Sample Letter for Settlement Release

Overview of this form

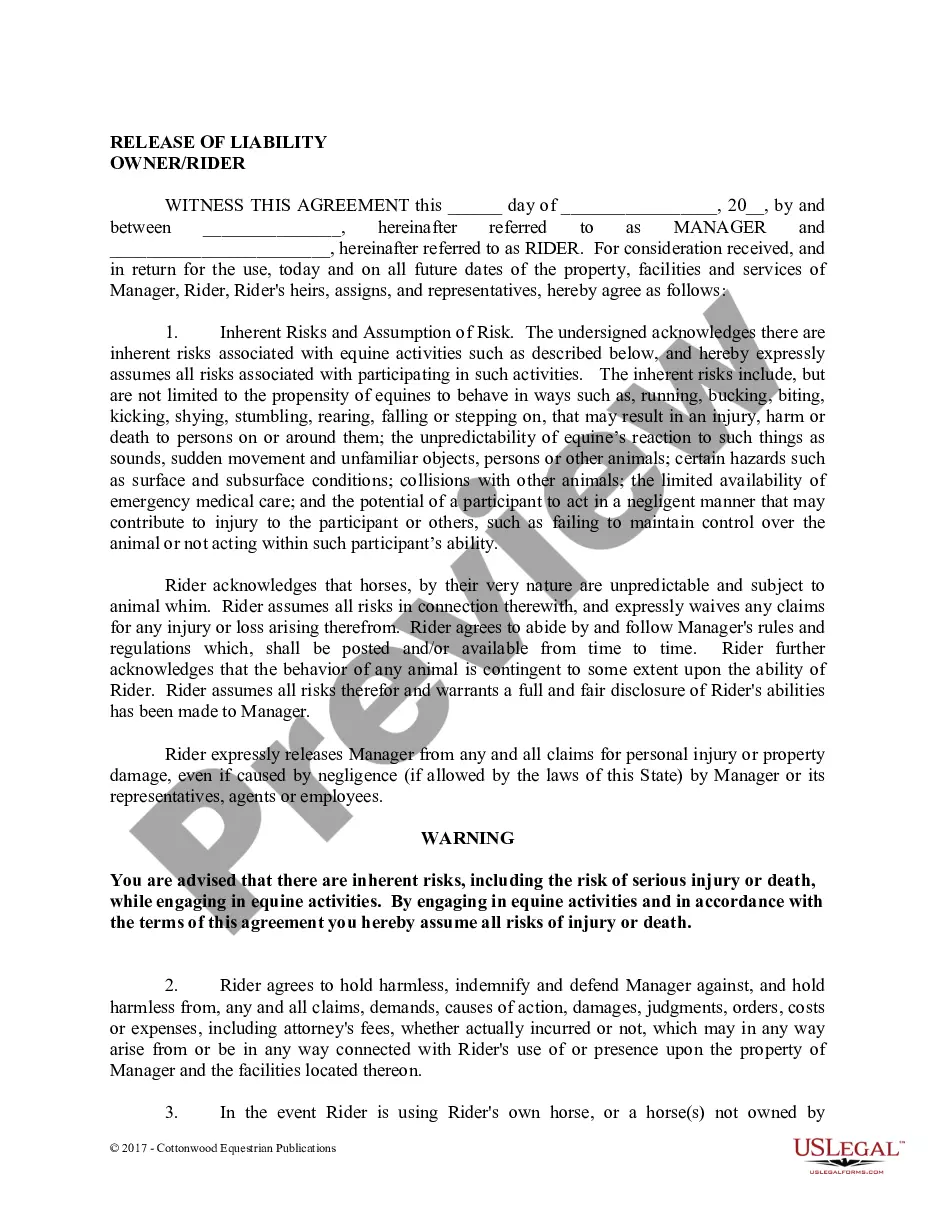

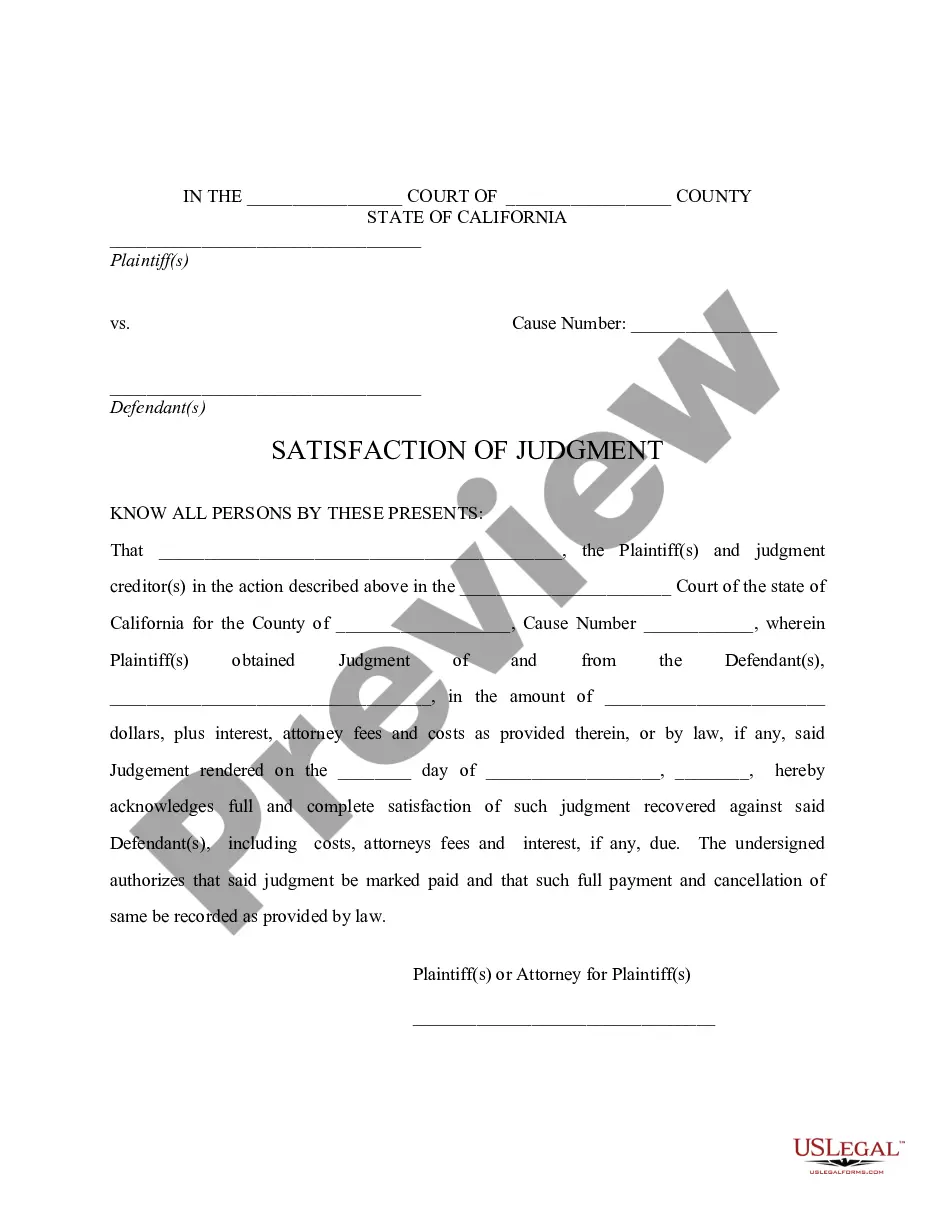

The Sample Letter for Settlement Release is a legal template used to formally request and document the release of claims following a settlement agreement. It enables the parties to finalize the settlement by signing a release of liability, ensuring that the settling party cannot pursue further legal claims related to the same issue. This letter stands apart from other legal forms as it combines the functions of both a notification and a contractual agreement, streamlining the process for both sides involved in a settlement.

Form components explained

- Identification of the parties involved in the settlement.

- A clear statement indicating that the release is contingent upon approval from the recipient's client.

- A request for the return of the signed release document.

- A suggestion to arrange a meeting for the exchange of the release and payment.

When this form is needed

This form is useful when two parties have reached a settlement regarding a dispute or claim. It should be utilized when one party needs to formally request a release document from the other party to finalize the settlement and prevent future claims based on the same incident. Common scenarios include personal injury settlements, contractual disputes, and various civil matters where a resolution has been agreed upon.

Who can use this document

- Individuals or organizations involved in a settlement agreement.

- Legal representatives acting on behalf of clients who have settled a dispute.

- Any party seeking to document the release of claims formally.

Steps to complete this form

- Identify the parties involved in the settlement.

- Clearly state the terms of the settlement and the associated obligations.

- Request that the recipient forwards the release to their client for execution.

- Include a suggestion for a meeting date to complete the transaction.

- Sign and date the letter to formalize the request.

Does this document require notarization?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to clearly identify all parties involved.

- Not specifying the terms of the settlement clearly.

- Omitting to include a meeting suggestion for the exchange of documents.

- Forgetting to sign the letter before sending it.

Benefits of using this form online

- Convenience of downloading and customizing the template quickly.

- Access to forms any time, enabling efficient handling of legal matters.

