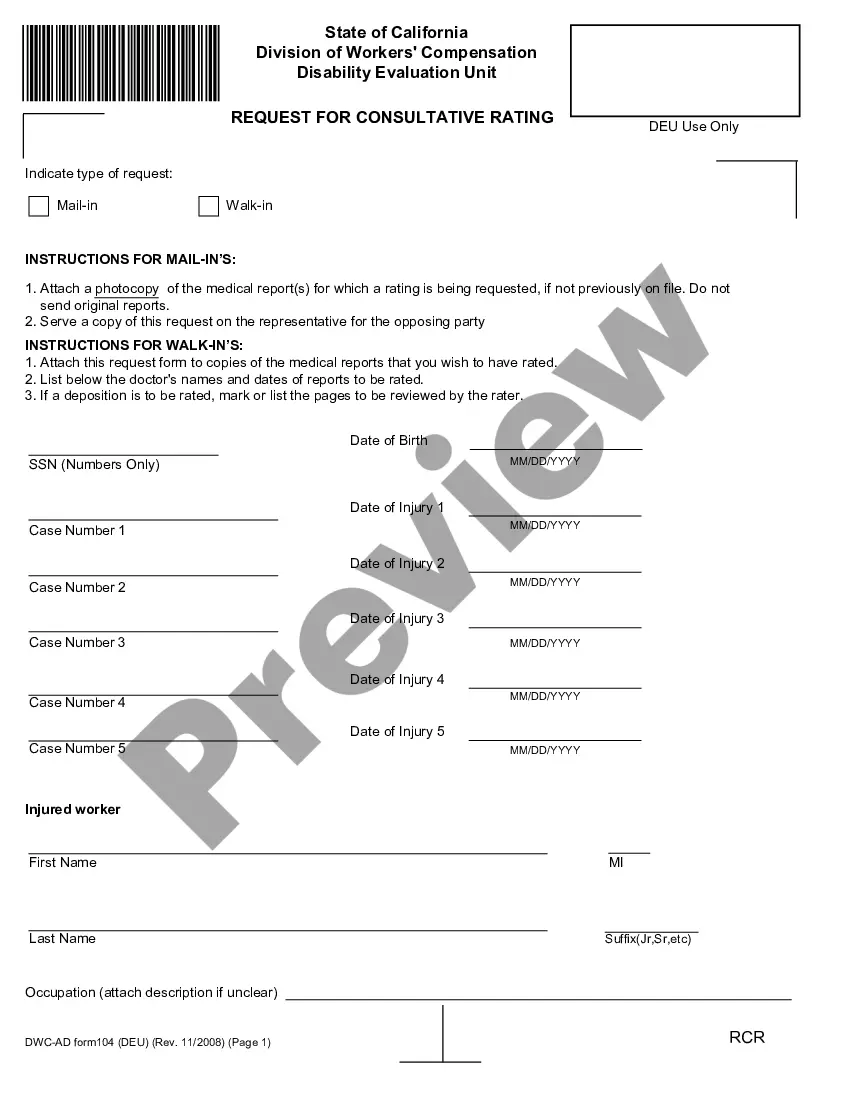

- Use the Review button to evaluate the form.

- Check the description to confirm you have selected the appropriate form.

- If the form doesn't match your needs, use the Lookup field to find the form that suits your requirements.

Form popularity

FAQ

New Mexico accepts federal extensions for corporations, which can simplify your filing process. When you file a federal extension, it automatically provides an extension for your New Mexico business tax filings as well. However, make sure to confirm this and also check if any specific state requirements need to be fulfilled. For clarity, our platform offers the New Mexico Sample Letter for Letter Requesting Extension to File Business Tax Forms to help you maintain compliance.

Filling out a tax extension form requires basic information such as your name, address, and type of return. You must also indicate your estimated taxes owed and any previous payments. For assistance, consider following a template, like the New Mexico Sample Letter for Letter Requesting Extension to File Business Tax Forms, which can guide you on how to provide the information clearly and effectively.

Estimating your taxes involves calculating your expected income for the year and determining applicable deductions. This can be done by gathering your financial records and using tax software or resources like tax preparation guides. If you are unsure, consider drafting a New Mexico Sample Letter for Letter Requesting Extension to File Business Tax Forms to extend your time for accurate reporting, allowing you to avoid underpayment penalties.

To ask for an extension of filing, you should draft a formal letter to the appropriate tax authority in New Mexico. Be clear about your request and include all necessary details to support your case. Using a New Mexico Sample Letter for Letter Requesting Extension to File Business Tax Forms can greatly assist you in this endeavor, ensuring you meet the formal requirements.

Yes, New Mexico honors the federal extension for tax filings. If you receive an automatic extension from the IRS, you can apply it to your state tax forms, but it's always prudent to confirm specific details with the state. By utilizing a New Mexico Sample Letter for Letter Requesting Extension to File Business Tax Forms, you can maintain clarity in your communications and processes.

To get a tax extension letter, you can create one or download templates available online. The letter should clearly state your intention to request an extension for your business tax forms. Using a New Mexico Sample Letter for Letter Requesting Extension to File Business Tax Forms can provide you with a professional format and ensure you include all essential details.

Yes, there is an automatic extension available for certain tax filings in New Mexico. This extension allows you additional time to file your business tax forms, but it's crucial to verify the specifics of your filing requirements. Engaging with tools like the New Mexico Sample Letter for Letter Requesting Extension to File Business Tax Forms can simplify this process.

New Mexico does not have a specific double time requirement for hours worked, but employers must comply with federal law regarding overtime. Businesses should be aware of the rules surrounding employee compensation to avoid costly mistakes. Always keep track of your employee hours to ensure compliance with labor laws.

Yes, New Mexico does have open range law, which means that livestock owners can graze their animals on public lands without fences. However, it is important for business owners to understand the legal implications when dealing with property and livestock. Always refer to local regulations and consult experts if needed as you navigate your responsibilities.

To request a business tax extension in New Mexico, you'll need to complete the form designated for this purpose. It provides an opportunity for you to extend your filing deadline for business tax forms. Make sure to include the necessary details, and consider using a New Mexico Sample Letter for Letter Requesting Extension to File Business Tax Forms to communicate your request effectively.