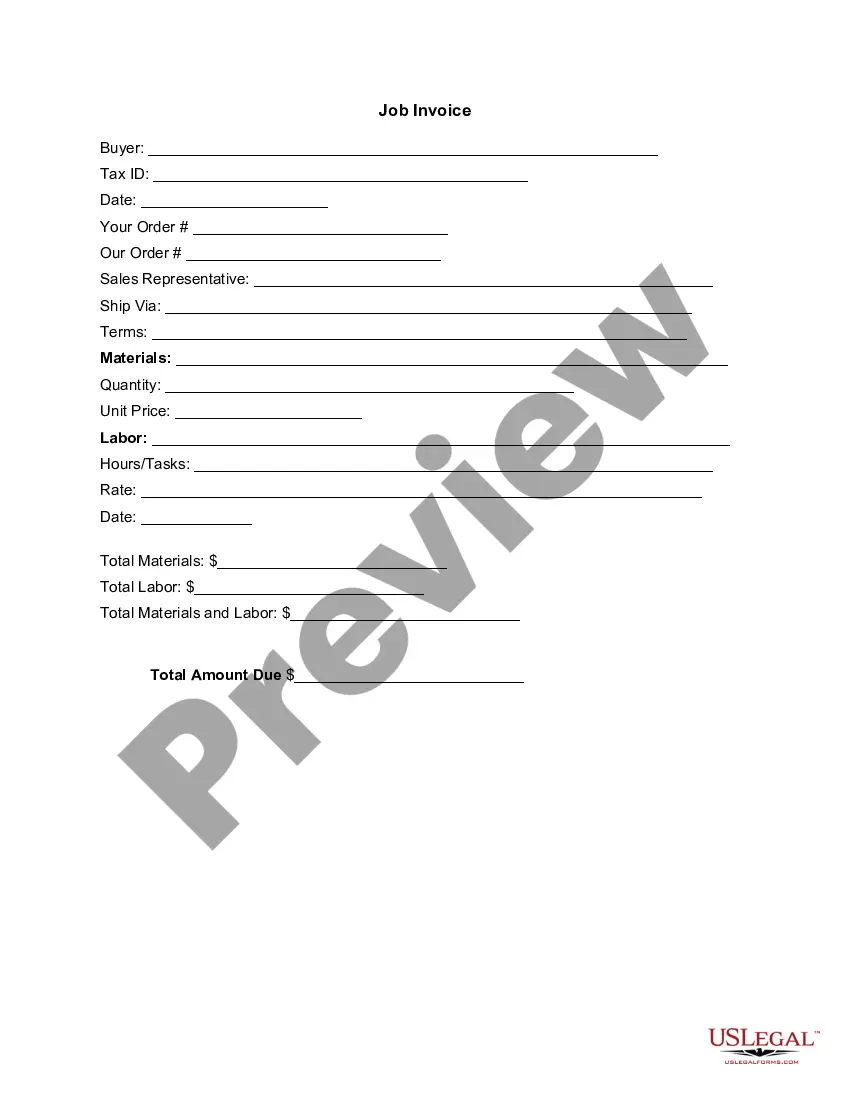

New Mexico Invoice Template for Branch Manager

Description

How to fill out Invoice Template For Branch Manager?

US Legal Forms - among the most important collections of legal documents in the United States - offers a variety of legal document formats that you can download or create.

By utilizing the platform, you can access numerous templates for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of documents such as the New Mexico Invoice Template for Branch Manager in just moments.

If you have a monthly subscription, Log In and obtain the New Mexico Invoice Template for Branch Manager from the US Legal Forms library. The Acquire button will be visible on every form you view. You can access all previously acquired documents from the My documents section of your account.

Make modifications. Complete, edit, and print and sign the downloaded New Mexico Invoice Template for Branch Manager.

Every document you added to your account has no expiration date and belongs to you permanently. Therefore, if you need to download or print another copy, just go to the My documents section and click on the document you require.

- If you wish to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/state. Click the Review button to inspect the form's details. Check the form description to confirm that you have chosen the right document.

- If the form does not fulfill your needs, utilize the Search area at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the pricing plan you prefer and provide your information to register for an account.

- Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

You do not need to have an LLC to send an invoice, but establishing one can provide legal protections and enhance your professional image. Using the New Mexico Invoice Template for Branch Manager allows you to create invoices regardless of your business structure. Just ensure that you include all necessary details like your name or business name, as this helps maintain credibility with clients.

To send an invoice to your manager, use a clear subject line that includes 'Invoice' and provide relevant details in the body of the email. Attach the invoice created using the New Mexico Invoice Template for Branch Manager and ensure you mention any specific project or task related to the invoice. Regular communication can help clarify expectations and streamline the payment process effectively.

You can send an invoice through various methods, such as email, postal mail, or online invoicing platforms. If you use the New Mexico Invoice Template for Branch Manager, you can easily convert your completed invoice into a PDF and attach it to your email. Make sure to include a friendly note expressing gratitude for their business. This simple touch can enhance your client relationships.

A CRS tax ID is the same as a CRS number and is used for identifying businesses in New Mexico for tax purposes. This ID is essential for filing taxes and managing tax obligations correctly. When you utilize a New Mexico Invoice Template for Branch Manager, you can seamlessly integrate your invoicing with your tax ID management.

A CRS number in New Mexico serves as an identification number for businesses required to report various taxes, including gross receipts tax. This unique identifier is crucial for filing taxes accurately and efficiently. By maintaining organized financial records with a New Mexico Invoice Template for Branch Manager, you can easily manage your CRS details.

To acquire a Business Tax Identification Number (BTIN) in New Mexico, you can register online through the state's Taxation and Revenue Department. This number is vital for tax reporting and compliance. Using a New Mexico Invoice Template for Branch Manager helps ensure that you have all the essential documentation ready for your BTIN application.

Indeed, New Mexico has various state tax forms that businesses must use for compliance. These forms can differ according to the type of business and tax obligations. By utilizing a New Mexico Invoice Template for Branch Manager, you can gather all necessary information to accurately complete these forms.

CRS numbers are Combined Reporting System numbers assigned to businesses for tax purposes in New Mexico. This identifier helps the state track businesses that report various types of taxes. Utilizing a New Mexico Invoice Template for Branch Manager can streamline your tax reporting efforts, making it easier to reference your CRS number.

You can find your New Mexico CRS number by checking the initial registration documents you received from the state, or through the New Mexico Taxation and Revenue Department portal. If you are unsure or unable to locate it, contacting the department directly can also help. Maintaining organized invoices with a New Mexico Invoice Template for Branch Manager can prevent future confusion regarding your CRS number.

To obtain a tax ID number in New Mexico, you can apply online through the New Mexico Taxation and Revenue Department’s website. Alternatively, you may fill out a paper application and submit it by mail. Using a New Mexico Invoice Template for Branch Manager can assist you in organizing the necessary business information to expedite the application process.