- Reliability of using attorney-drafted forms that meet legal standards.

Legal use & context

- This form helps establish a clear agreement on releasing claims associated with a settlement.

- It documents the settlement process and protects against future claims by formalizing the agreement.

Key takeaways

- The Sample Letter for Settlement Release is essential for finalizing settlements and preventing further legal action.

- Clear communication and documentation are vital in the settlement process.

- Using attorney-drafted forms helps ensure legal compliance and clarity.

Looking for another form?

Form popularity

FAQ

Dear Sir/Madam, I have been an employee at your company/organization from (Date) to (Date) and now I had to resign because I am going to settle abroad with my family next month. I have had a great experience at your company/organization and I got to learn a lot from this experience.

Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors. You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

A study by the Center for Responsible Lending showed that on average debts are settled at 48% of the outstanding balance. But that balance increases 20 percent due to late fees and other charges the creditor might impose during negotiation.

Write a debt settlement letter to your creditor. Explain your current situation and how much you can pay. Also, provide them with a clear description of what you expect in return, such as removal of missed payments or the account shown as paid in full on your report.

Original creditor and collection agent's company name. Date the letter was written. Your name. Your account number. Outstanding balance owed on the account (optional) Amount agreed to as settlement.

The creditor and/or debt collectors name. The date the letter was drafted. Your name. Your account number.

Dear Sir/Madam, I am currently having a loan account bearing the number __________ in your bank at ______ branch. The loan account shows the principal outstanding for Rs. __________ and interest overdue for Rs.

Dear Sir / Madam, This is to bring your kind notice that I ____________, have given resignation to my job on ________ and I have also cleared all the advances which I have taken during my tenure. So I am requesting you to please issue my full and final settlement amount.

2714 Retain relevant documents. 2714 Decide whether (and when) to make offer. 2714 Evaluate the reasons for settling. 2714 Assess motivating factors to settle. 2714 Confirm client's ability to settle. 2714 List all covered parties. 2714 List all legal issues to be settled.